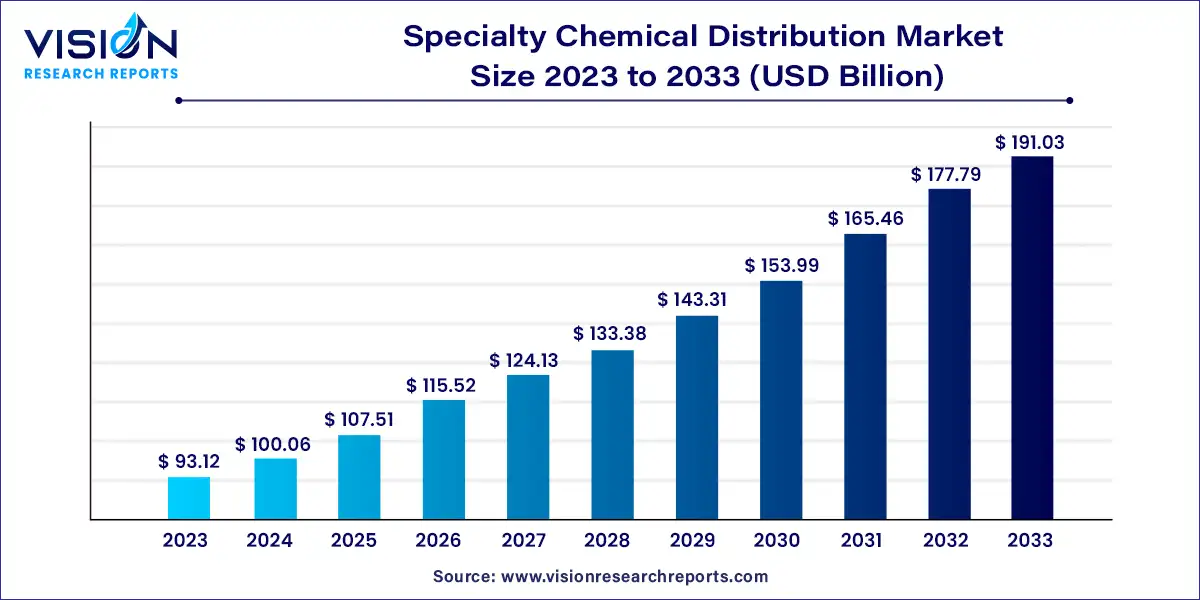

The global specialty chemical distribution market size was estimated at around USD 93.12 billion in 2023 and is projected to hit around USD 191.03 billion by 2033, growing at a CAGR of 7.45% from 2024 to 2033.

The specialty chemical distribution market plays a vital role in the global chemical industry, acting as a crucial link between manufacturers and end-users across various sectors. This market encompasses the distribution of specialty chemicals, which are high-value, low-volume chemicals used for specific applications in industries such as pharmaceuticals, agriculture, electronics, automotive, and construction.

The growth of the specialty chemical distribution market is propelled by an increasing demand for specialty chemicals across diverse industries such as pharmaceuticals, electronics, and automotive drives market expansion. Additionally, globalization and the expansion of supply chains enable distributors to reach new markets and cater to a broader customer base. Technological advancements in logistics and distribution infrastructure enhance efficiency and streamline operations, further fueling market growth. Moreover, strategic partnerships and collaborations between distributors and manufacturers facilitate product innovation and market penetration.

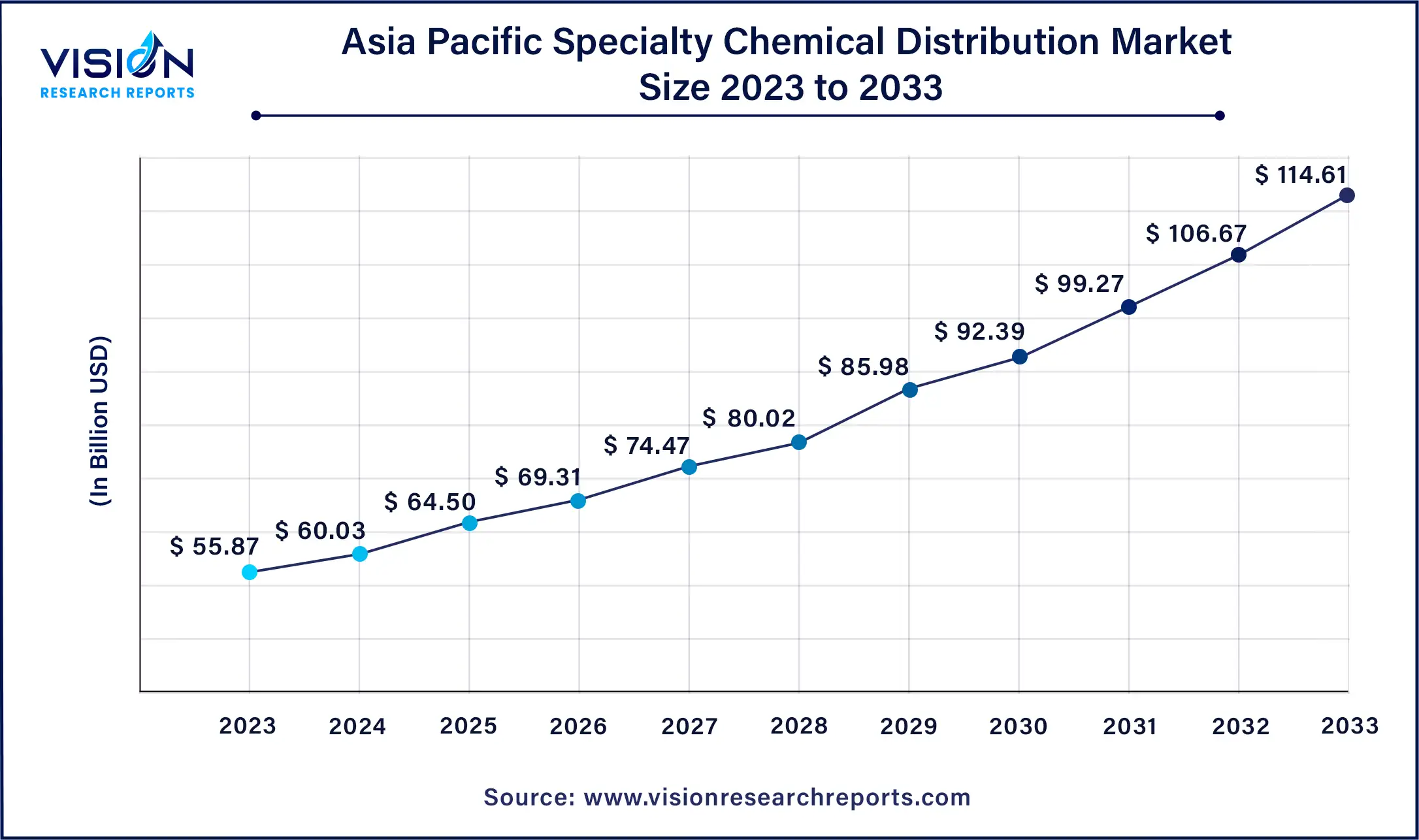

The Asia Pacific specialty chemical distribution market size was estimated at USD 55.87 billion in 2023 and it is expected to surpass around USD 114.61 billion by 2033, poised to grow at a CAGR of 7.45% from 2024 to 2033.

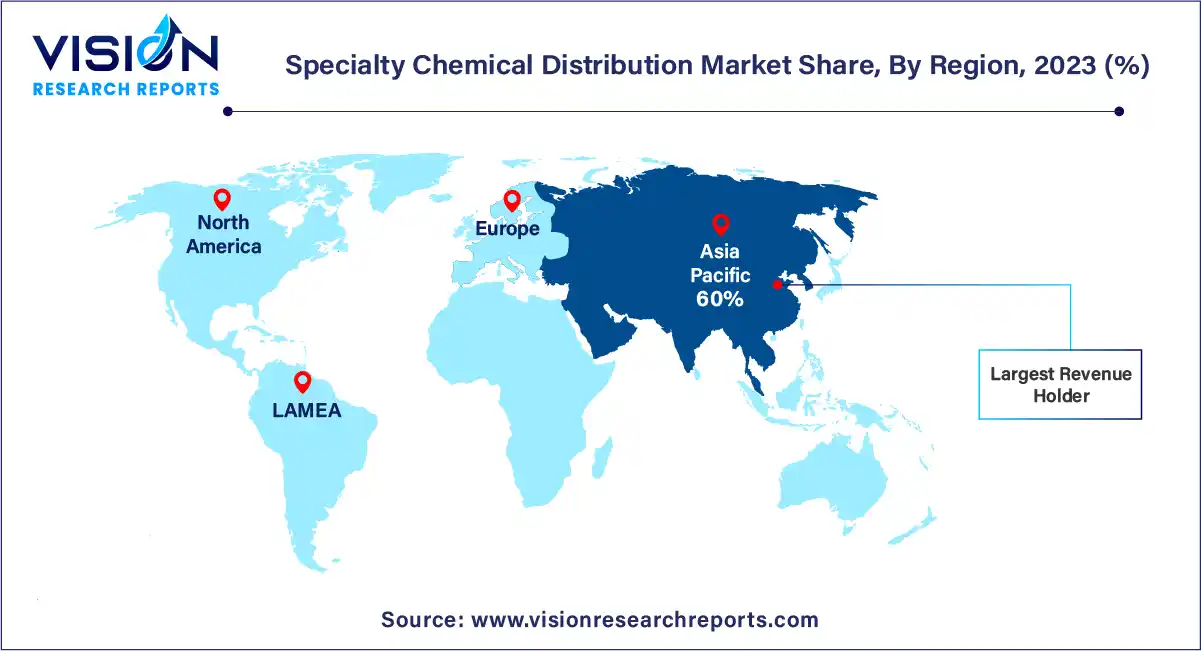

In 2023, Asia Pacific emerged as the dominant force in the specialty chemical distribution market, capturing a substantial revenue share of 60%. This dominance is largely driven by the escalating demand for various chemicals across key end-use industries such as automotive, pharmaceuticals, mining, cosmetics, and plastic additives. The remarkable growth in Asia-Pacific can be attributed to the rapid industrialization witnessed in major economies including China, Japan, India, South Korea, and Australia. This robust industrial expansion has significantly impacted the chemical distribution market, fueling demand for specialty chemicals across diverse sectors.

The specialty chemical distribution market in North America is projected to experience the most rapid compound annual growth rate (CAGR) throughout the forecast period. This growth can be attributed to the expanding utilization of specialty chemicals across a wide range of end-user industries, including pharmaceuticals, consumer goods, textiles, and automotive & transportation.

Within the pharmaceutical sector, specialty chemicals play integral roles in various processes. They are utilized in the manufacturing of Active Pharmaceutical Ingredients (APIs), crucial components in pharmaceutical formulations. Additionally, specialty chemicals are employed in the packaging of pharmaceutical products to ensure their safety, stability, and efficacy. Moreover, they are essential in sterilizing medical equipment both before and after use, contributing to maintaining stringent hygiene standards in healthcare facilities.

In 2023, the specialty polymers & resins segment emerged as the market leader, commanding a significant revenue share of 33%. This dominance is primarily attributed to the crucial role of specialty chemicals in the production of polymer additives, which are essential for enhancing or modifying the properties of plastic resins. These additives are instrumental in creating process-ready polymer compounds or imparting specific characteristics to the resins, such as improved luster, strength, heat resistance, or durability. Common types of polymer additives include plasticizers, heat stabilizers, antioxidants, and others.

The increasing demand for specialty adhesives, coatings, and related materials in high-performance sectors like construction, automotive, and paints is expected to further drive the demand for CASE (Coatings, Adhesives, Sealants, and Elastomers) products in the market. Additionally, the development of high-quality industrial coatings tailored for custom-built and prefabricated structures will serve as a significant market driver.

Specialty chemicals play a pivotal role in enhancing the structural strength, protection, and energy efficiency of infrastructure projects. Throughout the construction process, these chemicals are utilized to ensure high longevity, durability, and environmental sustainability of the built environment. A wide array of specialty chemicals and materials are deployed in the construction sector, facilitating the manufacturing of diverse products including liquid pigments for colored concrete, cement additives, roofing underlayments, self-adhered windows, deck and door flashings, structural waterproofing systems, as well as roof, floor, and waterproofing coatings.

In 2023, the industrial manufacturing distribution segment emerged as the market leader, commanding the largest revenue share of 22%. This segment's significant share can be attributed to its diverse applications across various industrial sectors. The industrial manufacturing segment encompasses a wide range of applications, including pulp & paper chemicals, water management chemicals, oilfield chemicals, metalworking fluids, and rubber processing chemicals. The favorable physicochemical properties of specialty chemicals have fueled their demand in critical areas such as lubricants and oil additives, witnessing substantial growth across industries like rubber processing, metalworking, oil fields, and pulp & paper.

Specialty chemicals play a vital role in the automotive industry, where they are utilized to enhance both the aesthetics and functionality of vehicles. For example, motor oil serves to dissipate heat from the engine, ensuring smooth engine operation. Various specially formulated adhesives and sealants, including epoxy, polyimide, polyurethane, and silicone-based variants, are increasingly replacing traditional welded joints, mechanical fasteners, and gaskets in automotive applications. Furthermore, the rising demand for lightweight electric vehicles is anticipated to further drive the market's growth in the automotive and transportation sectors.

In the construction industry, specialty chemicals such as fluorinated compounds, phthalates, polybrominated diphenyl ethers, and short-chain chlorinated paraffins play pivotal roles in the manufacturing of precast concrete, concrete admixtures, and cement processing additives, among other products. These chemicals impart unique properties to building materials, enhancing durability, appearance, structural strength, and providing protection against water leakage and fire hazards. Moreover, chemicals are instrumental in enhancing the aesthetic appeal of buildings. The demand for specialty chemicals in construction applications closely correlates with the growth of construction activities worldwide.

By Product

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others