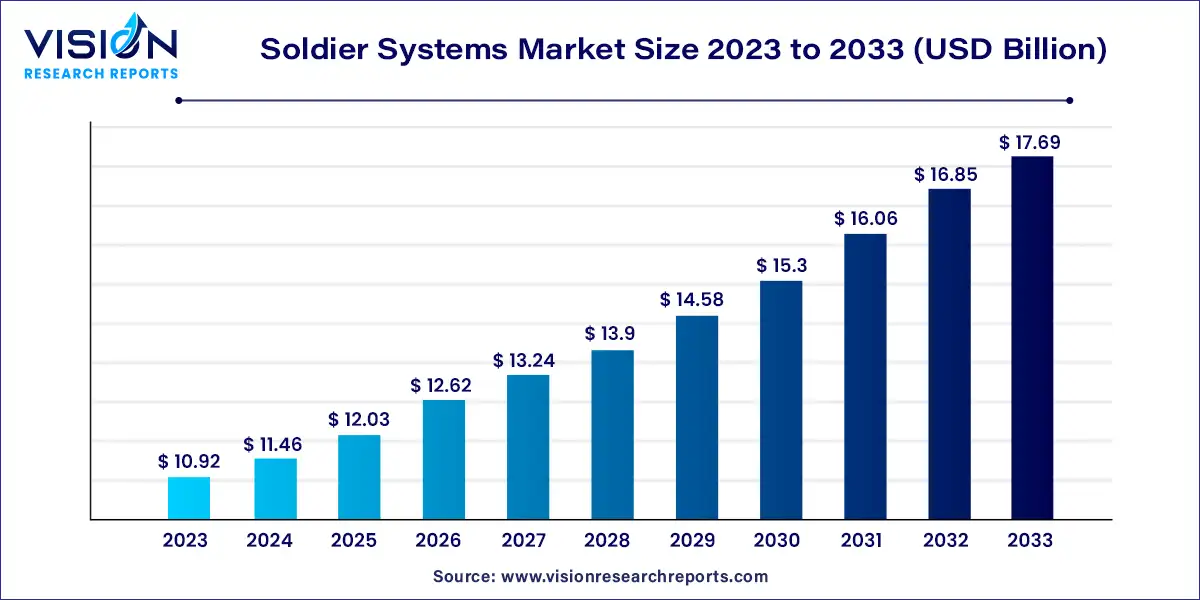

The global soldier systems market size was estimated at around USD 10.92 billion in 2023 and it is projected to hit around USD 17.69 billion by 2033, growing at a CAGR of 4.94% from 2024 to 2033.

The soldier systems market, a critical segment of the defense industry, encompasses a wide array of technologies and equipment designed to enhance the operational capabilities of military personnel. These systems integrate advanced communication, surveillance, mobility, and weaponry to ensure that soldiers are better equipped, protected, and effective in various combat situations.

The growth of the soldier systems market is primarily driven by advancements in military technology, which have significantly enhanced the capabilities of modern soldiers. Increasing defense budgets globally, particularly in developed and emerging economies, are fueling investments in the modernization of military forces. The rising need for advanced personal protection, communication, and navigation systems, coupled with the growing emphasis on soldier safety and survivability in complex combat environments, is also contributing to market expansion. Additionally, the demand for integrated soldier systems that offer enhanced mobility, situational awareness, and operational effectiveness is further propelling market growth.

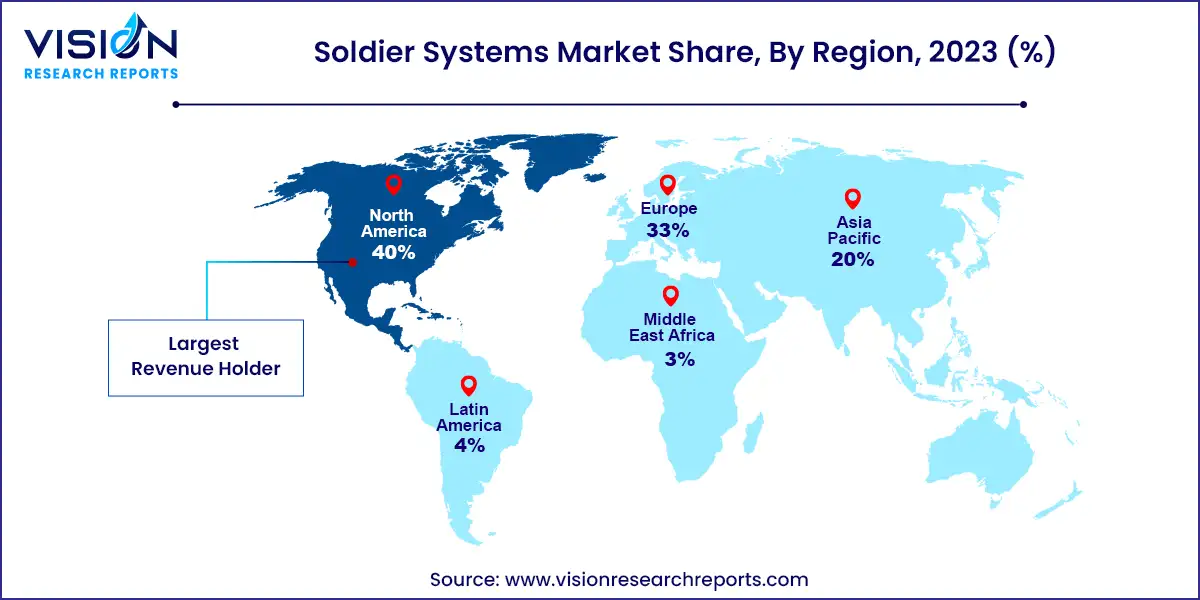

North America led the soldier systems market in 2023, with nearly 40% of the total revenue share. The market in this region is driven by rising defense budgets and a strong focus on soldier modernization programs. Additionally, the pursuit of technological superiority and interoperability among NATO allies plays a significant role in market growth.

| Attribute | North America |

| Market Value | USD 4.36 Billion |

| Growth Rate | 4.96% CAGR |

| Projected Value | USD 7.07 Billion |

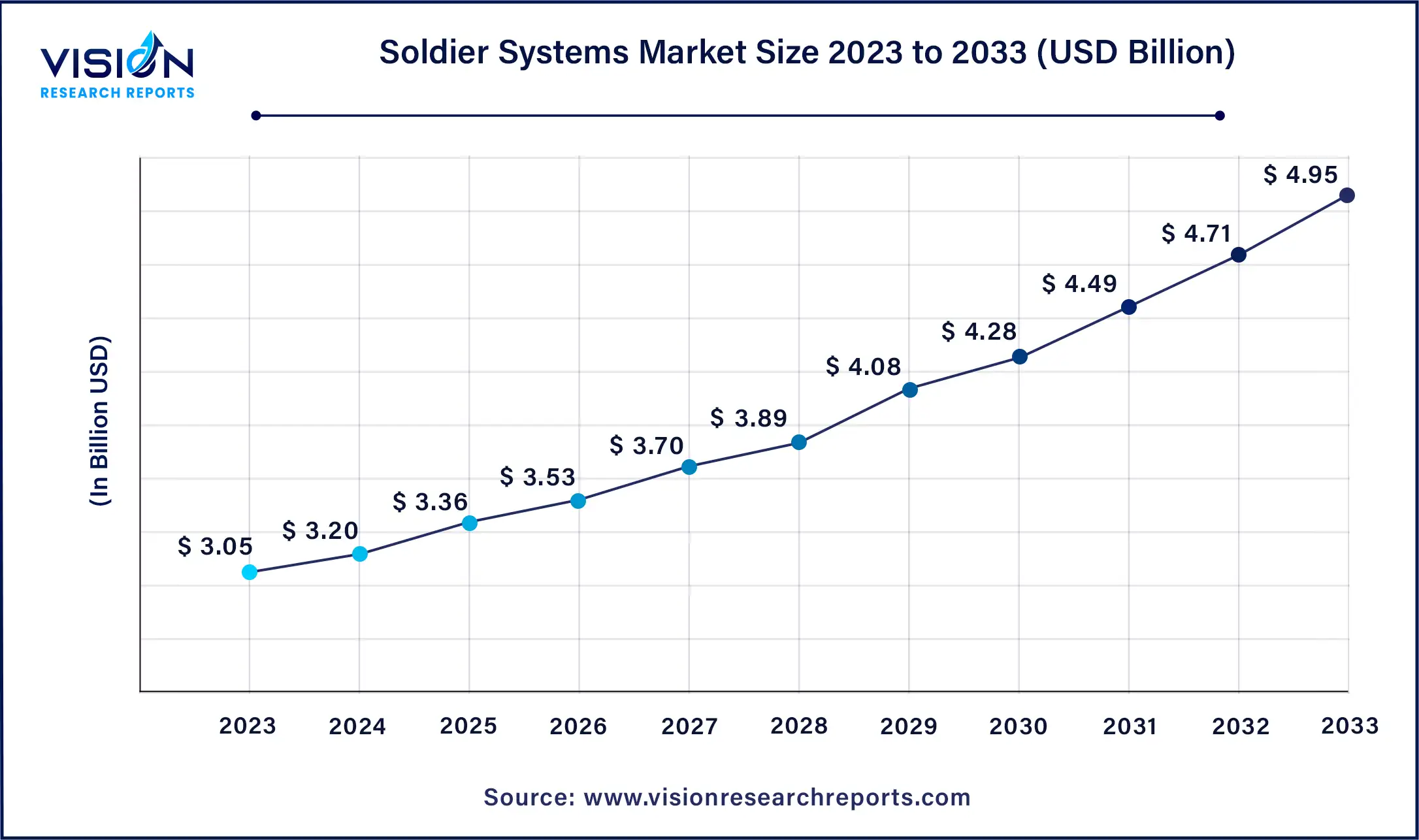

The U.S. soldier systems market size was estimated at around USD 3.05 billion in 2023 and it is projected to hit around USD 4.95 billion by 2033, growing at a CAGR of 4.96% from 2024 to 2033.

This growth is largely driven by technological advancements and increasing defense budgets aimed at improving soldier survivability and operational capabilities.

Asia Pacific Soldier Systems Market Trends

The soldier systems market in the Asia Pacific region is expected to grow at the highest CAGR of over 8.02% from 2024 to 2033. The region's market growth is propelled by escalating security concerns, territorial disputes, and the need to enhance the combat capabilities of armed forces amidst rising geopolitical tensions.

Europe Soldier Systems Market Trends

The region benefits from collaborative defense projects among EU nations and a consistent focus on enhancing soldier survivability and operational efficiency. This focus is driven by the evolving nature of warfare and heightened security challenges across the continent.

In 2023, the personal protection segment led the market, holding a significant share of around 32%. This dominance is attributed to the growing emphasis on soldier safety and survivability. Innovations in materials and technology have enabled the creation of lighter, yet more effective, body armor, helmets, and protective gear. These advancements not only provide superior protection against ballistic threats but also enhance mobility, making them crucial in modern combat situations. As defense organizations continue to prioritize the safety of their personnel, the demand for advanced personal protection equipment is expected to keep driving the growth of this segment.

The navigation and targeting segment is projected to experience the highest compound annual growth rate (CAGR) of over 5.3% from 2024 to 2033. This growth is driven by the rising need for precision and situational awareness in contemporary combat. Advanced GPS systems, laser rangefinders, and augmented reality devices are enhancing soldiers' capabilities to navigate complex terrains and target adversaries with greater accuracy. These technologies not only improve mission effectiveness but also minimize collateral damage, making them essential for current military operations. As defense agencies emphasize operational excellence, the demand for sophisticated navigation and targeting systems is on the rise.

In 2023, the combat operations segment captured the largest revenue share, a result of the increasing frequency and complexity of modern warfare scenarios. The growing need for real-time situational awareness, precision targeting, and effective communication systems is driving the demand for advanced soldier systems tailored to combat missions. The emergence of asymmetric warfare and the intensification of counter-terrorism efforts further underscore the necessity for sophisticated equipment that ensures mission success and soldier safety. As military strategies continue to evolve, investments in combat-specific soldier systems are expected to increase, propelling market growth.

The surveillance and reconnaissance segment is forecasted to register the highest growth rate from 2024 to 2033, fueled by the escalating need for real-time situational awareness in modern combat environments. Cutting-edge technologies, including drones, wearable sensors, and enhanced optics, provide soldiers with critical intelligence, thereby improving decision-making and mission success rates. The rise in asymmetric warfare and counter-terrorism operations amplifies the demand for advanced surveillance and reconnaissance tools. This growing focus on gathering actionable intelligence drives continuous investment and innovation within this segment, accelerating its growth.

In 2023, the military segment accounted for the largest revenue share, driven by increased investments in modernization programs and the evolving tactics of warfare. Governments and defense organizations are increasingly focusing on enhancing soldier capabilities through advanced technologies such as wearable electronics, improved communication systems, and enhanced protective gear. This growth is further supported by rising defense budgets and the need to maintain military readiness and superiority in various combat scenarios. Consequently, the demand for advanced soldier systems is expanding, contributing to the overall market growth.

The government and law enforcement segment is expected to achieve the highest growth rate from 2024 to 2033, due to increased investments in equipping personnel with advanced technologies aimed at improving operational efficiency and safety. Governments are prioritizing modernization programs to address growing security concerns and geopolitical tensions, leading to higher demand for state-of-the-art communication, surveillance, and protective equipment. Additionally, law enforcement agencies are adopting advanced soldier systems to enhance their ability to manage sophisticated criminal activities and maintain public safety. This increasing focus on capability upgrades is driving growth in the soldier systems market within this segment.

By Equipment

By Application

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Equipment Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Soldier Systems Market

5.1. COVID-19 Landscape: Soldier Systems Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Soldier Systems Market, By Equipment

8.1. Soldier Systems Market, by Equipment, 2024-2033

8.1.1 Personal Protection

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Communication

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Navigation and Targeting

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Power and Energy Systems

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Soldier Systems Market, By Application

9.1. Soldier Systems Market, by Application, 2024-2033

9.1.1. Combat Operations

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Surveillance and Reconnaissance

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Training and Simulation

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Soldier Systems Market, By End Use

10.1. Soldier Systems Market, by End Use, 2024-2033

10.1.1. Military

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Government and Law Enforcement

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Soldier Systems Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End Use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End Use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Equipment (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 12. Company Profiles

12.1. Lockheed Martin Corporation.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. BAE Systems plc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Kopin Corporation.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Thales Group.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Safariland, LLC.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Point Blank Enterprises, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Hosl GmbH.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Harris Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. L3Harris Technologies, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Rohde & Schwarz GmbH & Co KG

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others