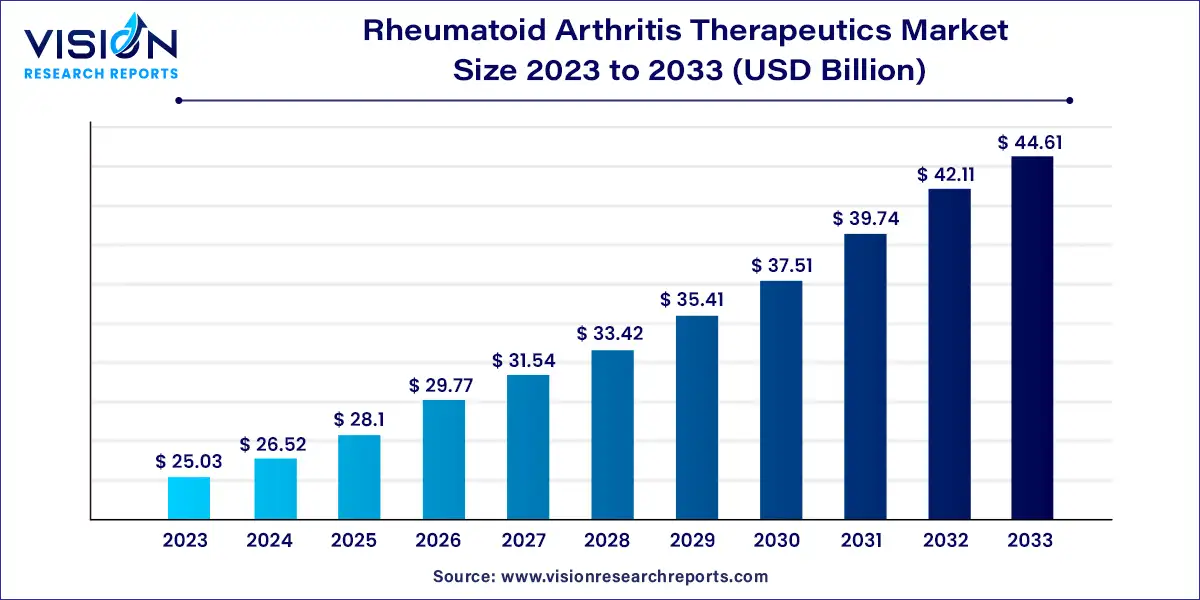

The global rheumatoid arthritis therapeutics market size was estimated at around USD 25.03 billion in 2023 and it is projected to hit around USD 44.61 billion by 2033, growing at a CAGR of 5.95% from 2024 to 2033. Rheumatoid arthritis (RA) is a chronic autoimmune disorder characterized by inflammation, pain, and damage to the joints. The condition affects millions globally, creating a significant demand for effective therapeutic solutions. The rheumatoid arthritis therapeutics market encompasses various treatment modalities, including pharmaceuticals, biologics, and other innovative therapies aimed at managing symptoms, slowing disease progression, and improving the quality of life for patients.

The growth of the rheumatoid arthritis therapeutics market is propelled by an increasing prevalence of rheumatoid arthritis, driven by an aging global population and lifestyle factors, is a significant contributor. As the number of diagnosed cases rises, so does the demand for effective treatment options. Secondly, advancements in drug development, particularly in biologics and targeted therapies, have revolutionized RA management by offering more personalized and effective treatment approaches. These innovations enhance patient outcomes and drive market growth. Additionally, rising healthcare expenditure and increased awareness about rheumatoid arthritis are leading to higher adoption of advanced therapies. Supportive government initiatives and the expansion of healthcare infrastructure also play a crucial role in facilitating market growth, ensuring better access to therapeutic options for a broader patient base.

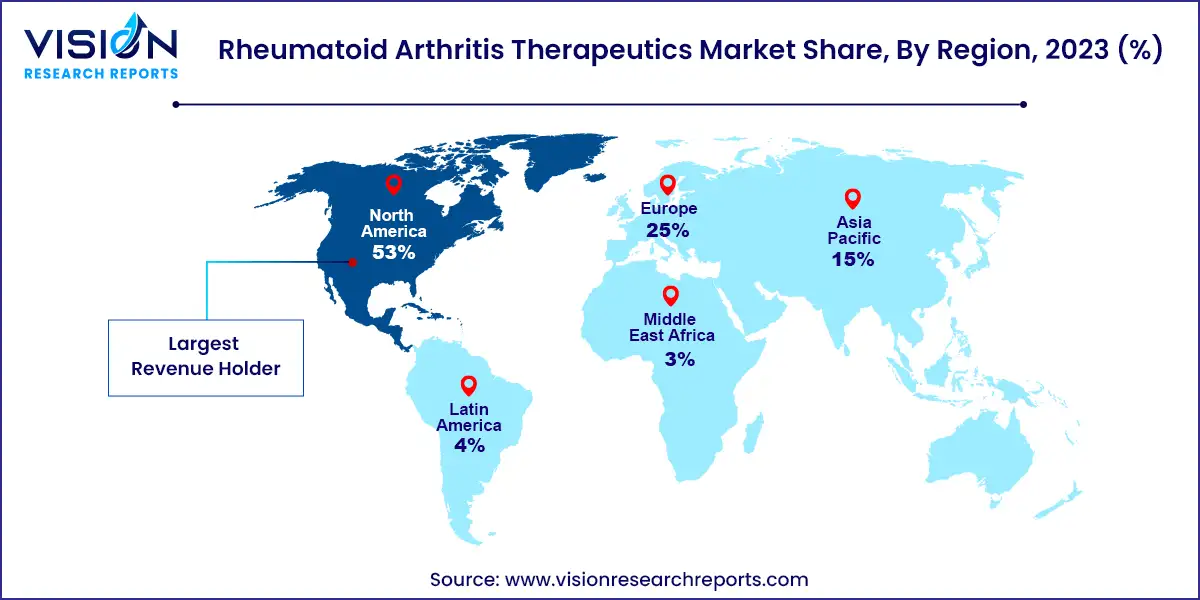

In 2023, North America accounted for 53% of the rheumatoid arthritis therapeutics market. This market continues to grow, driven by demographic changes, medical research advancements, regulatory shifts, and a focus on personalized healthcare. The aging population in the region significantly impacts the demand for rheumatoid arthritis treatments, as longer life expectancy increases the prevalence of chronic conditions like RA. This demographic trend is a major driver of ongoing market growth.

| Attribute | North America |

| Market Value | USD 13.26 Billion |

| Growth Rate | 5.97% CAGR |

| Projected Value | USD 23.64 Billion |

The European market for rheumatoid arthritis therapeutics is undergoing significant changes due to healthcare reforms, research advancements, and patient-centric initiatives. The growing prevalence of RA, driven by an aging population and evolving lifestyles, is fueling demand for innovative and effective treatment options across the continent.

The Asia Pacific market for rheumatoid arthritis therapeutics is experiencing robust growth, spurred by rising RA prevalence, enhanced healthcare infrastructure, and advancements in treatment options. The increasing incidence of RA in the region is attributed to factors such as aging populations, lifestyle changes, and improved awareness leading to earlier diagnoses. This trend is driving demand for effective and affordable RA treatments, prompting a focus on enhancing RA care and management.

The Latin American rheumatoid arthritis therapeutics market is shaped by healthcare policies, regulatory frameworks, and pharmaceutical innovations. Although detailed country-specific data may be limited, regional trends highlight a shift towards the adoption of biosimilar drugs for RA treatment. This transition reflects broader pharmaceutical advancements and regulatory changes across the region.

The biopharmaceuticals segment dominated the market, representing 89% of global revenue in 2023. Biopharmaceuticals are large-molecule drugs derived from biological sources, including proteins and nucleic acids, used for therapeutic purposes. This segment encompasses biologics with active patent terms intended for parenteral use, as well as biosimilars, which are non-patented copies of biologics. Biosimilars enter the market following the expiration of biologics' patents and are typically more affordable than their patented counterparts.

The pharmaceuticals segment also held a significant share in 2023. Pharmaceutical medications play a crucial role in managing rheumatoid arthritis (RA), a chronic inflammatory condition primarily affecting the joints. RA, an autoimmune disease, can lead to disease progression and disability. Recent advancements in treatment have significantly improved management. First-line therapies typically involve Conventional Disease-Modifying Antirheumatic Drugs (cDMARDs), such as methotrexate, sulfasalazine, and leflunomide, sometimes in combination with glucocorticoids. If these treatments are ineffective, second-line options, including Biologic Disease-Modifying Antirheumatic Drugs (bDMARDs) and biosimilars, are considered.

The prescription segment led the market with a 90% share in 2023. With increasing rheumatologist consultations, the prescription segment is expected to remain dominant in the rheumatoid arthritis medication market. Rheumatologists assess and recommend prescription therapies tailored to patient needs. According to Dr. Colin C. Edgerton from the American Rheumatology Network, prescription drug spending is anticipated to surpass U.S. GDP and healthcare spending due to the rise in specialty drug purchases. Although only 2.5% of the population uses specialty drugs, these account for about 50% of prescription costs. Continuous therapy tends to drive these expenses higher than over-the-counter (OTC) drugs, impacting product sales negatively.

The Over-the-Counter (OTC) segment is expected to grow significantly from 2024 to 2033. Self-medication with OTC drugs has become more prevalent due to increased consumer awareness, broader availability of essential pharmaceuticals, and economic benefits for public healthcare. The Consumer Healthcare Products Association (CHPA) reports that around 96% of Americans believe OTC medications simplify the treatment of minor ailments. However, OTC self-medication poses risks such as polypharmacy, overdosing, misuse, and drug interactions.

By Molecule

By Sales Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Rheumatoid Arthritis Therapeutics Market

5.1. COVID-19 Landscape: Rheumatoid Arthritis Therapeutics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Rheumatoid Arthritis Therapeutics Market, By Molecule

8.1. Rheumatoid Arthritis Therapeutics Market, by Molecule

8.1.1. Pharmaceuticals

8.1.1.1. Market Revenue and Forecast

8.1.2. Biopharmaceuticals

8.1.2.1. Market Revenue and Forecast

Chapter 9. Rheumatoid Arthritis Therapeutics Market, By Sales Channel

9.1. Rheumatoid Arthritis Therapeutics Market, by Sales Channel

9.1.1. Prescription

9.1.1.1. Market Revenue and Forecast

9.1.2. Over-the-Counter (OTC)

9.1.2.1. Market Revenue and Forecast

Chapter 10. Rheumatoid Arthritis Therapeutics Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Molecule

10.1.2. Market Revenue and Forecast, by Sales Channel

Chapter 11. Company Profiles

11.1. AbbVie, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Boehringer Ingelheim International GmbH

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Novartis AG

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Regeneron Pharmaceuticals Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Pfizer, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Bristol-Myers Squibb Company

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. F. Hoffmann-La Roche Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. UCB S.A.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Johnson & Johnson Services, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Amgen, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others