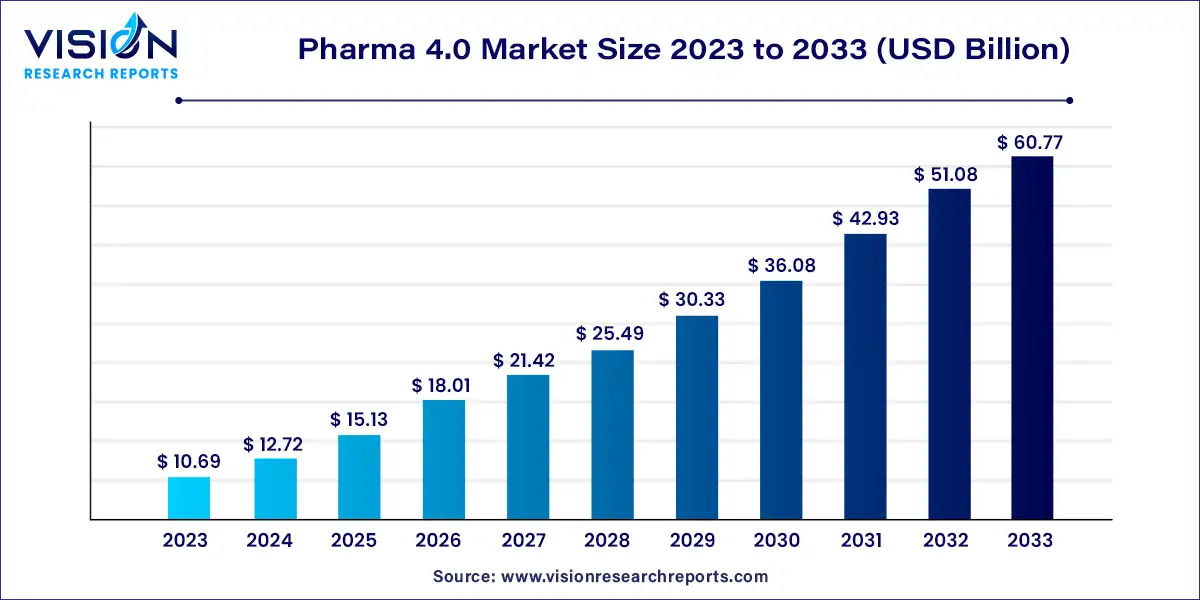

The global pharma 4.0 market size was estimated at USD 10.69 billion in 2023 and it is expected to surpass around USD 60.77 billion by 2033, poised to grow at a CAGR of 18.98% from 2024 to 2033. Pharma 4.0 refers to the integration of Industry 4.0 principles into the pharmaceutical industry, leveraging advanced technologies to enhance the efficiency, quality, and flexibility of pharmaceutical manufacturing processes. This paradigm shift incorporates elements like automation, data analytics, and digitalization, transforming traditional practices into highly interconnected and intelligent systems.

The growth of the pharma 4.0 market is driven by the technological advancements, particularly in automation, data analytics, and artificial intelligence, are revolutionizing pharmaceutical manufacturing by enhancing production efficiency and product quality. These technologies enable more precise and adaptable manufacturing processes, which are crucial for meeting the increasing demand for personalized medicine. Additionally, stringent regulatory requirements for higher quality standards are pushing pharmaceutical companies to adopt Pharma 4.0 solutions to ensure compliance and transparency. The need for operational efficiency is also a significant driver, as Pharma 4.0 technologies optimize processes, reduce downtime, and improve overall productivity.

Overview: Pfizer, a global leader in pharmaceuticals, has integrated Artificial Intelligence (AI) and Machine Learning (ML) into its drug development processes to enhance efficiency and accuracy.

Implementation: Pfizer employed AI-driven platforms to analyze vast datasets from clinical trials, genetic research, and real-world evidence. The company used AI for various applications, including predicting drug interactions, optimizing clinical trial designs, and identifying new drug candidates.

Outcomes:

Overview: Sanofi, a leading global healthcare company, has formed multiple AI partnerships to advance drug development and personalized medicine.

Implementation: In 2022, Sanofi established collaborations with Atomwise, BioMed X, and Insilico Medicine. These partnerships aimed to leverage AI for various purposes, including target identification, drug candidate generation, and predicting clinical trial outcomes.

Outcomes:

Overview: Johnson & Johnson, a global healthcare leader, implemented blockchain technology to enhance transparency and traceability in its supply chain.

Implementation: The company utilized blockchain to track the entire supply chain from production to distribution, ensuring the authenticity of pharmaceutical products and preventing counterfeiting.

Outcomes:

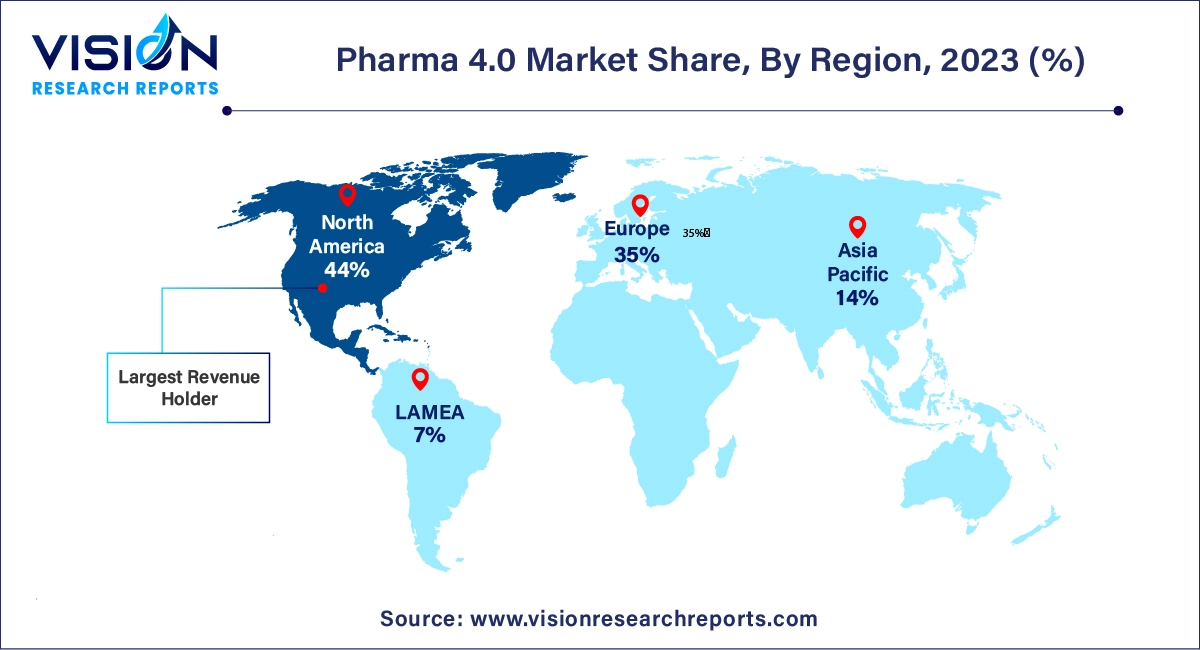

North America led the pharma 4.0 market with a 44% share in 2023 and maintained its dominance during the forecast period. Market growth in this region is driven by technological advancements, the need for increased efficiency, and regulatory compliance within the pharmaceutical industry. Additional factors include the rising need to manage costs and time in drug discovery and development, increasing cross-industry collaborations, and the upcoming patent expirations of major drugs, all contributing to North America's market growth.

| Attribute | North America |

| Market Value | USD 4.70 Billion |

| Growth Rate | 18.99% CAGR |

| Projected Value | USD 26.73 Billion |

Europe is expected to experience substantial growth in the pharma 4.0 market. The region faces challenges such as increasing healthcare costs, a rising incidence of chronic conditions, an aging population, and growing demand for healthcare services. Investment in AI is expected to drive market expansion. For instance, in 2022, Sanofi secured significant AI partnerships, including collaborations with Atomwise, BioMed X, and Insilico Medicine, to advance drug development and research through AI.

Asia Pacific is projected to grow rapidly at a rate of 21.14% over the forecast period. This growth is fueled by an expanding patient pool, increasing acceptance of cloud computing, and rising government support for AI initiatives. Moreover, biopharmaceutical firms in the region are applying AI to modernize drug discovery processes and enhance diagnostic capabilities.

In 2023, the software segment led the market with a significant share of 57%. The rising demand for software solutions in the pharmaceutical industry is driven by the need to leverage advanced digital technologies to boost efficiency, innovation, and regulatory compliance. Integration of Artificial Intelligence (AI), Machine Learning (ML), and big data analytics is revolutionizing drug discovery, development, and personalized medicine. These solutions integrate diverse datasets—including genomic, clinical, and behavioral data—to advance personalized medicine, thereby enhancing treatment outcomes and patient satisfaction. Additionally, the use of Internet of Things (IoT) sensors within these software solutions enables real-time monitoring of manufacturing processes, ensuring rigorous quality control and facilitating prompt interventions. This technological evolution is fueling sector growth, with major companies offering specialized software solutions. For example, Oracle Health Sciences provides cloud-based solutions equipped with AI and big data analytics, tailored for pharmaceutical research, clinical trials, and regulatory compliance.

The services segment in Pharma 4.0 encompasses a wide range of offerings designed to assist pharmaceutical companies in adopting and integrating advanced technologies. These services are crucial for leveraging IoT, AI, blockchain, and other digital innovations to enhance efficiency, productivity, quality, and compliance. Key players are driving this segment’s growth by offering specialized services. For instance, IBM Watson Health delivers AI and data analytics consulting to enhance drug discovery and development, while Siemens Healthineers provides IoT and predictive maintenance consulting for pharmaceutical manufacturing. As digital transformation continues, the demand for these services is expected to increase significantly.

The AI/ML segment commanded the largest market share of 33% in 2023. AI offers substantial opportunities for pharmaceutical manufacturers by enhancing process design, control, monitoring, and maintenance, thus driving continuous improvement. When integrated with other advanced technologies, AI can advance pharmaceutical quality, strengthen supply chains, and improve medicine availability. The FDA is actively preparing for AI’s integration into pharmaceutical manufacturing, and companies are investing heavily in generative AI solutions to boost production volume and operational efficiency.

Blockchain technology is also poised for rapid growth, particularly in enhancing drug safety, reducing counterfeiting and fraud, optimizing supply chain efficiency, and ensuring regulatory compliance. The adoption of blockchain by pharmaceutical companies is increasing due to its ability to streamline supply chains. For example, Pfizer employs the MediLedger blockchain project to create a closed ecosystem for precise drug tracking, ensuring authenticity and preventing counterfeit products. This adoption is expected to drive growth in the blockchain segment throughout the forecast period.

The drug discovery and development segment held the largest market share of 40% in 2023. Both large and small pharmaceutical companies are increasingly adopting AI drug discovery platforms to streamline their R&D processes, reduce discovery timelines, lower costs, and improve overall efficiency.

The pharmaceutical supply chain is complex and highly regulated, necessitating strict adherence to quality standards, traceability, and regulatory compliance. Pharma 4.0 technologies such as blockchain, IoT, and advanced analytics address these challenges by enhancing transparency, traceability, and compliance. These technologies are vital for mitigating risks, ensuring product safety, and maintaining regulatory approvals. Furthermore, they are transforming supply chain management by enabling predictive maintenance, demand forecasting, intelligent inventory management, and automated decision-making, thereby enhancing supply chain resilience and efficiency.

In terms of end-use, the pharma and biotech segment dominated with a 50% market share in 2023. Pharmaceutical companies are increasingly adopting Pharma 4.0 technologies to enhance efficiency, productivity, and quality in their manufacturing processes. Globally, these companies are leveraging advanced machine learning algorithms and AI-powered tools to optimize drug discovery. These tools help identify complex patterns in large datasets, addressing challenges associated with intricate biological networks.

Moreover, blockchain technology simplifies regulatory compliance by providing a clear and auditable trail of activities and transactions, facilitating faster regulatory approvals. Additionally, IoT and blockchain technologies enhance supply chain transparency and efficiency, reducing logistics and inventory management costs. Leading pharmaceutical companies such as Johnson & Johnson, Pfizer, Bayer, and Eli Lilly are adopting these transformative technologies to boost efficiency, quality, and innovation in their manufacturing operations, driving growth in this segment.

By Type

By Technology

By Application

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others