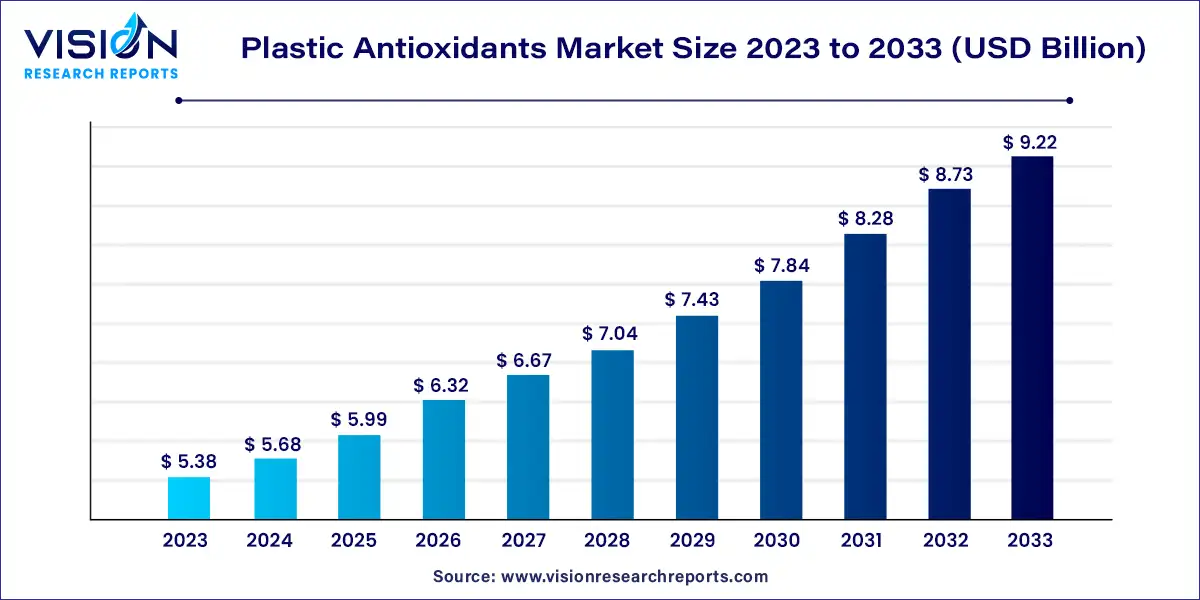

The global plastic antioxidants market size was estimated at USD 5.38 billion in 2023 and is expected to surpass around USD 9.22 billion by 2033, poised to grow at a CAGR of 5.53% from 2024 to 2033.

The plastic antioxidants market has witnessed significant growth driven by the increasing demand for high-performance plastics in various industries such as automotive, packaging, and construction. Plastic antioxidants are essential additives used to protect polymers from degradation caused by thermal, oxidative, and ultraviolet light exposure, thereby extending the life of plastic products.

The growth of the plastic antioxidants market is fueled by an increasing demand for high-performance plastics across automotive, packaging, and construction industries is a primary driver. These industries rely on plastics for their lightweight properties and durability, where antioxidants play a crucial role in protecting materials from degradation caused by thermal, oxidative, and UV exposure. Moreover, advancements in antioxidant technologies continue to enhance their effectiveness, driving adoption across various applications. Emerging economies in Asia-Pacific and Latin America are also significant growth contributors, with rapid industrialization and infrastructure development increasing the demand for reliable plastic antioxidant solutions.

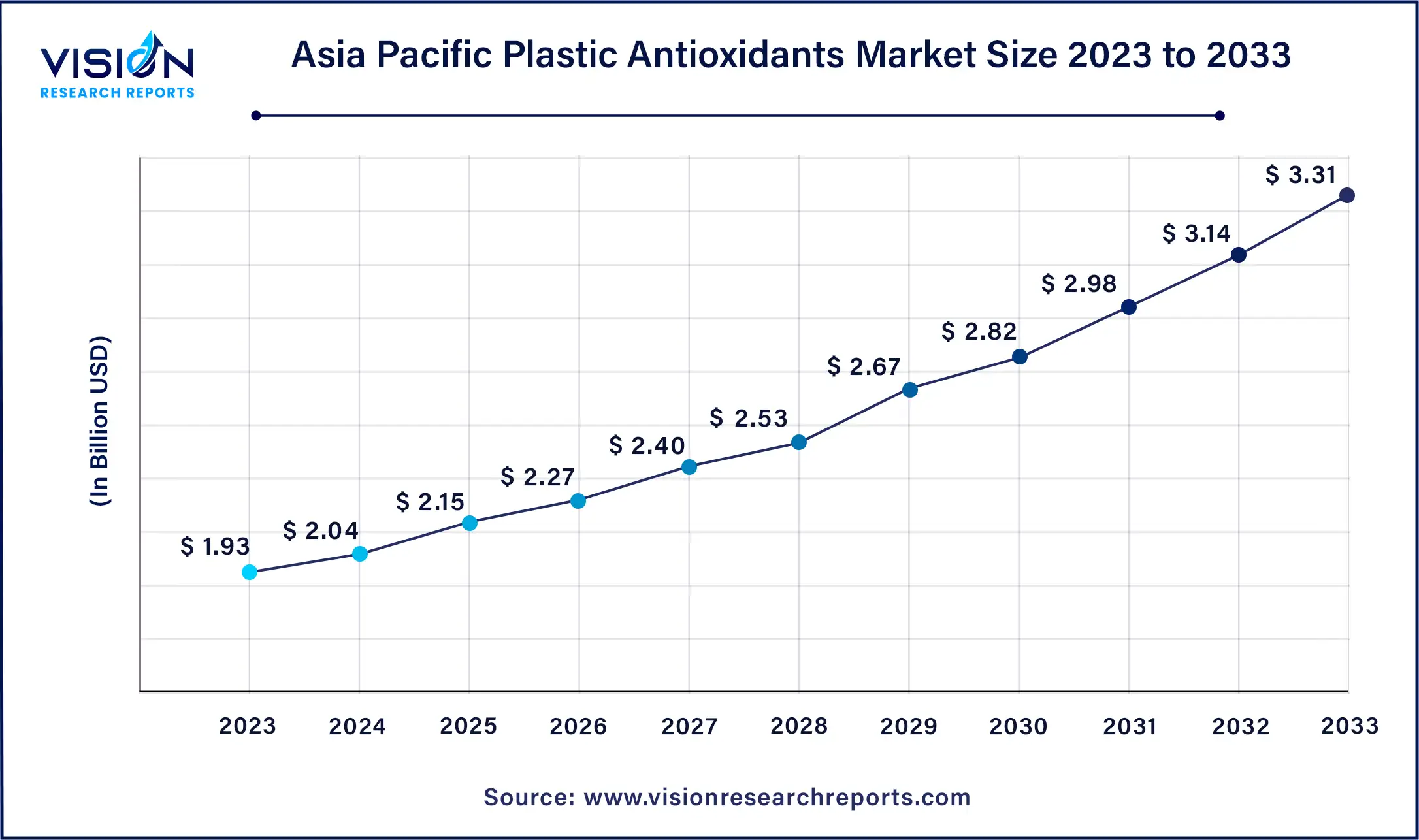

The Asia Pacific plastic antioxidants market size was surpassed at USD 1.93 billion in 2023 and is expected to hit around USD 3.31 billion by 2033, growing at a CAGR of 5.54% from 2024 to 2033.

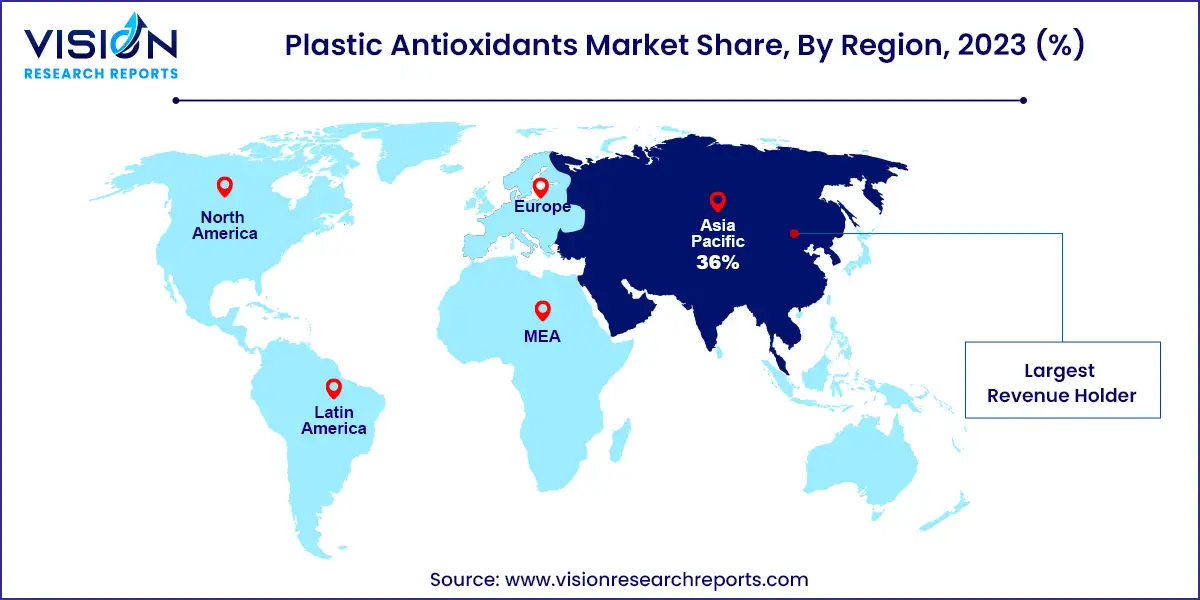

Asia Pacific accounted for 36% of the market share in 2023, driven by rapid industrialization and growth in automotive, construction, packaging, and consumer goods sectors. Urbanization in countries like China, India, and Southeast Asia fuels demand for plastics and additives, including antioxidants, in infrastructure development, housing, transportation, and consumer products.

North America dominated the market with a revenue share of 27% in 2023, driven by stringent regulations and increasing awareness about environmental protection. The aerospace and electronics industries in countries like the United States, Canada, and Mexico contribute significantly to the demand for protective coatings, further boosting the market for antioxidants.

The phenolic segment emerged as the market leader in 2023, capturing the largest revenue share of 41%. Phenolic antioxidants are widely utilized to protect polymers and plastics from oxidative degradation, thereby enhancing their longevity and performance. These antioxidants find extensive applications in construction, including laminates, adhesives, insulating materials, and coatings, driven by the growing demand for durable and fire-resistant construction materials.

Phosphite and phosphonite antioxidants are also witnessing increased demand across industries, particularly in packaging for food, beverages, and pharmaceuticals. These antioxidants serve as stabilizers, protecting polymers from thermal and oxidative degradation, thereby supporting the demand for high-performance plastic materials in packaging applications.

In 2023, polyethylene (PE) dominated the resin type segment with a substantial revenue share of 35%. PE is widely favored for its stability and is extensively used in flexible packaging solutions for food, beverages, and pharmaceutical products. The use of antioxidants is crucial in PE to maintain material stability and durability, supporting its widespread adoption.

Polypropylene (PP) has also seen significant growth, especially in automotive applications where it is used in interior and exterior components. Antioxidants play a critical role in preserving the performance and appearance of PP components under various environmental conditions.

The food & beverage segment led the market in 2023, holding a revenue share of over 38%. Plastic antioxidants play a crucial role in ensuring the safety and integrity of packaging materials used in food and beverage applications. Increasing consumer preference for sustainable packaging materials drives the demand for antioxidants that enhance the recyclability and sustainability of plastics in this sector.

The automotive segment is expected to grow significantly, driven by the increasing adoption of plastic antioxidants to enhance the performance, durability, and aesthetic appeal of plastic components in vehicles. The shift towards electric vehicles (EVs) further amplifies the demand for lightweight materials, where antioxidants contribute to the longevity and reliability of EV plastic components.

By Antioxidant Type

By Resin Type

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others