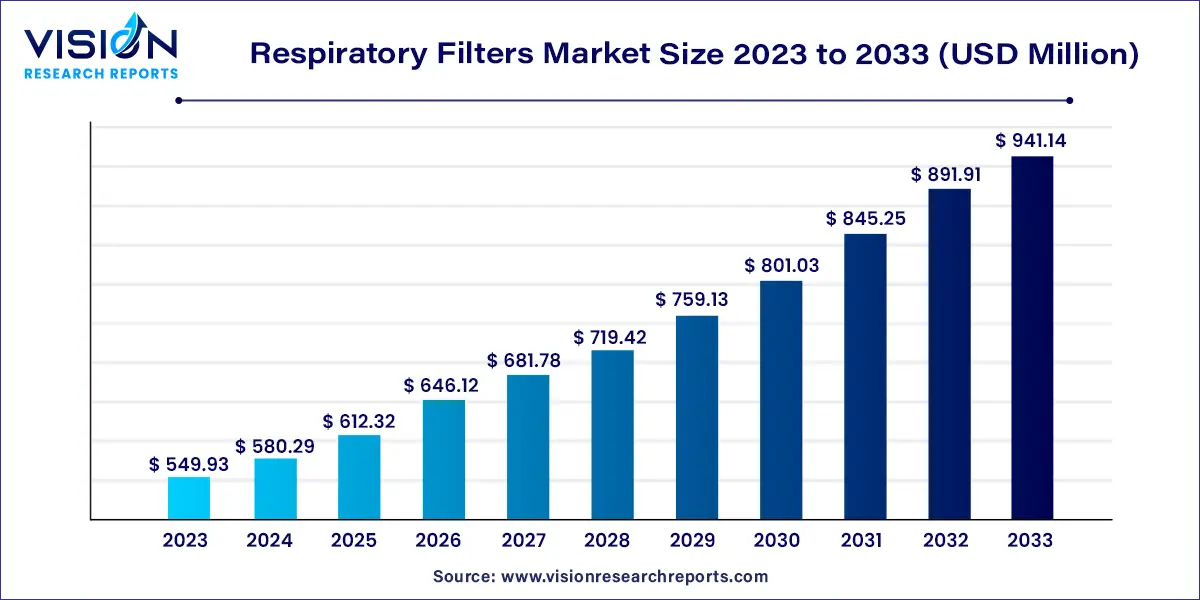

The global respiratory filters market size was estimated at USD 549.93 million in 2023 and it is expected to surpass around USD 941.14 million by 2033, poised to grow at a CAGR of 5.52% from 2024 to 2033.

The respiratory filters market stands at the forefront of the battle for cleaner, safer air in a world faced with escalating environmental challenges. As air pollution levels continue to rise globally, the demand for efficient respiratory filters has never been more critical. This market overview delves into the key facets of this dynamic industry, shedding light on its growth trajectory, driving factors, and the innovative solutions that are reshaping the way we breathe.

The growth of the respiratory filters market is propelled by several key factors. Firstly, the alarming increase in air pollution levels, especially in urban areas, has heightened the demand for efficient respiratory filters. Governments and environmental agencies enforcing stringent regulations mandating the use of high-quality filters across various industries further contribute to market expansion. Additionally, the growing awareness among individuals about the importance of breathing clean air fuels market demand, leading to increased adoption in both industrial and residential sectors. Furthermore, continuous advancements in filtration technologies, coupled with a focus on sustainability and eco-friendly materials, drive innovation within the industry. These factors combined create a favorable environment for the market's growth, ensuring that respiratory filters continue to play a crucial role in promoting healthier living standards.

| Report Coverage | Details |

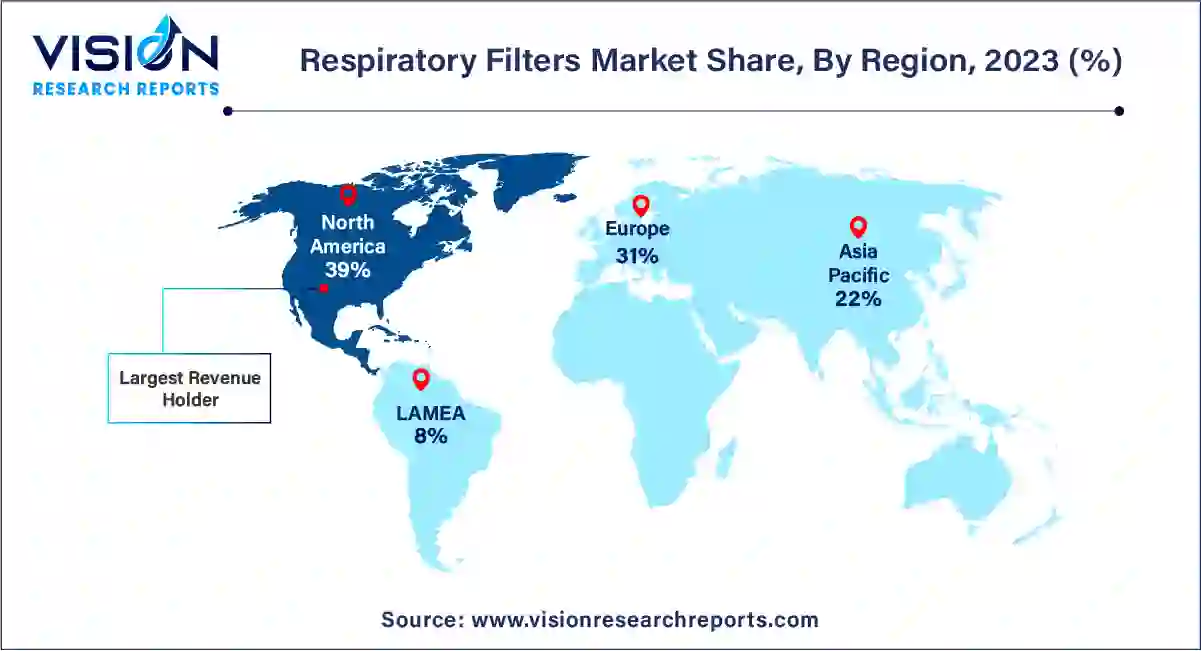

| Revenue Share of North America in 2023 | 39% |

| CAGR of Europe from 2024 to 2033 | 6.27% |

| Revenue Forecast by 2033 | USD 941.14 million |

| Growth Rate from 2024 to 2033 | CAGR of 5.52% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The positive airway pressure device filters segment accounted for the biggest revenue share of 25% in 2023. The global respiratory filters market is witnessing a significant surge in demand, particularly in segments such as Positive Airway Pressure (PAP) Device Filters and Humidifier Filters. PAP Device Filters, designed to work in conjunction with positive airway pressure therapy devices, have become indispensable in managing sleep-related breathing disorders, such as sleep apnea. These filters ensure that the air entering the patient's airways is not only pressurized but also purified from dust particles and allergens, thereby enhancing the overall effectiveness of the therapy. The rising prevalence of sleep disorders and the increasing awareness about their management have contributed to the growing adoption of PAP Device Filters, driving market growth.

The humidifier filters segment is expected to grow at the fastest CAGR of 6.85% over the forecast period. Humidifier Filters have become integral components in respiratory care, especially for patients using respiratory support systems. These filters add moisture to the air delivered through ventilators and oxygen concentrators, preventing the airways from drying out and reducing irritation. As respiratory care technology continues to advance, the demand for efficient and durable Humidifier Filters has surged. Medical professionals and patients alike recognize the importance of maintaining optimal humidity levels in respiratory therapies, thereby fueling the market for Humidifier Filters.

The hospitals segment held the largest revenue share of 36% in 2023. Hospitals, as the backbone of healthcare systems, serve a diverse array of patients, from those requiring acute respiratory support to those undergoing surgical procedures. In these settings, respiratory filters are essential components, ensuring the air supplied to patients is clean, free from contaminants, and conducive to the healing process. The stringent infection control protocols in hospitals necessitate the use of high-quality filters, reducing the risk of airborne infections and contributing significantly to patient safety.

Simultaneously, outpatient facilities, ranging from specialized respiratory clinics to primary care centers, cater to a wide spectrum of respiratory health needs outside the hospital environment. Patients seeking ongoing respiratory therapies or consultations rely on outpatient facilities for their healthcare requirements. Here, respiratory filters are integral, ensuring that individuals receiving treatments such as oxygen therapy or nebulization are provided with purified air, enhancing the effectiveness of their treatments. Outpatient facilities also serve patients with chronic respiratory conditions who require continuous respiratory support, making the availability of efficient filters crucial for managing these conditions effectively.

North America led the global market with the largest market share of 39% in 2023. In North America, stringent regulatory frameworks and a robust healthcare infrastructure drive the market. The region's emphasis on technological advancements and the early adoption of innovative filtration solutions contribute significantly to market growth. Additionally, the increasing prevalence of respiratory diseases in this region fuels the demand for specialized filters, making North America one of the leading markets for respiratory filters.

Asia Pacific is predicted to grow at a significant CAGR of 6.27% over the forecast period. Asia-Pacific emerges as a rapidly growing market, driven by factors such as increasing industrialization, urbanization, and a rising awareness of respiratory health. Countries like China and India, experiencing rapid economic growth, witness a surge in pollution levels, leading to a heightened demand for advanced respiratory filters. Moreover, the region's growing healthcare expenditure and the adoption of advanced medical technologies contribute to market expansion. Local manufacturers often focus on cost-effective solutions, catering to a large consumer base with diverse affordability levels.

By Product

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Respiratory Filters Market

5.1. COVID-19 Landscape: Respiratory Filters Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Respiratory Filters Market, By Product

8.1. Respiratory Filters Market, by Product, 2024-2033

8.1.1. Nebulizer Filters

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Humidifier Filters

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Positive Airway Pressure Device Filters

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Oxygen Concentrators Filters

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Ventilator Filters

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Respiratory Filters Market, By End-use

9.1. Respiratory Filters Market, by End-use, 2024-2033

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Outpatient Facilities

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Home Care

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Respiratory Filters Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. GE Healthcare

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Koninklijke Philips N.V.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. ICU Medical (Smiths Medical)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Invacare Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Medtronic

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Fisher & Paykel Healthcare

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. ResMed

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Linde

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Mindray

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Chart Industries

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others