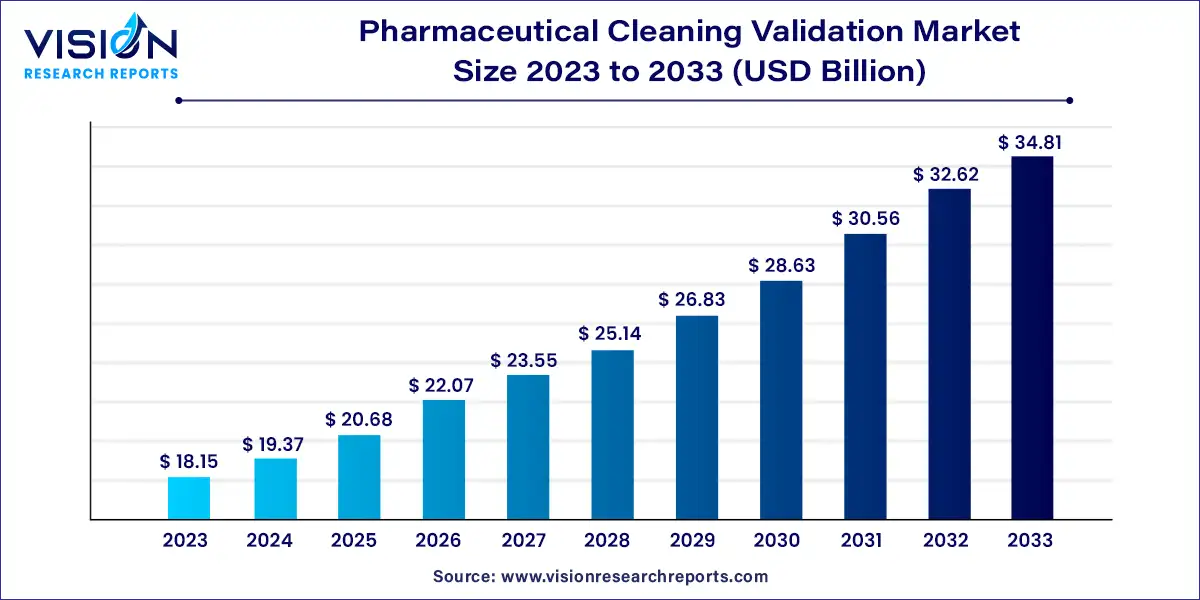

The global pharmaceuticals cleaning validation market size was estimated at around USD 18.15 billion in 2023 and it is projected to hit around USD 34.81 billion by 2033, growing at a CAGR of 6.73% from 2024 to 2033. The pharmaceutical cleaning validation market is a critical component of the pharmaceutical industry, ensuring the safety and efficacy of drug products through rigorous cleaning protocols. This market encompasses various technologies and services designed to validate cleaning processes, ensuring that pharmaceutical manufacturing equipment is free from contaminants and residues.

The growth of the pharmaceutical cleaning validation market is driven by an increasing complexity of pharmaceutical formulations and the expansion of biologics and biosimilars necessitate more stringent cleaning protocols to prevent cross-contamination and ensure product purity. Regulatory pressure from agencies like the FDA and EMA, which enforce rigorous cleaning validation standards, further accelerates market demand. Technological advancements also play a crucial role; innovations in cleaning technologies and validation methods, such as automated cleaning systems and advanced analytical tools, enhance the efficiency and accuracy of validation processes. Additionally, the rising emphasis on quality assurance and compliance in pharmaceutical manufacturing underscores the need for robust cleaning validation practices, contributing to market growth.

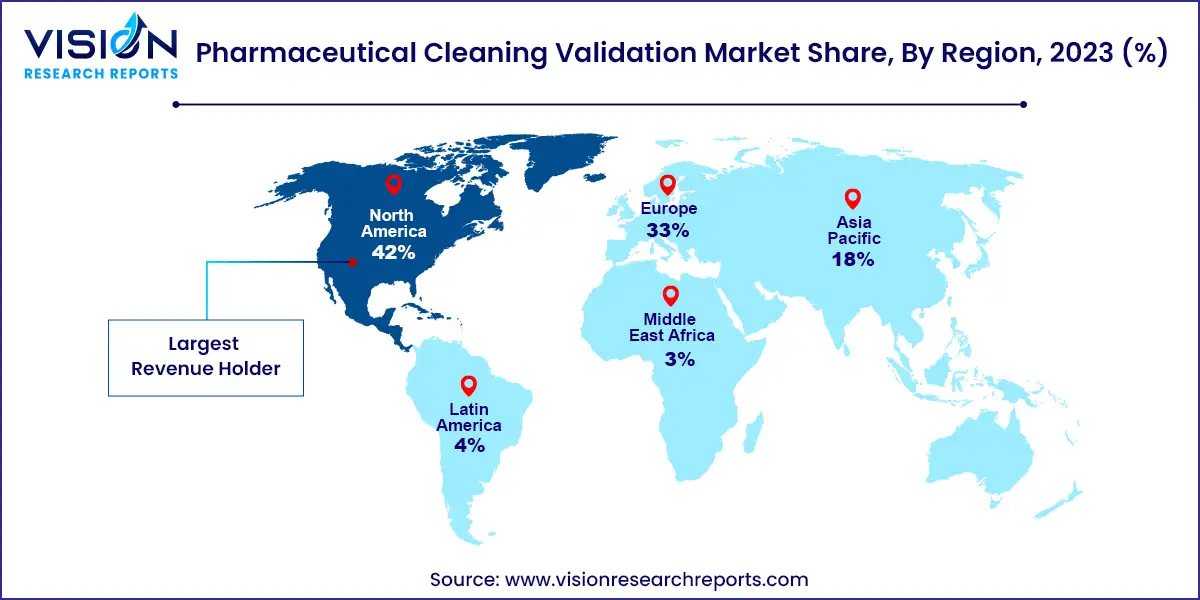

In 2023, North America held a 42% revenue share. Stringent regulations by the US FDA and Health Canada ensure high cleaning standards, supporting a robust regional manufacturing base. Additional factors such as a growing presence of pharmaceutical companies, increased healthcare spending, and a rising disease burden contribute to North America's market leadership.

| Attribute | North America |

| Market Value | USD 7.62 Billion |

| Growth Rate | 6.74% CAGR |

| Projected Value | USD 14.62 Billion |

The European pharmaceutical cleaning validation market is expanding due to several key factors. European healthcare systems face rising costs, a growing burden of chronic diseases, an aging population, and the need to deliver high-value care. The European Medicines Agency (EMA) is at the forefront of setting regulatory standards for risk-based cleaning validation to prevent cross-contamination. These factors have driven demand for cleaning validation solutions among pharmaceutical manufacturers, resulting in notable market growth.

The Asia-Pacific market is expected to see significant growth during the forecast period, primarily due to increasing awareness of the need for cleaning validation processes, particularly in China. This growth is supported by the rapid expansion of pharmaceutical manufacturing facilities, a rising prevalence of diseases, an aging population, higher healthcare expenditure, and increased investments to meet international regulatory standards.

In 2023, the small molecule drug segment dominated the market, capturing a revenue share of 47%. This segment's leadership is due to the widespread use of small-molecule drugs, which often involves complex chemical reactions and generates various residues. Effective cleaning validation is crucial to remove these residues and prevent cross-contamination. The increasing demand for small-molecule drugs and the stringent cleaning validation requirements contribute to the substantial revenue share of this segment.

The peptides segment is expected to experience the highest growth rate, with a projected CAGR of 8.13% from 2024 to 2033. Peptide production typically uses solid-phase synthesis, which makes the cleaning validation process more complex and specialized. As investment in peptide therapeutics research and development rises, the demand for advanced cleaning validation solutions will increase, driving significant growth in this segment within the global pharmaceutical cleaning validation market.

In 2023, product-specific analytical tests held a dominant revenue share of 65%. This segment's leading position is driven by the preference for advanced techniques like High-Performance Liquid Chromatography (HPLC) and UV spectroscopy among pharmaceutical companies. HPLC, in particular, is widely used for detecting small drug molecules and detergents in swab and rinse samples. The effectiveness of product-specific analytical tests, such as Enzyme-Linked Immunosorbent Assay (ELISA) and HPLC, has significantly supported the revenue share of this segment by providing reliable testing methods for cleaning validation samples.

The non-specific tests segment is projected to grow at a CAGR of 7.53% from 2024 to 2033. The rising demand for Total Organic Carbon (TOC) testing, which accounted for 45.8% of the non-specific tests revenue share, is a key driver of this growth. The increased acceptance of TOC testing by the U.S. FDA, including its use as a replacement for oxidizable substances tests in USP Purified Water, has further fueled this segment's expansion. The limitations of product-specific testing, which can cause equipment downtime, have led to a greater reliance on non-specific methods like TOC analysis. This approach allows for more efficient process evaluation by focusing on broader residue indicators.

By Products

By Validation Test

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others