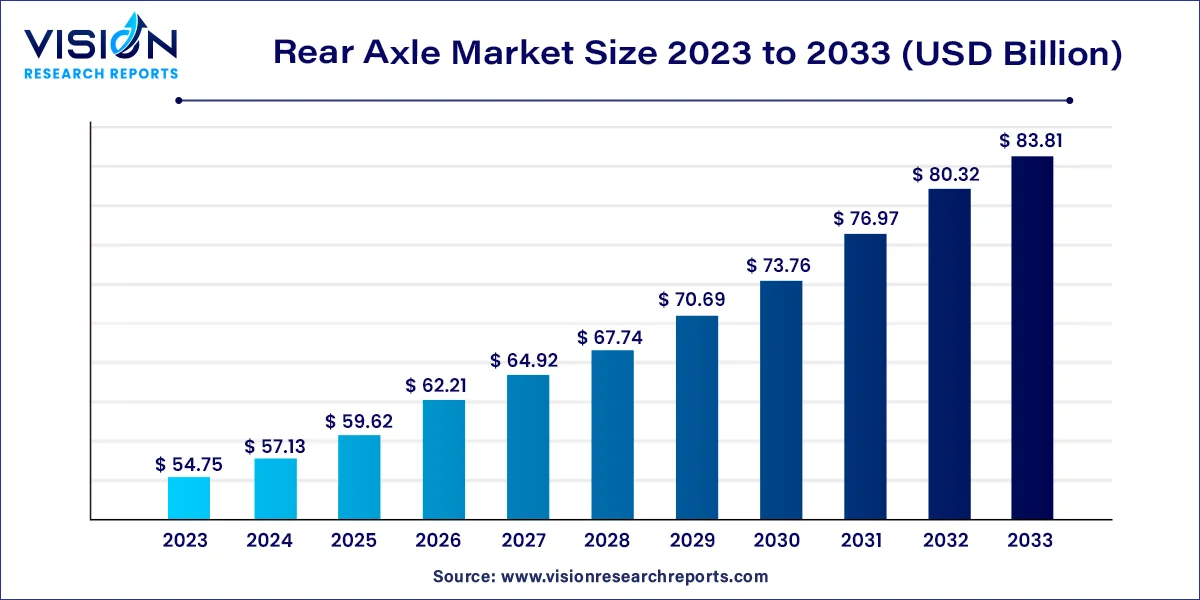

The global rear axle market size was valued at USD 54.75 billion in 2023 and it is predicted to surpass around USD 83.81 billion by 2033 with a CAGR of 4.35% from 2024 to 2033. The rear axle market plays a crucial role in the automotive and transportation sectors, serving as a key component in vehicle dynamics and performance. As the automotive industry evolves, particularly with the rise of electric vehicles (EVs) and advancements in vehicle technology, the rear axle market is witnessing significant changes.

The growth of the rear axle market is driven by an increasing demand for vehicles, particularly in emerging markets, significantly boosts production levels, necessitating more rear axles. Additionally, the automotive industry's transition towards electric vehicles (EVs) is creating a demand for specialized rear axles designed to accommodate unique powertrains and weight distribution needs. The emphasis on enhancing vehicle performance, safety, and fuel efficiency is also prompting manufacturers to innovate and develop advanced axle designs that incorporate lightweight materials and smart technologies. Furthermore, the rise in commercial vehicle usage, driven by e-commerce and logistics, is contributing to the market's expansion, as these vehicles require robust and reliable rear axles for optimal performance.

In 2023, the Europe rear axle market held the largest share of the global rear axle market at 35%. The region's dominance is supported by its advanced automotive industry, with leading countries such as Germany, France, Italy, and the UK manufacturing high-quality vehicles that require sophisticated rear axles. Europe is also recognized for producing luxury cars and fostering innovations in rear axle technologies to enhance the driving experience.

The German rear axle market is expected to witness significant growth in the coming years, bolstered by the country’s strong manufacturing capabilities, especially in high-quality automotive parts production. German manufacturers are known for their stringent adherence to quality standards and regulations, employing rigorous controls to ensure the structural integrity of their rear axles.

In 2023, the North America rear axle market held a substantial share of the global rear axle market. This region has positioned itself as a technological frontrunner in the automotive sector, with significant investments in research and development driving advancements in rear axle performance and efficiency. Efforts focused on cost reduction have also reinforced the region's leadership in the rear axle market, ensuring ongoing growth and competitiveness.

The U.S. rear axle market dominated the North American market with a revenue share of 82.83% in 2023. The efficiency of the U.S. manufacturing industry in producing rear axles in large volumes satisfies both local and export demands. With a vast vehicle market and robust industry partnerships, American firms maintain a leading role in rear axle production.

The Asia Pacific rear axle market is projected to achieve the highest CAGR of 5.23% in the global rear axle market during the forecast period. Factors contributing to industry growth in this region include a booming automotive sector, increased demand for commercial vehicles, potential electric vehicle adoption, technological advancements, and government support for sustainable practices. Furthermore, environmental concerns are driving a shift towards electric vehicles in the region, creating demand for new rear axles compatible with electric drive systems.

The Chinese rear axle market is expected to expand rapidly in the coming years. The automotive sector in China has experienced substantial growth due to rising demand for passenger cars. This has led to numerous manufacturers establishing operations in the country, making China the largest rear axle market. The development of a strong supply chain network, facilitated by the establishment of automotive manufacturing bases, has significantly contributed to rear axle production, positioning China as a key player in the global rear axle market.

The drive axle segment led the global rear axle market in 2023, capturing a revenue share of 55%. Drive axles are essential for distributing power from the engine to the wheels, which is crucial for achieving optimal performance in both commercial and passenger vehicles. Recent advancements in design have enhanced the service life, strength, and reliability of drive axles, making them a preferred choice in the automotive industry for improving drive systems and overall vehicle performance.

Meanwhile, lift axles are projected to exhibit the highest CAGR of 4.63% during the forecast period. Their ability to enhance fuel efficiency by redistributing vehicle weight significantly boosts performance and fuel economy. As consumers increasingly prioritize safety and comfort, lift axles are gaining popularity, especially in heavy-duty or off-road applications, thereby driving demand for this technology.

In 2023, the economy vehicles segment commanded a significant share of the global rear axle market, with a revenue contribution of 36%. Economy vehicles focus on affordability, budget considerations, and return on investment (ROI), making them appealing to a broad consumer base. Our rear axles for these vehicles strike a balance between cost-effectiveness and performance, ensuring durability and efficiency. By effectively transferring torque from the wheels to the differential, these axles enhance overall fuel economy, aligning with environmentally friendly initiatives and boosting the demand for sustainable vehicles.

Luxury vehicles are anticipated to experience the fastest CAGR of 5.25% during the forecast period. Premium consumers demand superior safety, comfort, and performance in their luxury vehicles. High-quality rear axles equipped in these vehicles provide a smooth ride and improved safety, fulfilling these stringent standards. As the global luxury market expands due to rising disposable incomes and aspirational lifestyles, we are committed to developing innovative rear axle solutions that cater to the evolving requirements of this lucrative segment.

By Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Rear Axle Market

5.1. COVID-19 Landscape: Rear Axle Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Rear Axle Market, By Type

8.1. Rear Axle Market, by Type, 2024-2033

8.1.1. Drive Axle

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Dead Axle

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Lift Axle

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Rear Axle Market, By Application

9.1. Rear Axle Market, by Application, 2024-2033

9.1.1. Heavy Vehicles

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Luxury Vehicles

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Executive Vehicles

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Economy Vehicles

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. SUV

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. MUV

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Rear Axle Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. American Axle & Manufacturing, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Dana Limited

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Cummins Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. GKN Automotive Limited

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. HYUNDAI WIA CORP.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. ZF Friedrichshafen AG

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. BENTELER International Aktiengesellschaft

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Marelli Holdings Co., Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. ROC-SPICER LTD.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others