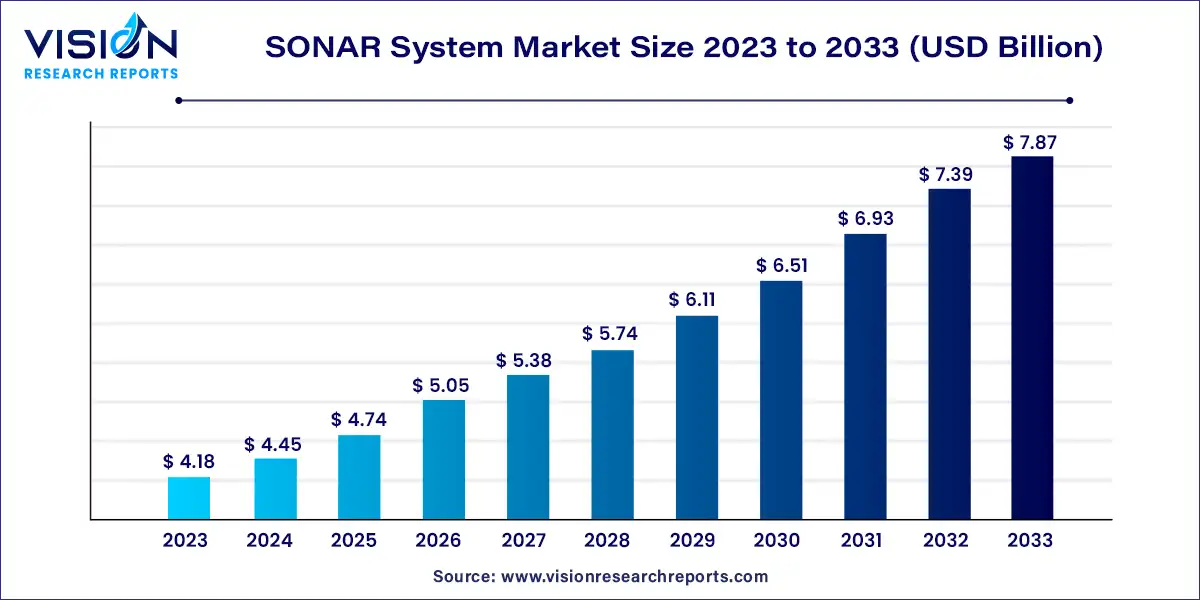

The global SONAR system market size was estimated at around USD 4.18 billion in 2023 and it is projected to hit around USD 7.87 billion by 2033, growing at a CAGR of 6.53% from 2024 to 2033. The SONAR (Sound Navigation and Ranging) system market is witnessing significant growth due to the increasing demand for advanced surveillance systems in both military and commercial applications.

The SONAR system market is experiencing robust growth driven by an increasing defense expenditures globally are significantly boosting the demand for advanced SONAR systems for submarine detection, mine countermeasures, and underwater surveillance. Additionally, the commercial shipping and fishing industries rely heavily on SONAR technology for navigation and locating marine resources, further propelling market growth. Technological advancements, such as the development of synthetic aperture SONAR and the integration of unmanned underwater vehicles (UUVs), are enhancing the efficiency and accuracy of these systems, making them more attractive for various applications. Moreover, the offshore oil and gas exploration sector's need for reliable underwater exploration and pipeline monitoring solutions is driving the adoption of SONAR systems.

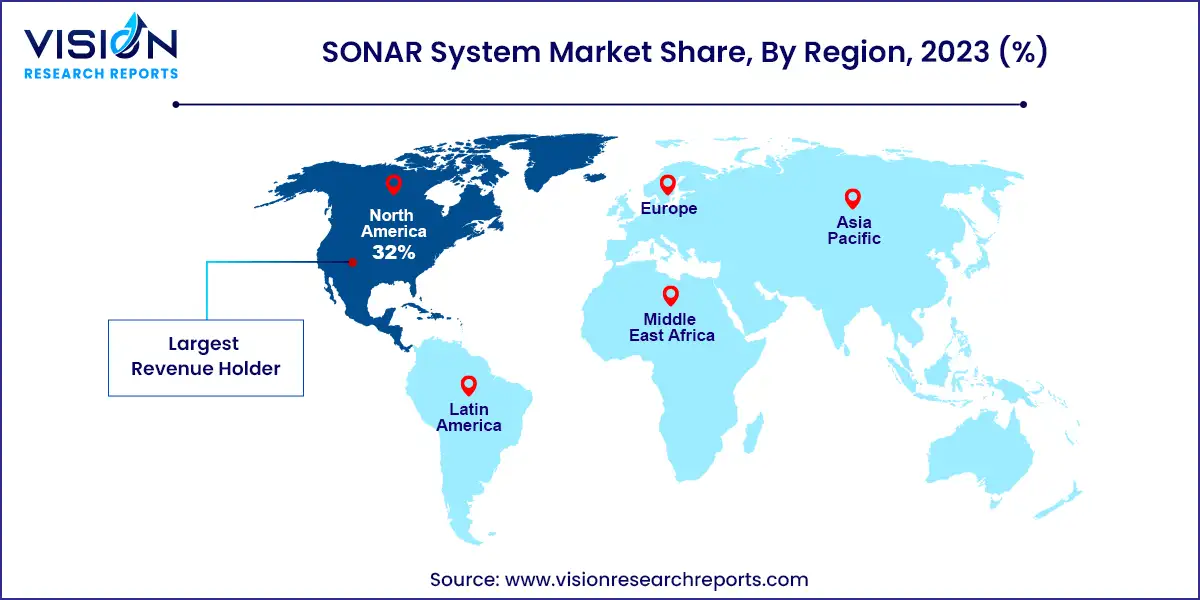

The North America SONAR system market dominated the global market in 2023 and accounted for a 32% share. The market is driven by robust defense spending and technological innovation. The United States, in particular, is focused on maintaining its naval superiority through the continuous upgrade of its SONAR capabilities for anti-submarine warfare, mine detection, and underwater surveillance. The presence of major defense contractors and advanced research facilities in North America supports the development of cutting-edge SONAR technology. Additionally, the commercial sector, including offshore oil and gas exploration and marine research, is also a significant driver of the SONAR market.

| Attribute | North America |

| Market Value | USD 1.33 Billion |

| Growth Rate | 6.58% CAGR |

| Projected Value | USD 2.51 Billion |

The U.S. SONAR system market size was estimated at USD 0.93 billion in 2023 and it is expected to surpass around USD 1.76 billion by 2033, poised to grow at a CAGR of 6.58% from 2024 to 2033.

In the U.S. SONAR system market, technological advancements and innovations in anti-submarine warfare systems are critical to addressing evolving maritime threats. Additionally, the commercial sector's demand for advanced SONAR systems in offshore oil and gas exploration and marine research contributes to market growth.

The growth in the Asia Pacific SONAR system market can be attributed to the deployment and utilization of SONAR systems driven by heightened maritime concerns, territorial disputes, and the imperative to safeguard lucrative shipping routes and underwater resources. Countries such as China, India, and Japan are actively modernizing their naval capabilities, with SONAR technology enhancing underwater surveillance, submersible detection, and ensuring maritime domain awareness. Additionally, the rapid growth of commercial shipping and the burgeoning offshore energy industry further increase demand for SONAR systems to ensure safe navigation and protect regional stability. Technological advancements and regional collaborations are also contributing to the market's expansion as countries seek to bolster their defense and commercial maritime capabilities.

The Europe SONAR system market is propelled by the need to enhance maritime security and maintain strategic maritime interests. Countries such as the UK, Germany, and France are investing in advanced SONAR technologies to support their naval modernization programs and bolster underwater surveillance capabilities. The region's focus on anti-submarine warfare and the protection of maritime borders is a key driver of market growth. Additionally, Europe's extensive involvement in marine research and environmental monitoring activities necessitates the use of high-resolution SONAR systems.

The hull-mounted segment dominated the market with a revenue share of 41% in 2023. Key factors driving the use of hull-mounted SONAR systems include enhancing maritime security by detecting submarines and underwater mines, supporting fisheries management through fish detection, and facilitating underwater mapping and exploration. Advancements in technology, such as improved sensor sensitivity and signal processing capabilities, continue to drive the evolution of hull-mounted SONAR systems, making them indispensable for various marine applications. Additionally, technological advancements have led to the development of more compact and efficient hull-mounted SONAR systems, making them easier to install and maintain on various types of vessels.

The Sonobuoy segment is experiencing growth driven by its critical role in anti-submarine warfare and maritime surveillance. Sonobuoys, which are deployed from aircraft or ships, provide real-time data on underwater acoustic environments, aiding in the detection and tracking of submarines. The increasing need for enhanced maritime security and defense capabilities is a major driver, prompting investments in advanced sonobuoy technology. Innovations such as improved signal processing, longer operational life, and better data transmission have made sonobuoys more effective and reliable. Additionally, rising geopolitical tensions and the strategic importance of maintaining naval dominance in contested waters are further propelling the demand for sophisticated sonobuoy systems.

The ship type segment dominated the market in 2023. This dominance can be attributed to the growing need for effective underwater navigation, detection, and communication. These systems enhance maritime safety and security by enabling ships to detect underwater obstacles, map the seabed, locate submarines, and communicate with other vessels or underwater assets. Naval and commercial vessels are increasingly being equipped with sophisticated hull-mounted and towed array SONAR systems, which are essential for navigation, threat detection, and marine research.

The airborne segment is experiencing notable growth due to its critical role in rapid and expansive underwater surveillance. Maritime patrol aircraft and helicopters equipped with advanced SONAR systems can quickly deploy and collect real-time data over large ocean areas. This capability is essential for anti-submarine warfare, search and rescue operations, and maritime border security, providing a swift response to potential threats. Technological advancements have enhanced the efficiency and accuracy of airborne SONAR systems, making them more effective in diverse operational environments.

The defense segment held the largest market share in 2023. The growth of the sector is due to growing maritime threats, including submarine activity, which drive the need for advanced underwater surveillance and detection capabilities. Moreover, the rise of Autonomous Underwater Vehicles (AUVs) and unmanned underwater systems has created a demand for improved underwater communication and navigation, further fueling the adoption of SONAR systems. Technological advancements, such as improved signal processing and AI integration, have made defense SONAR systems more effective in detecting and tracking underwater threats. The modernization of naval fleets and the development of new submarines and surface vessels are further driving the demand for cutting-edge SONAR technology.

The commercial segment is expanding rapidly, driven by the growing need for advanced underwater navigation, exploration, and resource management. Commercial applications such as oil and gas exploration, commercial fishing, and maritime shipping rely heavily on SONAR technology for safe and efficient operations. Innovations in high-resolution imaging and seabed mapping have significantly improved the accuracy and effectiveness of commercial SONAR systems. Additionally, the increasing focus on sustainable fishing practices and environmental monitoring is driving the adoption of SONAR systems in the commercial sector.

By Product

By Platform

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on SONAR System Market

5.1. COVID-19 Landscape: SONAR System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global SONAR System Market, By Product

8.1. SONAR System Market, by Product, 2024-2033

8.1.1 Hull-Mounted

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Stern Mounted

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Sonobuoy

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. DDS

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global SONAR System Market, By Platform

9.1. SONAR System Market, by Platform, 2024-2033

9.1.1. Ship Type

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Airborne

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global SONAR System Market, By Application

10.1. SONAR System Market, by Application, 2024-2033

10.1.1. Defense

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global SONAR System Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Platform (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Platform (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Platform (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Platform (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Platform (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Platform (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Platform (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Platform (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Platform (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Platform (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Platform (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Platform (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Platform (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Platform (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Platform (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Platform (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Platform (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Platform (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Platform (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Platform (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Platform (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Raytheon Systems International Company.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Thales.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Atlas Elektronik.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Sonardyne.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. L3Harris Technologies, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Ultra Electronics Group

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. KONGSBERG.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Lockheed Martin Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Teledyne Technologies Incorporated.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Furuno Electric Co., Ltd.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others