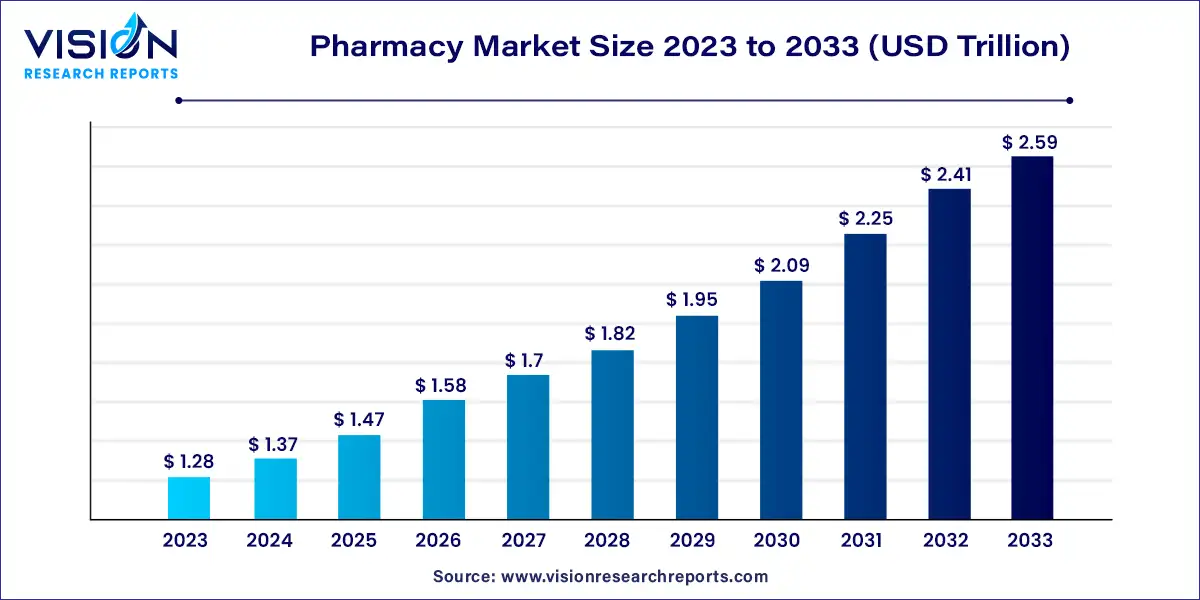

The global pharmacy market size was estimated at around USD 1.28 trillion in 2023 and it is projected to hit around USD 2.59 trillion by 2033, growing at a CAGR of 7.29% from 2024 to 2033. The pharmacy market is a dynamic sector encompassing various elements, including prescription medications, over-the-counter (OTC) drugs, and pharmaceutical services. As a vital component of the global healthcare system, the pharmacy market plays a crucial role in ensuring the availability and accessibility of medications and healthcare products.

The pharmacy market is poised for robust growth due to several key factors driving its expansion. A significant contributor is the aging global population, which is increasing the demand for medications and healthcare services to manage chronic conditions associated with older age. Additionally, the rise in chronic diseases such as diabetes, cardiovascular disorders, and respiratory illnesses fuels the need for ongoing pharmaceutical care and innovative treatments. Technological advancements are also a major growth driver, with digital health solutions, telepharmacy, and automation enhancing efficiency and accessibility in medication management. The increasing prevalence of personalized medicine, driven by advancements in genomics and biotechnology, further propels the market by offering tailored treatment options that improve therapeutic outcomes.

North America dominated the market with a 54% share in 2023. This dominance is attributed to the presence of major multinational chains such as Boots, Walgreens, CVS Health, UnitedHealth Group, Cigna, Kroger, Walmart, and Rite Aid Corp., which are employing diverse strategies and advanced technologies to strengthen their market position. For instance, in March 2022, Rite Aid Corp. introduced its Wellness + loyalty program, offering significant savings and incentives to its customers.

Europe also held a notable market share in 2023. Growth in this region is driven by the increasing number of individuals with chronic conditions opting for online pharmacies to access medications conveniently, particularly in rural areas.

Asia Pacific is expected to be the fastest-growing market in the coming years. The region is experiencing demographic shifts, with an aging population and rising incidence of chronic diseases such as diabetes, cancer, and cardiovascular conditions driving increased demand for pharmacy services.

Latin America is seeing growth due to the expanding influence of pharmacy chains, with some retailers now operating over three-quarters of pharmacies in countries like Chile, Colombia, and Peru. This consolidation is driven by strategies including wholly owned outlets, franchises, and cooperatives.

In 2023, the prescription segment led the pharmacy market, capturing the largest revenue share of 82%. This dominance is driven by the growing need for prescription drugs to treat various conditions, including diabetes, cardiovascular diseases, respiratory issues, infections, blood disorders, and cancer. The increasing prevalence of chronic diseases and the aging population are further fueling the demand for these medications.

According to the IDF Diabetes Atlas, 537 million adults globally had diabetes in 2021, with this number projected to rise to 783 million by 2045. Nearly 90% of older adults regularly use at least one prescription medication, often taking multiple drugs to manage chronic conditions. This rising demand for prescription drugs, particularly among the elderly, is anticipated to significantly boost the industry's growth in the coming years.

Conversely, the OTC segment is expected to experience the fastest growth rate during the forecast period. This growth is attributed to cost savings compared to prescription drugs, increased consumer empowerment for managing minor health issues, a shift towards preventive healthcare, a broader product range, enhanced consumer awareness, and the influence of online sales and e-commerce platforms. The trend towards self-medication and the conversion of prescription drugs to OTC status also contribute to this segment's expansion. For example, in March 2023, the U.S. FDA approved Narcan (4 mg), a naloxone hydrochloride nasal spray, for OTC use, marking the first naloxone product approved for over-the-counter sale.

The retail pharmacy segment commanded the highest revenue share of 56% in 2023. This growth is driven by the proliferation of chain and independent pharmacies, along with the availability of medications in supermarkets and mass retailers in countries like the UK and the U.S. Major chains such as Boots, Walgreens, CVS Health, Lloyds, Shoppers Drug Mart, and Well Pharmacy have a significant presence in regions including Canada, the U.S., Australia, the UK, and Russia, boosting the segment’s growth.

The ePharmacy segment is anticipated to grow the fastest during the forecast period. Innovations such as telepharmacy, prescription ordering apps, medication reminders, and online consultations have improved efficiency and accessibility. The COVID-19 pandemic further accelerated revenue growth for ePharmacies, with notable examples like CVS Health reporting increased digital refills for specialty medications and Walgreens Boots Alliance U.K. seeing a 15.2% rise in online sales in 2022. The growing use of smartphones, widespread adoption of digital technologies in healthcare, and the increasing number of retailers launching online platforms are expected to drive further growth in this segment.

By Product

By Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others