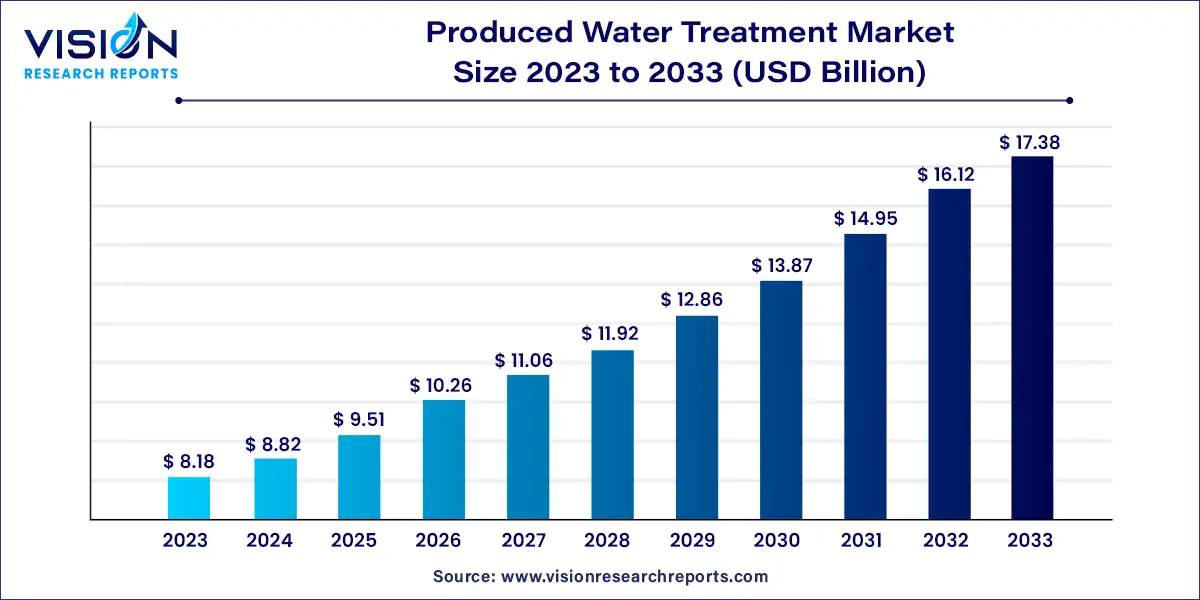

The global produced water treatment market size was estimated at around USD 8.18 billion in 2023 and it is projected to hit around USD 17.38 billion by 2033, growing at a CAGR of 7.83% from 2024 to 2033. The produced water treatment market is a critical segment within the broader water treatment industry, focusing on the management and processing of water that emerges during the extraction of oil and gas. This water, known as produced water, contains a complex mixture of hydrocarbons, salts, and other contaminants that necessitate specialized treatment methods. With the growing demand for oil and gas, the produced water treatment market is poised for significant expansion.

The produced water treatment market is experiencing robust growth fueled by the surge in oil and gas production activities globally is a significant driver. As extraction rates escalate, the volume of produced water generated increases, necessitating advanced treatment solutions to handle and process this byproduct effectively. Additionally, stringent environmental regulations are compelling companies to adopt state-of-the-art treatment technologies to ensure compliance and mitigate environmental impact. Technological innovations, such as membrane filtration and advanced oxidation processes, are enhancing treatment efficiency and enabling the recycling and reuse of produced water, which further drives market growth. Moreover, the industry’s shift towards sustainability and water conservation is promoting the adoption of produced water recycling, thereby reducing freshwater dependency and operational costs.

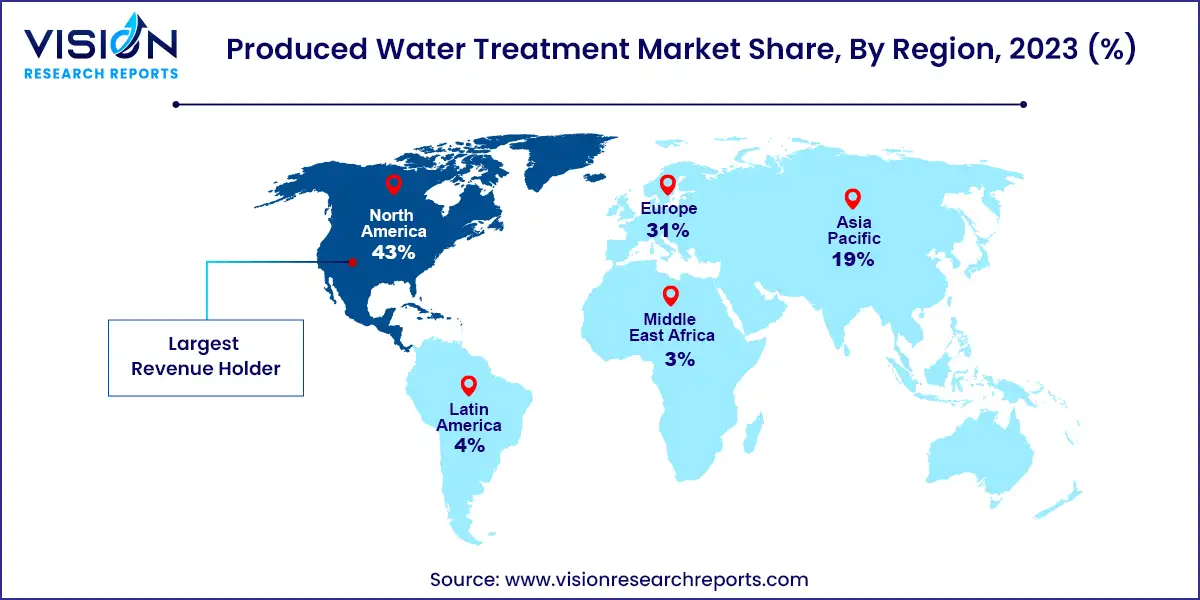

North America led the market with a 43% share in 2023. The region's substantial crude oil reserves in the U.S. and Canada are driving the demand for water management services. The significant volumes of produced water generated by the booming oil and gas industry necessitate effective treatment solutions to comply with stringent environmental regulations. Growing concerns over water scarcity and contamination further underscore the need for efficient produced water treatment before disposal or reuse.

| Attribute | North America |

| Market Value | USD 3.51 Billion |

| Growth Rate | 7.83% CAGR |

| Projected Value | USD 7.47 Billion |

In 2023, Europe was the second-largest regional market for produced water treatment. New regulations are being introduced to encourage the adoption of advanced water treatment technologies. Regulatory bodies and agencies, such as the European Water Association, are actively developing policies to reduce the disposal of untreated produced water.

The Asia Pacific region is expected to see significant growth in the produced water treatment market from 2024 to 2033. As industrial activities, including oil and gas production, expand across APAC countries, the volume of produced water is also rising. This increase in production demands effective treatment solutions to adhere to stringent environmental regulations and support sustainable water management practices.

In 2023, the onshore application segment dominated the global market, accounting for over 72% of the total revenue. Produced water, which is generated during onshore oil and gas extraction, is extracted from reservoirs alongside oil or gas. The treatment of this water involves physical, chemical, and biological methods or a combination of these approaches. Biological treatment methods are often less practical for offshore operations due to their significant environmental impact.

The offshore application segment is projected to experience substantial growth during the forecast period. Offshore produced water can either be re-injected into reservoirs, discharged into the sea after treatment, or transported to shore for treatment and disposal. For example, in July 2023, Egypt announced an $8.1 billion investment in offshore gas exploration, including plans to drill around 35 exploratory gas wells by July 2025. Additionally, Shell revealed a $5 billion investment plan for offshore oil production in Nigeria in December 2023, with an additional $1 billion dedicated to increasing natural gas output in the region. These global investments are expected to drive increased demand for offshore produced water treatment solutions.

In 2023, the physical treatment segment led the market in revenue. Advancements in physical treatment technologies, such as membrane filtration, electrocoagulation, and flotation, have improved their efficiency and reliability. The cost-effectiveness and simplicity of physical treatments, compared to chemical or biological methods, make them appealing to end-users. Their ability to handle a wide range of contaminants and water compositions also contributes to their widespread use.

The chemical treatment segment is expected to experience robust growth from 2024 to 2033. Chemical treatments are versatile, effectively addressing a broad spectrum of contaminants including oil, grease, heavy metals, and organic compounds. The scalability and adaptability of these processes allow for tailored solutions based on specific treatment needs and water quality parameters. Additionally, ongoing innovations in chemical formulations and delivery systems are enhancing treatment efficiency, effectiveness, and environmental compatibility, fueling market expansion.

By Treatment

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others