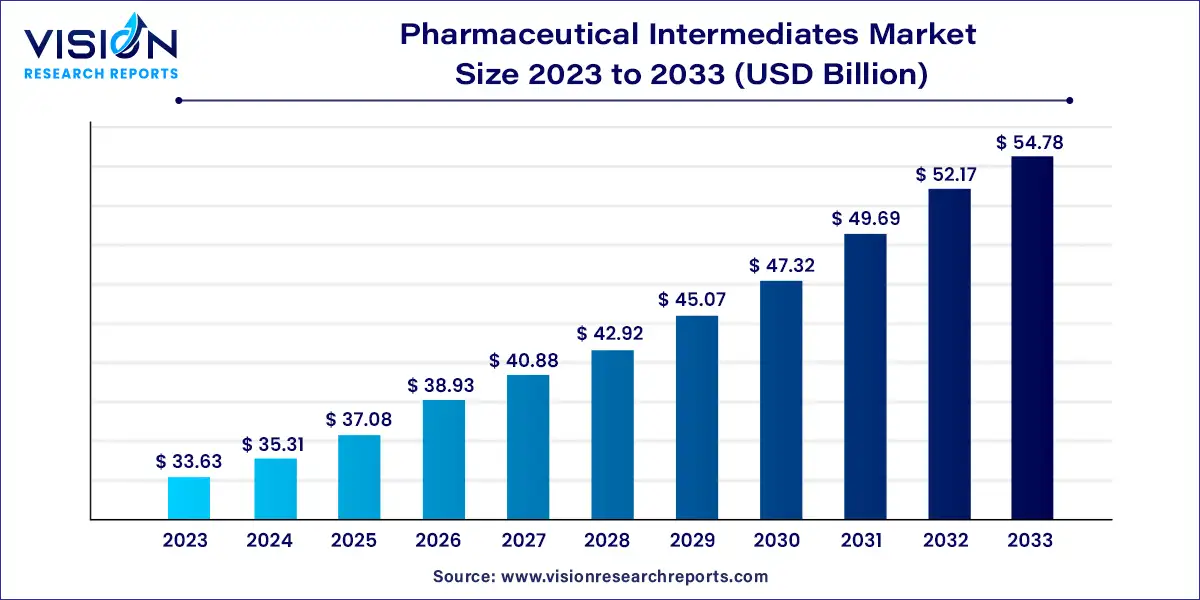

The global pharmaceutical intermediates market size was estimated at around USD 33.63 billion in 2023 and it is projected to hit around USD 54.78 billion by 2033, growing at a CAGR of 5% from 2024 to 2033. The pharmaceutical intermediates market plays a crucial role in the global pharmaceutical industry by providing essential substances for the synthesis of active pharmaceutical ingredients (APIs). These intermediates are compounds used during the production process of APIs, influencing the efficacy, safety, and cost-effectiveness of pharmaceutical products.

Pharmaceutical intermediates are drugs used as raw materials in the production of bulk drugs. Moreover, they are widely used to refer to a material created during the synthesis of an active pharmaceutical ingredient (API) before the processing of becoming an API. Pharmaceutical intermediates are usually formed using high-grade raw materials. These intermediates are widely used in the pharmaceutical and cosmetic industries. The rising demand in these industries is expanding the global pharmaceutical intermediates market. Pharmaceutical intermediates are popularly used for research and development in the pharmaceutical industry. The pharmaceutical intermediates are increasingly being produced using raw materials such as coal tar or petroleum to manufacture pesticides, pharmaceuticals, resins, additives, plasticizers, etc. However, several intermediates can be produced in organic synthesis, and be used in creating various drugs and products.

The growth of the pharmaceutical intermediates market is driven by an increasing global prevalence of chronic diseases, coupled with an aging population, has significantly heightened the demand for pharmaceuticals, thereby boosting the need for intermediates. Advancements in chemical synthesis and biotechnology also contribute to market growth by improving the efficiency and yield of pharmaceutical intermediate production. Additionally, the rise in generic drug production, spurred by patent expirations of major drugs, has created a robust demand for intermediates. Moreover, the expansion of pharmaceutical research and development activities, aimed at discovering new treatments and therapies, further stimulates the market. Together, these factors underscore a dynamic environment for the pharmaceutical intermediates market, paving the way for sustained growth.

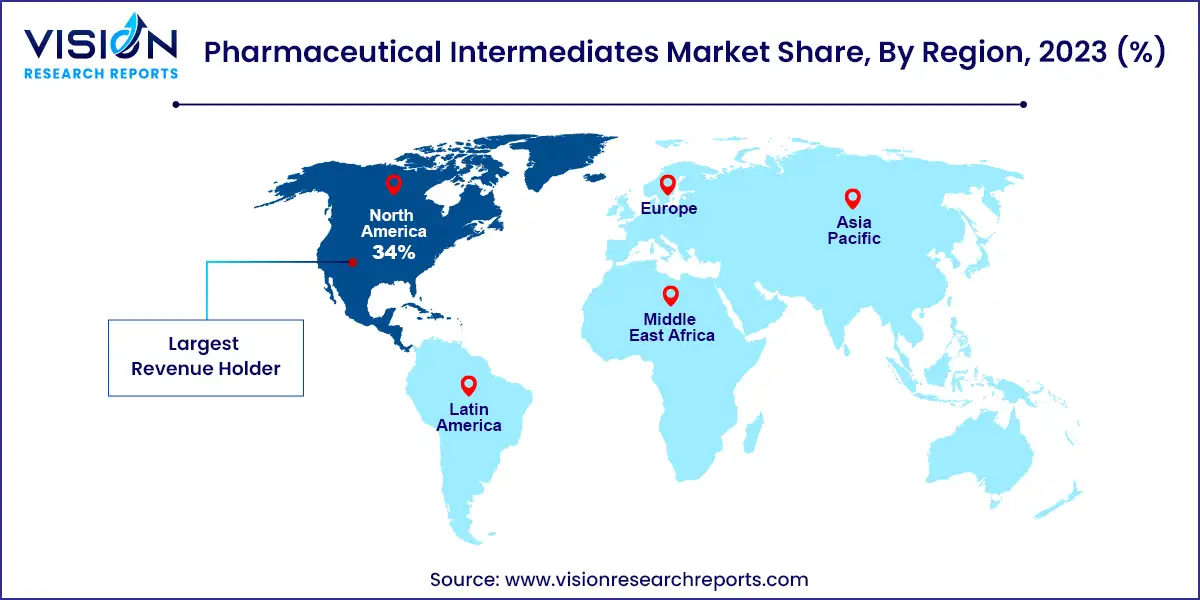

In 2023, North America led the global market with the largest market share of 34% and is projected to maintain its leading position throughout the forecast period. This dominance is attributed to the region's robust presence of pharmaceutical companies, research centers, and laboratories, alongside the rapidly expanding Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) in the US and Canada. Additionally, significant investments by both government and private sectors aimed at advancing the biopharmaceutical industry are expected to further support North America's market leadership.

| Attribute | North America |

| Market Value | USD 11.43 Billion |

| Growth Rate | 5% CAGR |

| Projected Value | USD 18.62 Billion |

In contrast, the Asia Pacific region is anticipated to present significant growth opportunities during the forecast period. Investments by market players to establish manufacturing facilities in countries such as China, India, Japan, South Korea, and Singapore—driven by the availability of low-cost production factors and favorable government policies—are expected to fuel the growth of the pharmaceutical intermediates market in this region.

The bulk drug intermediates segment represented the largest revenue share in 2023. These intermediates are crucial for the production of active pharmaceutical ingredients (APIs), which are essential for the therapeutic efficacy of drugs. Government initiatives aimed at promoting and developing bulk drug parks, such as the Department of Pharmaceuticals' focus on 56 APIs under the Make-in-India initiative, are likely to drive the growth of this segment.

Conversely, the custom intermediates segment is projected to be the fastest-growing. Custom drug intermediates involve the tailored synthesis of specific molecules to achieve targeted therapeutic effects. This segment is gaining traction as demand for customized solutions increases.

In terms of application, the analgesics segment accounted for approximately 31% of the global pharmaceutical intermediates market in 2023 and is expected to maintain its dominance. Analgesics are widely used for pain relief, and the growing prevalence of chronic conditions such as arthritis, cancer, and cardiovascular diseases is driving the demand in this segment.

On the other hand, the anti-cancer drugs segment is anticipated to experience rapid growth. This surge is due to the increasing global incidence of cancer. According to the International Agency for Research on Cancer, there were approximately 19.3 million new cancer cases and 10 million cancer deaths worldwide in 2020, highlighting the need for continued growth in this segment.

The CROs/CMOs segment led the pharmaceutical intermediates market in 2023 in terms of revenue and is expected to maintain its leading position. The growing presence and expansion of Contract Manufacturing Organizations and Contract Research Organizations have significantly increased the demand for pharmaceutical intermediates for drug production and research purposes.

In contrast, research laboratories are expected to see rapid growth during the forecast period. Increased private investment in pharmaceutical research for new drug development is likely to drive the expansion of this segment.

By Product

By Application

By End User

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others