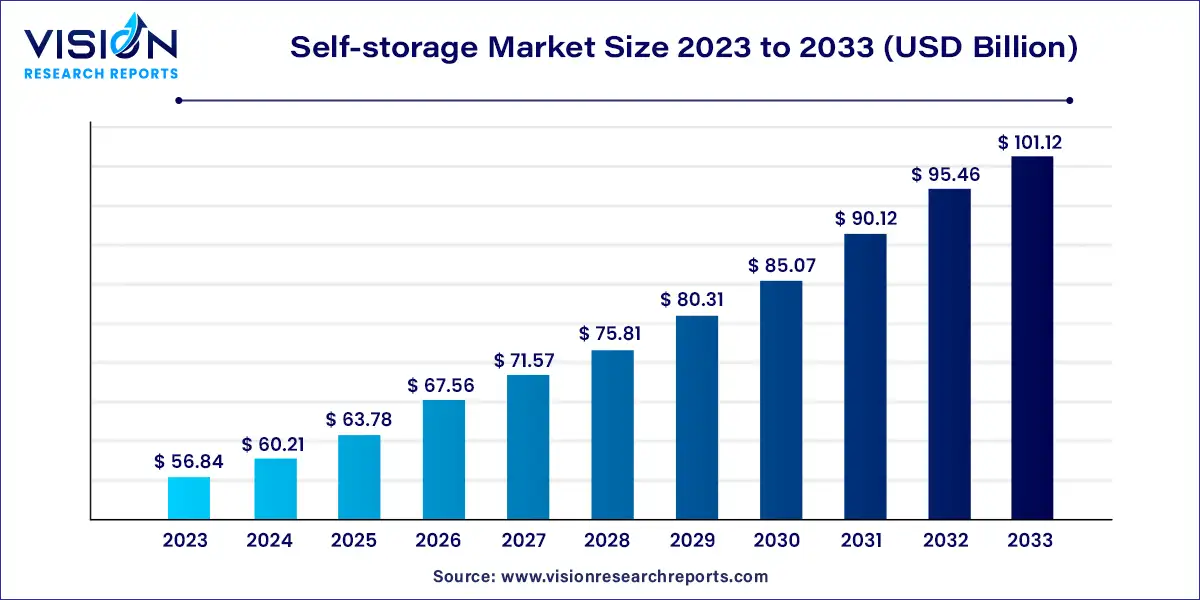

The global self-storage market size was valued at USD 56.84 billion in 2023 and it is predicted to surpass around USD 101.12 billion by 2033 with a CAGR of 5.93% from 2024 to 2033. The self-storage market has witnessed significant growth globally, driven by increasing urbanization, changing lifestyles, and a growing need for additional space. Self-storage facilities provide individuals and businesses with secure units to store goods and belongings for short or long-term periods

The self-storage market is experiencing robust growth driven by an urbanization trends and rising population densities are increasing the demand for additional storage space among both residential and commercial sectors. Moreover, changing consumer lifestyles, including a growing preference for temporary or transitional housing arrangements, further fuel the need for self-storage solutions. Additionally, the rise of e-commerce has led to heightened demand for warehouse storage space, benefiting the self-storage industry as well. These factors, coupled with technological advancements in facility management and security, are contributing to a positive growth trajectory for the global self-storage market.

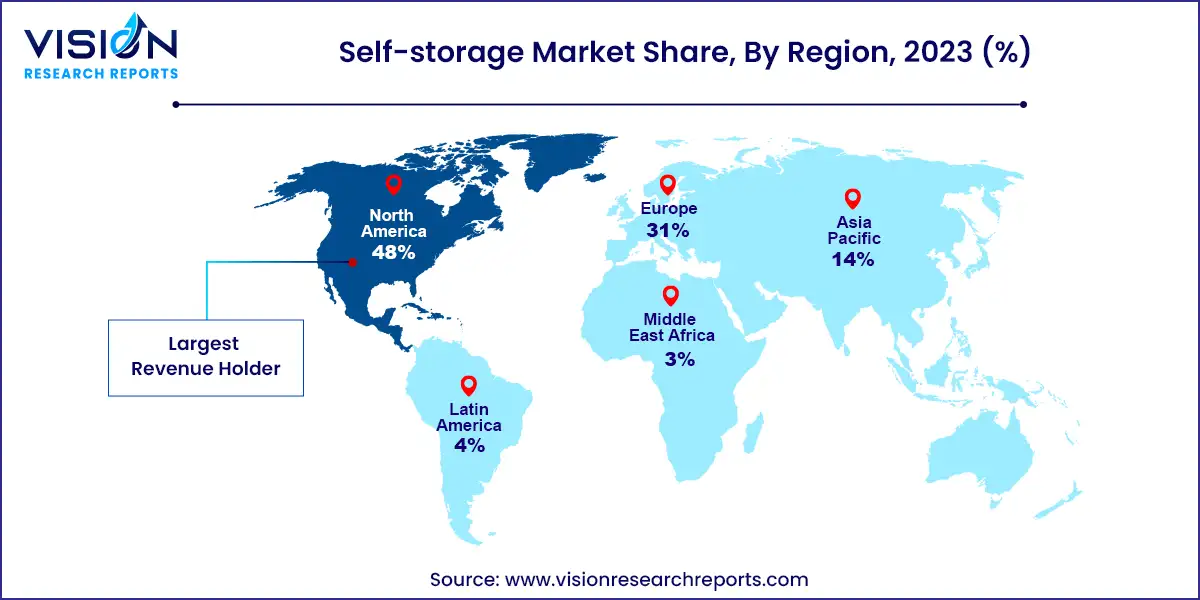

North America dominated the global self-storage market in 2023, accounting for over 48% of revenue. Market growth in the region is supported by demographic factors such as an aging population that often downsizes homes but requires storage for personal belongings. Furthermore, the integration of advanced technologies in self-storage facilities, including digital access controls and online reservation platforms, enhances customer experience and operational efficiency, driving market expansion.

| Attribute | North America |

| Market Value | USD 27.28 Billion |

| Growth Rate | 5.93% CAGR |

| Projected Value | USD 48.53 Billion |

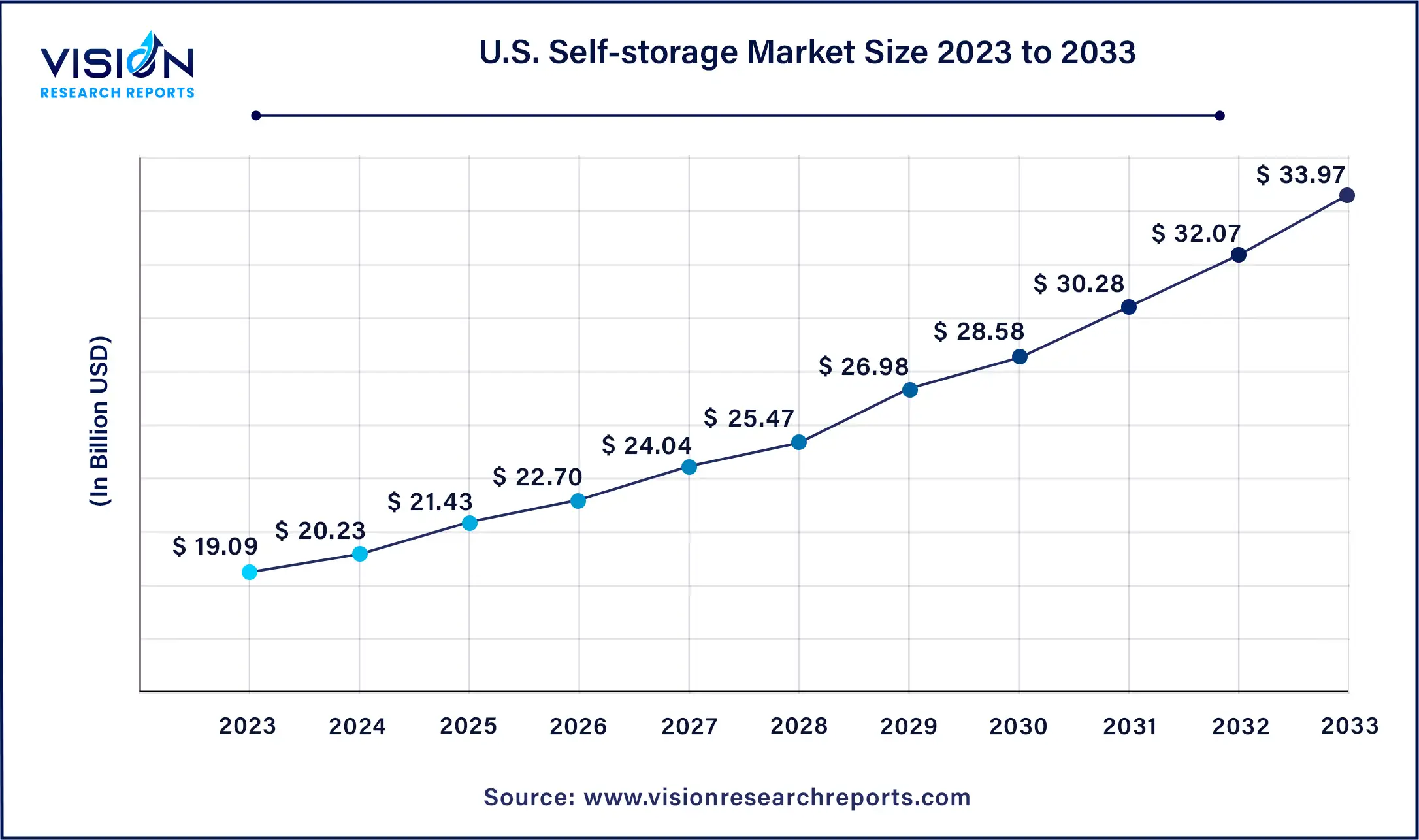

The U.S. self-storage market size was estimated at around USD 19.09 billion in 2023 and it is projected to hit around USD 33.97 billion by 2033, growing at a CAGR of 5.93% from 2024 to 2033.

The Asia Pacific self-storage market is expected to grow at the fastest CAGR of 7.15% from 2024 to 2033. Rapid urbanization across major cities in the region has led to smaller living spaces and increased demand for external storage solutions. The expansion of e-commerce activities further fuels demand for storage space to manage inventory and logistics operations efficiently.

In Europe, the self-storage market is anticipated to grow at a significant CAGR of 5.73% from 2024 to 2033. The presence of a sizable expatriate population in major European cities drives demand for temporary storage solutions during relocations and transitions. This demographic trend, coupled with evolving urban lifestyles, continues to support market growth across the continent.

The self-storage market categorizes unit sizes into small, medium, and large segments. As of 2023, the medium segment led the market, holding a substantial share of over 46%. This dominance is primarily attributed to the versatility and cost-effectiveness of medium-sized units. They strike a balance between space and affordability, catering well to diverse storage needs such as household items, furniture, and business inventory. Medium units offer an economical solution for customers requiring more space than small units yet less than what large units provide, making them highly attractive across various customer segments.

The large segment is forecasted to experience the fastest compound annual growth rate (CAGR) of 6.63% from 2024 to 2033. Growth in this segment is driven by the convenience and security features it offers. Large units provide convenience by allowing customers to consolidate all their items into one unit, eliminating the need for multiple smaller units. Enhanced security measures at these facilities further enhance their appeal for storing valuable or bulky items. Additionally, businesses, particularly in the expanding e-commerce and retail sectors, find large units beneficial for managing substantial inventory, equipment, or seasonal stock demands.

In 2023, the personal segment dominated the market, accounting for over 67% of global revenue. This segment's growth is spurred by increasing urbanization, which often results in smaller living spaces that necessitate additional storage solutions. Lifestyle changes such as frequent relocations, downsizing, and evolving family dynamics also contribute to the demand for personal storage. As urban populations grow globally, the need for self-storage solutions for personal belongings continues to rise.

The business segment is projected to witness a robust CAGR of 6.53% from 2024 to 2033, driven by the rapid expansion of the e-commerce sector. The rise of online retailing has led to heightened demand for storage space to store inventory, packaging materials, and logistics supplies. Small and medium-sized enterprises (SMEs) increasingly turn to self-storage as a flexible and cost-effective warehousing solution. This flexibility allows businesses to scale their storage needs according to demand fluctuations without committing to long-term leases, thereby optimizing operational costs.

By Unit Size

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Self-storage Market

5.1. COVID-19 Landscape: Self-storage Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Self-storage Market, By Unit Size

8.1. Self-storage Market, by Unit Size, 2024-2033

8.1.1. Small

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Medium

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Large

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Self-storage Market, By Application

9.1. Self-storage Market, by Application, 2024-2033

9.1.1. Personal

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Business

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Self-storage Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Unit Size (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. CubeSmart

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Metro Storage LLC

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. SmartStop Self Storage

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Life Storage Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Safestore

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. W. P. Carey Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Public Storage

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Prime Storage

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Shurgard Self Storage

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Storage Giant

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others