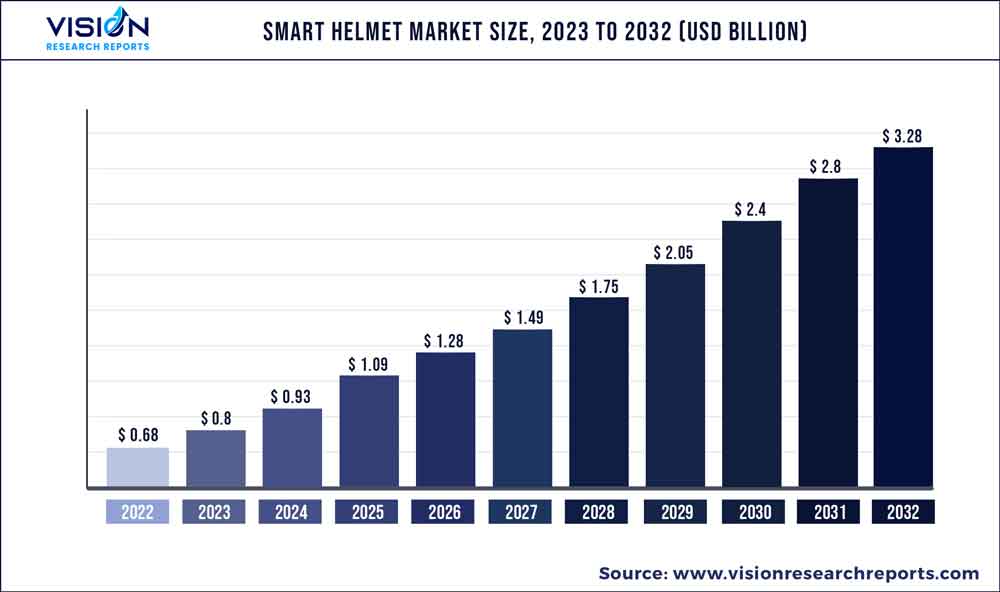

The global smart helmet market was estimated at USD 0.68 billion in 2022 and it is expected to surpass around USD 3.28 billion by 2032, poised to grow at a CAGR of 17.05% from 2023 to 2032. The smart helmet market in the United States was accounted for USD 227.5 million in 2022.

Key Pointers

Report Scope of the Smart Helmet Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 41.06% |

| Revenue Forecast by 2032 | USD 3.28 billion |

| Growth Rate from 2023 to 2032 | CAGR of 17.05% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Beijing BaBaALi Technology Co.Ltd; Crosshelmet; Bell Helmets; Forcite Helmet Systems; Intelligent Cranium Helmets LLC (ICH); JARVISH INC; LIVALL Tech Co., Ltd.; H&H Sports Protection USA, Inc. (TORC); Sena Technologies, Inc.; Lumos Helmet US |

The market growth can be attributed to rising safety and security concerns and technological advancements in smart wearables. Smart helmets include multiple electronic devices and sensors that can help users gather real-time data, reduce operational risks, and improve safety in the long run. Moreover, stringent road safety regulations laid down by governments across the globe are expected to drive market growth over the forecast period.

Smart helmets offer better safety to individuals while using automobiles or working at construction sites. Smart helmets of the new age incorporate many technologically advanced features such as GPS, map navigation, health monitoring (Skin temperature monitoring), sensor data collection, humidity check, air quality check, live streaming camera, and interconnected devices, among other features. Key market players are launching innovative solutions in the market with revolutionary features. For instance, in May 2022, Sena Technologies, Inc. announced the launch of OutForce, a full face motorcycle smart helmet. The helmet has features such as Bluetooth 5.0 connectivity, 4-way Bluetooth Intercom, smartphone app compatibility, and integrated speakers & microphones. Such product launches are harnessing innovation and growth in the market.

Additionally, smart helmet technology providers are investing aggressively in research & development activities to develop innovative products and expand their respective product portfolios. New product launches are particularly aimed at enhancing the efficiency of a smart helmet and providing a better customer experience. For instance, in November 2021, Huawei, a technology provider, announced the launch of the Helmetphone BH51M Neo, a smart helmet, in China. The smart helmet offered smart features such as voice commands and Bluetooth calling. It is powered by the company’s operating system: HarmonyOS, and is suitable for biking, skateboarding, roller skating, and electric bicycle. Such product launches are contributing to the market’s growth.

Road traffic accidents are a significant public safety issue and the primary cause of disability and deaths worldwide. As per the World Health Organization (WHO), around 1.2 million people die yearly due to traffic accidents, and many are wounded or disabled. Moreover, according to the National Highway Traffic Safety Administration (NHTSA), an agency of the U.S. federal government and part of the Department of Transportation, 5,579 motorcyclists died in 2020, and another 82,528 were injured. The most common causes of motorcycle accidents were speeding, distracted driving, alcohol, and drug impairment, and improper lane use. The rising number of road accidents is driving governments across the globe to mandate helmet usage, creating significant growth opportunities for the smart helmet industry.

As per the National Highway Traffic Safety Administration (NHTSA), the efficacy of motorcycle helmets in reducing fatal injuries for riders and passengers is reported to be 37% and 41%, respectively. Additionally, the employment of motorcycle helmets is estimated to have safeguarded over 25,000 lives since 2002. Nevertheless, the expansion of the smart helmet industry may face significant impediments such as the high cost of smart helmets, substantial investments required in product research and development, apprehensions regarding vision obstruction, and inadequate knowledge concerning the safety benefits of these helmets. In response to these challenges, manufacturers are emphasizing on enhancing consumer awareness about the functionalities of smart helmets through diverse digital media platforms.

Type Insights

Based on type, the global smart helmet industry has been further segmented into full-face, half face, and hard hat segments. The full-face segment dominated the market in 2022 and accounted for a revenue share of more than 58.08%. Numerous companies across the globe are focusing on developing full-face smart helmets with built-in Bluetooth communication systems. For instance, in June 2020, Sena Technologies, Inc, a technology provider for motorcycle communications, announced the launch of Outrush, a modular smart helmet equipped with a Bluetooth communication system. Outrush is a DOT-certified helmet and was the latest addition to the company's line of smart helmets. Such launches bode well for the growth of the segment.

The hard hat segment is also expected to witness significant growth over the forecast period owing to the increasing demand for hard hats in North America and Europe's manufacturing, mining, and construction industries. Occupational injuries in the construction sector are a global issue, and the sector witnesses frequent accidents. Smart hard hats are used in the manufacturing, construction, and mining industries to identify harmful gas leakages, track real-time locations, and analyze the health vitals of users. These helmets aim to ensure enhanced safety for workers operating in challenging environments, driving the segment's demand in the smart helmet industry.

Component Insights

Based on component, the global smart helmet industry has been further segmented into communication, navigation, camera, and others (audio systems, health monitoring, lighting, and safety features). The communication segment dominated the market in 2022 and accounted for a revenue share of more than 33.05%. Smart helmets are incorporated with the Integration Communication System (ICS), allowing the bike rider to control all the functions and applications via voice order. When users connect their phones to the smart helmet, they can perform several hands-free functions, such as making calls and finding directions through the helmet’s microphone, contributing to the segment’s growth.

The navigation segment is expected to emerge as the fastest-growing segment over the forecast period. Smart helmets offer navigation, positioning, and tracking features owing to the use of a Global Navigation Satellite System (GNSS). They are incorporated with Augmented Reality (AR) interface, which allows the bike rider to view the projected image, on the helmet visor, about the route and other important aspects while maintaining complete focus on the road. Such features make the driving experience easier for motorcyclists. Additionally, workers in industries such as mining are leveraging smart helmets with navigation systems that help them navigate harsh or remote environments. Such factors are contributing to the segment’s increasing growth.

End-use Insights

Based on end-use, the market has been segmented into consumer, manufacturing, construction, and others (healthcare, mining, disaster prevention). The consumer segment dominated the market in 2022 and accounted for a revenue share of more than 75.04%. It is also expected to retain its dominance over the forecast period owing to the growing safety concerns and increasing sales of two-wheelers. Smart helmets are widely used in various sports events and by bike riders across the globe. They offer multiple features, such as an accidental alert system, a built-in Bluetooth system, and a system for cell phone charging through solar power. These features are attracting the interest of consumers toward the adoption of smart helmet technology, which is driving the segment’s growth.

The manufacturing segment is expected to emerge as the fastest-growing segment over the forecast period. Smart helmets protect the wearer from various physical threats in the manufacturing environment. Workers in the manufacturing segment may face hazardous environmental conditions such as suffocation, gas poisoning, and gas explosions. Hence, air quality and hazardous event detection are essential in the manufacturing industry. Smart helmets have the potential to detect and provide real-time monitoring of harmful gases such as LPG, CH4, and CO, among others. It can also detect humidity and temperature. The growing health concerns due to exposure to harmful gases in the manufacturing industry are driving the demand for smart helmets in the segment.

Regional Insights

North America dominated the smart helmet industry in 2022 and accounted for a revenue share of more than 41.06%. The U.S. market is relatively mature, and consumers in the U.S. are early adopters of emerging technologies. Additionally, smart helmet providers are also focusing on developing and enhancing their product portfolios in this region. For instance, in May 2021, Sena Technologies, Inc., a communication technology provider, announced the launch of Outrush R, a smart modular helmet, in North America. The product is the updated version of Outrush modular helmet. Such product launches and the strong regional presence of key market players are contributing to the regional market’s growth.

Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period. The increasing sales of two-wheelers, rapid urbanization in developing economies such as China and India, and the growing manufacturing sector in the Asia Pacific region are expected to be the major growth drivers for smart helmets in this region. Moreover, the growing adoption of advanced wearable technology among construction workers is creating significant growth opportunities for the regional market.

Smart Helmet Market Segmentations:

By Type

By Component

By End-Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Smart Helmet Market

5.1. COVID-19 Landscape: Smart Helmet Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Smart Helmet Market, By Type

8.1. Smart Helmet Market, by Type, 2023-2032

8.1.1 Full Face

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Half Face

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Hard Hat

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Smart Helmet Market, By Component

9.1. Smart Helmet Market, by Component, 2023-2032

9.1.1. Communication

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Navigation

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Camera

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others (Audio Systems, Health Monitoring, Lighting, Safety Features)

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Smart Helmet Market, By End-Use

10.1. Smart Helmet Market, by End-Use, 2023-2032

10.1.1. Consumer

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Manufacturing

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Construction

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others (Healthcare, Mining, Disaster Prevention)

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Smart Helmet Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Component (2020-2032)

11.1.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Component (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Component (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Component (2020-2032)

11.2.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Component (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Component (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Component (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Component (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Component (2020-2032)

11.3.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Component (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Component (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Component (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Component (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Component (2020-2032)

11.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Component (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Component (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Component (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Component (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Component (2020-2032)

11.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Component (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Component (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

Chapter 12. Company Profiles

12.1. Beijing BaBaALi Technology Co.Ltd

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Crosshelmet

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Bell Helmets

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Forcite Helmet Systems

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Intelligent Cranium Helmets LLC (ICH)

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. JARVISH INC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. LIVALL Tech Co., Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. H&H Sports Protection USA, Inc. (TORC)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Sena Technologies, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Lumos Helmet US

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others