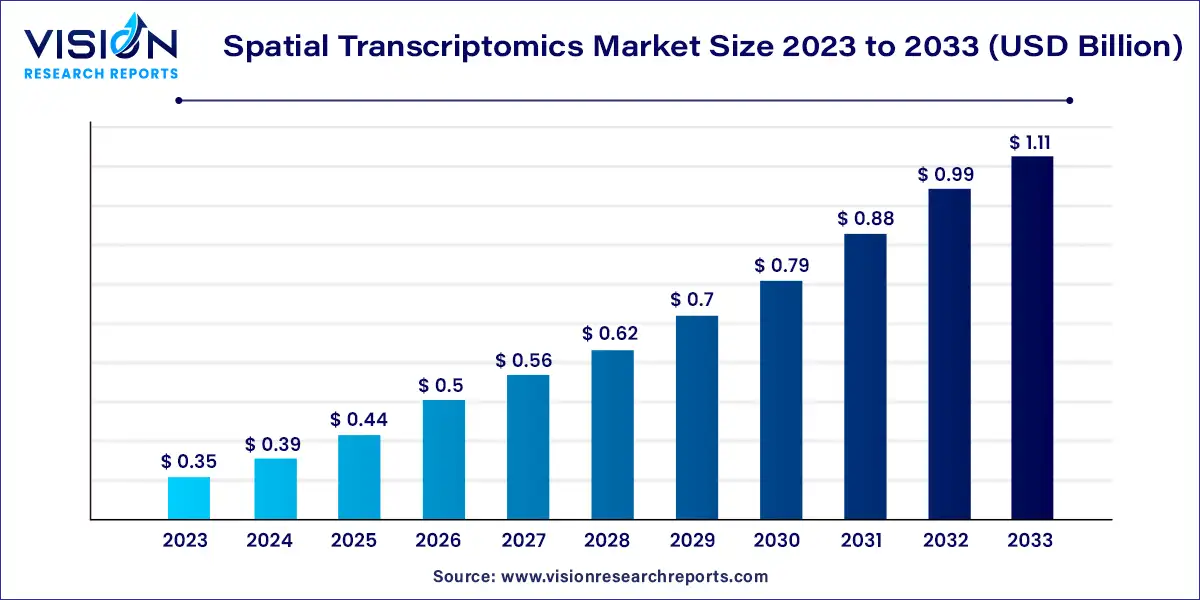

The global spatial transcriptomics market size was estimated at around USD 0.35 billion in 2023 and it is projected to hit around USD 1.11 billion by 2033, growing at a CAGR of 15.25% from 2024 to 2033.

The spatial transcriptomics market is experiencing a significant surge driven by advancements in technology and increasing applications across various research domains. This innovative approach allows researchers to visualize gene expression within the context of tissue morphology, providing invaluable insights into complex biological systems. With the ability to analyze gene expression patterns in their spatial context, researchers can unravel intricate molecular mechanisms underlying diseases and developmental processes. As a result, the spatial transcriptomics market is poised for robust growth as demand for high-resolution spatial gene expression data continues to escalate across academic, pharmaceutical, and biotechnology sectors.

The growth of the spatial transcriptomics market is propelled by the technological advancements in spatial transcriptomics platforms have enabled high-throughput analysis of gene expression patterns with enhanced spatial resolution, driving adoption across research fields. Additionally, the increasing demand for spatially resolved transcriptomic data to decipher complex biological processes and diseases fuels market expansion. Moreover, collaborations between academic institutions, research organizations, and biotechnology companies are fostering innovation and driving the development of novel spatial transcriptomics solutions. Furthermore, rising investments in life sciences research and the growing emphasis on precision medicine applications contribute to market growth by creating a conducive environment for the adoption of spatial transcriptomics technologies.

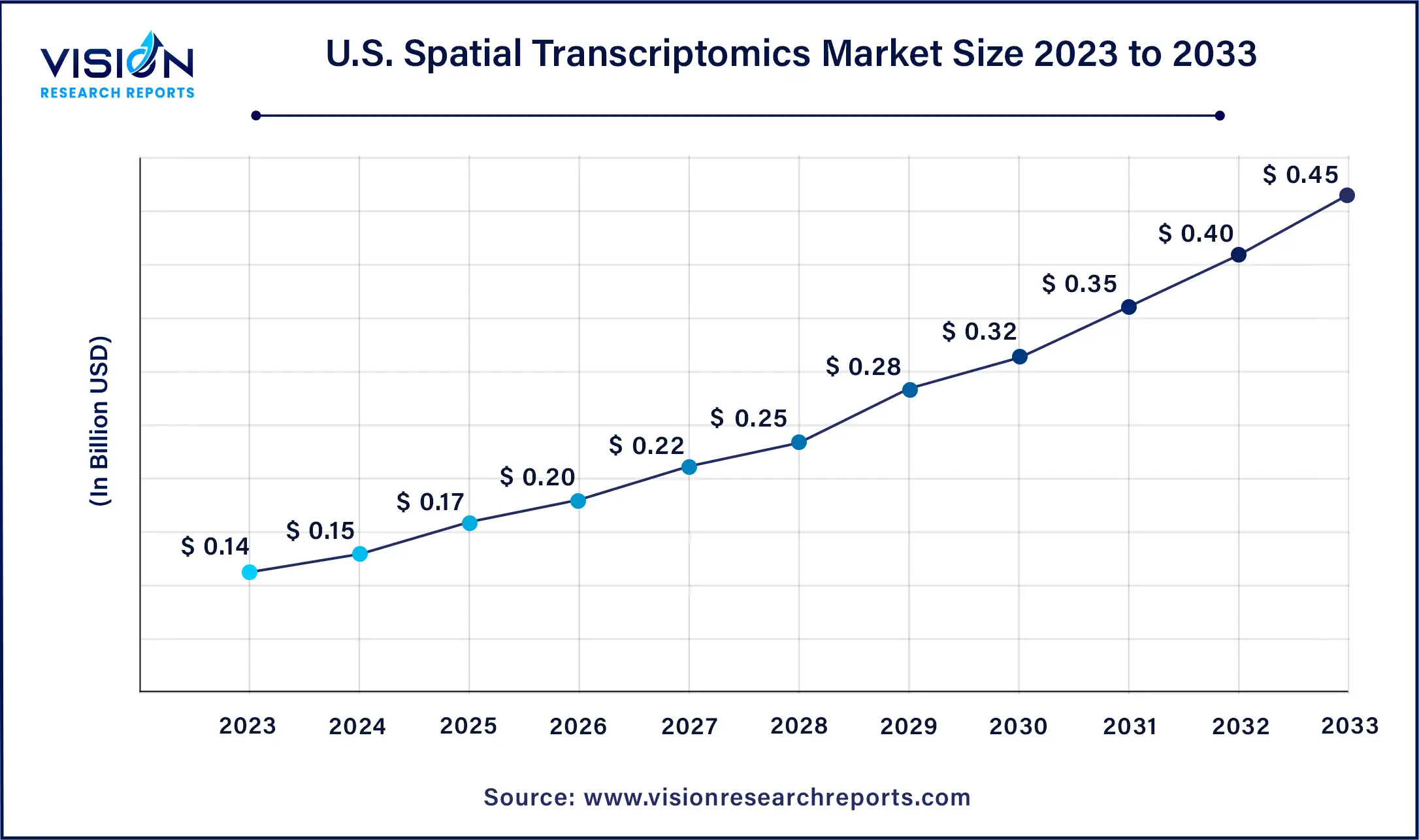

The U.S. spatial transcriptomics market size was estimated at around USD 0.14 billion in 2023 and it is projected to hit around USD 0.45 billion by 2033, growing at a CAGR of 12.38% from 2024 to 2033.

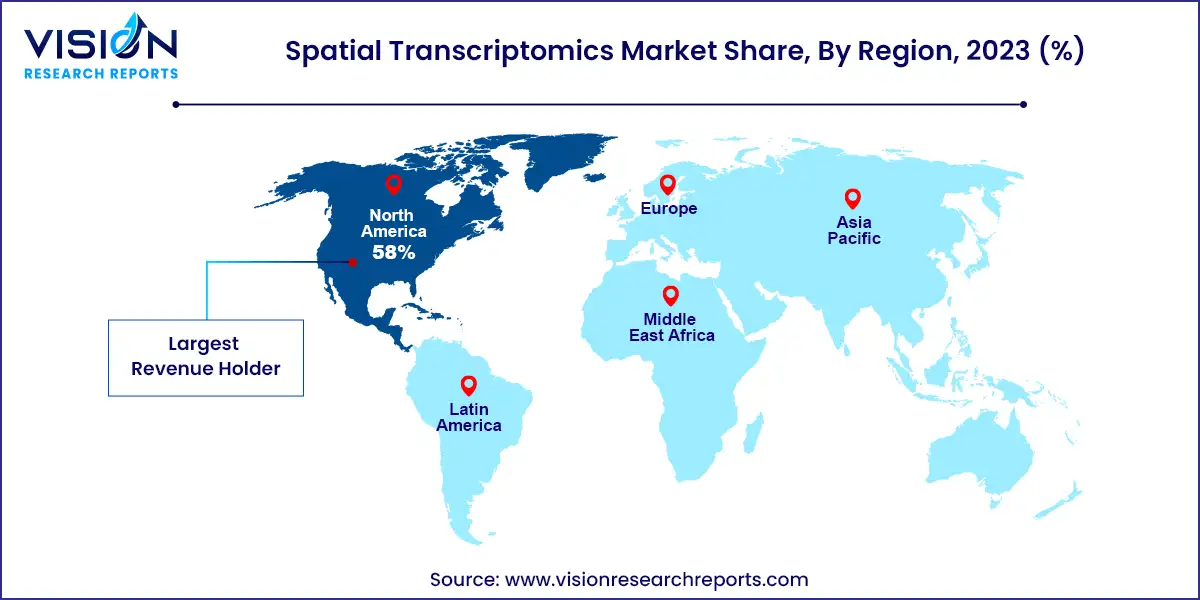

North America accounted for the largest market share of 58% in 2023. Factors such as increasing cancer prevalence, growing demand for personalized medicine, well-developed healthcare facilities, and availability of novel diagnostic techniques contribute to the region's dominance. Initiatives and programs by companies for discovering and increasing translational applications further drive market growth in North America.

The Asia Pacific spatial transcriptomics market experienced the highest CAGR of 16.94% over the forecast period. This significant increase is primarily attributed to the rising incidence of various diseases such as cancer, diabetes, Alzheimer’s disease, rheumatoid arthritis, and other neurodegenerative, autoimmune, and metabolic disorders in the region. Additionally, the Asia Pacific region boasts a large population and untapped markets within emerging economies, which has intensified the focus of leading global firms on this market. Furthermore, the region offers relatively inexpensive manufacturing and operating units, making it conducive for conducting research and development activities.

In 2023, the consumables segment held the market's largest share at 53%. This segment encompasses products necessary for instrument operation throughout various stages of genome mapping, from sample preparation to result derivation. Its dominance stems from high product penetration, increased usage of reagents and kits, wide availability, and frequent purchases for instrument operation.

The software segment is expected to exhibit the highest CAGR over the forecast period. This category includes products for data visualization, interpretation, and management resulting from spatial DNA and RNA studies. The escalating volume of ongoing genomic research necessitates robust software solutions for data management and interpretation, thus driving the segment's growth in the foreseeable future.

The sequencing-based methods segment accounted for 54% of the market share in 2023 and is poised to register the highest CAGR. This dominance is attributed to technological advancements and increasing demand in research and clinical diagnostics. Sequencing-based methods provide high-resolution, accurate spatial mapping of gene expression within tissues, offering detailed insights critical for advanced research and clinical applications.

The microscopy-based RNA imaging techniques segment is anticipated to achieve a significant CAGR over the forecast period. This growth is fueled by the widespread adoption of fluorescence microscopy for protein subcellular location determination and advancements in microscopy technology. These advancements enhance sensitivity, imaging resolution, and throughput, providing insightful single-cell level information with exceptional spatial resolution.

The instrumental analysis segment held a 48% market share in 2023 and is expected to grow at the highest CAGR. This growth is primarily attributed to substantial advancements in instruments such as microscopy and mass spectrometry. Mass spectrometry, especially, is a promising tool for nucleic acid and protein quantification, with companies launching new, advanced mass spectrometers for various applications.

The sample preparation segment is projected to register a significant CAGR over the forecast period. Streamlining and automating the sample preparation procedure are crucial for obtaining high-quality sequencing products for transcriptomics studies. Companies launching new products aimed at improving sample preparation procedures are expected to drive segment growth.

In 2023, the FFPE segment dominated the market due to its standard usage in preserving human tissue for clinical diagnosis. This technique is highly regarded for researching tissue morphology for clinical histopathology and diagnostic purposes, with ongoing developments in gene expression profiling driving segment growth.

The fresh frozen segment is expected to achieve a higher CAGR of 16.85% over the forecast period. Its growth is attributed to high application in proteomic studies based on tandem Mass Spectrometry (MS). Additionally, advancements such as 3D-printed devices for preparing fresh-frozen needle biopsies are propelling segment growth.

Translational research emerged as the dominant segment in 2023, holding a share of 57%, and is anticipated to grow at the fastest CAGR. Spatial transcriptomics' utilization in translating real-time tissue responses to external agents increases its adoption in translational research, benefitting researchers in various ways.

The academic customers segment is expected to register a significant CAGR over the forecast period. Academic institutes focusing on cancer, metabolic, neurologic, autoimmune, and inflammatory diseases drive demand for spatial transcriptomics analyses. Universities' commercialization of research to fund further research and funding bodies' interest in promoting research commercialization contribute to segment growth.

By Product

By Technology

By Workflow

By Sample Type

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others