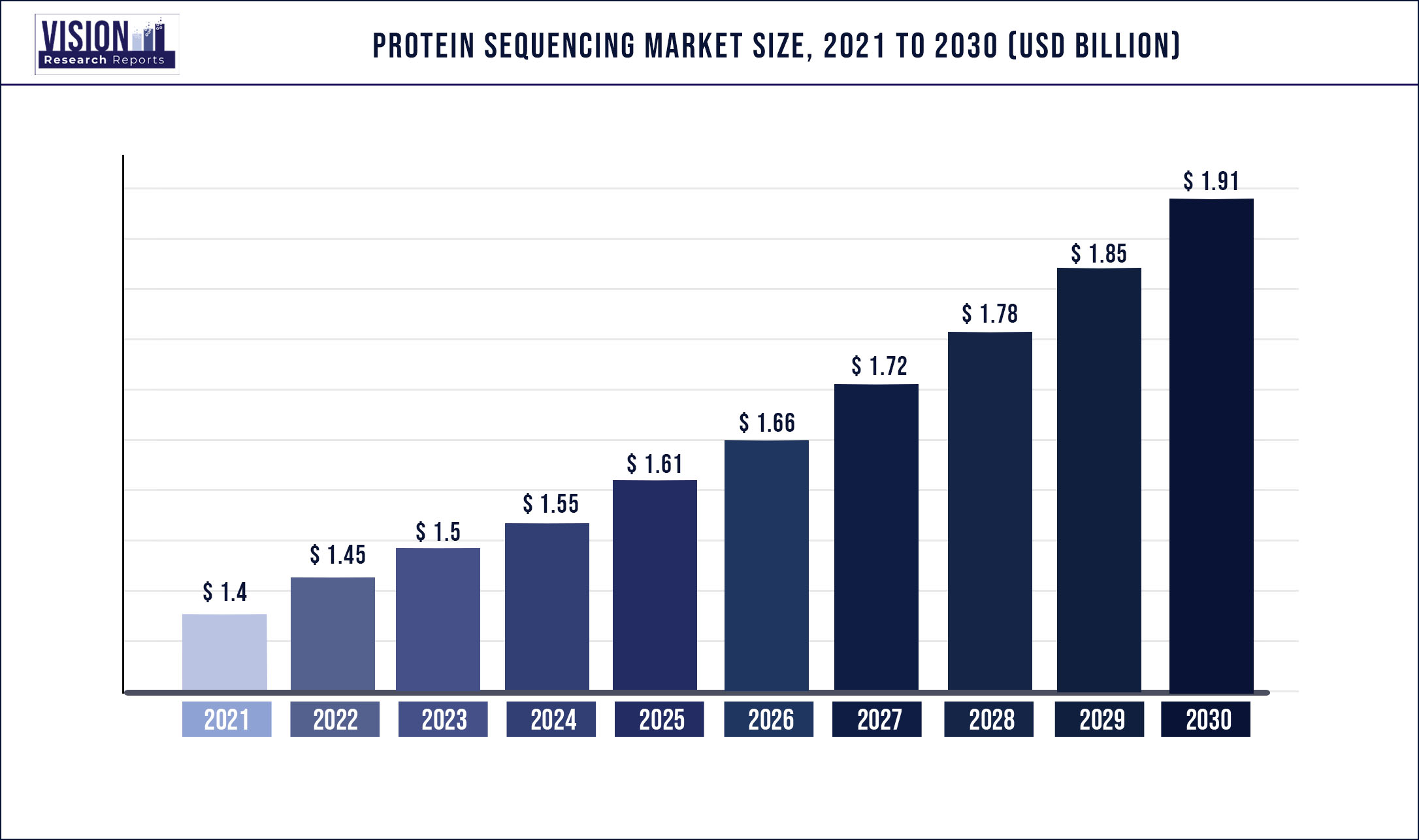

The global protein sequencing market was surpassed at USD 1.4 billion in 2021 and is expected to hit around USD 1.91 billion by 2030, growing at a CAGR of 3.51% from 2022 to 2030.

Report Highlights

The increasing research in genomics and proteomics, coupled with the rising demand for protein-based therapeutics around the world, is contributing to the demand for protein sequencing. For instance, in May 2022, Amphista Therapeutics announced a collaboration with Bristol Myers Squibb for discovering and developing small-molecule protein degraders. Bristol Myers Squibb is expected to receive an exclusive license to manufacture and commercialize the product. Hence, the rising demand for protein degradation is anticipated to extend the application scope for protein sequencing.

Increasing funding and grants for biomedical R&D by governments and major companies are anticipated to have a significant impact on the usage of sequencing. As per a WHO report published in January 2022, in 2019, approximately 80,178 grants were awarded to biomedical research from 11 funders. Out of those, 69.4% of grants were assigned for research, while 19.5% were for training purposes. Moreover, approximately 75% of the overall grants were awarded to organizations in the U.S. Federal funding in the U.S. has created the demand for protein sequencing from end-users.

Similarly, the usage of recombinant antibodies is growing in the management of rheumatoid arthritis, cancer, and other pathological conditions, which is likely to increase the use of protein sequencing. According to research published in February 2022, the de novo antibody sequencing through mass spectrometry techniques is feasible for numerous complicated clinical samples via endogenous sources including serum. Hence, such research is likely to increase applications of the market in the area of therapeutics.

The COVID-19 pandemic resulted in increased usage of protein sequencing in assessing the components of the COVID-19 virus, along with assessing the changes in the genome post-COVID-19. A study published in September 2022 performed 97,437 COVID-19 protein sequencing to detect non-synonymous mutations in 26 various sequences. This had a positive impact on the global market.

The growing demand for personalized medicine and vaccination is likely to be an essential factor for the market growth since it is an emerging application of the market. For instance, in January 2022, Amgen collaborated with Generate Biomedicines in order to discover and advance protein-based therapeutics for multiple fields. The collaboration is estimated to be valued at around USD 1.9 billion.

On the other hand, advancements in sampling technologies covering proteomes are expected to support the growth of the technique in the proteome market. However, the regulation on intellectual property such as patents on protein sequencing is not formally drafted. For instance, in Australia, a patent on sequencing highly depends on the jurisdiction. The lack of patenting regulations restrains academic institutions to conduct R&D on developing new technologies.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.4 billion |

| Revenue Forecast by 2030 | USD 1.91 billion |

| Growth rate from 2022 to 2030 | CAGR of 3.51% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product and service, application, end-user, region |

| Companies Covered |

Thermo Fisher Scientific, Inc.; Shimadzu Corporation; Agilent Technologies, Inc.; Rapid Novor, Inc.; Charles River Laboratories; Proteome Factory AG; Selvita; Bioinformatics Solutions Inc.; Creative Proteomics; Alphalyse; Bruker |

Product & Service Insights

The protein sequencing products segment led the market with a share of over 80.07% in 2021. In the instruments segment, the mass spectrometry instruments sub-segment held the largest share in 2021. Over the past few years, several bio-analytical tools are being employed to study proteins and peptides in the field of proteomics. Mass spectrometry has become a promising tool for proteomics research for the determination of the molecular mass of proteins, peptides, and sequences.

Along with that, the reduced pricing of instruments has positively impacted market growth. For instance, in 2018, the price of mass spectrometry was estimated at around USD 400,000; however, in 2020, the unit price ranges from below USD 10,000 to USD 100,000. Increasing financing options such as leasing the instruments have enabled researchers to employ the technology at the minimal cost possible.

The protein sequencing services segment is anticipated to witness lucrative growth during the forecast period. The increasing number of academic institutions and research centers offer access to researchers to their labs and instruments at a nominal cost, ranging from USD 8 per hour to USD 300 per hour.

Along with that, various companies are developing innovative technologies that ease protein sequencing for the service providers. For instance, in September 2022, NVIDIA Corporation announced to combine NeMo LLM cloud service with BioNeMO, which offers researchers access to biology language models and pre-trained chemistry. These services assist in research interaction and manipulate protein and data for various applications, including drug discovery.

Application Insights

The bio-therapeutics segment captured the largest share of over 55.02% in 2021. This can be attributed to the increasing participation of pharmaceutical companies in developing bio-therapeutics. Recombinant therapeutic proteins, specifically monoclonal antibodies, are considered to be the essence of bio-therapeutics for treating numerous diseases. As of May 2021, 100 monoclonal antibodies were approved by the U.S. FDA.

Similarly, increasing strategic initiatives by the players in the bio-therapeutics sector are expected to support the growth of the market. For instance, in November 2021, Generate Biomedicines announced to raise USD 370 million via Series B to support the development of a drug generation platform. The platform is to understand the genetic coding in the functionality of proteins. It is a revolutionary technique in drug development and protein therapeutics.

End-user Insights

The academic institutes and research centers segment held the largest share of over 45.11% in 2021. It is one of the major revenue generators of the market. The institutions are conducting thorough research and development to develop protein sequencing technologies. For instance, in January 2022, researchers from the University of Texas announced the development of a practical approach for single-molecule protein sequencing. Hence, technological advancements in the techniques of protein sequencing are anticipated to boost the market growth.

The pharmaceutical and biotechnological companies segment is anticipated to witness the fastest growth during the forecast period. The use of protein sequencing, especially mass spectrometry, in the pharmaceutical industry is associated with the drug discovery and development process. Thus, the growing demand for biomolecule analysis and drug component analysis is surging the segment growth. The advanced mass spectrometry systems offer high throughput and an optimized environment for testing. Thus, the demand for such advanced products is increasing among these end-users.

Regional Insights

North America held the largest revenue share of over 35.21% in 2021. This can be attributed to the existence of well-established academic institutions and research centers in the region, along with increasing funding opportunities in R&D. The government funding in the region is considerably strong in support of organizations. For instance, UniProt is a portal that offers resources for protein sequencing and functional information free of cost. This portal is backed by various government institutions, including the National Eye Institute (NEI); the National Heart, Lung, and Blood Institute (NHLBI); and the National Human Genome Research Institute (NHGRI).

Asia Pacific is estimated to witness the fastest growth in the forecast period owing to the increasing adoption of mass spectrometry-based technologies in India and China for various applications. Additionally, the rising attention toward proteomics and genomics research and growing initiatives by academic institutions for developing protein-based therapeutics have provided the Asia Pacific market with significant growth opportunities.

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Protein Sequencing Market

5.1. COVID-19 Landscape: Protein Sequencing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Protein Sequencing Market, By Product & Service

8.1. Protein Sequencing Market, by Product & Service, 2022-2030

8.1.1 Protein Sequencing Products

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Protein Sequencing Services

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Protein Sequencing Market, By Application

9.1. Protein Sequencing Market, by Application, 2022-2030

9.1.1. Bio-therapeutics

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Genetic Engineering

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Protein Sequencing Market, By End-user

10.1. Protein Sequencing Market, by End-user, 2022-2030

10.1.1. Academic Institutes & Research Centers

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Pharmaceutical & Biotechnology Companies

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Protein Sequencing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by End-user (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-user (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product & Service (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-user (2017-2030)

Chapter 12. Company Profiles

12.1. Thermo Fisher Scientific, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Shimadzu Corporation

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Agilent Technologies, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Rapid Novor, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Charles River Laboratories

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Proteome Factory AG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Selvita

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Bioinformatics Solutions Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Creative Proteomics

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Alphalyse

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others