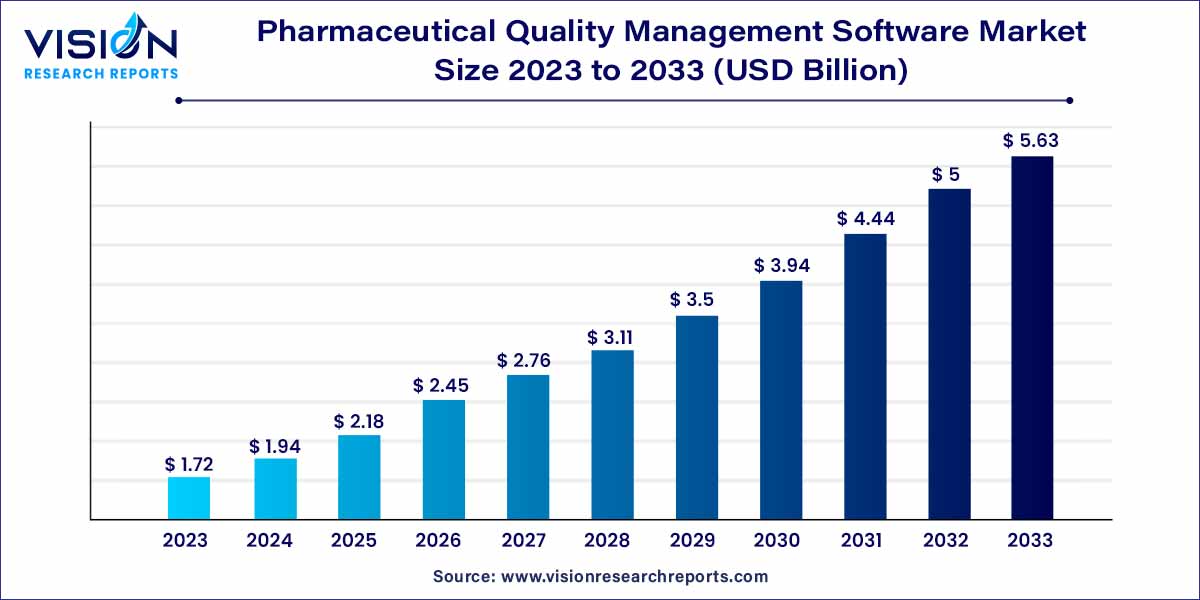

The global pharmaceutical quality management software market size was estimated at around USD 1.72 billion in 2023 and it is projected to hit around USD 5.63 billion by 2033, growing at a CAGR of 12.59% from 2024 to 2033. The pharmaceutical industry is undergoing a significant transformation, marked by stringent regulatory requirements and a growing emphasis on product quality and safety. In this landscape, pharmaceutical quality management software (QMS) has emerged as a pivotal solution, addressing the industry's complex challenges and ensuring compliance with regulatory standards.

The growth of the pharmaceutical quality management software (QMS) market is propelled by several key factors. Firstly, stringent regulatory requirements imposed by authorities worldwide necessitate the implementation of advanced quality management solutions within the pharmaceutical industry. These regulations, such as the FDA's Current Good Manufacturing Practice (cGMP) guidelines, drive the demand for QMS, ensuring compliance and adherence to quality standards. Secondly, the industry's heightened focus on patient safety and product efficacy compels pharmaceutical companies to invest in robust QMS tools. These systems streamline quality control processes, enhancing the overall safety profile of pharmaceutical products. Thirdly, the pursuit of operational efficiency drives the adoption of QMS, automating quality management tasks and reducing human errors. As pharmaceutical companies expand globally, standardized quality management practices across diverse locations become imperative, further fueling the market growth. Additionally, the ongoing technological advancements, including cloud-based solutions and integration of artificial intelligence (AI), are reshaping the QMS landscape, offering more sophisticated and efficient tools. These factors collectively contribute to the continuous growth of the Pharmaceutical Quality Management Software market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.59% |

| Market Revenue by 2033 | USD 5.63 billion |

| Revenue Share of North America in 2023 | 39% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The data management segment held the largest market share of 19% in 2023. QMS solutions streamline the data collection process, organizing and analyzing vast amounts of data related to manufacturing, raw materials, and product testing. By centralizing this data, QMS enhances transparency and traceability, leading to improved decision-making and swift responses to deviations or quality issues. The seamless data management facilitated by QMS not only enhances operational efficiency but also provides a robust foundation for maintaining rigorous quality standards, essential in pharmaceutical manufacturing.

The regulatory and compliance management segment is anticipated to grow at the fastest CAGR over the forecast period. Regulatory and compliance management, QMS serves as a linchpin for pharmaceutical companies navigating the intricate landscape of regulations and standards. With stringent guidelines imposed by regulatory bodies globally, compliance is a non-negotiable aspect of the industry. QMS solutions automate compliance tasks, ensuring adherence to industry-specific regulations such as good manufacturing practices (GMP) and good laboratory practices (GLP). These systems provide comprehensive audit trails, facilitate document control, and support electronic signatures, allowing companies to demonstrate compliance during inspections and audits. By offering real-time visibility into compliance status, QMS mitigates the risk of regulatory violations, safeguarding the company's reputation and ensuring the continuous supply of high-quality pharmaceutical products to the market.

The cloud & web-based segment contributed the largest market share of 77% in 2022. Cloud-based and web-based deployment models have gained substantial traction due to their flexibility and scalability. Cloud-based solutions, in particular, offer pharmaceutical companies the advantage of accessing QMS tools and data from any location with internet connectivity. This mobility enhances collaboration among team members, allowing seamless sharing of information and real-time updates. Additionally, cloud-based QMS solutions alleviate the burden of IT infrastructure management, reducing operational costs and enabling companies to focus on their core competencies. The scalability of these models ensures that pharmaceutical companies can easily adjust their resources based on demand, making them ideal choices for businesses aiming for rapid growth and global expansion.

On-premises software accounted for a significant revenue share in 2023. The on-premises deployment mode continues to be a viable option for pharmaceutical companies seeking complete control over their QMS infrastructure and data. By hosting the software internally, organizations can customize the system to align perfectly with their unique requirements. On-premises solutions offer a high level of security, ensuring sensitive pharmaceutical data remains within the confines of the company's network. This level of control is particularly crucial for enterprises dealing with highly confidential information and proprietary research. Additionally, on-premises deployment provides pharmaceutical companies with the ability to integrate QMS seamlessly with other in-house applications and systems, fostering a cohesive and integrated operational environment.

North America dominated the market with the largest market share of 40% In 2023. In North America, particularly in the United States, stringent regulatory standards set by the FDA drive the adoption of QMS solutions. The region is characterized by a strong emphasis on research and development activities, leading to a high demand for advanced quality management tools in pharmaceutical companies. Additionally, the presence of key market players and a robust healthcare infrastructure further fuels the growth of the QMS market in North America.

Asia Pacific is expected to be the fastest-growing regional market. The Asia-Pacific region, particularly countries like China, India, and Japan, is experiencing rapid growth in the pharmaceutical industry. Factors such as the large patient population, increasing healthcare expenditure, and rising awareness about healthcare standards drive the demand for QMS solutions. In this region, pharmaceutical companies are increasingly investing in quality management software to enhance product quality, comply with international standards, and gain a competitive edge in the global market. Additionally, collaborations between regional pharmaceutical firms and international players further stimulate the adoption of QMS solutions, fostering market growth.

By Application

By Deployment Mode

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others