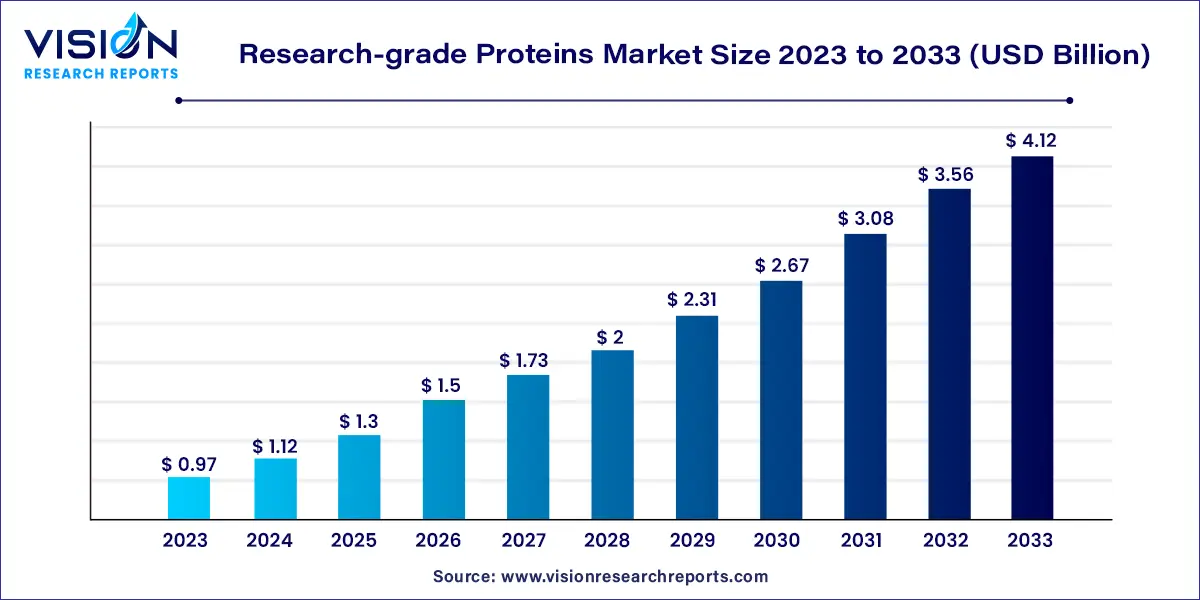

The global research-grade proteins market size was valued at USD 0.97 billion in 2023 and it is predicted to surpass around USD 4.12 billion by 2033 with a CAGR of 15.55% from 2024 to 2033.

In the ever-evolving landscape of scientific research, research-grade proteins have emerged as indispensable assets, empowering researchers and scientists in diverse fields such as biotechnology, pharmaceuticals, and healthcare. These proteins, meticulously produced and purified for experimental use, serve as essential tools in understanding biological processes, developing therapeutic solutions, and unraveling the complexities of diseases. This overview delves into the multifaceted dimensions of the research-grade proteins market, shedding light on its current state, key players, growth drivers, challenges, and the transformative impact it has on the scientific community.

The growth of the research-grade proteins market is propelled by several key factors. One of the primary drivers is the escalating demand for advanced research tools in the fields of biotechnology and pharmaceuticals. As the focus on personalized medicine and targeted therapies intensifies, there is a corresponding increase in the need for precise and reliable research-grade proteins. Additionally, collaborations and partnerships between academic institutions, pharmaceutical companies, and biotechnology firms are fostering research endeavors, amplifying the consumption of research-grade proteins. Technological innovations, particularly in protein engineering and purification methods, are expanding the diversity and quality of available research-grade proteins, enabling scientists to explore new avenues of research. Moreover, the burgeoning biopharmaceutical industry, marked by the development of biologics and biosimilars, relies heavily on research-grade proteins for drug discovery and preclinical testing. These factors combined are propelling the market forward, driving continuous growth and innovation in the research-grade proteins sector.

| Report Coverage | Details |

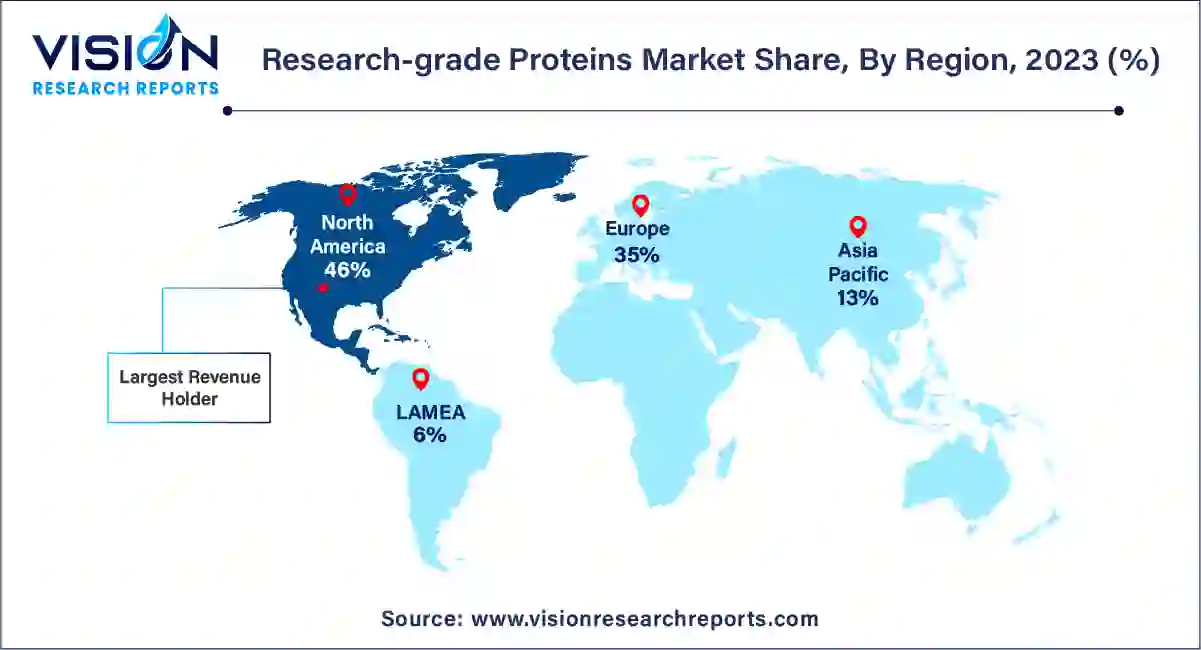

| Revenue Share of North America in 2023 | 46% |

| CAGR of Asia Pacific from 2024 to 2033 | 18.54% |

| Revenue Forecast by 2033 | USD 4.12 billion |

| Growth Rate from 2024 to 2033 | CAGR of 15.55% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The cytokines & growth factors segment held the largest market share of 25% in 2023 and it is anticipated to grow at the fastest CAGR of 17.68% during the forecast period. cytokines and growth factors are essential components of the research-grade proteins market, serving as vital signaling molecules in biological processes. These proteins play a central role in cell-to-cell communication, immune responses, and tissue regeneration. Researchers rely on cytokines and growth factors to study and manipulate cellular pathways, making them invaluable tools in fields such as immunology, oncology, and regenerative medicine. The market offers a wide array of cytokines and growth factors, each with specific functions and applications, allowing scientists to conduct intricate experiments and gain insights into disease mechanisms.

The antibodies segment is expected to grow at a significant CAGR of 15.69% from 2024 to 2033. Antibodies, also known as immunoglobulins, are pivotal research-grade proteins used extensively in molecular and cellular biology research. These proteins are integral in recognizing and binding to specific antigens, enabling researchers to detect and study target molecules with exceptional precision. Antibodies find applications in various research techniques, including Western blotting, immunohistochemistry, and enzyme-linked immunosorbent assays (ELISAs). They are indispensable in the investigation of proteins, genes, and cellular structures, facilitating the identification of biomarkers and the development of diagnostic tools. The research-grade antibodies market offers a vast range of monoclonal and polyclonal antibodies, providing researchers with the tools needed to advance their scientific inquiries.

The mammalian cells segment contributed more than 57% of revenue share in 2023. Mammalian cells, including human, mouse, and other animal cells, are widely utilized in the production of research-grade proteins due to their ability to express complex proteins with post-translational modifications, mimicking natural biological processes closely. Researchers favor mammalian cell systems for studies involving proteins intended for therapeutic use, as they ensure proper folding, assembly, and functionality. These cells are particularly essential in biopharmaceutical research and drug development, where the authenticity of protein structures is crucial for effective treatments.

The bacterial cells segment is predicated to grow at the fastest CAGR of 15.78% during the forecast period. Bacterial cells, especially Escherichia coli (E. coli), are extensively employed in the production of research-grade proteins due to their simplicity, rapid growth, and cost-effectiveness. Bacterial expression systems are widely used for producing proteins for research purposes, diagnostics, and vaccine development. While they lack the post-translational modification capabilities of mammalian cells, bacterial cells are invaluable for generating large quantities of proteins quickly and inexpensively. However, their application is limited when it comes to proteins that require specific modifications such as glycosylation, which are common in mammalian systems.

The pharmaceutical & biotechnology companies segment registered the maximum market share of 63% in 2023. These companies heavily rely on research-grade proteins to advance their drug discovery and development efforts. Proteins are crucial components in the formulation and testing of new pharmaceuticals, especially biologics and biosimilars. Researchers in these companies utilize research-grade proteins to investigate disease mechanisms, study cellular pathways, and assess drug efficacy, ensuring the safety and effectiveness of potential therapeutic molecules. The precision and reliability of research-grade proteins are paramount in pharmaceutical and biotechnology research, where even subtle variations can have profound effects on drug development outcomes.

The others segment is anticipated to grow at a significant CAGR of 16.27% during 2024-2033. The others segment includes contract research organizations and manufacturing organizations. These end-users employ these proteins in medical research activities, enabling the advancement of novel therapies, precision medicine, and the validation of diagnostic tests, ultimately translating scientific discoveries into improved patient outcomes. In February 2023, Lunaphore, a Swiss-based life sciences firm developing innovative technology for facilitating spatial biology in laboratories, collaborated with Sirona Dx, a prominent player in multi-omics and single-cell analytical services. Thus, this is anticipated to speed up drug research and development, as well as bring significant advancements to the field.

North America held the maximum revenue share of 46% of the global market in 2023. North America stands as a key hub for research-grade proteins, driven by the presence of leading pharmaceutical and biotechnology companies, advanced research facilities, and substantial investments in research and development. The region's well-established healthcare infrastructure and robust academic collaborations contribute to the high consumption of research-grade proteins, particularly in cutting-edge biopharmaceutical research and clinical diagnostics.

The Asia Pacific market is anticipated to grow at the noteworthy CAGR of 18.54% from 2024 to 2033. Asia-Pacific is witnessing significant growth in the research-grade proteins market, primarily due to the rapid expansion of the biopharmaceutical sector and increased research activities in countries like China, India, Japan, and South Korea. The region's emerging economies, coupled with a rising focus on healthcare and biotechnology, contribute to the escalating demand for research-grade proteins. Moreover, advancements in academic research and the establishment of biotechnology clusters further boost the market's growth in this region.

By Product

By Host Cell

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others