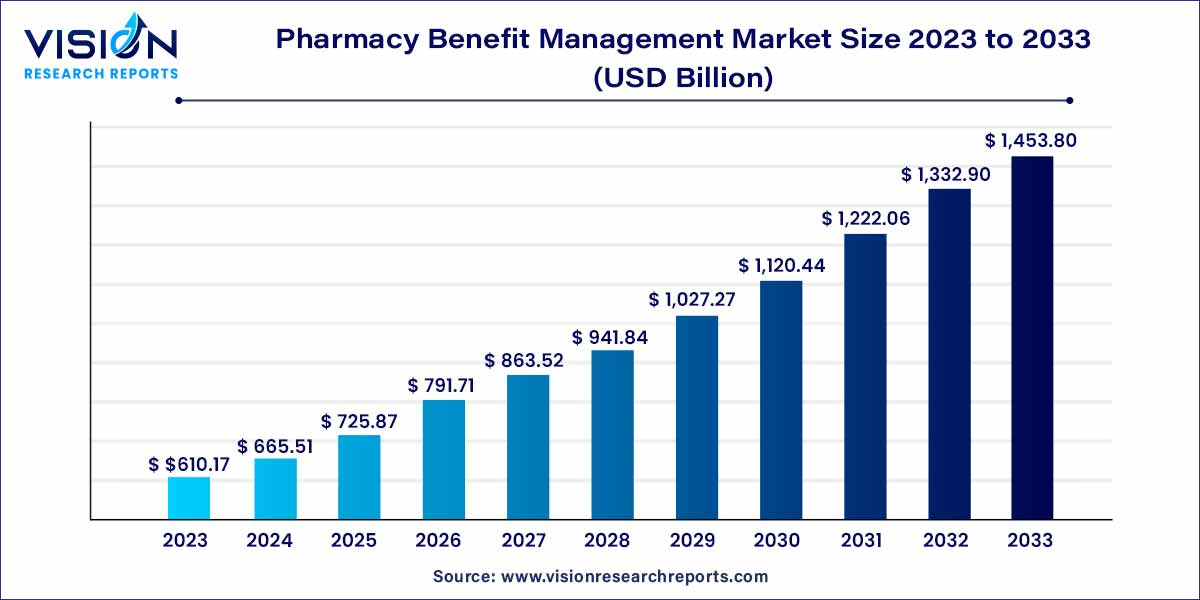

The global pharmacy benefit management market size was estimated at around USD 610.17 billion in 2023 and it is projected to hit around USD 1,453.8 billion by 2033, growing at a CAGR of 9.07% from 2024 to 2033. Pharmacy benefit management is an organization of drug guides that oversees, investigates, and manages every healthcare-related subject while providing businesses with the benefits of drug programs. Additionally, it helps to provide lower-cost management using medical services and biologic drugs.

The pharmacy benefit management (PBM) market plays a pivotal role in the healthcare industry by optimizing medication use, controlling costs, and improving patient outcomes. PBMs act as intermediaries between health insurers, pharmaceutical companies, pharmacies, and patients to facilitate the procurement, dispensing, and management of prescription drugs.

The growth of the pharmacy benefit management (PBM) market is driven by several key factors. Firstly, the rising demand for cost-effective healthcare solutions amid escalating prescription drug prices is propelling the adoption of PBMs by health insurers and employers. Additionally, the increasing prevalence of chronic diseases necessitates effective medication management strategies, further boosting the demand for PBM services. Moreover, advancements in technology and data analytics enable PBMs to enhance medication adherence, optimize formulary management, and identify opportunities for cost savings. Furthermore, regulatory initiatives aimed at promoting transparency and controlling pharmaceutical expenditures are driving the expansion of the PBM market. Lastly, the growing focus on value-based care models and population health management underscores the importance of pharmacy benefit management in improving patient outcomes and reducing overall healthcare costs. These factors collectively contribute to the sustained growth and evolution of the pharmacy benefit management market.

In 2023, the specialty pharmacy segment emerged as the leading revenue generator, capturing the largest share of 35% in the market. This dominance is primarily attributed to the escalating prevalence of rare and chronic diseases worldwide, which has driven the demand for specialty drugs. However, the steep prices associated with these medications render them inaccessible to a significant portion of the global population. Consequently, the burgeoning demand for pharmacy benefit management (PBM) services arises as a solution to address the affordability barrier. PBMs play a pivotal role in negotiating lower prices for specialty drugs, thereby making them more accessible to patients. As a result of these factors, the specialty pharmacy segment has established dominance in the global pharmacy benefit management market.

Moreover, the benefit plan design and administration segment is poised to witness significant opportunities during the forecast period. This growth is propelled by the increasing adoption of medical insurance claims worldwide. According to India Express, the percentage of individuals opting for medical insurance policies surged from 30% in March 2020 to 80% in March 2021. Consequently, the rising uptake of medical claims globally is anticipated to drive substantial growth in this segment throughout the forecast period.

In 2023, the insurance companies segment emerged as the dominant player in the global pharmacy benefit management market. This dominance is primarily attributed to the increasing number of acquisitions and mergers between insurance companies and pharmacy benefit management service providers. Such collaborations have propelled the insurance companies segment to the forefront of the market. For example, First Medical Health Plan, Inc. and Abarca Health LLC formed a partnership for pharmacy benefit management services over a three-year period. Additionally, the expanding presence of health insurance companies across developed and developing nations has further bolstered market growth.

Conversely, the retail pharmacy segment is forecasted to experience the highest growth during the projection period. This growth is fueled by the proliferation of retail pharmacy outlets globally, alongside the increasing prevalence of online pharmacies. The rising availability of internet access, the widespread adoption of smartphones, and the growing popularity of e-commerce among consumers are key drivers behind the expansion of online retail pharmacies. According to the International Telecommunications Union, approximately 64% of the global population had internet access, with this figure expected to rise significantly. Online pharmacies offer rapid home delivery, convenient payment methods, substantial discounts, and hassle-free refund and replacement policies, driving consumer demand. Consequently, the escalating popularity of online retail pharmacies is poised to propel growth within the retail pharmacy segment of the global pharmacy benefit management market.

In 2023, North America emerged as the dominant force in the global pharmacy benefit management market. The US, in particular, boasted a PBM market valued at US$450 billion in 2022, up from US$426.5 billion in 2021. With its leading pharmaceutical manufacturers, insurance providers, pharmacy benefit management service providers, and retail pharmacy chains, the US is a hub of industry innovation and investment. The widespread adoption of health insurance among the US population has been a key driver of market growth, especially considering that over half of the population suffers from one or more chronic diseases. This, coupled with high healthcare expenditures and increased insurance policy adoption, has propelled the North America pharmacy benefit management market forward. According to the Centers for Medicare and Medicaid Services, total healthcare expenditure in the US surged to US$4.1 trillion in 2020, marking a 9.7% increase from the previous year. Additionally, the extensive presence of health insurance providers in the region has further bolstered market expansion, as many patients rely on reimbursements for access to treatment. Favorable government reimbursement policies have also played a crucial role in fostering market growth in North America.

Conversely, Asia Pacific is poised to experience significant growth during the forecast period. This can be attributed to the rising adoption of healthcare insurance among the population, alongside an increasing prevalence of chronic diseases and escalating healthcare expenditures in the region. Furthermore, the expanding presence of pharmacy benefit management service providers in Asia Pacific is expected to further drive market growth in the coming years.

By Service

By Service Provider

By Business Model

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Service Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pharmacy Benefit Management Market

5.1. COVID-19 Landscape: Pharmacy Benefit Management Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pharmacy Benefit Management Market, By Service

8.1. Pharmacy Benefit Management Market, by Service, 2024-2033

8.1.1 Specialty Pharmacy Services

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Benefit Plan Design & Administration

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Formulary Management

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Pharmacy Claims Processing

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Pharmacy Benefit Management Market, By Service Provider

9.1. Pharmacy Benefit Management Market, by Service Provider, 2024-2033

9.1.1. Retail Pharmacies

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Insurance Companies

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Standalone Pharmacy Benefit Management Providers

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Pharmacy Benefit Management Market, By Business Model

10.1. Pharmacy Benefit Management Market, by Business Model, 2024-2033

10.1.1. Government Health Programs

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Employer-sponsored Programs

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Health Insurance Management

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Pharmacy Benefit Management Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Service (2021-2033)

11.1.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.1.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Service (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Service (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Service (2021-2033)

11.2.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.2.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Service (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Service (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Service (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Service (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Service (2021-2033)

11.3.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.3.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Service (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Service (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Service (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Service (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Service (2021-2033)

11.4.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.4.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Service (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Service (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Service (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Service (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Service (2021-2033)

11.5.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.5.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Service (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Business Model (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Service (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Service Provider (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Business Model (2021-2033)

Chapter 12. Company Profiles

12.1. CVS Health.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. SS&C Technologies, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Anthem Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Medimpact.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Express Scripts Holding Company.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Benecard Services, LLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. CaptureRx Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Change Healthcare

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. OptumRx, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Cigna

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others