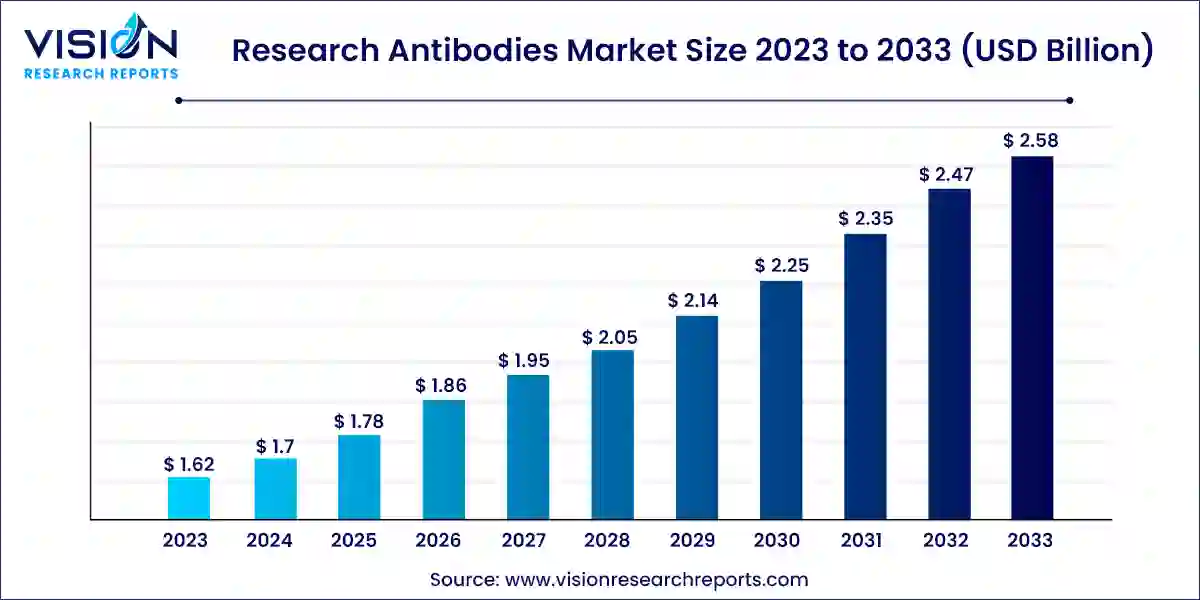

The global research antibodies market size was valued at USD 1.62 billion in 2023 and is anticipated to reach around USD 2.58 billion by 2033, growing at a CAGR of 4.78% from 2024 to 2033.

The research antibodies market is a flourishing sector within the life sciences industry, playing a critical role in propelling scientific advancements. These highly specialized proteins, meticulously crafted by the immune system, serve as invaluable tools for researchers, empowering them to delve into the intricacies of biology and unravel the mysteries of disease.

The research antibodies market is flourishing due to a confluence of forces. One key driver is the surging research and development (R&D) activity within the life sciences industry. As pharmaceutical and biotechnology companies dedicate more resources to drug discovery and development, their demand for research antibodies as essential tools intensifies. Furthermore, the applications of research antibodies are expanding beyond traditional research, encompassing exciting new frontiers in personalized medicine and the creation of more precise diagnostic tests. Finally, advancements in antibody engineering and conjugation techniques are constantly redefining what's possible. These innovations are leading to the development of a new generation of research antibodies with superior specificity, sensitivity, and versatility, further propelling the growth of this dynamic market

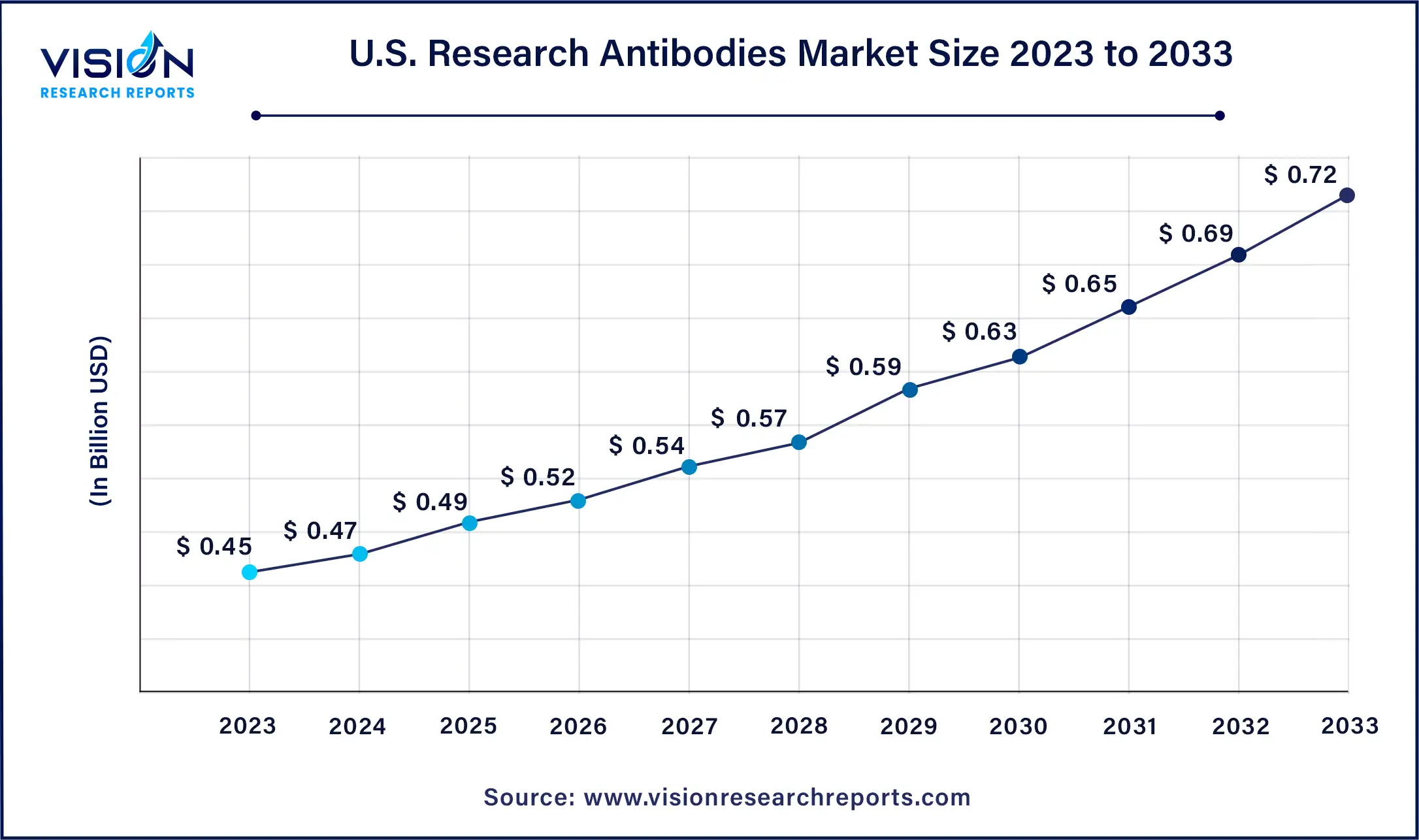

The U.S. research antibodies market size was estimated at around USD 0.45 billion in 2023 and is projected to hit around USD 0.72 billion by 2033, growing at a CAGR of 4.81% from 2024 to 2033.

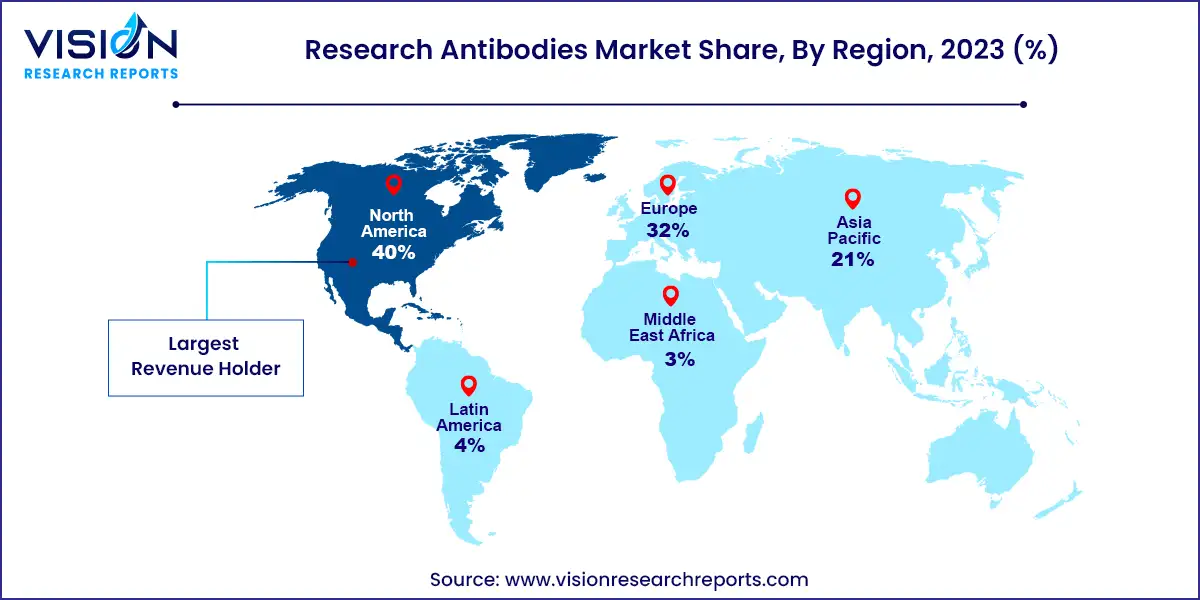

North America dominated the market in 2023 by capturing the largest revenue share of 40%. Growing emphasis on biomedical, stem cells, as well as cancer research, is a major contributor to its large market share. Presence of key players such as Thermo Fisher Scientific, Inc. and PerkinElmer, Inc. among others and increasing number of biotechnology & biopharmaceutical firms in the region that focus on life sciences innovation are expected to drive the market growth.

The market in the Asia Pacific region is expected to grow at the fastest CAGR from 2024 to 2033 due to an increase in collaborative activities among academic institutions. For instance, scientists from Tsinghua University, China Medical University, and the Vaccine Research Center at the NIH are currently conducting a research study on the identification and characterization of HIV-1 strains as well as their robust and widespread resistance to a variety of neutralizing antibodies. The National Natural Science Foundation Award, China's Ministry of Science and Technology, and Gates Foundation Grand Challenges China all supported this project. As a result, such government-funded scientific activities in the region are anticipated to drive the market growth.

The primary antibodies segment captured the highest revenue share of 75% in 2023, and is also projected to grow at the fastest rate throughout the forecast period. This can be attributed to increasing availability of primary antibodies using rabbit, mouse, goat, and other species as host, and the wide range of utility offered by such antibodies for applications in the R&D space. Also, owing to the usage of primary antibodies for frequently performed laboratory procedures, such as staining and imaging, the segment is predicted to grow at an exponential rate.

The secondary antibodies segment is expected to grow at a significant CAGR from 2024 to 2033 as these are more convenient and cost-effective to develop. Demand for secondary research antibodies is also anticipated to increase due to the availability of ready-to-use conjugated antibodies that can improve product development activities by assisting in the identification, grouping, and purification of targeted antigens. For instance, Thermo Fisher Scientific, Inc. provides fluorescent dye-conjugated secondary antibodies that make it easier to identify proteins in a variety of applications, including immunohistochemistry, western blotting, and fluorescent cell imaging, among others.

Monoclonal antibodies segment accounted for the dominant share of the market in 2023, due to a sharp increase in the number of cancer research projects that demand high specificity antibodies. As monoclonal antibodies can efficiently adhere to or block antigens on cancer cells, these are employed in the identification and development of new medicines for various cancer types. This factor is expected to expand the growth prospects for the segment in the near future.

Polyclonal antibodies are projected to grow at lucrative CAGR over the forecast period as these antibody structures are essential for the research aspects focusing on purification of antigens and examination of histopathological tissue. Furthermore, polyclonal antibodies provide benefits like stability, practical storage methods, strong affinity, and excellent compatibility for ELISA and western blotting technologies, thereby propelling the market growth.

Western blotting segment accounted for the largest market share in 2023, due to the widespread availability and adoption of the technique. In addition, due to the increased accuracy that the western blotting technique offers, it is typically chosen over alternative technologies for applications involving the detection of important protein entities. These attributes are expected to positively affect the segment growth.

Immunohistochemistry segment is projected to grow at the fastest CAGR from 2024 to 2033. The segment is anticipated to expand steadily due to its significant applications in detection of enzymes, antigens, tumor suppressor genes, and tumor cell growth for cell-based research. Additionally, rising R&D spending and a high level of scientific awareness regarding the technique have led to increasing growth prospects for immunohistochemistry. Furthermore, benefits provided by the technique, such as high sensitivity & simplicity of use, are some of the factors anticipated to drive the market growth.

The rabbit source segment held the largest market share in 2023. Rabbits are extensively used for antibody production, owing to several advantages such as higher affinity antibodies provided by rabbits as compared to those obtained from other animal hosts. Furthermore, higher specificity provided by these antibodies makes them ideal for detection of small molecules, hormones, toxins and other biologically important substances.

Mouse source segment is anticipated to witness the fastest CAGR from 2024 to 2033. Mice have been predominantly used in production of antibodies due their high reproduction rate and smaller size. Furthermore, the main factor influencing their widespread use is the structural similarity between mouse and human antibodies, which can significantly drive their adoption for R&D applications.

Oncology segment accounted for the largest market share in 2023, owing to rise in prevalence of cancer in key geographies. According to the American Cancer Society, in 2021, over 1.9 million new cancer cases were estimated to be recorded in the U.S. Additionally, over 608,570 cancer deaths were also recorded in the same year in the U.S. As a result, more research antibodies will likely be used for designing and evaluation of new diagnostic and therapeutic approaches for mitigation of cancer.

Stem cells segment is expected to witness the fastest CAGR from 2024 to 2033 owing to increase in number of stem cell research activities globally. The growth is also attributable to increase in adoption of stem cells for the treatment of a wide range of chronic ailments such as diabetes, cancer, Alzheimer’s, Parkinson’s, rheumatoid arthritis, and kidney and lung diseases. Furthermore, antibodies are also used for stem cell research areas that include disease modeling, developmental biology, drug screening, reprogramming techniques development, and cell therapy that can positively affect the market growth.

The academic & research institutions segment captured the highest revenue share in 2023 and is projected to grow at the fastest growth rate throughout the forecast period. This can be attributed to the increase in scientific initiatives by such centers for development of novel therapies and tests for chronic diseases. For instance, in January 2021, researchers at The University of Texas Medical Branch at Galveston (UTMB Health) and The University of Texas Health Science Center at Houston (UTHealth) discovered two novel antibodies CoV2-06 and CoV2-14 for a potential novel antibody therapy for COVID-19 infection. Such initiatives can positively affect the segment growth in the near future.

Pharmaceutical and biotechnology companies end-use segment is expected to grow at a significant CAGR over the forecast period due to the increase in R&D activities in life sciences domain. Furthermore, the increasing importance of antibodies for development of novel biologic products and rising demand for quality control applications for various techniques, such as PCR and electrophoresis, are likely to boost the segment growth.

By Product

By Type

By Technology

By Source

By Application

By End Use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others