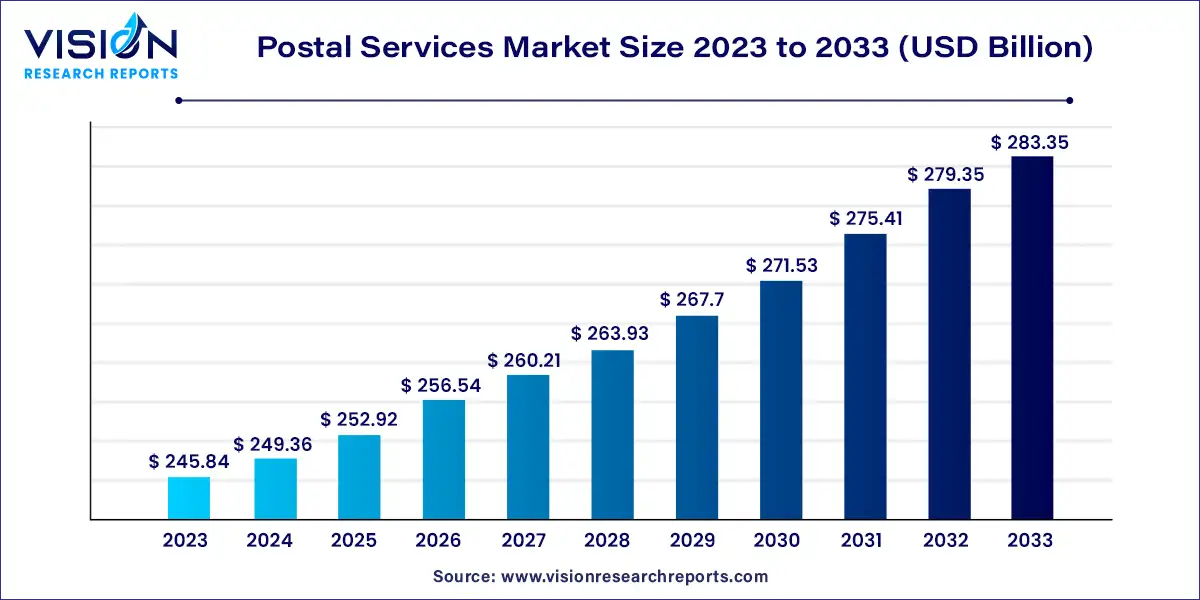

The global postal services market size was surpassed at USD 245.84 billion in 2023 and is expected to hit around USD 283.35 billion by 2033, growing at a CAGR of 1.43% from 2024 to 2033. The global postal services market plays a vital role in connecting individuals and businesses across different regions, facilitating the exchange of goods, documents, and information. Postal services, traditionally dominated by government entities, have evolved with the advent of technology, enabling both state-run and private companies to offer a wide range of solutions, from mail and package delivery to express logistics and e-commerce support.

The growth of the postal services market is primarily driven by several the technological advancements have significantly enhanced operational efficiency and service delivery, enabling postal services to offer more reliable and faster solutions. The rise of e-commerce has spurred a surge in parcel volumes, with consumers increasingly relying on postal services for delivery of online purchases. Additionally, the expansion of global trade and cross-border transactions has bolstered demand for international shipping and logistics services. The adoption of digital solutions, such as automated sorting systems and tracking technologies, has further streamlined operations and improved customer satisfaction. Moreover, the integration of innovative business models, including last-mile delivery partnerships and diversified service offerings, has positioned postal services as essential components of modern logistics and communication networks.

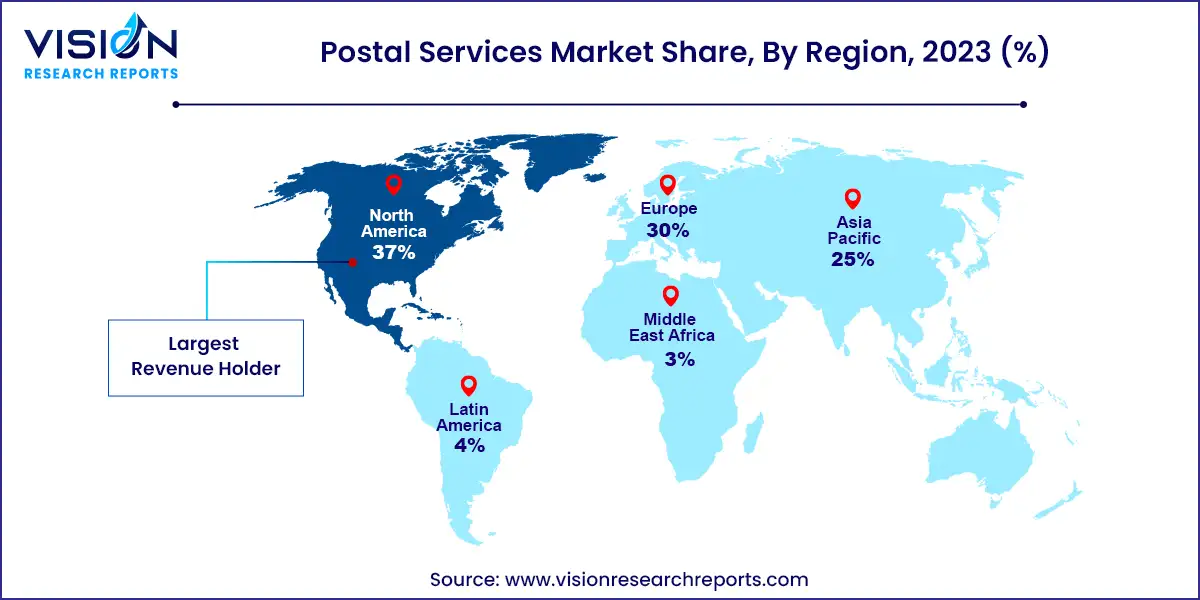

North America led the global postal services market in 2023, accounting for 37% of the global revenue. This leadership is attributed to the region’s well-established infrastructure, robust logistics networks, and high demand for efficient mail and parcel delivery services. Major players such as the United States Postal Service (USPS), Canada Post, and private couriers like FedEx and UPS contribute to North America's dominant position. The region's rapid e-commerce growth has increased the demand for reliable and fast shipping services. Technological innovations, including automation and advanced data analytics, further support North America's competitive edge. The strong economic environment and high consumer spending also drive the market’s expansion in this region.

| Attribute | North America |

| Market Value | USD 90.96 Billion |

| Growth Rate | 1.44% CAGR |

| Projected Value | USD 104.83 Billion |

The postal services market in Europe is anticipated to experience steady growth from 2024 to 2033. This growth is supported by a strong regulatory framework that ensures high service standards across member states. Europe’s market features a mix of government-owned services, such as Deutsche Post in Germany and La Poste in France, and private couriers serving various customer needs. Rising demand for cross-border e-commerce drives the need for efficient international postal services. Additionally, the adoption of digital technologies and sustainable practices, such as electric delivery vehicles, is enhancing the efficiency and environmental impact of postal services in Europe. The region's focus on innovation and strong consumer protection laws ensures that postal operators continue to adapt to market changes.

The postal services market in Asia Pacific is expected to grow at a substantial CAGR from 2024 to 2033, driven by rapid economic development and explosive e-commerce growth. Leading countries such as China, Japan, and South Korea are spearheading this growth with their advanced logistics networks and high online shopping demand. The surge in cross-border e-commerce is increasing the need for efficient international postal services. Additionally, the growing middle class in many Asia Pacific countries is boosting demand for postal and parcel delivery services. Regional postal operators are adopting technological innovations, including automation and AI-driven logistics, to enhance efficiency. Sustainable practices, such as electric delivery vehicles and energy-efficient sorting facilities, are also gaining momentum in the region.

In 2023, the standard segment led the market, accounting for over 76% of global revenue. Standard postal services, typically used for sending letters, documents, and non-urgent parcels, dominate due to their well-established infrastructure and the universal service obligation (USO) in many countries. This obligation ensures that basic postal services are available at a uniform rate nationwide, including in remote and rural areas. Despite a decline in traditional letter mail, standard services remain crucial due to their affordability, particularly for small businesses and individuals. The extensive postal networks and distribution systems built over decades support the continued strength of standard services for both national and international deliveries.

The express segment is projected to experience a faster compound annual growth rate (CAGR) from 2024 to 2033. The increasing demand for rapid delivery, especially for e-commerce and time-sensitive shipments, drives this growth. Express services offer premium pricing for expedited delivery, often including same-day or next-day options. Technological advancements in logistics, such as improved tracking, route optimization, and customer service enhancements, contribute to the segment's expansion. Additionally, express services are essential in the business-to-business (B2B) sector for timely delivery of critical documents and products. The rise of cross-border e-commerce further fuels the demand for express services, positioning them for continued growth.

The shipping and package services segment led the market in 2023. With the surge in online shopping, the need for reliable shipping services has grown significantly. This segment, which handles the transportation and delivery of various-sized parcels, is critical to the e-commerce ecosystem. The dominance of shipping and package services is supported by the trend toward home delivery, which has become a preferred option for many consumers. Major market players are investing in expanding their logistics and distribution networks to manage the increasing package volume. Innovations such as automated sorting centers, real-time tracking, and enhanced last-mile delivery solutions reinforce the segment's market position. Additionally, small and medium-sized enterprises (SMEs) depend on these services for cost-effective customer reach, further solidifying the segment’s importance.

The marketing mail (standard mail) segment is expected to grow at the fastest CAGR during the forecast period from 2024 to 2033. Despite the rise of digital marketing, direct mail remains a potent tool for businesses targeting specific audiences. This segment includes bulk mailing services for promotional materials, catalogs, brochures, and other marketing communications. Marketing mail's growth is driven by its high response rates and effectiveness in reaching audiences who prefer physical mail over digital ads. Advances in data analytics and customer segmentation have enhanced businesses' ability to tailor marketing campaigns, boosting the appeal of direct mail. Although more traditional, direct mail complements digital marketing strategies, particularly for reaching older demographics and local customers.

The domestic segment was the market leader in 2023 and is expected to register the highest CAGR during the forecast period. This segment involves the delivery of mail and packages within a country’s borders, essential for national logistics and communication networks. Domestic services benefit from extensive infrastructure that supports efficient deliveries across various areas, including urban, suburban, and rural regions. The growth of e-commerce has increased the demand for domestic parcel services, as consumers prefer home deliveries. Domestic postal services are favored for their convenience, speed, and reliability. The rise of same-day and next-day delivery options, especially in densely populated areas, has further accelerated this segment's growth. Additionally, the COVID-19 pandemic has boosted domestic delivery services due to the shift towards online shopping and contactless options.

The international segment is projected to grow significantly during the forecast period. This segment handles mail and parcels across international borders, making it a crucial part of global logistics and supply chains. The demand for efficient international postal services is driven by the rise in cross-border transactions and global e-commerce. Investments in global logistics networks and partnerships, along with innovations in tracking and customs processes, are improving the efficiency of international deliveries. Despite challenges like varying customs regulations and tariffs, the expansion of international postal services is expected to continue as global trade and e-commerce activities grow.

By Type

By Service

By Destination

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Postal Services Market

5.1. COVID-19 Landscape: Postal Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Postal Services Market, By Type

8.1. Postal Services Market, by Type, 2024-2033

8.1.1 Standard

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Express

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Postal Services Market, By Service

9.1. Postal Services Market, by Service, 2024-2033

9.1.1. Shipping & Package Services

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. First-class Mail

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Marketing Mail (Standard Mail)

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. International Mail

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Periodicals

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Postal Services Market, By Destination

10.1. Postal Services Market, by Destination, 2024-2033

10.1.1. Domestic

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. International

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Postal Services Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Service (2021-2033)

11.1.3. Market Revenue and Forecast, by Destination (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Destination (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Destination (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.3. Market Revenue and Forecast, by Destination (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Destination (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Destination (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Destination (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Destination (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.3. Market Revenue and Forecast, by Destination (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Destination (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Destination (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Destination (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Destination (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.3. Market Revenue and Forecast, by Destination (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Destination (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Destination (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Destination (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Destination (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.5.3. Market Revenue and Forecast, by Destination (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Destination (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Destination (2021-2033)

Chapter 12. Company Profiles

12.1. Australia Post.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Canada Post Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. China Post Group Corporation.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. FedEx.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. JAPAN POST Co., Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Koninklijke PostNL

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. La Poste.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Poczta Polska SA

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Royal Mail Group Limited.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Singapore Post Limited (SingPost)

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others