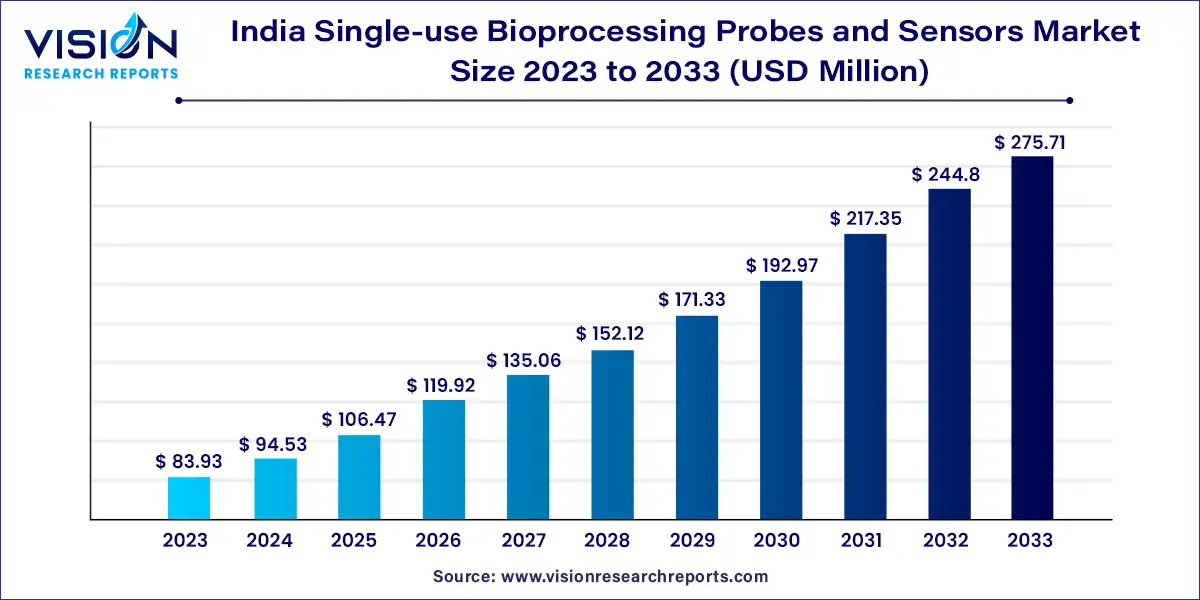

The India single-use bioprocessing probes and sensors market size was estimated at around USD 83.93 million in 2023 and it is projected to hit around USD 275.71 million by 2033, growing at a CAGR of 12.63% from 2024 to 2033. The single-use bioprocessing probes and sensors market in India has experienced significant growth in recent years. This growth is driven by the increasing adoption of single-use technologies in biopharmaceutical manufacturing, which offers benefits such as reduced contamination risks, lower operational costs, and enhanced process efficiency.

The India single-use bioprocessing probes and sensors market is propelled by the burgeoning biopharmaceutical industry in India, driven by an increasing demand for advanced therapies and biologics, necessitates efficient and contamination-free manufacturing processes. Single-use technologies, including probes and sensors, offer significant advantages by minimizing the risk of cross-contamination and streamlining operations. Additionally, the Indian government’s supportive policies and investments in the healthcare sector bolster the adoption of innovative bioprocessing solutions. The shift towards personalized medicine and complex biologics further fuels the need for advanced monitoring and control systems, enhancing the market's growth prospects. Technological advancements in sensor technology and the rising focus on reducing production costs also contribute to the expansion of the single-use bioprocessing probes and sensors market in India.

In 2023, pH sensors dominated the market, accounting for the largest revenue share of 21%, and they are projected to grow at the fastest compound annual growth rate (CAGR) over the forecast period. This growth is attributed to the widespread adoption and increasing use of pH sensors in India. These sensors play a crucial role in measuring the acidity and alkalinity of water and solutions, which has significantly contributed to their market success. Additionally, advancements in pH sensors, such as the integration of temperature monitoring features, are driving demand among Indian biopharmaceutical manufacturers. These technological enhancements improve process control and optimization, making these sensors highly attractive to leading pharmaceutical companies in India.

The oxygen sensors segment is also anticipated to register a notable CAGR during the forecast period. The growing biopharmaceutical industry's need for accurate and efficient oxygen monitoring, particularly in the production of biologics like monoclonal antibodies and vaccines, drives this segment's growth. Single-use oxygen sensors offer several benefits, including reduced risk of contamination, cost savings by eliminating the need for cleaning and sterilization, and easy integration into disposable bioprocessing systems. These advantages have been pivotal in increasing the adoption of single-use oxygen sensors by Indian biopharmaceutical manufacturers, aiming to enhance production efficiency and meet the rising demand for biologics both domestically and globally.

The market is segmented into upstream and downstream workflows. In 2023, the upstream segment led the market, holding a 74% share, and it is expected to grow at the fastest CAGR over the forecast period. This dominance is driven by the widespread adoption of single-use technologies by major pharmaceutical companies, such as Thermo Fisher Scientific, Inc. The ability to effectively monitor and control critical process parameters—such as dissolved oxygen, temperature, and pH—using specialized single-use sensors is a key factor driving the adoption of these technologies in the upstream segment. Companies aim to boost manufacturing efficiency and cater to the increasing demand for biologics and biosimilars in India.

The downstream segment is also forecasted to experience significant growth over the forecast period. This growth is fueled by the demand for adaptable and scalable bioprocessing solutions. Downstream processing, which is essential for the separation, isolation, and purification of products from cell cultures, requires scalable production capabilities to meet market needs. The increasing popularity of single-use bioprocessing probes and sensors in this area is due to their flexibility and availability in various sizes, facilitating easier scalability of production. This adaptability is crucial for Indian biopharmaceutical companies looking to streamline their downstream processes and meet the growing demand for biologics and biosimilars both domestically and internationally.

The market is categorized into biopharmaceutical & pharmaceutical companies, CROs & CMOs, academic & research institutes, and other end uses. In 2023, the biopharmaceutical & pharmaceutical companies segment dominated, with a market share of 42%. Leading Indian companies, such as Sartorius AG, are investing heavily in advanced single-use systems to enhance their manufacturing capabilities and meet the increasing global demand for biopharmaceuticals. The continuous introduction of innovative single-use bioprocessing products by both domestic and international companies is driving the adoption of these technologies in India. For example, Biocon, a major Indian biopharmaceutical firm, has implemented single-use bioprocessing solutions across its facilities to improve operational efficiency and reduce costs.

The CROs & CMOs segment is expected to grow at the fastest CAGR over the forecast period. Indian Contract Research Organizations (CROs), such as Syngene International, are investing in these technologies to enhance their service offerings, boost efficiency, and ensure compliance, making them more attractive as outsourcing partners. Government initiatives to position India as a global biopharma hub are further accelerating the adoption of single-use bioprocessing solutions among CMOs and CROs, supporting the market's expansion

By Type

By Workflow

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others