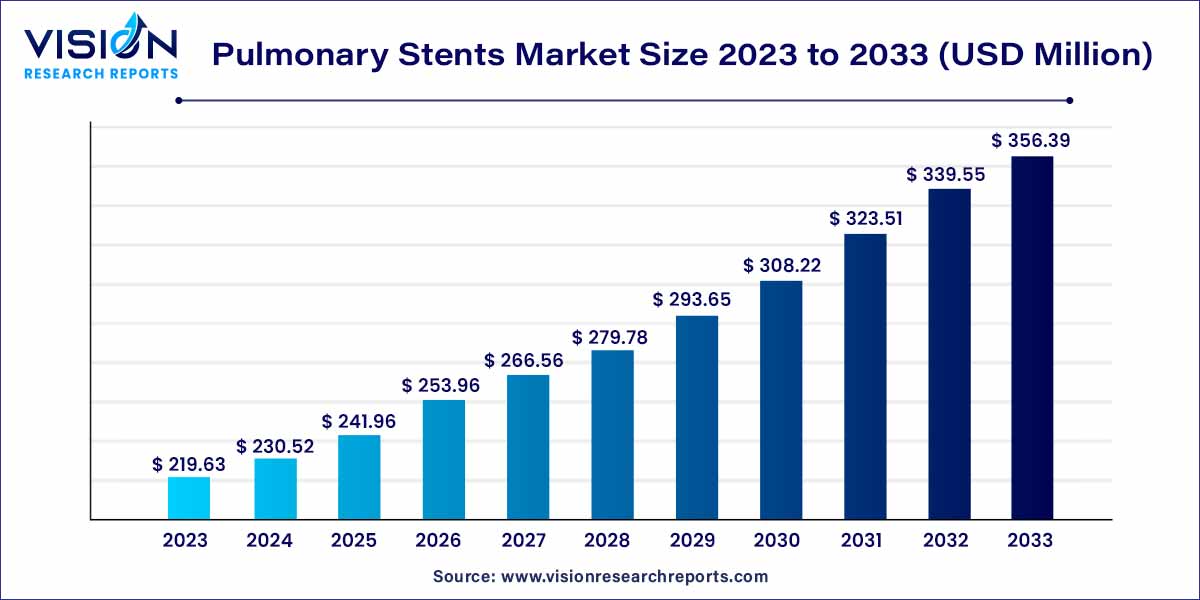

The global pulmonary stents market size was estimated at around USD 219.63 million in 2023 and it is projected to hit around USD 356.39 million by 2033, growing at a CAGR of 4.96% from 2024 to 2033.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 356.39 million |

| Growth Rate from 2024 to 2033 | CAGR of 4.96% |

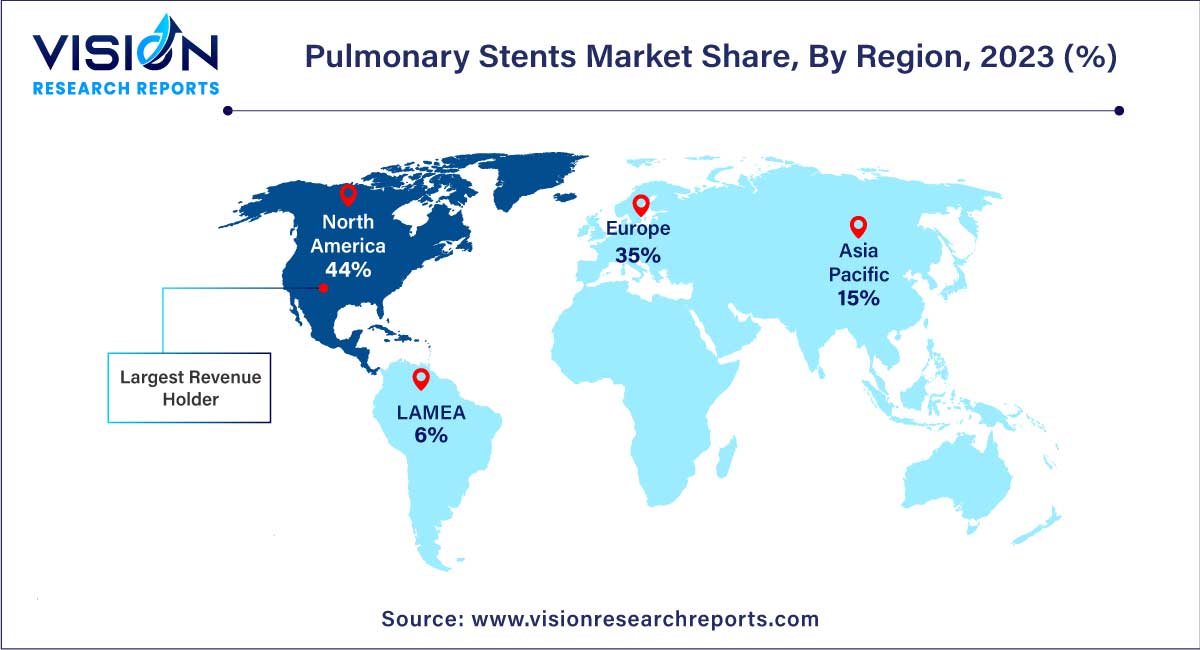

| Revenue Share of North America in 2023 | 44% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

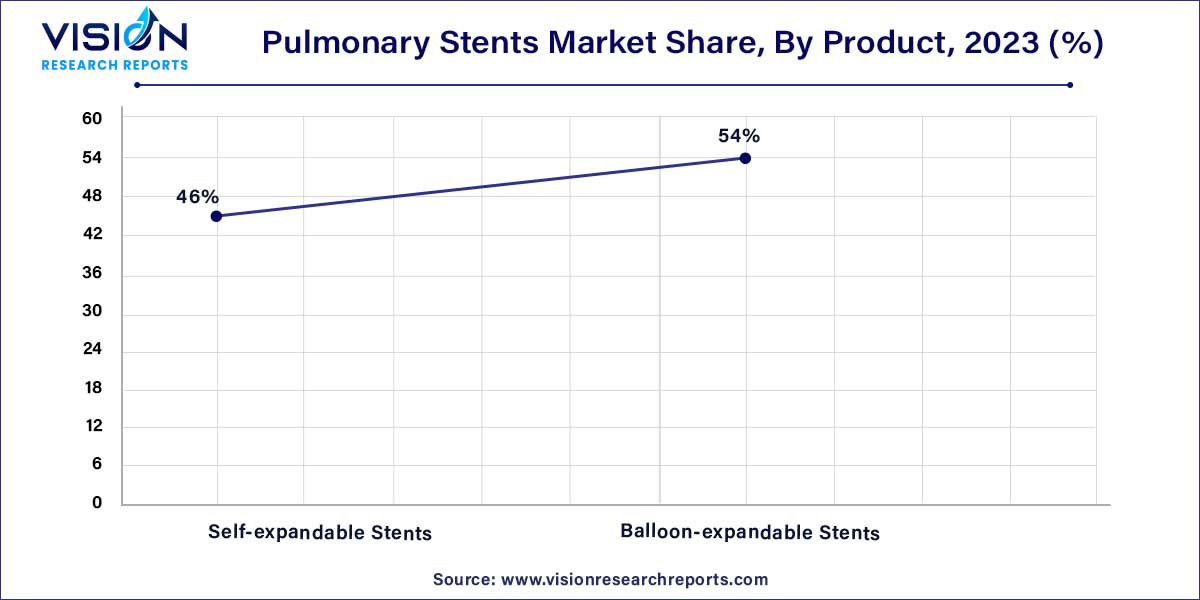

The balloon-expandable stents segment accounted for the largest revenue share of 54% in 2023. Balloon angioplasty (BA) has long been established as the primary intervention for pulmonary artery stenosis (PAS) in pediatric cases. Despite its efficacy, a notable subset of lesions proves resistant to conventional BA methods. In addressing this challenge, ultra-high pressure (UHP) balloons have emerged as a promising alternative.

A recent study, published on NCBI in January 2023, conducted a retrospective analysis of data from 28 children who underwent 37 UHP BA procedures for PAS. Success in this context was defined as achieving a post-procedure gradient of less than 25 mmHg across the stenotic area. The findings revealed a remarkable success rate of 78.4% for ultra-high pressure balloon angioplasty (UHP BA) in effectively treating pulmonary artery stenosis (PAS) among children with congenital heart defects (CHD).

Self-expandable stents are anticipated to witness the fastest market growth over the forecast period. Self-expandable metallic stents (SEMS) emerge as a secure and effective therapeutic choice for obstructive atelectasis, demonstrating a high rate of technical success and promising clinical outcomes. In a 2020 NCBI article, the study aimed to appraise the safety and efficacy of SEMS in addressing obstructive atelectasis and evaluate the predictive value of preoperative computed tomography (CT) enhancement for successful lung re-expansion post-SEMS placement.

The metal segment held the largest revenue share of 59% in 2023. Bare metal and drug-eluting stents find primary application in addressing narrowed arteries, particularly in the coronary arteries of the heart. While both stents maintain open arteries and enhance blood flow, they operate through distinct mechanisms. As per the National Heart, Lung, and Blood Institute, Drug-eluting stents (DES) are the predominant choice for coronary artery interventions. These stents feature a coating of medication that is gradually released into the artery, aiming to prevent restenosis, the reappearance of narrowing post-stenting. Various types of DES incorporate diverse medications, each possessing unique properties and applications in clinical contexts.

The Silicon segment is estimated to register the fastest CAGR over the forecast period. According to the NCBI article published in April 2023, a recent meta-analysis examined the efficacy of silicone stents in treating benign airway obstructions. This comprehensive analysis, which included data from eight studies involving 395 patients, revealed promising outcomes for silicone stents. The curative rate, defined as the proportion of patients with stents removed without symptomatic restenosis within one year, exceeded 40%.

The stability rate was comparable, measuring the proportion of patients who maintained stable stent placement. Consequently, the "effective rate," encompassing curative and stability rates, surpassed 75%. Regarding complications, the migration rate was 25%, with a granulation rate of 15.7%. Remarkably, no evidence of publication bias was detected. These findings underscore the potential of silicone stents as an effective and durable treatment option for benign airway obstructions.

The tracheobronchial stents segment accounted for the largest revenue share of 73% in 2023. Tracheobronchial Stents are used primarily for COVID-19 patients. According to the NCBI article published in September 2021, tracheobronchial stent placement, a relatively safe and effective treatment for tracheobronchial stenosis, typically involves silicone stent insertion under general anesthesia with positive-pressure ventilation using rigid bronchoscopy.

Moreover, extracorporeal membrane oxygenation (ECMO) is a valuable technique for maintaining oxygenation and adequate ventilation while concurrently removing carbon dioxide. While traditionally considered a relative contraindication for patients with advanced malignancy due to poor outcomes despite ECMO support, ECMO remains a viable option for high-risk asphyxiation patients who prove difficult to manage under conventional ventilation during tracheal stent placement.

The laryngeal stents segment is anticipated to grow at the fastest rate during the forecast period. According to the NCBI article published in October 2022, a novel, cost-effective stent option for pediatric laryngotracheal reconstruction (LTR) has emerged as a refashioned Foley catheter. This prospective clinical study evaluated the efficacy and safety of these stents in treating laryngotracheal stenosis (LTS) in children up to 8 years of age.

The study enrolled 31 pediatric patients with LTS, encompassing 17 males and 14 females with an average age of 3.45 years. Subglottic stenosis was the most prevalent cause of LTS, accounting for 74.2% of the cases. The mean stenting duration was 40.5 days. Remarkably, decannulation was achieved in 96.8% of the patients. The stents were well-tolerated, with no reported complications such as stent migration, excessive granulation tissue, intractable aspiration, or pressure necrosis.

North America held the largest revenue share of 44% in 2023 due to high prevalence of asthma in the region. According to the Asthma and Allergy Foundation of America, asthma, a chronic respiratory condition that affects the airways, poses a significant public health challenge. With more than 27 million individuals affected in the U.S. alone, asthma represents a substantial growth driver for the North American market. Asthma is more widespread in female adults as compared to male adults, with an estimated 10.8% of females affected compared to 6.5% of males. This gender gap necessitates gender-specific treatment strategies and interventions.

The U.S. accounted for the largest market share in North America in 2023. The U.S. faces a significant burden of chronic obstructive pulmonary disease (COPD), according to the CDC, 16 million adults are affected, and a substantial number are unaware of their condition. This widespread prevalence, particularly among women, combined with the unmet needs in managing severe airway obstructions, has emerged as a key driver for the growth of the U.S. pulmonary stents industry.

Asia Pacific region is expected to grow at the fastest rate during the forecast period. Surge in patient numbers and the increasing presence of prominent healthcare providers in swiftly developing economies like India and China create opportunities for expansion. According to the WHO, in November 2023, China had a significant burden of chronic obstructive pulmonary disease (COPD), with an estimated 100 million individuals affected, representing nearly 25% of global COPD cases.

China has implemented a comprehensive nationwide intervention to strengthen COPD care in primary healthcare settings to address this pressing health concern. Key initiatives include screening for high-risk individuals and enhancing the utilization of lung function tests through a national program. These efforts, spearheaded by the Chinese government, have substantially bolstered the capacity for COPD screening and management in primary care facilities.

Japan’s healthcare system is witnessing a transition in service portfolio from nursing care to preventive care in disease management because of rising healthcare expenditure. According to the GSK news in September 2023, Japan has significant stride in public health by approving Arexvy, the first respiratory syncytial virus (RSV) vaccine for older adults. This approval can potentially safeguard around 43.5 million Japanese people aged 60 and over.

By Product

By Material

By Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pulmonary Stents Market

5.1. COVID-19 Landscape: Pulmonary Stents Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pulmonary Stents Market, By Product

8.1. Pulmonary Stents Market, by Product, 2024-2033

8.1.1 Self-expandable Stents

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Balloon-expandable Stents

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Pulmonary Stents Market, By Material

9.1. Pulmonary Stents Market, by Material, 2024-2033

9.1.1. Metal

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Silicon

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Hybrid

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Pulmonary Stents Market, By Type

10.1. Pulmonary Stents Market, by Type, 2024-2033

10.1.1. Tracheobronchial Stents

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Laryngeal Stents

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Pulmonary Stents Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Material (2021-2033)

11.1.3. Market Revenue and Forecast, by Type (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Material (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Material (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Material (2021-2033)

11.2.3. Market Revenue and Forecast, by Type (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Material (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Material (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Material (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Type (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Material (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Type (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Material (2021-2033)

11.3.3. Market Revenue and Forecast, by Type (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Material (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Material (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Material (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Type (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Material (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Type (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Material (2021-2033)

11.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Material (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Material (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Material (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Type (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Material (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Type (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Material (2021-2033)

11.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Material (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Material (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Type (2021-2033)

Chapter 12. Company Profiles

12.1. Bess medizintechnik GmbH.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Boston Scientific Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Cook Group.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. E. Benson Hood Laboratories Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Efer Endoscopy.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Endo-Flex GmbH

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Merit Medical Systems Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Micro-Tech (Nanjing) Co. Ltd

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Standard Sci Tech Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Olympus Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others