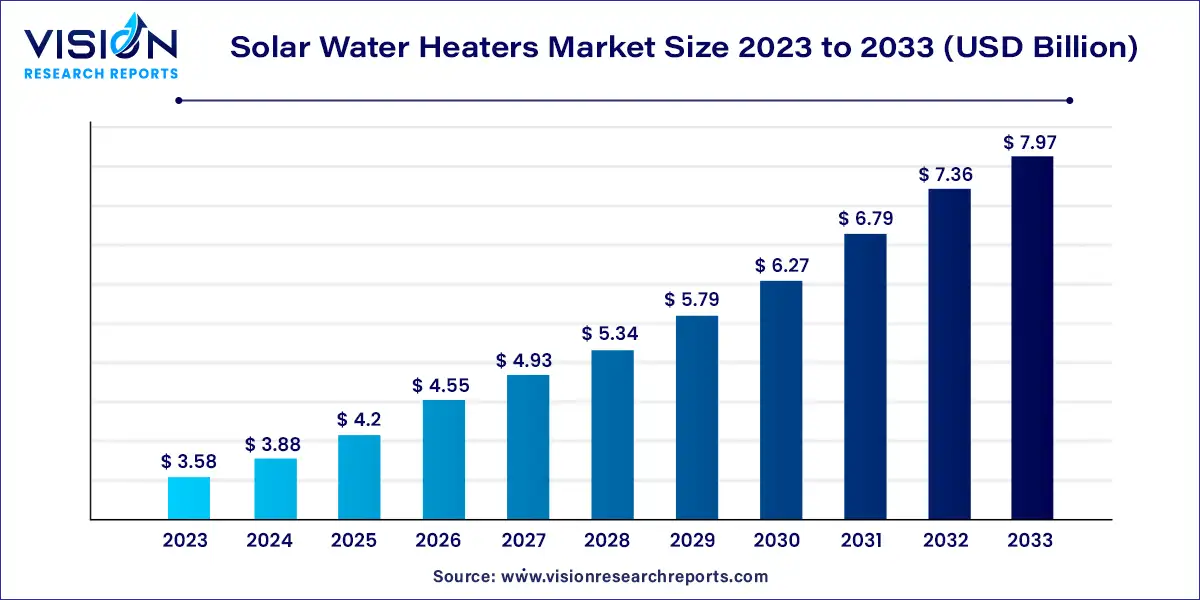

The global solar water heaters market size was estimated at around USD 3.58 billion in 2023 and it is projected to hit around USD 7.97 billion by 2033, growing at a CAGR of 8.33% from 2024 to 2033.

Solar water heaters (SWHs) utilize solar energy to heat water for residential, commercial, and industrial purposes. These systems offer a sustainable and eco-friendly alternative to conventional water heating methods, which rely on fossil fuels. The growing emphasis on renewable energy sources, coupled with rising energy costs and environmental concerns, has significantly boosted the adoption of solar water heaters worldwide.

The solar water heaters market is experiencing robust growth driven by an increasing awareness about environmental sustainability and the urgent need to reduce greenhouse gas emissions are propelling the adoption of solar water heaters. Government incentives, such as subsidies and tax rebates, further encourage both residential and commercial installations. Additionally, rising energy costs are making solar water heaters an economically attractive alternative to traditional heating methods. Technological advancements, which have improved the efficiency and affordability of solar thermal systems, also play a significant role in market expansion. As a result, the market is poised for continued growth, driven by a combination of environmental, economic, and technological factors.

The market is segmented into evacuated tube collectors, flat plate collectors, and unglazed water collectors. In 2023, the evacuated tube collector (ETC) segment held the largest revenue share at 45% and is projected to register the fastest CAGR over the forecast period. This growth is driven by the increasing demand for energy-efficient hot water distribution systems in industrial and commercial buildings. Key factors such as space efficiency, high conversion rates, and low maintenance costs contribute to the segment's expansion.

The unglazed water collector segment is expected to experience significant CAGR during the forecast period. These collectors are ideal for warmer climates due to their design and efficiency in utilizing solar energy. Unlike glazed collectors, unglazed collectors lack a glass covering, allowing for direct sunlight absorption. This makes them particularly effective in regions with consistent sunlight and higher average temperatures.

In 2023, the residential segment led the market with the largest revenue share of 40%. By harnessing solar energy, households can reduce their reliance on unstable external energy sources, which is crucial in areas with high energy costs or unreliable infrastructure. Solar power provides a stable, cost-effective alternative, protecting against price fluctuations and supply interruptions. Applications include household water heating, swimming pool heating, and others. As electricity and natural gas costs rise, homeowners seek more cost-effective energy solutions, driving market growth.

The commercial segment is anticipated to register the fastest CAGR over the forecast period. Solar water heaters are increasingly used in commercial settings such as hotels, restaurants, and hospitals, where there is a need for efficient and regular heating of large amounts of water. The growing demand in these sectors will boost sales of commercial water heaters, which are designed for uninterrupted operation, ensuring a consistent hot water supply.

In 2023, the thermosyphon segment led the market with the largest revenue share of 59%. Thermosyphon systems are a popular and efficient method for solar water heating, utilizing the natural circulation of water to transfer heat from solar collectors to a storage tank without mechanical pumps. This process is based on the principle that hot water rises while cooler water sinks. Due to their simplicity, reliability, and low operational costs, thermosyphon systems are widely used, particularly in residential applications.

The pumped system segment is expected to witness the fastest CAGR during the forecast period. Pumped systems in solar water heaters are designed for reliability and durability, providing a consistent hot water supply even in extreme weather conditions. The robust construction of these systems ensures long-term performance and minimal maintenance requirements, making them appealing to consumers seeking hassle-free solutions.

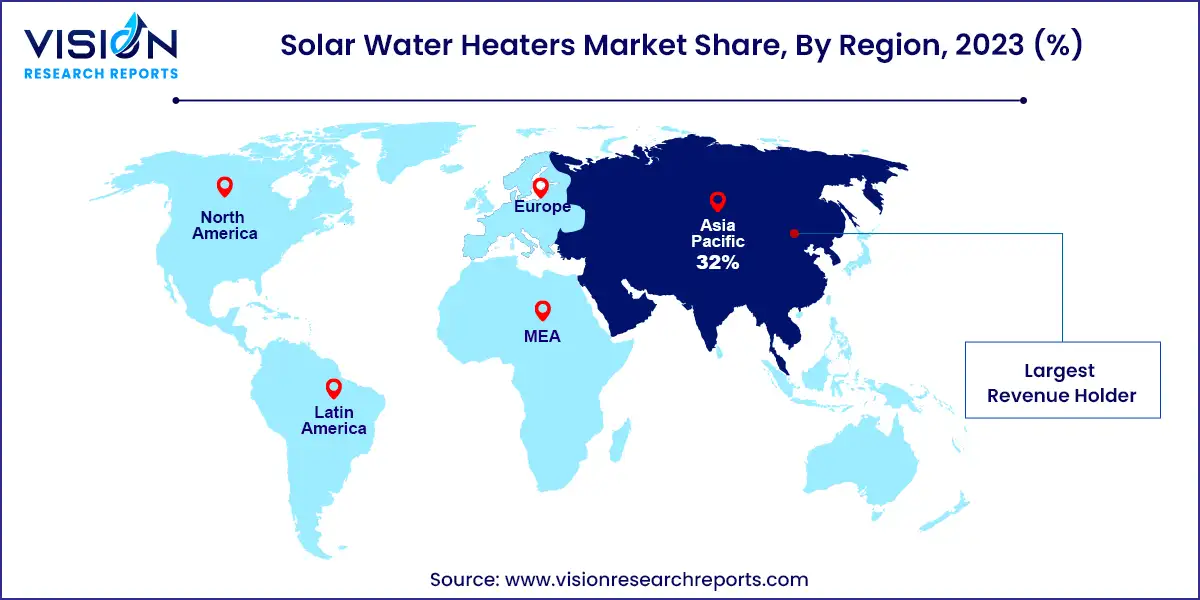

Asia Pacific dominated the solar water heaters market with a revenue share of 32% in 2023. Rapid economic growth, urbanization, and the region's increasing population have led to a surge in energy demand. Solar water heaters offer a sustainable solution to this demand, particularly for domestic hot water needs.

The solar water heaters market in North America accounted for a significant share in 2023. The growing trend towards green building certifications, such as LEED (Leadership in Energy and Environmental Design), which often incentivize or require the use of renewable energy sources, fuels market growth in the region.

By Technology

By Systems Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Technology Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Solar Water Heaters Market

5.1. COVID-19 Landscape: Solar Water Heaters Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Solar Water Heaters Market, By Technology

8.1. Solar Water Heaters Market, by Technology, 2024-2033

8.1.1 Evacuated Tube Collector

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Flat Plate Collector

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Unglazed Water Collector

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Solar Water Heaters Market, By Systems Type

9.1. Solar Water Heaters Market, by Systems Type, 2024-2033

9.1.1. Thermosyphon

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Pumped

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Solar Water Heaters Market, By Application

10.1. Solar Water Heaters Market, by Application, 2024-2033

10.1.1. Residential

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Industrial

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Solar Water Heaters Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Technology (2021-2033)

11.1.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.5.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Systems Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. A.O. Smith.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Bosch Thermotechnology.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Bradford White Corporation.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Eurostar Solar.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. G E Appliances.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Kodsan

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Racold.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Rheem Manufacturing Company

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. SunEarth.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. SUNPAD, GREENoneTEC Solarindustrie GmbH

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others