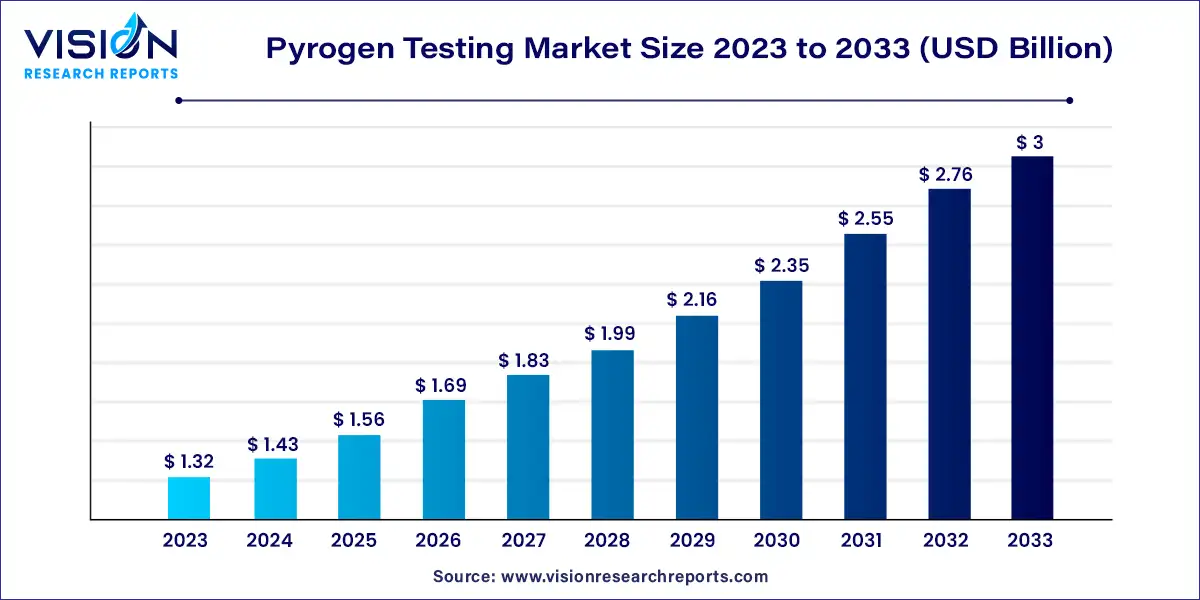

The global pyrogen testing market size was estimated at around USD 1.32 billion in 2023 and it is projected to hit around USD 3 billion by 2033, growing at a CAGR of 8.56% from 2024 to 2033.

The pyrogen testing market serves a critical role in ensuring the safety and efficacy of pharmaceutical and medical device products. Pyrogens, substances that induce fever when introduced into the body, pose significant risks to human health if present in medical products. As such, stringent regulatory requirements mandate thorough pyrogen testing throughout the manufacturing process.

The growth of the pyrogen testing market is driven by the stringent regulatory requirements mandating thorough testing to ensure product safety and efficacy propel market expansion. Additionally, the increasing prevalence of chronic diseases and the consequent rise in drug development activities contribute to market growth. Moreover, advancements in testing methodologies, including the adoption of automated systems and rapid testing kits, further fuel the market's upward trajectory. Furthermore, the escalating demand for biopharmaceuticals and biologics necessitates robust pyrogen testing protocols, driving market expansion. Overall, these factors collectively underscore the growing importance of pyrogen testing in maintaining the quality and safety of pharmaceutical and medical device products.

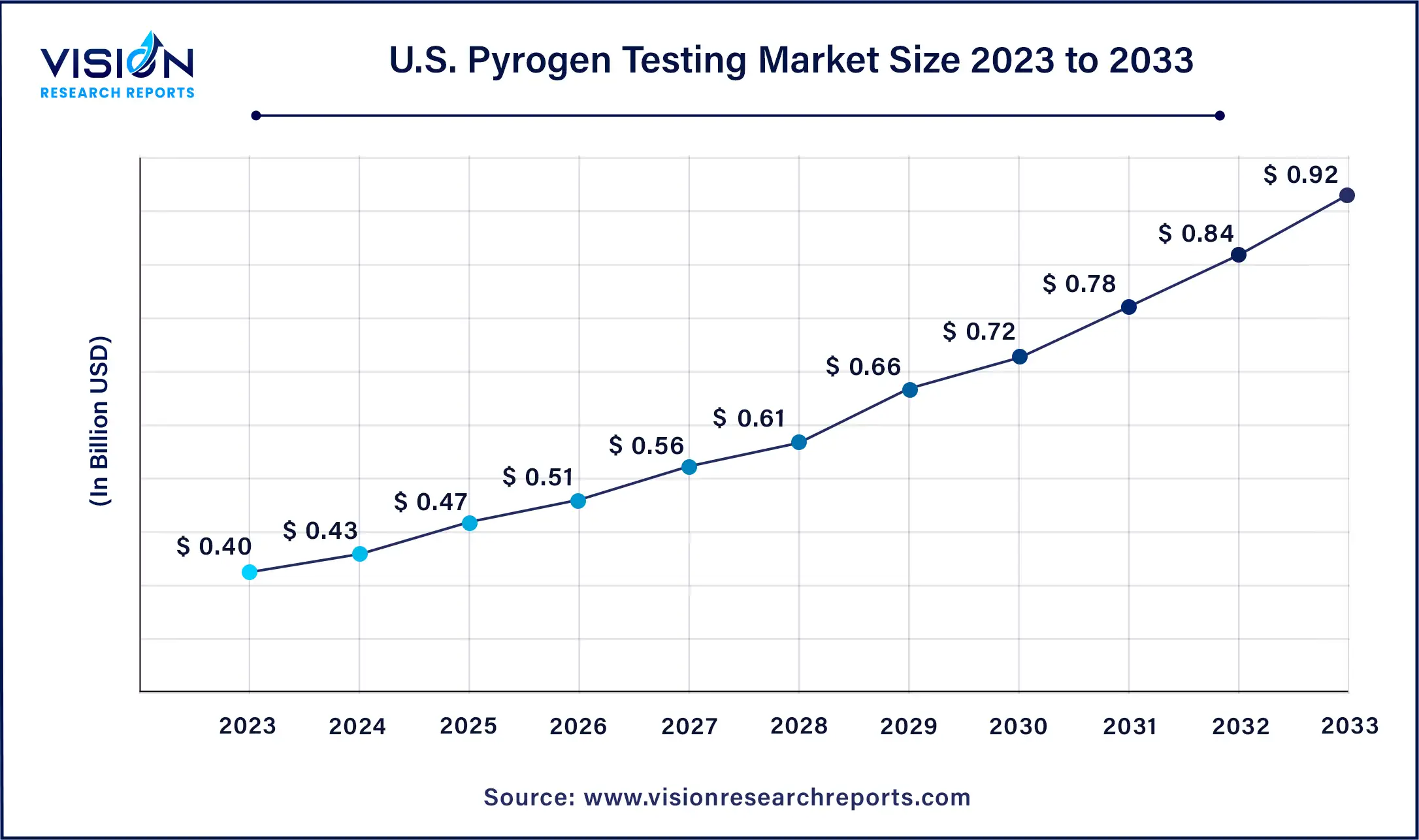

The U.S. pyrogen testing market size was estimated at around USD 0.40 billion in 2023 and it is projected to hit around USD 0.92 billion by 2033, growing at a CAGR of 8.68% from 2024 to 2033.

The U.S. market is poised for continued growth throughout the forecast period, attributed to the presence of key players such as Pfizer Inc., F. Hoffmann-La Roche AG, Merck Group, Celgene Corp., and Amgen Inc. These industry giants actively contribute to the pyrogen testing market. Moreover, the robust pharmaceutical manufacturing sector in the U.S. enhances the application of pyrogen tests across the country.

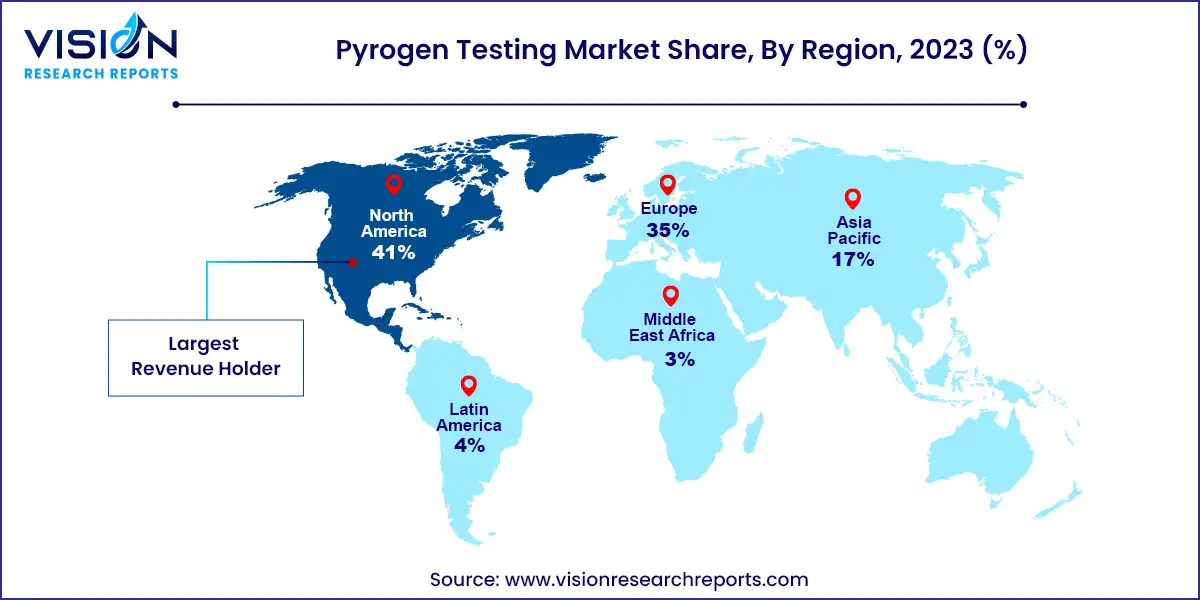

In 2023, North America emerged as the dominant force in the pyrogen testing market, capturing the largest revenue share at 41%. This growth is primarily driven by the increasing prevalence of chronic diseases, necessitating advancements in drug therapy. Additionally, North America boasts a highly developed healthcare and research infrastructure, coupled with a significant focus on new drug development, further fueling regional market growth.

Meanwhile, Asia Pacific is projected to witness a substantial growth rate in the coming years, driven by untapped opportunities within the region. Many manufacturers target Asian countries, particularly China and India, for drug discovery, development, and production. Furthermore, clinical research organizations are increasingly conducting clinical trials in Asian countries. The availability of less stringent government regulations for drug development, a vast genome pool, and rapidly developing healthcare infrastructure are among the key factors driving growth in the region.

The pyrogen testing industry is categorized into consumables, instruments, and services based on products. As of 2023, the consumables segment held the largest market share at 56% and is projected to maintain its dominance in the foreseeable future. This trend is primarily driven by the increasing incidence of chronic diseases, which leads to heightened production of pharmaceuticals, biologics, and medical devices. For example, according to a WHO report from September 2023, approximately 4.0 million deaths are attributed to chronic respiratory diseases annually. Consequently, there is a growing demand for drugs to treat these ailments, resulting in increased utilization of pyrogen testing consumables such as kits and reagents.

Meanwhile, the instruments segment is anticipated to witness substantial growth during the forecast period, propelled by technological advancements in product offerings. Notably, the PyroDetect System represents a validated non-animal alternative designed to replace traditional rabbit testing, providing reliable in vitro detection of both non-endotoxin and endotoxin contamination.

The pyrogen testing industry is divided into LAL tests, in vitro tests, and rabbit tests based on test types. As of 2023, the LAL test segment held the largest market share at 47%. This growth is driven by increasing demand for animal-free detection methods, known for their high reproducibility and reliability. For example, in February 2023, the European Pharmacopoeia (Ph. Eur.) published 59 texts proposing the replacement of rabbit pyrogen tests with alternative approaches for public consultation in Pharmeuropa 35.1. The LAL test is further classified into turbidimetric, chromogenic, and gel clot tests.

Moreover, the rabbit pyrogen test segment also held a significant market share in 2023. However, the growing adoption of animal-free tests is expected to somewhat limit the use of this test type in the near future. The increasing demand for animal-free tests is driven by their ability to assess products without harming any living organisms.

In 2023, pharmaceutical and biotechnology companies dominated the overall market, accounting for a share of 60%. This growth is driven by increased production of pharmaceuticals, biopharmaceuticals, and other biologic products. Pyrogen testing plays a critical role in ensuring the safety of parenteral pharmaceutical products, serving as a mandatory test to prevent severe fever reactions caused by pyrogenic substances. Consequently, there's a growing demand for pyrogen testing consumables and instruments in these companies, thereby propelling the market's growth.

Over the forecast period, the medical devices companies segment is expected to experience significant growth. The consideration of implementing pyrogen testing for medical devices stems from their potential exposure, either directly or indirectly, to human blood cells. Pyrogenicity tests are essential for evaluating the safety of products that come into contact with blood circulation, cerebrospinal fluid (CSF), the lymphatic system, and those that interact systemically with the human body. Official methods for assessing the pyrogenicity of medical devices and materials include the in vitro bacterial endotoxin test and the in vivo rabbit pyrogenicity test.

By Product

By Test Type

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others