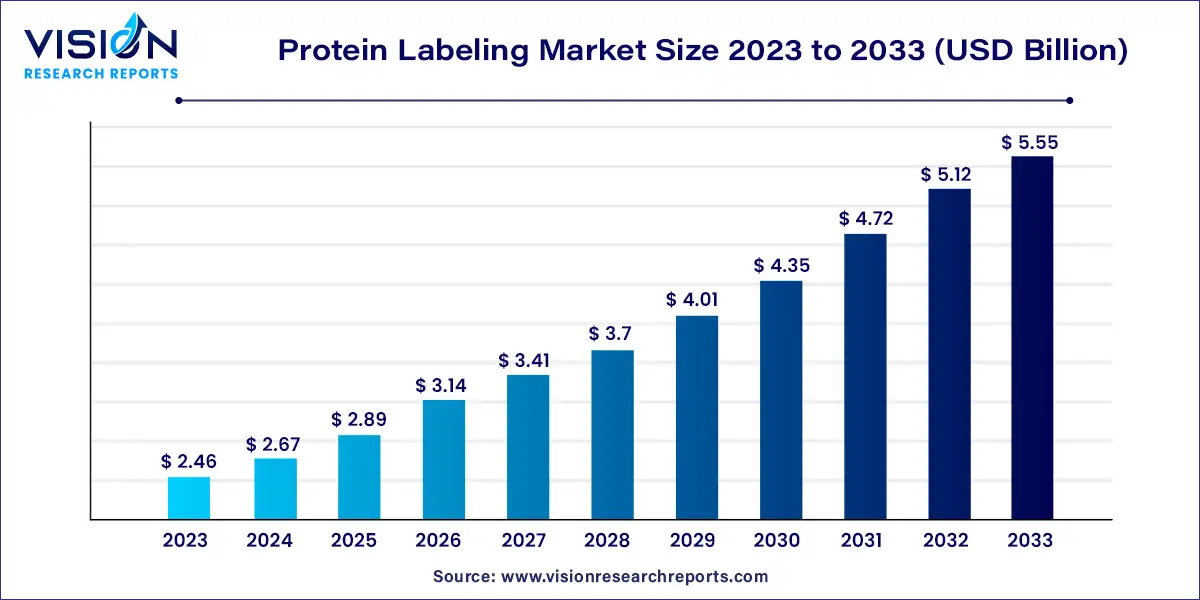

The global protein labeling market size was estimated at USD 2.46 billion in 2023 and it is expected to surpass around USD 5.55 billion by 2033, poised to grow at a CAGR of 8.48% from 2024 to 2033.

The protein labeling market is a rapidly growing segment within the broader biotechnology and pharmaceutical industries. This market encompasses various techniques and products used to attach detectable tags to proteins, enabling their identification, tracking, and analysis in a wide range of scientific and clinical applications. The increasing demand for protein-based research and diagnostics, driven by advancements in genomics, proteomics, and personalized medicine, is propelling the growth of this market.

The protein labeling market is experiencing robust growth driven by the rapid advancement in proteomics and genomics research, which necessitates sophisticated labeling techniques for the precise identification and analysis of proteins. Additionally, the increasing prevalence of chronic diseases, such as cancer and diabetes, drives demand for advanced diagnostic and therapeutic solutions where protein labeling plays a crucial role. Moreover, significant investments in biotechnology and pharmaceutical R&D activities are propelling the market forward, as companies seek to develop novel drugs and therapies. The growing adoption of personalized medicine further accelerates market growth, as it relies heavily on the accurate detection and targeting of specific proteins.

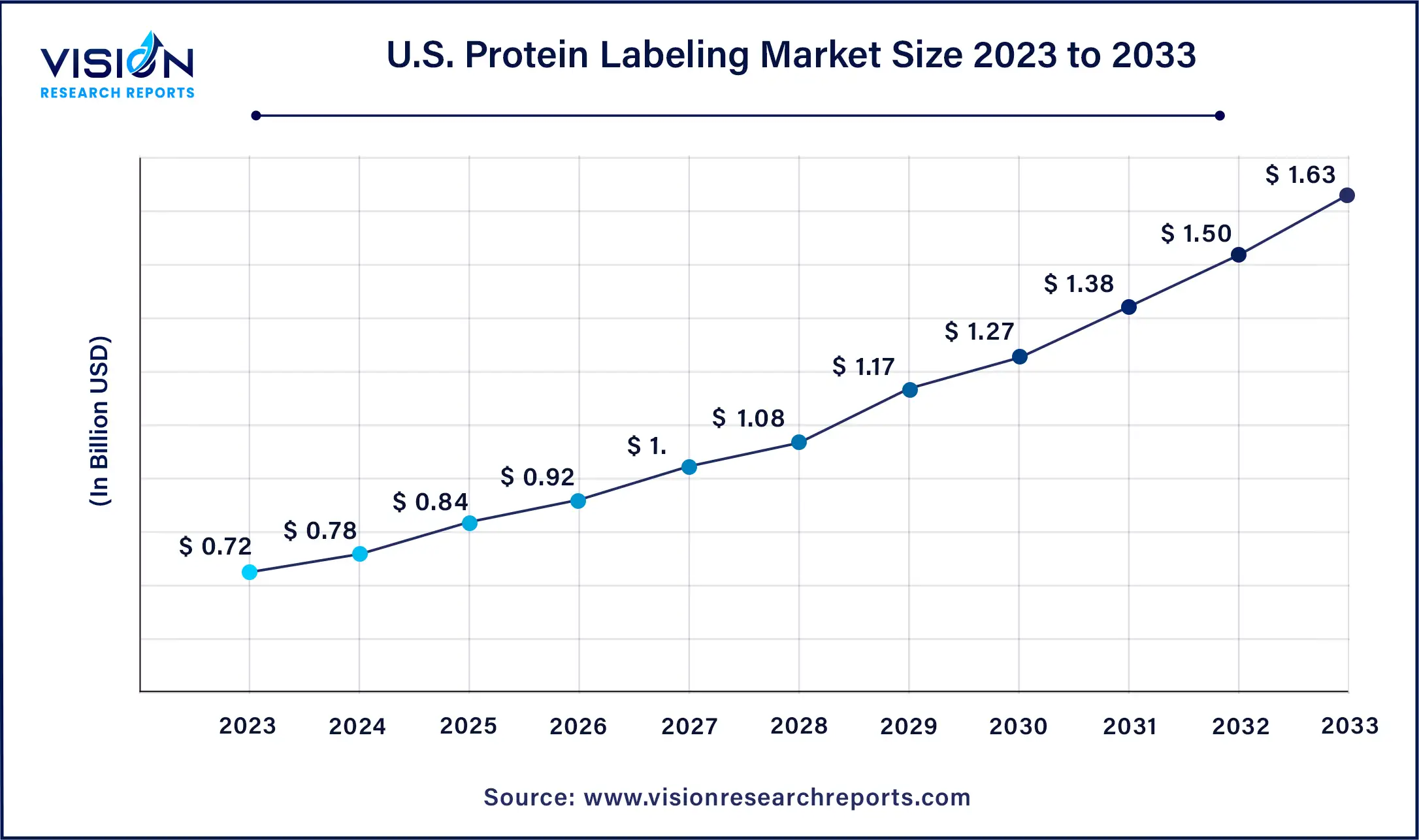

The U.S. protein labeling market size was estimated at around USD 0.72 billion in 2023 and it is projected to hit around USD 1.63 billion by 2033, growing at a CAGR of 8.51% from 2024 to 2033.

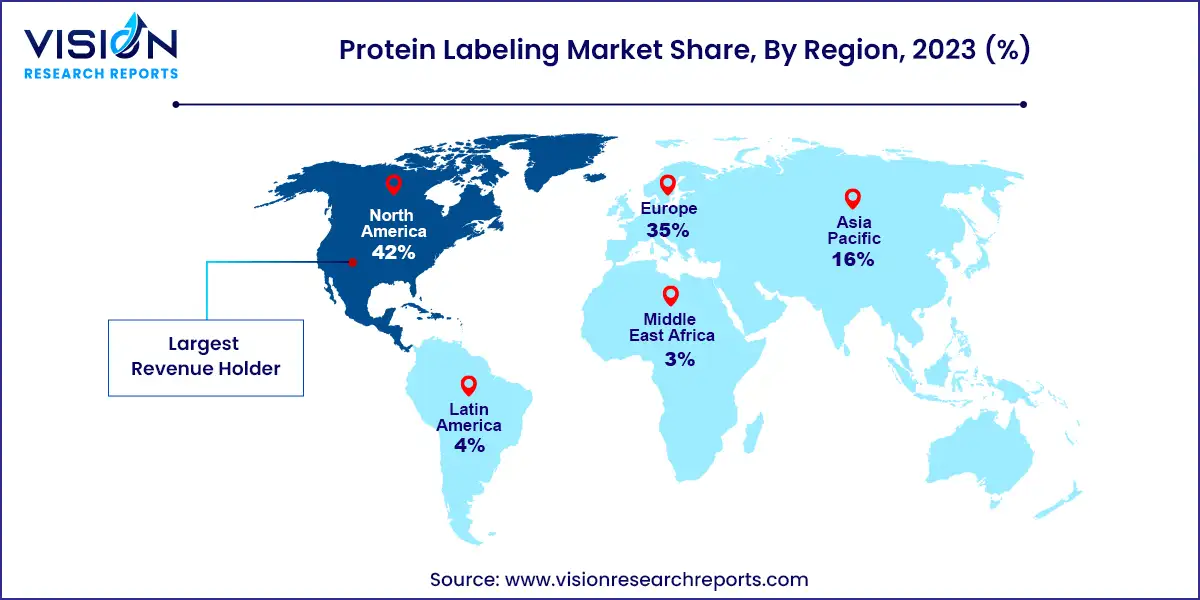

North America dominated the global protein labeling market in 2023 with a revenue share of 42%. Market growth in this region is driven by substantial investments in research and development, increased healthcare expenditures, and continuous technological innovations that enhance protein analysis accuracy and efficiency. Key market players such as Thermo Fisher Scientific, PerkinElmer Inc., Promega Corporation, and others contribute significantly to market expansion.

Asia Pacific protein labeling market is anticipated to witness the fastest CAGR of 10.48% from 2024 to 2033. Factors driving this growth include rising research and development activities, expanding biotechnology and pharmaceutical industries, advancements in proteomic research, and increasing prevalence of chronic diseases. These dynamics underscore the region's emerging role as a key player in the global protein labeling market.

In 2023, the reagents segment dominated the market, capturing 64% of the global revenue. This dominance is attributed to the increasing availability of labeling agents and genetically engineered protein labels. Protein labeling reagents serve as versatile tools for researchers and practitioners, facilitating a broad spectrum of applications. These applications range from advancing the understanding of cellular processes to elucidating disease mechanisms and aiding in the development of new therapeutics. Moreover, the presence of market players offering customized solutions based on diverse protocols is expected to drive further growth in this segment.

Over the forecast period, the kits segment is projected to witness the fastest compound annual growth rate (CAGR) of 9.64%. Protein labeling kits provide standardized and user-friendly tools that streamline specific labeling objectives, thereby reducing the complexity of experimental setups and enhancing reproducibility. The selection of a kit depends on the labeling method and intended application. Typically, these kits include essential components such as reagents, buffers, and protocols tailored for various labeling techniques. They are instrumental in labeling proteins and antibodies with fluorescent labels or biotin for applications such as cell-based assays, western blotting, ELISA, and immunofluorescence.

The in-vitro segment held the largest market share at 71% in 2023. In-vitro protein labeling methods involve processing samples in a laboratory setting, employing probes or tags such as enzymes, dyes, and nanoparticles. Enzymatic labeling predominates this segment due to its highly specific enzymatic reactions. Notably, the nanoparticle-based in-vitro procedures segment is expected to exhibit the fastest growth rate over the forecast period. This method utilizes gold nanoparticles for precise attachment to antibodies or hinge thiol on proteins like IgG or Fab. Nanoparticles' small size enables them to access intricate areas and form stable covalent bonds with target proteins or peptides, enhancing labeling efficacy and stability.

The in-vivo segment is projected to witness significant growth from 2024 to 2033. The adoption of photoreactive labeling methods, particularly Photo-Affinity Labeling (PAL), is poised to expand due to its specificity in investigating Protein-Protein Interactions (PPIs). This method is particularly valuable for live-cell monitoring and disease diagnosis applications.

The immunological techniques segment led the market in 2023 with a share of 40%. This dominance is primarily attributed to the rising prevalence of chronic diseases and increased R&D investments by biotechnology and biopharmaceutical companies. These investments focus on developing complex biologics such as monoclonal antibodies and vaccines. The segment's growth is further supported by expanding research activities in genomics and proteomics, which drive demand for protein labeling techniques and reagents. Immunological techniques encompass various applications including flow cytometry, immunoassays, western blotting, and immunofluorescence, crucial for cancer research, autoimmune disease studies, and therapeutic development.

The fluorescence microscopy segment is projected to witness the fastest CAGR of 9.78% from 2024 to 2033. By labeling target proteins with fluorescent tags, researchers visualize their distribution within cells and organelles. This technique supports biomedical research in fields such as cancer biology, neuroscience, and immunology, enhancing understanding of cellular and molecular mechanisms. Recent advancements include the introduction of fluorescence live-cell imagers that enable real-time cellular process observation under controlled incubator conditions.

By Product

By Method

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Protein Labeling Market

5.1. COVID-19 Landscape: Protein Labeling Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Protein Labeling Market, By Product

8.1. Protein Labeling Market, by Product, 2024-2033

8.1.1 Reagents

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Kits

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Protein Labeling Market, By Method

9.1. Protein Labeling Market, by Method, 2024-2033

9.1.1. In-vitro Labeling Methods

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. In-vivo Labeling Methods

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Protein Labeling Market, By Application

10.1. Protein Labeling Market, by Application, 2024-2033

10.1.1. Immunological Techniques

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Cell-based Arrays

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Fluorescence Microscopy

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Protein Microarray

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Mass Spectrometry

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Protein Labeling Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Method (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Method (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Method (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Method (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Method (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Method (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Method (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Method (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Method (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Method (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Method (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Method (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Method (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Method (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Method (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Method (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Method (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Method (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Method (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Method (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Method (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Thermo Fisher Scientific, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Merck KGaA.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Revvity Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Promega Corporation.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. F. Hoffmann-La Roche Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. LGC Ltd

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. New England Biolabs.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. LI-COR, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Danaher (Cytiva).

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Jena Bioscience GmbH

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others