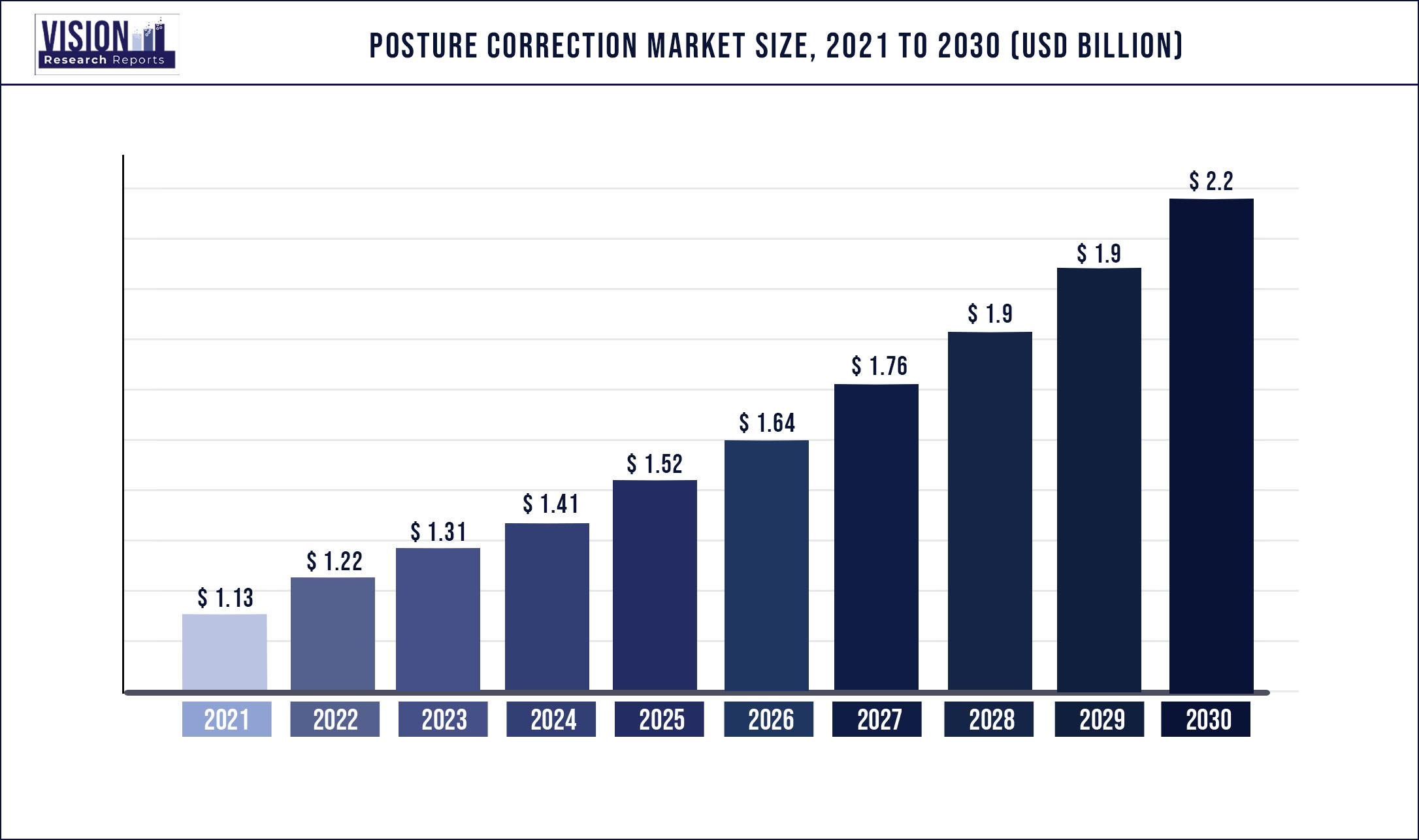

The global posture correction market was surpassed at USD 1.13 billion in 2021 and is expected to hit around USD 2.2 billion by 2030, growing at a CAGR of 7.68% from 2022 to 2030.

Report Highlights

The key factors driving the market growth include the rising number of back pain issues across the globe and the aging population. For instance, as per the NCBI in February 2022, back pain is a common condition among adults, up to 23% of people worldwide experience chronic low back pain.

The COVID-19 pandemic resulted in several challenges such as logistical blocks, low demand, decreased sales & marketing events, and reduced deals. On the other hand, lockdowns travel bans, and social isolation have made many posture-related issues worse as the most population had to work long period of durations while being seated at a one place which causes conditions including discomfort, stiffness, and muscle strain. However, sedentary lifestyles, bad posture, and chronic pain are the results. In addition, the pandemic has made it difficult for individuals to visit parks, gyms, and other activities, which has made their lives more sedentary.

Furthermore, long periods of sitting put more strain on the spinal disc and back muscles, resulting in back pain. Therefore, people use posture corrector goods to maintain and enhance their posture, which is driving up demand for these items. Products like backrests, lumbar support backrest cushions, and posture corrector chairs that assist people to improve their posture and lessen chronic pain while working are becoming more and more in demand. Therefore, the market for posture correctors has expanded due to the pandemic.

The market for posture correctors has been positively impacted by both the older population's growth and children's increased awareness of the advantages of good posture. For instance, Victoria State Government which is the state-level authority for Victoria, Australia provides plans to improve people’s posture which includes regular exercise and stretching, ergonomic furniture, and paying attention to the way the body feels. In addition, governments are attempting to raise awareness about numerous ongoing problems through a variety of media, and numerous businesses are seeking to correct posture deformities. One of the main forces for market expansion is the rising trend of naturally improving posture. Millennials are aware of the issues posture deformity can cause. They are taking preventative measures to avoid this issue, which is why posture correctors are being used. The increased use of posture correctors by young people has increased market revenue.

In addition, increasing demand for posture correction chairs is another driver estimated to contribute to the market growth. Since most people who work have desk jobs, they are more likely to experience chronic pain, musculoskeletal injuries, and other conditions that could harm their long-term health and productivity. The need for posture corrector chairs is rising as more people realize how crucial it is to adopt healthy working practices that promote posture. For improved spine alignment, posture corrector chairs have built-in headrests and lumbar supports. Hence, back pain is reduced, and various body parts are supported by posture correction chairs. But as more people choose to sit for extended periods while working, the need for posture correction chairs is rising.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.13 billion |

| Revenue Forecast by 2030 | USD 2.2 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.68% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product;, distribution channel; end-use |

| Companies Covered | BackJoy, Swedish Posture, Acorn International, Upright, Aspen Medical Products, LLC, Evoke Pro, Comfy Brace, ITA-Med Co., Super Ortho, Ottobock. |

Product Insights

Kinesiology tape dominated the market by product type in 2021 and the segment is also anticipated to grow at the fastest CAGR of over 8.4%. Since it reduces sports injuries, it is particularly helpful in sports. Injuries can be avoided by increasing joint space by sticking it to the knee or any other joint. It might also improve blood flow. Many times, increasing blood flow and reducing edema have been seen when kinesiology tape is applied to the injured site. Nowadays, individuals aim to avoid sedentary lives to prevent several concerns, including problems with their posture. Sports, games, and physical activity are therefore strongly promoted. This trend could lead to an expansion of the kinesiology tape market.

Additionally, according to an article published by National Safety Council, sports- and recreational-related injuries rose by 20% in 2021 after reaching a record low in 2020. For instance, the number of injuries related to exercise and sports activity grew slightly in 2021 (409,224 injuries compared to 377,939 in 2020), with 15 to 24-year-olds having the greatest injury incidence. Spending on posture corrector devices has increased due to the growing concerns about these sports-related ailments. These variables imply that the segment is anticipated to have considerable growth throughout the projected period.

Distribution Channel Insights

By distribution channel, pharmacies and retail stores held the highest market share of over 55% in 2021. Customers benefit from pharmacists' personalized advice, which is targeted to their unique requirements and circumstances in terms of health. This contrasts with the availability of medical internet forums on the internet, which are frequently managed by administrators who are unaware of aspects that might affect the best advice to offer. Usually, a community pharmacy provides much more than just medications. They provide excellent services, affordable rates, and a large selection of general healthcare.

The E-commerce segment is anticipated to grow at the fastest rate during the forecast period. Posture correctors may be found simply and quickly online. The online market provides practical services like home delivery and the availability of all different kinds of posture corrector devices. The popularity of smartphones is expanding rapidly. Hence, increasing the customer's exposure to online shopping. Due to lower costs associated with communications and infrastructure, established companies are increasingly turning to e- commerce. Additionally, it is projected that customer preference for items with quick availability would spur market expansion due to consumers' busy lives and demanding work schedules.

End-Use Insights

The end-use segment was dominated by adults in 2021. According to data published by National Safety Council, an estimated number of injuries were reported among people aged between 25 to 64. For example, 1,022,276 injuries are anticipated in 2021. In contrast, people 65 and older reported 232,838 injuries. The issues caused by postural deformities are known to millennials. They are taking preventative measures to avoid this issue, which is why posture correctors are being used. The increased use of posture correctors by young people has increased market revenue. Besides, constant product innovation by market participants boosts the market growth. In August 2021, Kinesio Holding Corporation announced the launch of Kinesio Medical Taping for the mature adult.

The geriatric population is projected to register the fastest CAGR of over 9.2% in the coming years. The need for posture braces and supports is anticipated to be mostly driven by the aging population. This group is very vulnerable to musculoskeletal conditions. As people age, their bones and supporting tissues like ligaments and cartilages eventually deteriorate. This puts older people at significant risk for muscular injuries, particularly to their shoulders and knees. As a result, the joints become even more rigid, necessitating the use of braces and supports to increase the distribution channel.

Regional Insights

North America accounted for the largest revenue share of over 49.5% in 2021. The large share of the North American region is due to the presence of key players and the growing prevalence of low back pain in the U.S. and Canada. For instance, according to Branko PRPA M.D. Spine Surgery in 2021, In the past three months of 2019, lower back issues affected about 30% of US citizens. Europe held the second largest share of the posture correction market. Besides, in June 2020, BackEmbrace announced that it is now available on Amazon, making it easier for Americans to live and work while spending more time in front of screens. Such product introductions aid in the expansion of regional markets.

Asia Pacific region is projected to register the highest CAGR of over 9.7% in the coming years. This is attributable to the high acceptance rate of posture correctors and inclination towards healthcare in the region. Asian nations are increasingly putting more of a focus on fitness centers, sports, and other physical activities to keep healthy and prevent posture deformity, which is progressively rising in many people owing to sedentary lives. Another factor driving the market for posture correctors is the growing elderly population in some countries. The WHO estimates that by 2040, the elderly in China may make up 28% of the country's population. This data implies that the market for posture correctors is expected to expand favorably throughout the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Posture Correction Market

5.1. COVID-19 Landscape: Posture Correction Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Posture Correction Market, By Product

8.1. Posture Correction Market, by Product, 2022-2030

8.1.1 Sitting Support Devices

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Kinesiology Tape

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Posture Braces

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Posture Correction Market, By Distribution Channel

9.1. Posture Correction Market, by Distribution Channel, 2022-2030

9.1.1. Pharmacies & Retail Stores

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. E-Commerce

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Posture Correction Market, By End User

10.1. Posture Correction Market, by End User, 2022-2030

10.1.1. Kids

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Adults

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Geriatric

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Posture Correction Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.1.3. Market Revenue and Forecast, by End User (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End User (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End User (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.3. Market Revenue and Forecast, by End User (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End User (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End User (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End User (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End User (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.3. Market Revenue and Forecast, by End User (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End User (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End User (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End User (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End User (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.3. Market Revenue and Forecast, by End User (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End User (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End User (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End User (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End User (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.5.3. Market Revenue and Forecast, by End User (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End User (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End User (2017-2030)

Chapter 12. Company Profiles

12.1. BackJoy

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Swedish Posture

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Acorn International

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Upright

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Aspen Medical Products, LLC

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Evoke Pro

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Comfy Brace

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. ITA-Med Co.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Super Ortho

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Ottobock

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others