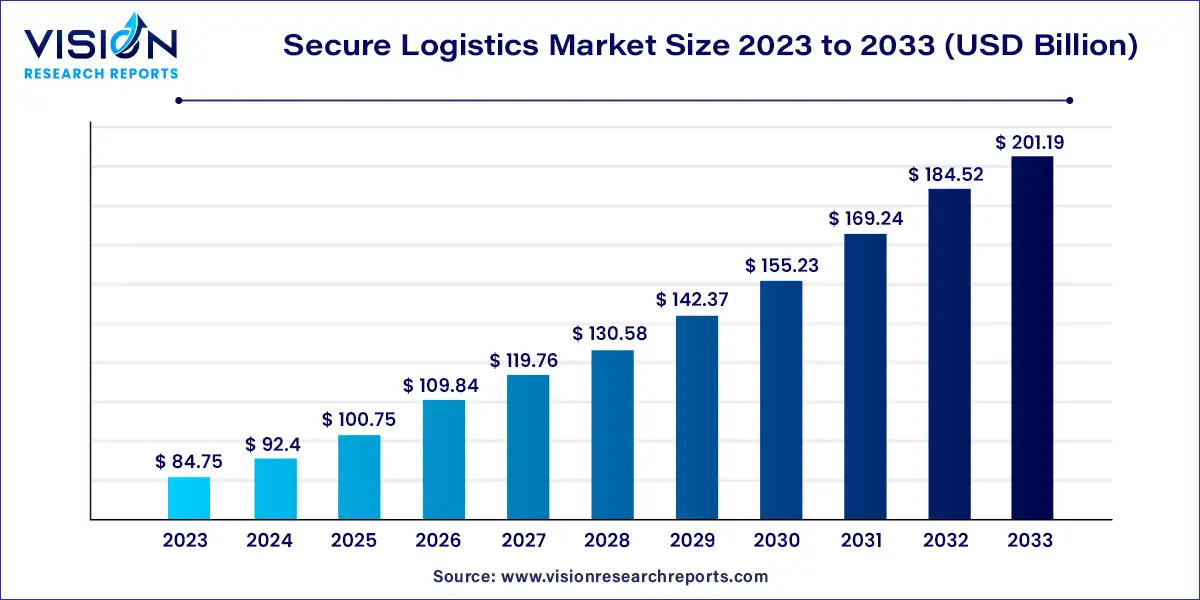

The global secure logistics market size was surpassed at USD 84.75 billion in 2023 and is expected to hit around USD 201.19 billion by 2033, growing at a CAGR of 9.03% from 2024 to 2033.

Secure logistics encompasses a spectrum of services designed to safeguard high-value goods during transit, storage, and handling. These goods may include cash, precious metals, jewelry, pharmaceuticals, electronics, and confidential documents, among others. The primary objective of secure logistics is to mitigate risks such as theft, tampering, counterfeiting, and damage, thereby ensuring the integrity of the supply chain and fostering trust among stakeholders.

The growth of the secure logistics market is driven by an increasing globalization of trade has led to a surge in cross-border transactions, necessitating secure transportation and storage solutions for valuable goods. Additionally, the rise of e-commerce has fueled demand for secure last-mile delivery services, as consumers expect their parcels to be safeguarded from theft and damage. Furthermore, heightened security concerns, driven by the proliferation of sophisticated criminal activities, have compelled businesses to invest in robust security measures throughout the supply chain. Moreover, regulatory requirements mandating stringent security standards have further bolstered the demand for secure logistics services.

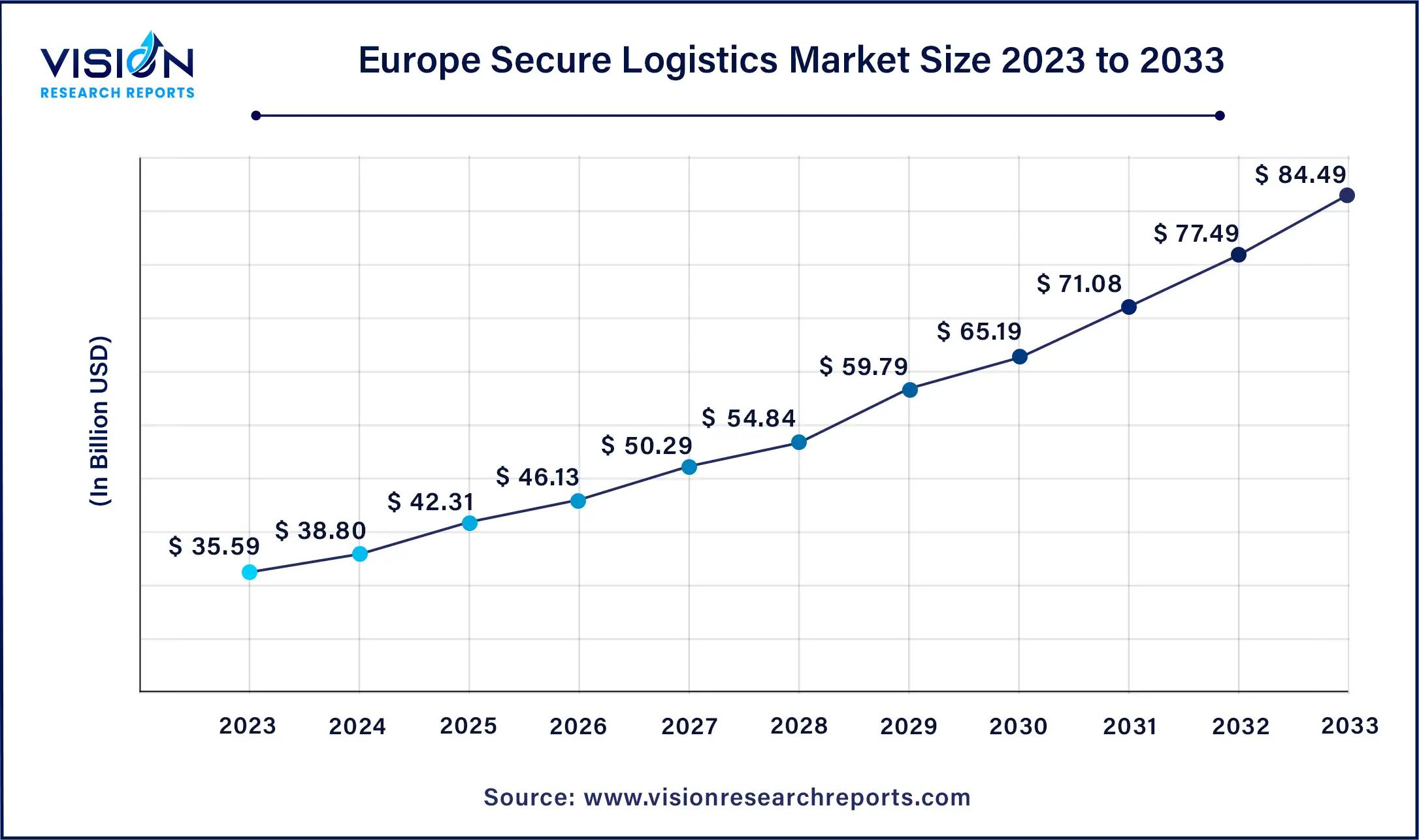

The Europe secure logistics market size was estimated at around USD 35.59 billion in 2023 and it is projected to hit around USD 84.49 billion by 2033, growing at a CAGR of 9.03% from 2024 to 2033.

Europe dominated the global market in 2023, accounting for over 42% of the market share, and has emerged as one of the most influential markets. The expanding presence of ATMs, coupled with their growing utilization in emerging economies, is expected to stimulate regional growth. The increasing circulation of cash and trade investments among European nations presents a myriad of opportunities for secure logistics. However, future market shares may be influenced by trade policies among countries and challenges associated with Brexit.

North America's secure logistics market is experiencing robust growth driven by various factors, including the rising demand for cash management services, expansion of the e-commerce and retail sectors, and stringent regulatory standards. Heightened security concerns, such as theft, fraud, and cybercrime, have compelled businesses and organizations to prioritize secure transportation and storage of valuable assets. The increasing need for robust security measures and advanced technological solutions to mitigate potential risks is fueling the demand for secure logistics services. Moreover, the rapid growth of the e-commerce and retail industries in North America has heightened the demand for secure transportation and delivery services. E-commerce firms rely on secure logistics providers to ensure the safe and prompt delivery of high-value goods to customers' doorsteps, thereby driving market growth.

The secure logistics market in Asia Pacific is poised to record the fastest compound annual growth rate (CAGR) of 12.35% during the forecast period from 2024 to 2033. This growth is anticipated due to several factors, including the escalating demand for ATMs, expansion of financial institutions, and the rising incidence of freight theft. Notably, in Australia, the Reduce Aviation Freight Theft (RAFT) project was established through a collaboration between the Australian Federal Police and customs to investigate aviation theft. Additionally, the formation of the Transported Asset Protection Association (TAPA) forum has brought together global freight carriers, manufacturers, law enforcement agencies, logistics providers, and other stakeholders to mitigate losses from international supply chains.

The global market is divided into various applications, including cash management, diamonds, jewelry & precious metals, manufacturing, and others. The "others" category encompasses retail and public infrastructure. In 2023, the cash management segment emerged as the leading application, securing over 56% of the total revenue share. This segment is projected to maintain its dominance throughout the forecast period, largely due to the escalating presence of ATMs in emerging economies. Cash management encompasses cash-in-transit, cash processing, and ATM services.

Cash-in-transit involves collecting funds from banks and transporting them to designated locations, such as ATMs, using armored trucks to minimize risks and enhance security against theft. Service providers often combine ATM services with traditional cash-in-transit operations, adhering to regulations set forth by regional, national, and local authorities, including the Ministry of Justice, the Ministry of Interior, and law enforcement agencies. Market players prioritize the development of innovative and efficient solutions to meet evolving industry demands.

The global market is categorized by mode of transport into road, rail, and air segments. In 2023, the road segment captured the largest share of revenue and is projected to maintain its dominance throughout the forecast period. This growth is primarily attributed to the flexibility and accessibility offered by road transport, making it the preferred choice for secure logistics providers to transport valuable shipments. The advancement of GPS technologies, vehicle tracking systems, and secure convoy protocols further solidifies road transport as a reliable option for secure door-to-door transportation, meeting consumer demands. Investments in armored trucks, surveillance systems, and trained personnel bolster the reliability and security of road transport for sensitive and high-value items.

Conversely, the air segment is poised to experience the highest CAGR during the forecast period from 2024 to 2033. This expansion is fueled by the escalating demand for rapid movement of expensive goods across the globe. Airlines play a vital role in transporting goods swiftly, especially for industries such as technology, banking, and pharmaceuticals, owing to their efficiency and speed. To comply with stringent security standards for air cargo, secure logistics providers invest in cutting-edge screening technologies, secure cargo facilities, and adherence to international air transport security protocols. The imperative for swift and secure transportation solutions driven by globalization is expected to sustain stable growth in the air segment of secure logistics, propelled by continual advancements in aviation security.

The global market is segmented by end-user into financial institutions, retailers, government, and others. Financial institutions held the dominant position in the secure logistics market in 2023. Secure logistics companies play a vital role in ensuring the safe transit of valuables, given that banks and financial institutions routinely handle high-value cash, confidential documents, and valuable assets. The demand for cash management solutions and specialized secure transit services, such as secure vaulting, has been steadily increasing. The secure logistics market for financial institutions is expected to experience steady growth as long as these institutions continue to prioritize security.

Meanwhile, the retail sector is projected to witness the fastest growth during the forecast period from 2024 to 2033. Retailers rely on dependable and secure shipping services to protect their valuable inventory, particularly those dealing with high-end merchandise, jewelry, and electronics. Secure logistics companies offer tailored solutions, including last-mile delivery, warehousing, and secure transportation. The retail secure logistics market is expected to grow steadily, driven by the expansion of e-commerce and the increasing demand for end-to-end security in the supply chain.

The global market is segmented by types into static and mobile categories. In 2023, the static type segment claimed the largest market share, exceeding 60%, and is projected to maintain its dominance throughout the forecast period. This segment relies on manned guards for security purposes, stationed at various points to ensure the security of logistics transportation. Numerous companies offer guarding services, providing specialized logistics security solutions aimed at detecting security breaches, minimizing shipment loss and damage, and preventing theft.

Conversely, the mobile type segment is anticipated to witness the fastest growth rate of 10.33% during the forecast period from 2024 to 2033. This growth is driven by advancements in secure journey management services, with providers offering vehicles equipped with electronic countermeasures, as well as radio and satellite communication systems. Electronic safes, primarily used by financial institutions to minimize management downtime, are integral to the mobile type segment. Service providers collaborate with various safe manufacturers to offer a diverse range of electronic safe services catering to different sizes and requirements.

By Application

By Mode of Transport

By End-User

By Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others