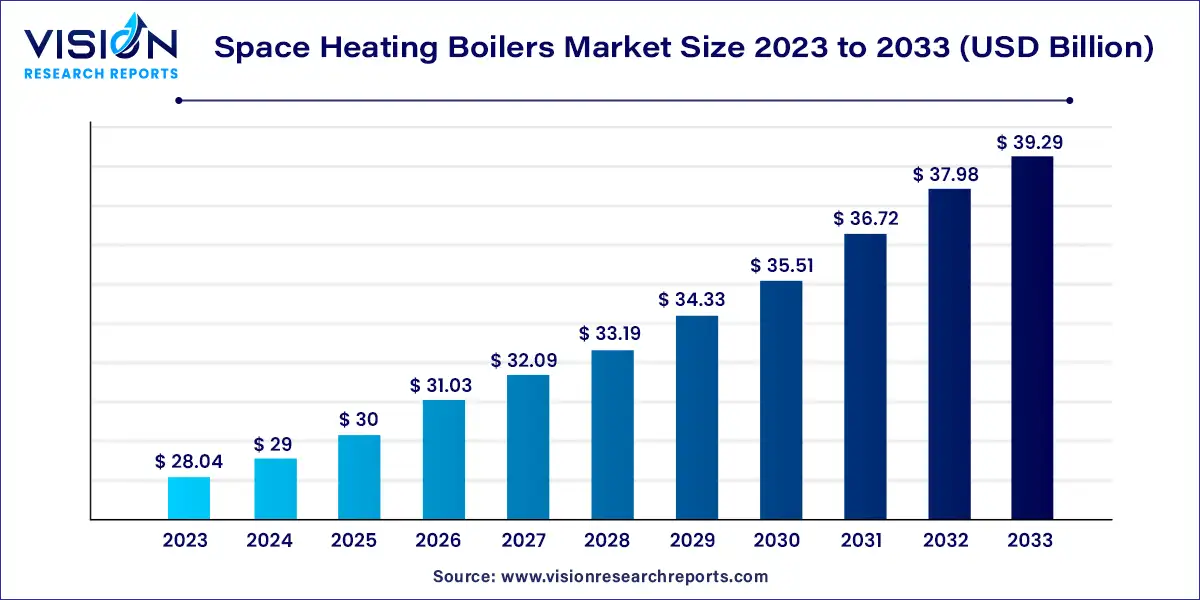

The global space heating boilers market size was valued at USD 28.04 billion in 2023 and it is predicted to surpass around USD 39.29 billion by 2033 with a CAGR of 3.43% from 2024 to 2033.

The space heating boilers market has experienced significant growth driven by the increasing demand for energy-efficient heating solutions and the growing awareness of environmental sustainability. Boilers, which serve as a critical component in space heating systems, are used in residential, commercial, and industrial applications to maintain comfortable indoor temperatures. This overview provides insights into the market’s current landscape, key trends, and factors influencing its growth.

The growth of the space heating boilers market is primarily driven by several key factors. Increasing consumer awareness of energy efficiency is a major catalyst, as both residential and commercial users seek to reduce energy consumption and lower utility bills. Advances in boiler technology, such as the development of high-efficiency condensing and smart boilers, are further propelling market expansion by offering improved performance and enhanced control. Additionally, stringent environmental regulations worldwide are pushing for the adoption of low-emission and sustainable heating solutions, which boosts demand for advanced boiler systems. The rising emphasis on renewable energy sources also contributes to market growth, with hybrid heating systems integrating solar and biomass technologies gaining popularity. Urbanization and infrastructure development in emerging markets create further opportunities, driving the demand for modern and efficient space heating solutions.

Adoption of Smart Technologies

Focus on Energy Efficiency

Incorporation of Renewable Energy

Growth of Modular and Compact Designs

High Initial Costs

Regulatory Compliance

Competition from Alternative Heating Technologies

Supply Chain Disruptions

The gas-fired space heating boilers operation segment led the space heating boilers market and accounted for 76% of the revenue share in 2023. The gas-fired space heating boilers vary depending on several key considerations such as the demand, adoption, and utilization of gas-fired space heating boilers in residential and commercial industries. Stringent energy efficiency regulations and environmental standards set by governments are expected to further drive the market demand.

The price of natural gas, as a primary fuel for gas boilers, plays a significant role in their adoption. When natural gas prices are competitive or lower compared to other energy sources, companies are more likely to choose gas-fired space heating boilers to benefit from cost savings. Further, gas-fired space heating boilers that offer high performance and reliability are preferred by companies.

The electric space heating boilers operation segment is expected to witness a CAGR of 5.66% over the forecast period. As a backup heat source for solar applications and applications requiring particular temperature settings, it is perfect for radiant systems. For instance, the AT Series electric boiler, which has a sophisticated microprocessor control and load managing controller, is a 100% efficient, small wall-hung boiler. The cast iron heat exchanger in the AT Series is a tried-and-true one-piece, and it comes with a 20-year limited warranty.

The commercial application segment led the market with a revenue share of 57% in 2023. Since water carries thermal energy quickly and maintains heat longer than air, commercial space heating boilers are inherently energy efficient. They also have a lower risk of developing system leaks since they use pipes rather than ductwork, which uses less energy. Since heat is properly dispersed throughout the area because boilers employ thermal radiation techniques to heat the structure. As long as the heating system is suitably balanced for the necessary heating load, they also operate continuously for extended periods, giving residents steady heat. These aforementioned factors are expected to drive the demand for space heating boilers for commercial application over the forecast period.

The AAON BL Series Packaged Boiler Outdoor Mechanical Room is factory engineered with pre-engineered pumping, piping, and controls in one quick connect package to save time and money at the work site. The BL Boiler is intended for indoor or outdoor application; it can be installed in a conventional mechanical room or moved to the building's exterior to make the most of available inside space. Further, the boiler is a minimum of 88% thermal efficient.

The residential application segment is anticipated to witness a CAGR of 3.67% over the forecast period. Space heating boilers used for residential applications are an essential part of home heating systems. They are designed to provide hot water and/or central heating for houses, apartments, and other residential properties. These aforementioned factors are anticipated to propel the demand for space heating boilers for residential applications in the coming years.

The condensing space heating boilers type segment led the market and accounted for 92% of the global revenue share in 2023. These are superior to non-condensing space heating boilers as they are energy efficient. Up to 30% of a boiler's heat is practically lost before condensing space heating boilers were invented since it was expelled directly into the flue pipe. Condensing space heating boilers also employ a Flue Gas Heat Recovery System to recycle waste heat from the flue to warm the cold water entering the boiler, which allows them to operate at a greater efficiency level.

Traditional boilers typically do not achieve efficiency levels over 55% - 65%. However, non-condensing space heating boilers can achieve up to 78% efficiency (the proportion of useful heat). Condensing space heating boilers, on the other hand, can achieve up to 90% - 99% efficiency. By installing a condensing space heating boiler in a domestic space, the user can save up to 1,200 kg of carbon emissions annually. Condensing space heating boilers are an ideal alternative heating technology since they considerably cut fuel costs and carbon footprint.

The non-condensing space heating boiler type segment is anticipated to witness a CAGR of 2.46% over the forecast period. Since non-condensing space heating boilers are typically less expensive to fix, doing so can result in immediate financial savings. Condensing space heating boilers can save more money, though, because of their longer lifespans and increased fuel efficiency. Owing to this, even though condensing space heating boiler prices are more, they ultimately prove to be the best option. These aforementioned factors are anticipated to propel the demand for space heating boilers in the coming years.

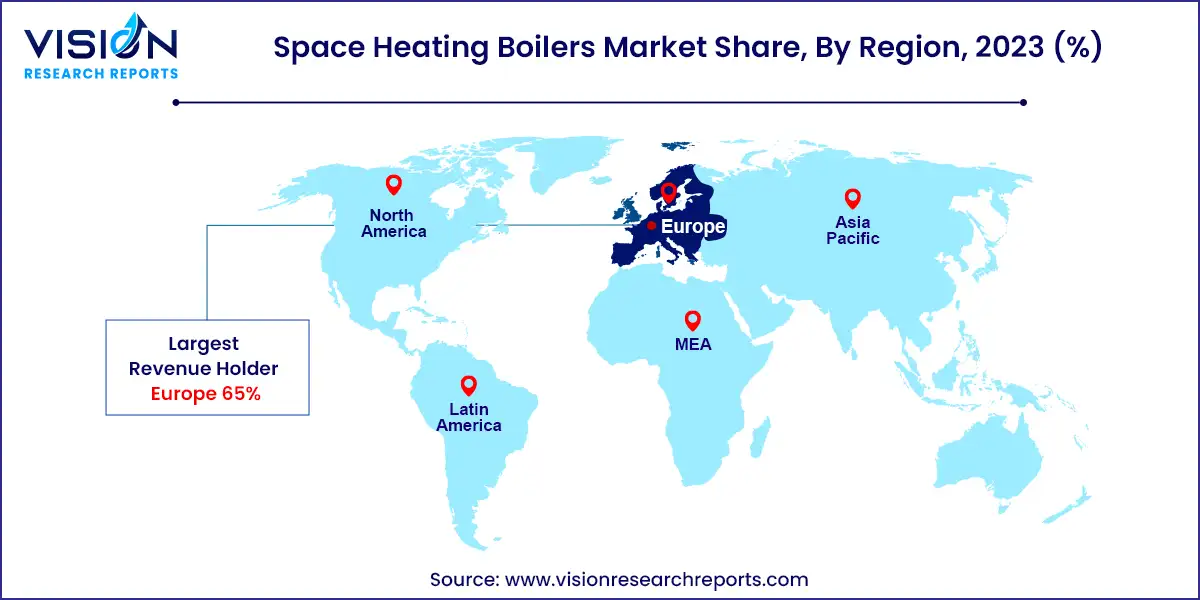

Europe region dominated the market in 2023 by accounting for a revenue share of 66%. The region has been at the forefront of promoting energy efficiency in the commercial and residential sectors. Stringent regulations and directives, such as the Energy Efficiency Directive (EED) and the Energy Performance of Buildings Directive (EPBD), have pushed businesses to invest in high-efficiency boilers. This has driven the demand for condensing boilers and other advanced technologies that offer better energy performance.

North America, particularly the U.S., and Canada, has stringent energy efficiency regulations and standards. These regulations have driven the demand for high-efficiency commercial space heating boilers, including condensing space heating boilers, which help end-users to reduce energy consumption and operating costs. Further, the growth of the commercial construction sector in North America has created a demand for heating systems, including commercial space heating boilers, in newly constructed buildings and renovated properties.

Asia Pacific region is expected to witness a CAGR of 4.07% over the forecast period. The ongoing urbanization and infrastructure development in the region have resulted in the construction of commercial buildings, shopping complexes, and other commercial facilities. These new constructions require modern and efficient heating systems, boosting the demand for space heating boilers for commercial applications in this region.

Efforts to improve energy infrastructure in the Central & South America region have resulted in increased installations of heating systems, including space heating boilers, for commercial and residential applications. Further, ensuring a stable and reliable energy supply is crucial for the region's economic development. Space heating boilers provide a dependable heating solution, especially in regions with cooler climates or specific industrial processes. These factors are anticipated to drive the demand for space heating boilers in the coming years.

By Operation

By Application

By Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Operation Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Space Heating Boilers Market

5.1. COVID-19 Landscape: Space Heating Boilers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Space Heating Boilers Market, By Operation

8.1. Space Heating Boilers Market, by Operation, 2024-2033

8.1.1 Gas-fired Space Heating Boilers

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Electric Space Heating Boilers

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Oil-fired Space Heating Boilers

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Space Heating Boilers Market, By Application

9.1. Space Heating Boilers Market, by Application, 2024-2033

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Space Heating Boilers Market, By Type

10.1. Space Heating Boilers Market, by Type, 2024-2033

10.1.1. Non-condensing Space Heating Boiler

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Condensing Space Heating Boiler

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Space Heating Boilers Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Operation (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by Type (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Operation (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Operation (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Operation (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by Type (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Operation (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Operation (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Operation (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Type (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Operation (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Type (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Operation (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by Type (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Operation (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Operation (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Operation (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Type (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Operation (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Type (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Operation (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Operation (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Operation (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Operation (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Type (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Operation (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Type (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Operation (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Operation (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Operation (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Type (2021-2033)

Chapter 12. Company Profiles

12.1. Rheem Manufacturing

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Ingersoll-Rand Plc

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Daikin Industries, Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Lennox International

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Viessmann Group

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Vaillant Group

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. ECR International, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. AAON

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Mitsubishi Electric Corporation

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Ariston Thermo USA LLC

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others