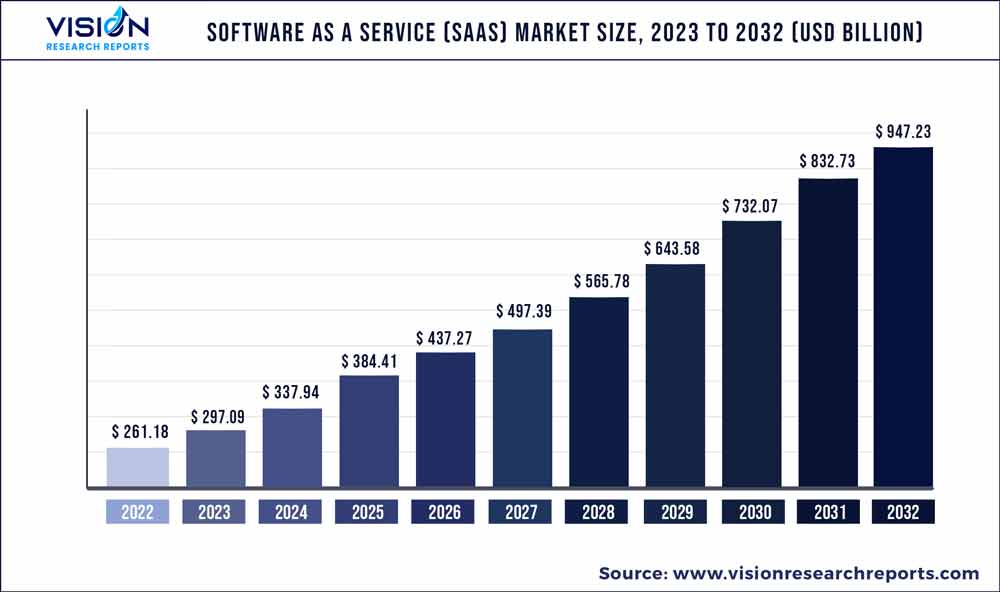

The global software as a service (SaaS) market was valued at USD 261.18 billion in 2022 and it is predicted to surpass around USD 947.23 billion by 2032 with a CAGR of 13.75% from 2023 to 2032.

Key Pointers

Report Scope of the Software As A Service (SaaS) Market

| Report Coverage | Details |

| Market Size in 2022 | USD 261.18 billion |

| Revenue Forecast by 2032 | USD 947.23 billion |

| Growth rate from 2023 to 2032 | CAGR of 13.75% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Adobe Inc.; Microsoft; Alibaba Cloud; IBM; Google LLC; Salesforce, Inc.; Oracle; SAP SE; Rackspace Technology, Inc.; VMware Inc.; IONOS Cloud Inc.; Cisco Systems, Inc.; Atlassian; ServiceNow |

The major growth factors of the market include the growing adoption of outsourcing business models in enterprises coupled with the growing number of small and medium enterprises (SMEs) and startups across the globe. Moreover, the rising trend towards mobile applications such as emails, video calls, and instant messaging further increases the usage of smart devices which further encourages the demand for software as a service (SaaS) during the forecast period.

Cloud-based software solutions have become increasingly popular due to their scalability, cost-effectiveness, and ease of use. Companies increasingly turn to cloud-based SaaS solutions for their business needs, including customer relationship management (CRM), human resources management, and accounting. Further, SaaS providers are increasingly integrating their software with other platforms to offer a more comprehensive suite of services. This includes integrations with other SaaS providers and on-premises software and legacy systems. For instance, in November 2022, IBM Corporation launched a managed cloud service solution for VMware, Inc., an American cloud computing and virtualization technology company. The new offering provides a secured, operated, and managed service by IBM Cloud to assist enterprises in deploying the cloud with the IBM Cloud infrastructure and VMware software stack.

SaaS providers increasingly incorporate artificial intelligence (AI) and automation into their software solutions to improve efficiency, accuracy, and productivity. This includes features such as chatbots, predictive analytics, and automated workflows. Furthermore, the COVID-19 pandemic has boosted the adoption of remote work and cloud-based software, which could lead to increased demand for SaaS solutions worldwide. This trend will continue even as the pandemic subsides, as many companies have discovered the benefits of cloud-based tools and are likely to continue using them. For instance, in November 2022, OutSystems launched a cloud-native development solution OutSystems Developer developing cloud applications. ODC combines a cutting-edge architecture developed on Linux containers, AWS, Kubernetes, enterprise-grade security, and micro services with DORA high-performance CD/CI and the unrivaled efficiency of visual, model-based development.

Component Insights

The software segment led the market in 2022 and accounted for a total revenue share of more than 84.05%. The pandemic has accelerated trends in remote work and flexible work arrangements, leading to a shift in employee expectations. As a result, many businesses are adopting SaaS solutions to enable remote collaboration, productivity, and communication. It includes tools for project management, video conferencing, and cloud storage. Additionally, there is a growing demand for SaaS solutions that offer automation and AI-powered insights to optimize workflows and increase efficiency. As digital transformation continues to accelerate across industries, businesses increasingly rely on data to expedite their operations and gain a better understanding of their customers or users. It has led to growing investment in analytics-driven SaaS solutions.

The services systems segment is estimated to grow significantly over the forecast period. SaaS servicing trends include a growing focus on customer experience, security, and compliance. SaaS providers are investing heavily in customer support and self-service options, such as chatbots and online knowledge bases, to provide quick and efficient support to users. Additionally, SaaS providers are increasingly offering more customizable and modular solutions to meet the unique needs of different businesses and integrating with other third-party tools and services to provide a seamless experience for users. For instance, in March 2022, Ada released a new generative AI capability that cut the time and labor required to create, train, and maintain customer service chatbots by multifold compared to conventional corporate automation solutions. To significantly strengthen Ada's conversational AI platform, Ada announced it would expand its use of OpenAI's technology.

Deployment Insights

The private cloud segment held the largest revenue share of over 43.02% in 2022. Combining the deployment of SaaS applications at the network's edge with a private cloud infrastructure can provide organizations with greater control and security over their data while improving performance and reducing latency. Additionally, organizations can maintain greater control over their data by using a private cloud infrastructure, ensuring compliance with regulatory requirements, and mitigating the risk of data breaches. Overall, combining edge computing with the private cloud can provide a powerful platform for delivering SaaS applications that meet the needs of modern businesses.

The hybrid cloud segment is predicted to foresee significant growth in the forecast period. The increasing demand for industry-specific SaaS applications, such as those tailored to healthcare, finance, and education, is driven by the need for specialized features and compliance with specific industry regulations. Organizations in these industries seek SaaS solutions customized to their unique needs and requirements, such as hybrid cloud. For instance, in August 2021, Accenture announced agreements of Information Technology Outsourcing (ITO) with Japanese equipment maker Kubota to speed up the migration of old systems to the Microsoft Azure cloud and with Chubu Electric Power Group to change its operations. Additionally, Infosys agreed to a multi-year contract for cloud modernization via Microsoft Azure with Australia's Ausgrid, an electricity distribution firm.

Enterprise-size Insights

The large enterprises segment led the market in 2022, accounting for over 60.07% share of the global revenue. SaaS solutions offer large enterprises several benefits, including cost-effectiveness, scalability, and flexibility. A trend seen in large enterprises is adopting multi-cloud and hybrid-cloud strategies, driven by the need to manage complex distributed application environments that span multiple geographies, data centers, and cloud providers. Another trend observed among large enterprises is the adoption of platform-as-a-service (PaaS) solutions. PaaS solutions provide a higher level of abstraction than SaaS solutions, allowing enterprises to focus on application development and deployment rather than managing the underlying infrastructure. It can help large enterprises to accelerate their time-to-market, reduce development costs, and improve agility and innovation.

The small & medium enterprises segment is estimated to grow significantly over the forecast period. The on-demand consumption model of SaaS has revolutionized the IT landscape, with small and medium enterprises rapidly adopting SaaS over the past few years. The cost-effectiveness, accessibility, and scalability of SaaS have made it an attractive option for SMEs that have smaller budgets and cannot afford the initial capital outlay and ongoing service and maintenance costs of traditional IT infrastructure. By adopting SaaS, SMEs can access powerful software applications and services that would otherwise have been beyond their reach. It can help them to compete more effectively with larger businesses, increase productivity, and drive growth.

Application Insights

The others segment held the largest revenue share of over 42% in 2022. Others segment include supply chain management, security as a service, AI as a service, IoT as a service, edge computing, unified communications as a service, and operations management. The emergence of new technologies like robotic process automation (RPA), cloud computing, and artificial intelligence (AI) can potentially revolutionize the supply chain software market. AI has the potential to transform supply chain management by providing real-time insights into inventory levels, demand forecasting, and delivery schedules. With increasing data availability and advanced analytics tools, AI will become a key enabler for supply chain optimization and agility.

The content, collaboration, and communication segment is predicted to foresee significant growth in the forecast period. Content, collaboration, and communication are critical components of modern business operations, and the rise of SaaS has transformed how organizations approach these areas. SaaS collaboration platforms are becoming increasingly popular, offering a central location for employees to share files, communicate with colleagues, and collaborate on projects. Collaboration software is becoming more integrated, with platforms combining multiple tools such as video conferencing, instant messaging, document sharing, and project management. Additionally, Artificial intelligence (AI) is being integrated into collaboration software to help teams work more efficiently. For instance, AI-powered chatbots help employees find information or schedule meetings, while machine learning algorithms can analyze data to provide insights and recommendations.

Industry Insights

The others segment led the market in 2022, accounting for over 38% share of the global revenue. The other segment includes the automobile and media & entertainment industries. Further, the BFSI segment accounted for over 24% share of the global revenue owing to the significant transformation in the sector, with new technologies and digital platforms disrupting traditional business models. Additionally, cloud-based core banking solutions are becoming increasingly popular as they offer greater flexibility and scalability than traditional on-premises solutions. These tools allow financial institutions to quickly adapt to changing market conditions, scale up or down as needed, and reduce costs. For instance, in June 2022, Aqua Security Software Ltd., a cloud-native security company, announced the general availability of cloud-native security software as a Service (SaaS) from Singapore, supplying the wider Asia Pacific and Japan (APJ) region. With this launch, government, banking, financial services, and other regulated sectors in the region can leverage the service for complete compliance, cloud-native security, and risk management that manages their data authority and management needs.

The education segment is estimated to grow significantly over the forecast period. The education sector is also rapidly adopting SaaS solutions to improve educational outcomes and streamline operations. Learning management systems (LMS) software is becoming increasingly popular in the education sector, enabling teachers to deliver online and hybrid learning experiences. SaaS solution providers like Canva and Blackboard, Inc. provide secure and reliable LMS services, helping to improve educational outcomes and reduce administrative burdens. Student information systems (SIS) software is essential for managing student data, such as grades and attendance records. Education analytics software is becoming increasingly important in the education sector, enabling teachers and administrators to analyze student data and identify trends.

Regional Insights

North America dominated the market in 2022, accounting for over 44.02% share of the global revenue. The U.S. is positively contributing to the growth of market revenue. The presence of well-established market players is one of the driving factors for market growth. Moreover, the developed IT infrastructure increases the easy deployment of cloud-based virtual services in the region, further contributing to the significant share in the global software as a service (SaaS) market. Moreover, the significant expenditure on the cloud infrastructure and the availability of many secured internet servers further contributed to the highest market share.

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. China and India are positively contributing to the growth of the market owing to the growing demand for outsourcing cloud-based software coupled with the rising number of small and medium enterprises outsourcing across the region. The SMEs significantly outsource cloud-based software platforms for reducing the cost of on-premises software deployment. Moreover, significant growth in the IT industry is further expected to offer ample opportunity to the market.

Moreover, the growing number of secured internet servers in China, Japan, and India further augmented the growth of the market during the forecast period. For instance, in May 2021, Beijing Infobird Software Co., Ltd. launched the next generation of SaaS in China to capture a massive share of the SaaS market. As the Chinese economy continues to mature, businesses are becoming more sophisticated in their use of technology, leading to an increased demand for enterprise software solutions. This drives the growth of SaaS solutions in areas such as ERP (enterprise resource planning), CRM (customer relationship management), and HR management.

Software As A Service (SaaS) Market Segmentations:

By Component

By Deployment

By Enterprise-size

By Application

By Industry

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others