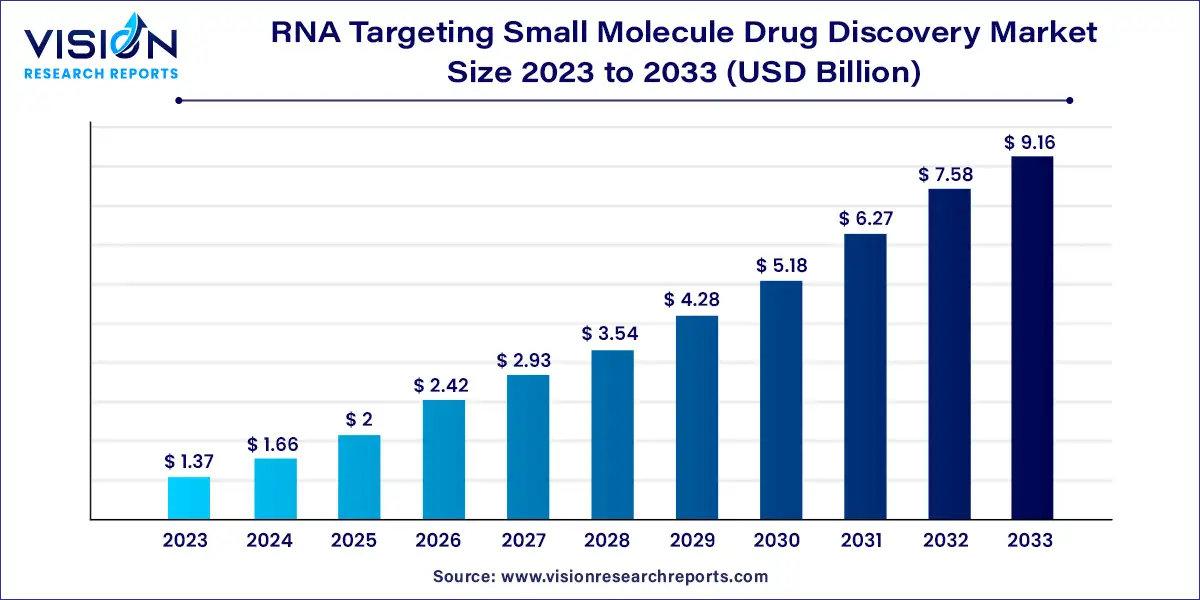

The global RNA targeting small molecule drug discovery market size was estimated at around USD 1.37 billion in 2023 and it is projected to hit around USD 9.16 billion by 2033, growing at a CAGR of 20.93% from 2024 to 2033.

The RNA targeting small molecule drug discovery market represents a burgeoning frontier in pharmaceutical research and development. This innovative field focuses on the development of small molecule drugs that can selectively bind to RNA molecules, thereby modulating their function and offering new therapeutic avenues for various diseases, including cancers, genetic disorders, and viral infections.

The growth of the RNA targeting small molecule drug discovery market is propelled by the technological advancements in RNA biology and high-throughput screening have significantly enhanced the ability to identify and develop effective RNA-targeting compounds. Additionally, the rising prevalence of genetic and rare diseases, which often lack effective treatments, creates a substantial demand for innovative therapies. The shift towards precision medicine also plays a crucial role, as RNA-targeting drugs can be tailored to address specific genetic mutations unique to individual patients. Furthermore, increased investment and strategic collaborations between biotechnology firms and pharmaceutical companies are accelerating research and development efforts in this promising field.

Increased Focus on RNA Biology:

Innovative Screening Technologies:

Expansion of Therapeutic Areas:

Personalized Medicine and Precision Therapeutics:

Target Identification and Validation:

Specificity and Selectivity:

Delivery Mechanisms:

Stability and Bioavailability:

Due to the high prevalence of cancer and the urgent need for more effective treatments, the cancer segment is anticipated to witness a lucrative CAGR of 21.33% in the RNA-targeting small molecules drug discovery industry. RNA-targeted medications are particularly advantageous for treating cancer because they can specifically target cancer cells and cancer-related genetic alterations, enhancing their efficacy while minimizing adverse effects. Many pharmaceutical companies are heavily investing in RNA-targeted drug discovery for cancer treatment, which is expected to drive market growth in the coming years. While significant growth is expected in the cancer segment, the market is also likely to diversify as more RNA-targeted drugs are developed for other indications, such as genetic disorders and viral infections.

The neurological diseases segment held a significant market share of 42% in 2023. This high revenue share is primarily due to the increasing number of companies expanding their neurological drug pipelines with RNA-targeted small molecules. For example, in January 2019, Skyhawk Therapeutics, Inc. and Biogen Inc. announced a strategic agreement to utilize Skyhawk’s SkySTAR technology platform to discover innovative RNA-targeting small molecule treatments for neurological diseases. Such initiatives support the dominant position of this segment and boost the growth of the RNA-targeting small molecules drug discovery industry.

Pharmaceutical and biopharmaceutical companies, with their vast resources and experience in drug discovery, are projected to continue dominating the market, holding a revenue share of 61% in 2023. Several small to medium-sized biopharmaceutical companies are also penetrating the market, introducing cutting-edge strategies that spur future expansion and competitiveness. The recent USD 115 million funding round for Ribometrix to develop new RNA-targeted therapeutics highlights the significant demand and opportunity for innovation in this industry.

Academic and research institutes are anticipated to witness a significant CAGR of 20.93% in the global market. As new players enter the market, collaborations between pharmaceutical companies and academic institutions are becoming increasingly common, supporting the growth of academic and research institutes in this field. The integration of advanced technologies, such as artificial intelligence and DNA-encoded library technology, is also driving innovation in the market. As the RNA-targeting small molecule drug discovery industry evolves, it presents exciting opportunities for research institutes to develop new drugs and technologies targeting RNA, potentially revolutionizing the treatment of various diseases.

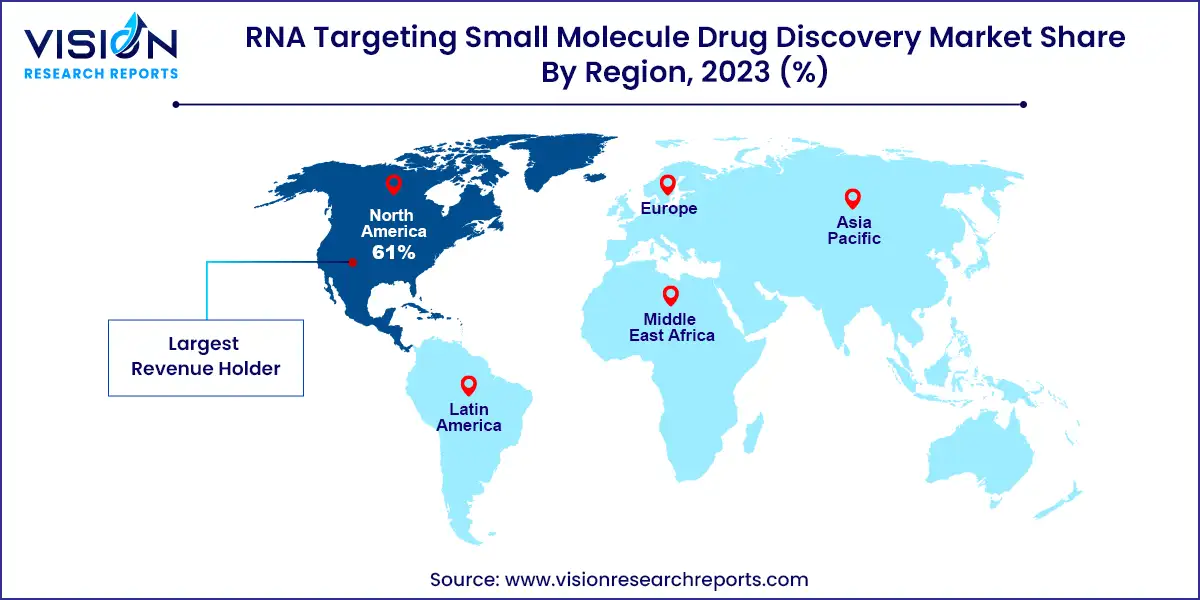

Globally, the RNA-targeting small molecule drug discovery industry is dominated by North America, with a market share of 61% in 2023. This dominance is largely due to the presence of many of the world's top pharmaceutical and biopharmaceutical firms, including Skyhawk Therapeutics, Inc.; Ribometrix; and Arrakis Therapeutics. These companies have the resources and expertise necessary to design and produce RNA-targeted medications on a large scale. They are investing heavily in RNA-targeting drug discovery, establishing relationships with regulatory agencies and healthcare providers, which are crucial for obtaining regulatory approval and launching new drugs. Additionally, North America's well-established healthcare infrastructure supports the development and commercialization of new drugs. The region is expected to maintain its dominance due to the increasing demand for RNA-targeted drugs and the presence of leading market players.

Due to rising investments in healthcare infrastructure and R&D activities, the Asia Pacific region is predicted to experience a stable growth rate of 20.63% CAGR in the RNA-targeting small molecule drug discovery industry. The rising incidence of chronic diseases, including cancer, cardiovascular conditions, and neurological disorders, drives the market in this region and has boosted the demand for cutting-edge RNA-targeted medications. Governments in the region are also supporting research and development activities, further driving market growth. Moreover, increasing investment in healthcare infrastructure and the availability of skilled labor are expected to contribute to the market's growth in the Asia Pacific region. Companies like AXXAM S.p.A. and xFOREST Therapeutics Co., Ltd are expanding their operations in the region to tap into the growing market opportunities.

By Indication

By End-user

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others