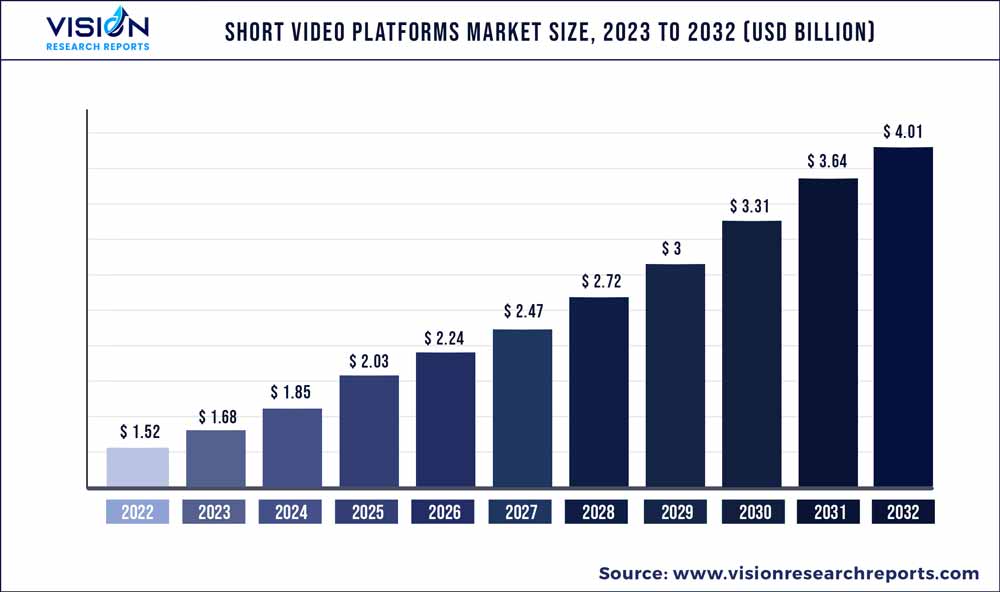

The global short video platforms market was estimated at USD 1.52 billion in 2022 and it is expected to surpass around USD 4.01 billion by 2032, poised to grow at a CAGR of 10.2% from 2023 to 2032.

Key Pointers

Report Scope of the Short Video Platforms Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.52 billion |

| Revenue Forecast by 2032 | USD 4.01 billion |

| Growth rate from 2023 to 2032 | CAGR of 10.2% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Beijing Wei Ran Internet Technology; ByteDance Ltd. (Toutiao); Doupai; Facebook (Instagram); Kuaishou Technology; Meipai; Snap Inc. (Snapchat); Snow Corp. (B612); Tencent Holdings Ltd. (Weishi); Vimeo, Inc.; Yixia Technology (Miaopai) |

The rise of smartphones, social media users, and the high rate of consumer adoption of streaming videos are responsible for the growth of the market. The short video platform has many applications, including entertainment, learning, and education. The audiovisual features of short videos capture the viewer’s attention, allowing users to analyze various information quickly and naturally. Worldwide implementation and adoption of the 5G network in the future are predicted to enhance video content consumption on these platforms considerably.

Education through short videos can be an excellent learning tool that can be very effective in the educational system. Users can ask questions, post comments, and provide feedback on these platforms, reshaping a new learning environment. A user’s learning experience can be improved by using these various educational-related features and functions of short video platforms.For instance, in May 2022, Coursera, an e-learning provider in the U.S., launched Clips, which provides over 10,000 short videos and lessons from leading businesses and universities. Through this, employees can easily access valuable and in-demand skill development content, allowing them to begin learning new skills quickly. The content of a short video platform communicates the message concisely, making users spend more time on them in search of more interesting information.

This gives brands another platform to invest. The use of short video platforms is growing for entertainment, income generation, and personal learning. For instance, in November 2022, SwaLay, a Music distribution organization in India, collaborated with Chingari, video sharing mobile app powered by GARI. This collaboration aims at helping thousands of aspiring artists and creators using the Chingari app and reaching millions of Indian consumers. Many businesses use these platforms to promote their products and services to strengthen their brand identity. The use of these platforms for advertising improves the company’s access to a larger audience and potential customers. Video content is becoming important to every brand’s content marketing strategy.

For instance, in May 2020, JD.com, a Chinese e-commerce company, announced a strategic partnership with Kuaishou, a short-video app in China. Through this partnership, the online retailer allows Kuaishou users to purchase JD products directly from the video app, redirecting shoppers to the e-commerce apps. The demand for these platforms increased significantly in North America as the U.S. is expected to hold the largest share in the regional market due to the presence of many players and the high demand for these platforms. increasing internet penetration in North America is also fueling market growth. For instance, in March 2020, YouTube launched its short video platform YouTube Shorts in the U.S. YouTube shorts enables new users to contribute to the YouTube ecosystem without filming and editing an entire video.

Type Insights

The video post segment dominated the industry in 2022 and accounted for the maximum share of 59.13% of the overall revenue. Video post promotes stronger engagement with targeted audiences and is easier to consume and recall. Short-form content’s potential can help businesses gain a competitive advantage, and sharing product demonstrations highlighting benefits and features promotes the video segment growth. The rise of online video and social sharing creates a significant opportunity for online marketing growth.

As a result, businesses are ready and eager to embark on a new venture with a certified marketing partner and a data-driven plan to manage a video-based marketing campaign.Live video allows marketers and consumers to share unedited, real-time footage on social media sites, such as Facebook and Instagram. Live video enables brands reach and interact with millions of people worldwide.The ability to incorporate a range of content and multimedia, such as images, text, as well as access to various presentation styles, contributed to the increased use of live videos.TikTok and YouTube experience tremendous development and high levels of interaction and other social networking sites are also introducing short video options to remain competitive.

Deployment Insights

The application-based segment dominated the market with the revenue share of more than 75.74% in 2022. The application-based segment includes Instagram Reel, Tiktok, Beat.ly, Vimeo, and others. The availability of wireless broadband technology and the emergence of 4G/5G mobile networks are expected to drive the segment growth. Several benefits associated with the application-based segment, such as the ability to watch videos at any time and record them, are projected to increase demand for this segment over the forecast period.

The website-based category is also expected to grow significantly over the forecast years due to a wide usage by companies to market their products/services. Moreover, everything from brand awareness videos to product demonstrations and customer testimonials can be included to market the product. For instance, Dubai Association Centre, a government-initiated entity that helps non-profit, apolitical, and nonreligious professional associations and trade bodies in Dubai, chose a vibrant animated explainer video. This video aims to distill the essence of their message into a single wonderfully textured and colorful animation.

Platform Insights

The IOS segment dominated the market with a revenue share of 42.61% in 2022. The global increase in smartphone adoption is a primary factor driving the expansion of this segment. Consumer data is at risk when using the short video app, but IOS is designed in such a way that no one can obtain it without the user's permission. Moreover, the iPhone's memory is encrypted, making it impossible to hack the device and read confidential data. The IOS segment is expected to grow significantly due to the increasing popularity of Apple products and the rising demand for luxury smartphones.

The Android segment is also expected to grow rapidly during the forecast period because of its low cost and ease of use and customers prefer the technology that is simple to use and inexpensive. Moreover, Android-based devices include multitasking, sensors, and fingerprint security features. As Android is an open-source platform, it provides greater freedom and customization choices, and it can be used on devices from various manufacturers. The emergence of new android smartphone manufacturers has resulted in the introduction of a diverse range of short video applications.

End-use Insights

The media and entertainment segment led the industry with the revenue share of 47.44% in 2022.The surge in live streaming events and growing consumer base, and advancements in mobile technology are predicted to play a significant role in the development of the media and entertainment segment. The essential aspects of the entertainment market include electronic, exhibition, live, mass media, and musical. Users can modify videos, apply face filters, and beauty effects, and add music or dialogues in the background; all of these factorsare propelling the media and entertainment sector.

The education segment is projected to register the fastest CAGR during the forecast period as people invest in learning new skills and expanding their knowledge in the information age to keep up with the ever-changing digital era. As the popularity of digital videos provided through short video learning apps grows, free skill learning platforms extend into the educational system. Short video-based learning is a great way to improve memory, coordination, and problem-solving skills and also engages users, which leads to the growth of the educational segment. Short video application is designed in such a way that helps learners retain and apply new knowledge and skills.

Regional Insights

North America dominated the industry in 2022 with the revenue share of 37.68%. The region’s growth is projected to continue shortly with the advent of superior 5G network technology, which will make short video platforms much faster and more agile. Moreover, many U.S. businesses use short video platforms to promote their products and services to strengthen their brand identity. For instance, in December 2022, Amazon.com, Inc. launched Inspire, a short-form video and photo feed. Inspire enables consumers to learn products and shop from content produced by businesses, influencers, and other customers.

Market in Asia Pacific is anticipated to grow significantly throughout the forecast period. As internet penetration increases across this region, the market is projected to benefit from the growing scope of live-streaming videos in the media & entertainment sector. Asia Pacific is expected to benefit the most from the trend as it has the world’s largest population, which is fueling the number of short video users. Moreover, the availability of live video streaming services on social media sites, such as Facebook and YouTube, is increasing the total number of users on these platforms.

Short Video Platforms Market Segmentations:

By Type

By Deployment

By Platform

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Short Video Platforms Market

5.1. COVID-19 Landscape: Short Video Platforms Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Short Video Platforms Market, By Type

8.1. Short Video Platforms Market, by Type, 2023-2032

8.1.1. Live Video

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Video Posts

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Short Video Platforms Market, By Deployment

9.1. Short Video Platforms Market, by Deployment, 2023-2032

9.1.1. Application-based

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Website-based

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Short Video Platforms Market, By Platform

10.1. Short Video Platforms Market, by Platform, 2023-2032

10.1.1. Android

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. IOS

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Windows

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Short Video Platforms Market, By End-use

11.1. Short Video Platforms Market, by End-use, 2023-2032

11.1.1. Education

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Media & Entertainment

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Live Commerce

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Short Video Platforms Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.3. Market Revenue and Forecast, by Platform (2020-2032)

12.1.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Platform (2020-2032)

12.1.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Platform (2020-2032)

12.1.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2020-2032)

12.2.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.3. Market Revenue and Forecast, by Platform (2020-2032)

12.2.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Platform (2020-2032)

12.2.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Platform (2020-2032)

12.2.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Platform (2020-2032)

12.2.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Platform (2020-2032)

12.2.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2020-2032)

12.3.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.3. Market Revenue and Forecast, by Platform (2020-2032)

12.3.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Platform (2020-2032)

12.3.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Platform (2020-2032)

12.3.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Platform (2020-2032)

12.3.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Platform (2020-2032)

12.3.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2020-2032)

12.4.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.3. Market Revenue and Forecast, by Platform (2020-2032)

12.4.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Platform (2020-2032)

12.4.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Platform (2020-2032)

12.4.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Platform (2020-2032)

12.4.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Platform (2020-2032)

12.4.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2020-2032)

12.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.3. Market Revenue and Forecast, by Platform (2020-2032)

12.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Platform (2020-2032)

12.5.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Platform (2020-2032)

12.5.6.4. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 13. Company Profiles

13.1. Beijing Wei Ran Internet Technology

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. ByteDance Ltd. (Toutiao)

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Doupai

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Facebook (Instagram)

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Kuaishou Technology

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Meipai

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Snap Inc. (Snapchat)

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Snow Corp. (B612)

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Tencent Holdings Ltd. (Weishi)

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Vimeo, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others