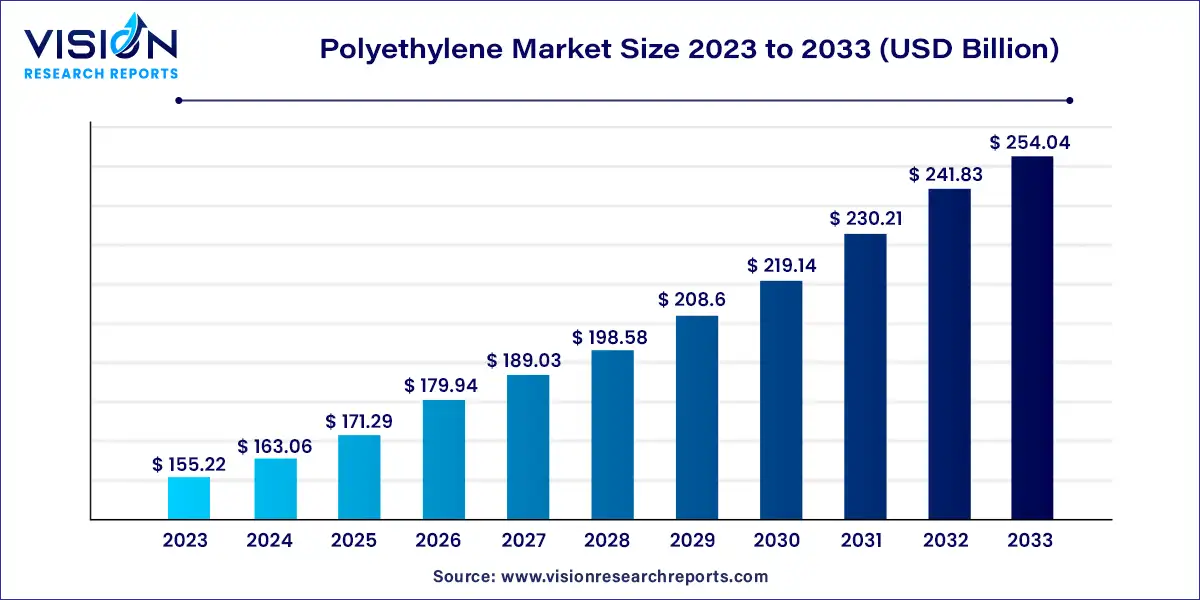

The global polyethylene market size was estimated at around USD 155.22 billion in 2023 and it is projected to hit around USD 254.04 billion by 2033, growing at a CAGR of 5.05% from 2024 to 2033.

Polyethylene, a versatile thermoplastic polymer, holds a significant position in the global market due to its wide-ranging applications across various industries. With its exceptional properties such as flexibility, chemical resistance, and ease of processing, polyethylene finds extensive usage in packaging, automotive, construction, electronics, and healthcare sectors, among others.

The global polyethylene market is witnessing steady growth, driven by factors such as increasing demand for packaging materials, growth in the automotive industry, and rising construction activities worldwide. Additionally, advancements in polymer technology and innovations in production processes contribute to the expansion of the market.

The growth of the polyethylene market is propelled by an increasing demand for packaging materials across industries such as food and beverages, consumer goods, and pharmaceuticals drives the market growth. Polyethylene's versatility, durability, and cost-effectiveness make it an ideal choice for packaging applications. Secondly, the expansion of the automotive sector worldwide contributes significantly to the demand for polyethylene, particularly in manufacturing automotive components such as bumpers, interior trims, and fuel tanks. Additionally, the growth in construction activities, driven by urbanization, infrastructure development, and housing projects, boosts the demand for polyethylene pipes, fittings, and insulation materials. Moreover, advancements in polymer technology, including the development of high-performance and specialty polyethylene grades, further fuel market growth by catering to specific industry needs and applications.

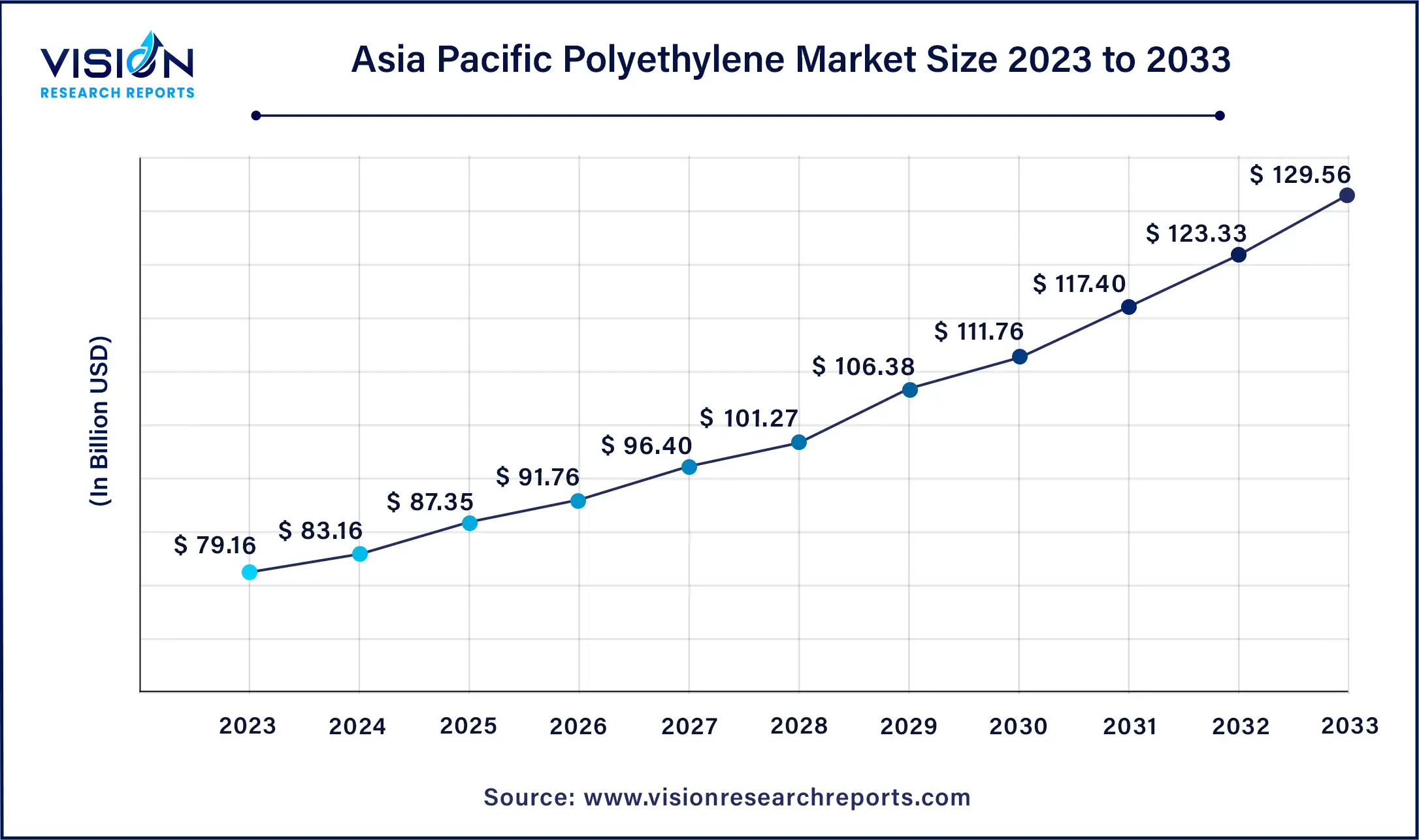

The Asia Pacific polyethylene market size was valued at USD 79.16 billion in 2023 and is expected to hit around USD 129.56 billion by 2033, at a CAGR of 5.05% from 2024 to 2033.

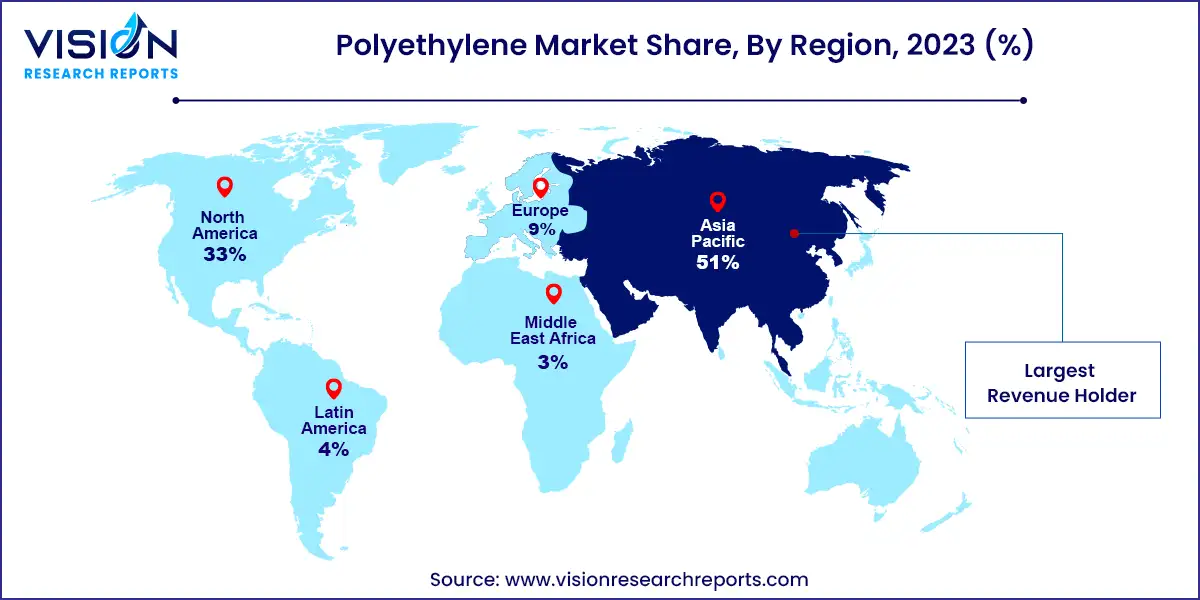

The Asia Pacific Polyethylene Market dominated the global industry in 2023 with a share of over 51%. Asia Pacific is a diverse market for PE owing to the growing automotive and construction industries in the region that are key consumers of this material. The growing manufacturing industry in Asia Pacific is anticipated to drive the requirement for PE.

The shale gas boom in North America has transformed the regional PE market. The abundant and easy availability of cost-effective feedstocks derived from shale gas, particularly ethane, has given PE producers, based in North America, a significant competitive advantage.

The polyethylene market in China held a significant share in the Asia Pacific region. The market is anticipated to register a CAGR of 5.35% over the forecast period. Government initiatives for infrastructure development projects are driving market growth in China. The ambitious infrastructure development plans of the country, including the Belt and Road Initiative, stimulate the demand for PE in construction and related activities.

In terms of revenue, the high-density polyethylene (HDPE) segment accounted for the largest revenue share of over 50% in 2023. The HDPE segment benefits from the increasing demand for durable and corrosion-resistant materials in construction and infrastructure projects. HDPE's suitability for pipes, geo-membranes, and other construction applications drives its demand.HDPE pipes are widely used for water distribution, irrigation, and drainage systems due to their durability, corrosion resistance, and flexibility. The demand for efficient and long-lasting solutions in water infrastructure and agriculture enhances the growth prospects of the HDPE segment.

Moreover, with rapid urbanization and continuous infrastructure development, the HDPE demand is expected to rise. The HDPE’s role in supporting critical sectors, such as construction, highlights its significance in driving the overall growth and stability of the market. The linear Low-density Polyethylene (LLDPE) segment is expected to grow at the fastest CAGR of 5.52% from 2024 to 2033. The role of LLDPE in the production of electrical conduits and cable insulation contributes to its demand in the electrical and telecommunication sectors. LLDPE's insulating properties, durability, and environmental resistance are essential for protecting insulating cables from sunlight, fire, adverse weather conditions, and chemical degradation.

In terms of revenue, the packaging industry led the end-use segment in 2023 with a share of over 53%. The extensive use of PE in the production of plastic bags, pouches, and flexible packaging films is driving the segment growth. From food & beverages to pharmaceuticals and consumer goods, PE packaging plays a crucial role in preserving product freshness, extending shelf life, and enhancing the overall visual appeal of products on retail shelves.

The construction industry is anticipated to grow at the fastest CAGR of 5.53% from 2024 to 2033 owing to the growing emphasis on sustainable and energy-efficient construction practices, positioning PE as a key driver in improving the performance of building structures. In addition, the demand for geomembranes and geotextiles, both made from PE, drives product adoption in the construction segment.

In terms of application, the bottles & containers segment led the market in 2023 and accounted for a substantial revenue share of 40%. The growth of the bottles & containers segment is driven by the consistent demand for efficient and cost-effective packaging solutions across various sectors, reflecting the adaptability of PE in meeting the diverse packaging needs of these sectors.

The films & sheets segment is projected to grow at the fastest CAGR of 6.05% from 2024 to 2033. The popular trend of smart packaging is driving the segment's growth. Polyethylene films are integrated with features, such as RFID tags and QR codes. These technologies enable real-time tracking, authentication, and communication of information about the packaged products. The films & sheets segment enhances the supply chain visibility and engages consumers with interactive packaging by facilitating the integration of smart packaging solutions.

By Product

By Application

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others