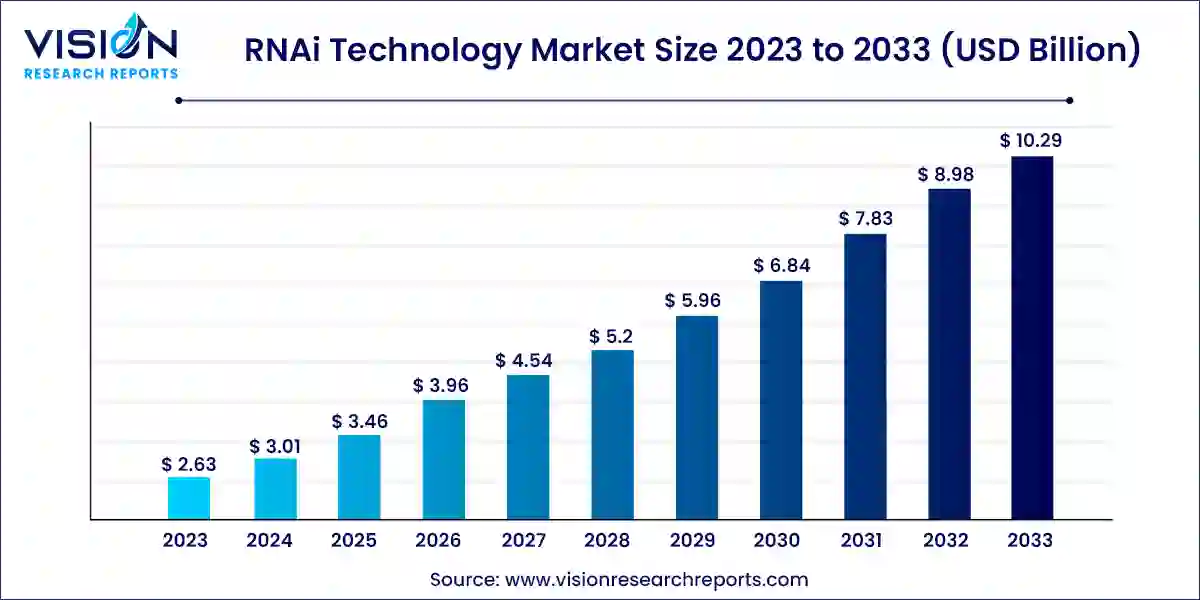

The global RNAi technology market size was estimated at around USD 2.63 billion in 2023 and it is projected to hit around USD 10.29 billion by 2033, growing at a CAGR of 14.62% from 2024 to 2033.

RNA interference (RNAi) technology has revolutionized the field of genetics and molecular biology, offering a novel approach to gene silencing. This technology utilizes small interfering RNA (siRNA) and microRNA (miRNA) to regulate the expression of specific genes, making it a powerful tool for research, therapeutics, and agriculture. As the demand for targeted gene therapy and precision medicine grows, the RNAi technology market is poised for significant expansion.

The RNAi technology market is experiencing robust growth due to an advancements in genetic and molecular research have significantly enhanced the understanding of gene functions and the mechanisms of gene silencing, fostering innovation in RNAi applications. The rising prevalence of chronic diseases, such as cancer and genetic disorders, has increased the demand for targeted, effective treatments that RNAi technology can provide. Additionally, substantial investments from both government bodies and private sector companies have accelerated research and development efforts, leading to the commercialization of RNAi-based products and therapies. These factors, combined with the growing interest in precision medicine and personalized treatment approaches, are driving the expansion of the RNAi technology market.

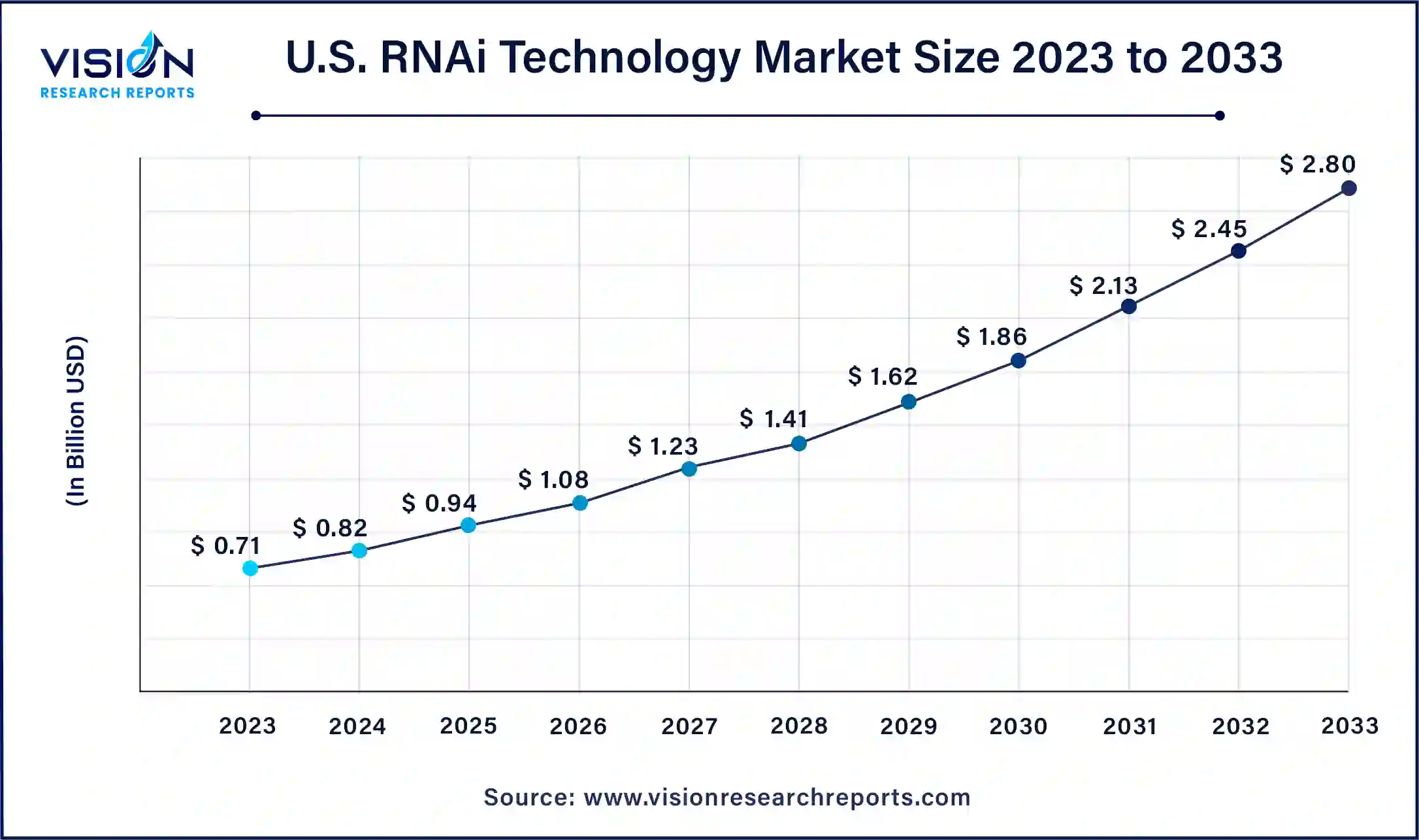

The global RNAi technology market size was valued at USD 0.71 billion in 2023 and it is predicted to surpass around USD 2.80 billion by 2033 with a CAGR of 14.7% from 2024 to 2033.

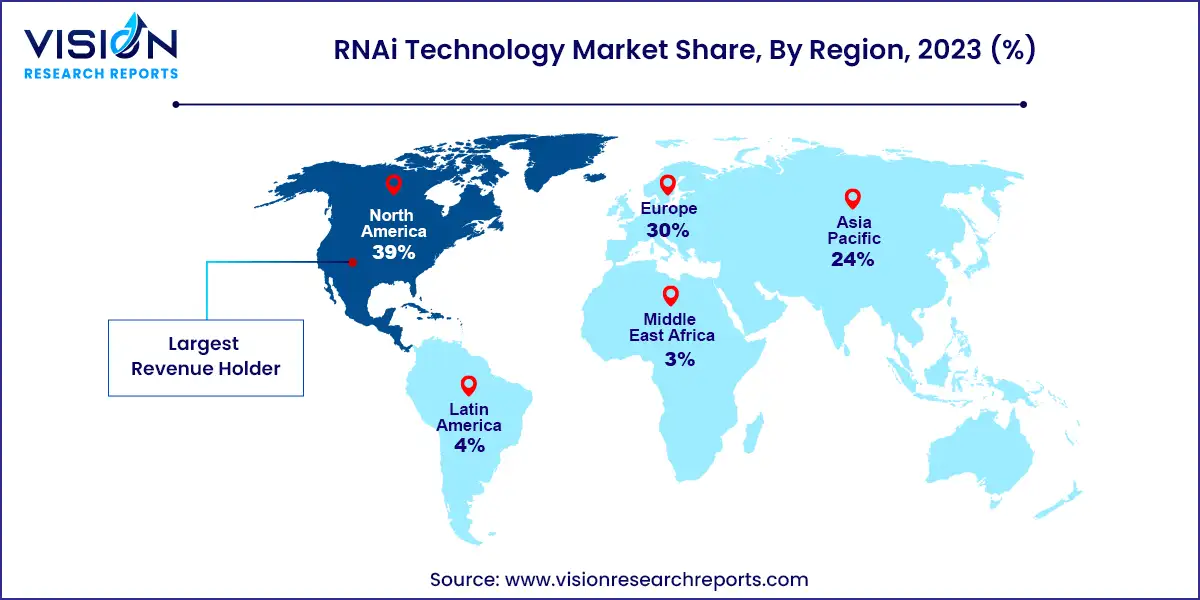

North America accounted for the largest market share of 39% in 2023. This is attributed to the strong presence of research institutions and universities engaged in cutting-edge research in genomics, molecular biology, and biotechnology. The demand for RNAi therapeutics in research applications is driven by these institutions' exploration of technologies used in RNAi therapeutics. Moreover, government grants and funding programs provide researchers with resources to develop novel RNA technologies and therapeutic applications. These factors are anticipated to boost market growth in the region over the forecast period.

The RNAi technology market in Asia Pacific is expected to exhibit the highest CAGR of 16.76% over the forecast period. This growth is driven by a high birth rate and a high prevalence of genetic disorders, due to factors such as consanguineous marriages and founder mutations. RNA oligonucleotides and RNAi techniques are increasingly used in gene therapy applications, contributing to the region's market expansion.

The market is segmented by application into drug discovery & development, functional genomics, and others. In 2023, the drug discovery & development segment led the market with a 69% share and is projected to grow at the highest CAGR during the forecast period. RNAi technology's precise targeting and gene silencing capabilities make it a vital tool in drug discovery and development. This precision enables researchers to study gene functions and their roles in diseases more effectively, accelerating the identification and validation of new therapeutic targets. Additionally, increased investments and strategic collaborations among pharmaceutical companies to develop RNAi-based treatments, coupled with advancements in RNAi delivery techniques for enhanced efficacy, are expected to significantly drive market growth.

The functional genomics segment is anticipated to register a significant CAGR during the forecast period. This growth is driven by research efforts focused on understanding the phenotypical expressions associated with specific disease conditions. A substantial number of cancer gene therapies are developed based on functional genomic technology, which is expected to propel the segment's growth over the forecast period.

Based on product & service, the market is divided into products (miRNA products, siRNA products, and others) and services. The products segment held the largest market share in 2023, further segmented into miRNA, siRNA, and others. miRNA and siRNA have shown considerable promise in therapeutic applications, particularly in gene silencing, crucial for addressing various illnesses such as cancer, viral infections, and hereditary conditions. Their ability to specifically target and degrade mRNA molecules enables precise molecular interventions, making them powerful tools in modern medical practices. Additionally, increasing investments are expected to advance the product portfolio.

The services segment is projected to register the highest CAGR of 16.03% over the forecast period. The complexity and technical demands of RNAi technology drive the need for specialized companies with the necessary expertise and equipment. Contract Research Organizations (CROs) and similar firms offer comprehensive RNAi services, from target identification to preclinical and clinical trial studies, facilitating the accelerated development of new drugs. This trend is expected to drive the segment's growth in the coming years.

Based on end-use, the market is segmented into pharmaceutical & biotechnology companies, academic & research institutes, and CROs & CMOs. In 2023, the pharmaceutical & biotechnology companies segment dominated the market with a 57% share. This dominance is attributed to ongoing research and development efforts, the introduction of innovative therapies, and advanced pharmaceutical products. Additionally, the increasing demand for healthcare solutions and advancements in biotechnology have likely contributed to the segment's strong market position.

The CROs & CMOs segment is expected to register the highest CAGR over the forecast period. Outsourcing is becoming a strategic move for pharmaceutical and biotech firms aiming to reduce expenses and enhance operational efficiency. By entrusting specialized service providers, such as Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs), with tasks like research and production, these firms can concentrate on their core competencies. This strategy allows them to leverage the advanced expertise and technology available in the outsourcing sector, thereby propelling the growth of the segment in the foreseeable future.

By Product & Service

By Application

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others