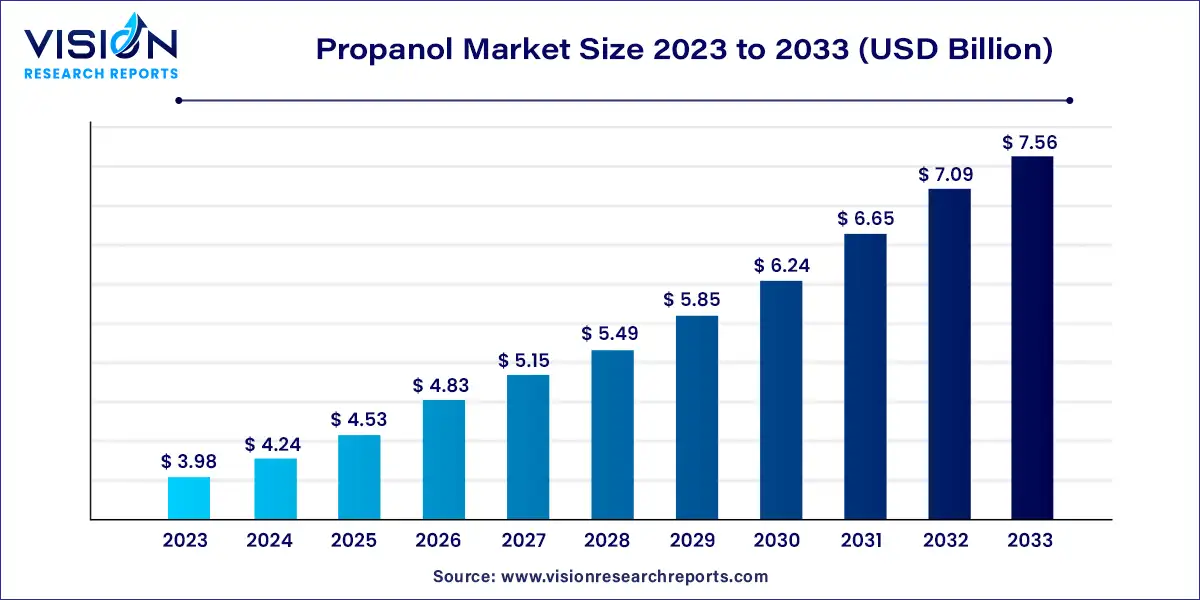

The global propanol market size was estimated at USD 3.98 billion in 2023 and it is expected to surpass around USD 7.56 billion by 2033, poised to grow at a CAGR of 6.63% from 2024 to 2033.

The growth of the propanol market is primarily driven by the rising demand in the pharmaceuticals and personal care sectors is a major contributor, as propanol, especially isopropanol, is essential in the production of hand sanitizers and disinfectants. Additionally, the expanding use of propanol as an industrial solvent in paints, coatings, and inks further propels market growth. The booming cosmetics industry also significantly boosts the demand for n-propanol, used in various personal care products. Furthermore, rapid industrialization and urbanization, particularly in emerging economies, are creating new opportunities and expanding the market scope for propanol applications.

The isopropanol form segment dominated the market with the highest revenue share of 86% in 2023. This is attributed to its extensive use as a solvent, antiseptic, astringent, cleaning agent, chemical intermediate, and in various other applications. The increasing demand for isopropyl alcohol is driven by its antibacterial properties and low chemical reactivity.

There is a steady increase in demand for cleaning agents in households due to growing awareness of hygiene. Emerging economies are experiencing rapid expansion in cleaning agent sales, supported by product differentiation and innovative manufacturer strategies. Rising disposable incomes have also contributed to the expansion of these products, where isopropyl alcohol plays a significant role in cleaning formulations, thus driving steady growth in the application market.

N-propanol finds primary application in the production of chemical intermediates. The market demand for n-propanol is fueled by its use in alcoholic beverages and in the manufacturing of acetylated chemicals and alkyl halides. These chemicals further support the production of specialty chemicals and pharmaceuticals.

The direct solvent application segment of isopropanol dominated the market with a revenue share of 34%, driven by its increasing use in dyes, soaps, antifreeze, lacquer formulations, window-cleaning agents, and other products.

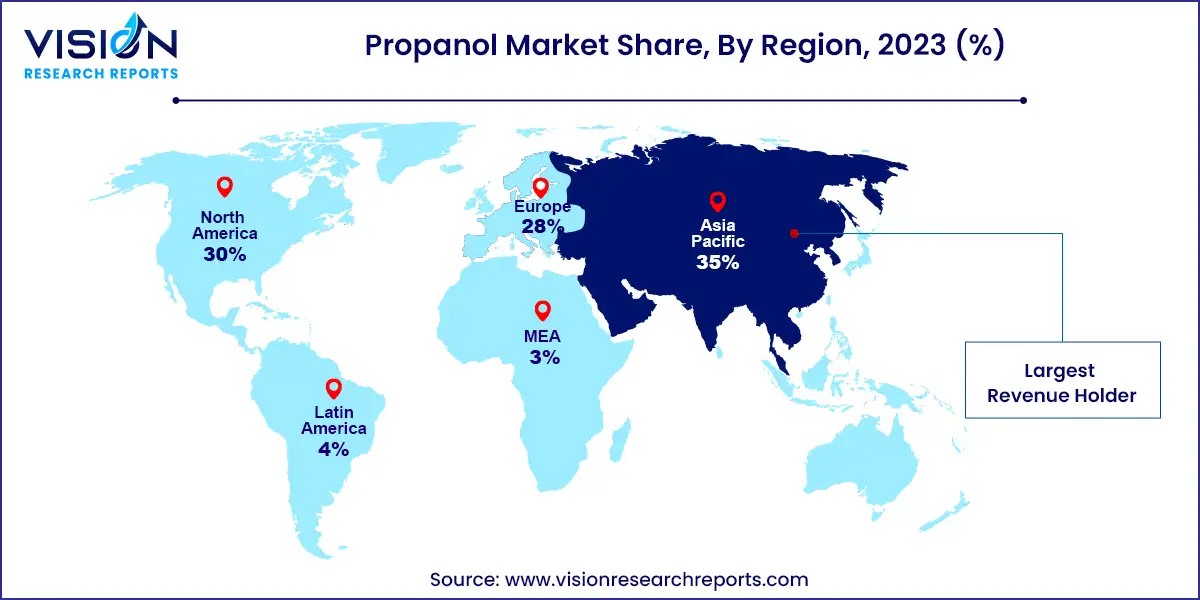

Asia Pacific dominated the product market with the highest revenue share of 35% in 2023. This growth is attributed to rapid industrial expansion in countries like India, China, and South Korea. Key factors driving product consumption include increased infrastructure spending and a robust pharmaceutical industry in the region.

In Europe, product demand is rising across various industries such as specialty chemicals and pharmaceuticals. Since 2023, consumption has surged due to heightened demand for sanitizers, leading to shortages of chemicals like isopropyl alcohol. To address this, many companies in the region are optimizing their raw material supply chains to efficiently produce isopropyl alcohol.

Germany, a leading propanol producer in Europe, is enhancing production capacities to meet growing demand, supported by companies like Oxea GmbH and INEOS. Increased production of n-propanol is also underway to support the manufacturing of disinfectant products.

Product By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Propanol Market

5.1. COVID-19 Landscape: Propanol Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Propanol Market, By Product By Application

8.1. Propanol Market, by Product By Application Type, 2024-2033

8.1.1. Isopropanol

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Direct Solvent

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Chemical Intermediate

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Pharmaceuticals

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Household and personal care

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Other

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. n-propanol

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Chemical Intermediate

8.1.8.1. Market Revenue and Forecast (2021-2033)

8.1.9. Direct Solvent

8.1.9.1. Market Revenue and Forecast (2021-2033)

8.1.10. Others

8.1.10.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Propanol Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Product By Application (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Product By Application (2021-2033)

Chapter 10. Company Profiles

10.1. Shell Chemicals

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. ExxonMobil

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. BASF SE

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Dow Inc.

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Sasol Limited

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Eastman Chemical Company

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Tokuyama Corporation

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Lyonellbasell

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. Solvay

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Mitsui Chemicals Inc.

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others