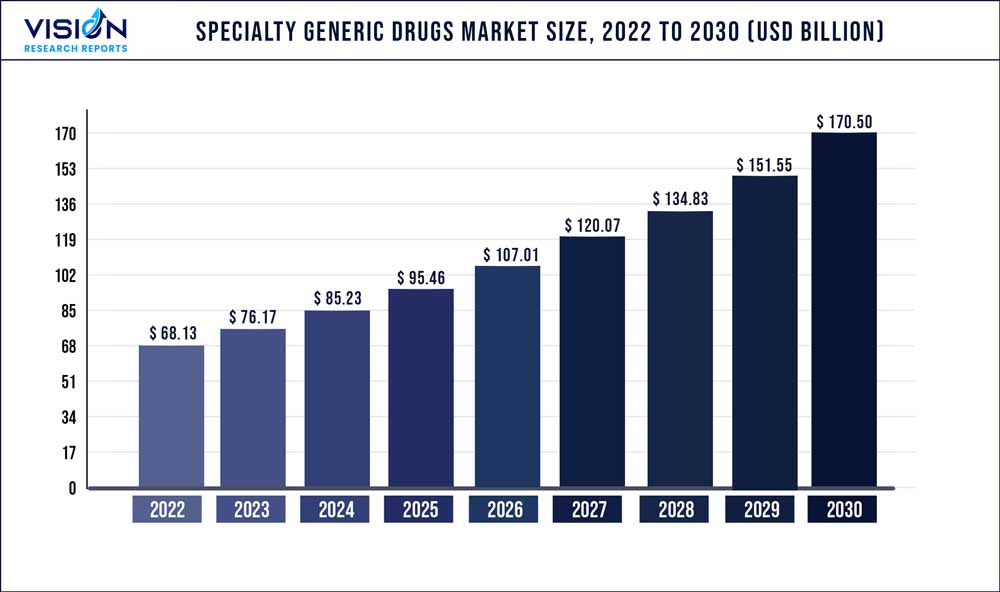

The specialty generic drugs market presented an earning of USD 68.13 billion by 2022 and is expected to reach approximately USD 170.50 billion by 2030 at a compound annual growth rate of 12.2% during the forecast period.

The use of specialty generic drugs has experienced a recent demand from the market with the increase in awareness among the people regarding the availability of various cost-effective services which are provided by the government and the private sector. Rapid increase in the number of patients all over the world resulting from the huge geriatric population has helped the market to boost to new heights. Since the effect of the medicine on the body is similar to the effect shown by the use of branded medicines, people have opted for generic drugs on a large scale. The existence of chronic diseases among the people all over the world has also helped the generic drug market to show great returns. Chronic diseases require a long period of time for complete treatment which means that the demand and supply of certain medicines are constantly required by the market. Developed ability of these medicines under the category of generic drugs has propelled the growth of the market to a great extent.

The outbreak of the COVID pandemic had a significant impact on the specialty generic drug market due to the huge demand and supply that was experienced in the market. The people suffering during the pandemic had experienced the existence of a number of associated diseases and disorders which had imposed and additional expenditure on the pockets of the people. The supply of advanced generic drugs by the key market players into the market emerged as a potential option for these people. The increasing demand for generic drugs among the people pertaining to the similarity in the major components of the medicine has helped the market to record a considerable growth during the forecast period. The sales and supply of the drugs acting on the cardiovascular system experienced huge demand from the market. The huge number of people who were infected during the pandemic help the market of generic drugs to record a considerable revenue. With a view to reduce the total expenditure on treatment people opted for branded generic drugs as well as for pure generic drugs.

Growth factors

Major market players in the generic drug industry have introduced new medicines into the market which use advanced technology to treat the patients and bring about cure in a shorter period of time by producing minimal side effects on the body of the patient. Huge investments which are made by the key market players with a view to enhance and develop the production and manufacturing process of generic drugs has boosted the economy for the market. The total cost of production has been tremendously reduced with the use of modern technology which has emerged as a major driving force for the generic drug market. The recent advancements which have taken place in the market in the form of acquisitions and collaborations among many market players has boosted the economy of the generic drug market to a great extent.

Key Market Drivers

Key Market Challenges

Key Market Opportunities

Segmental Insights

Brand Insights

On the basis of brand, the segment of pure generics has proved to be the fastest growing category due to the huge demand experienced in the market. The increasing awareness among the people regarding the originality of the drugs and the quality of the medicines has helped the segment of pure genetics to showcase a tremendous growth and is foreseen to be continued during the future as well. With the growing competition among the key market players with a view to introduce advanced medicines in the market which have a very high quality has helped the pure generic drugs to capture the current market.

The therapeutic value of the pure generic drugs it's far better then it's competitors. The use of pure generic drugs has shown a great result on the health of the individuals which has boosted the life expectancy of the people. Additionally, these drugs are being purchased over the counter on a large scale by the potential consumers in order to fulfill the requirements. The rapid increase in the sales and demand of the pure genetic drugs resulting from the need of the specific components in the medicines has helped to boost the size of the market to a great extent.

On the other hand, branded generic drugs are foreseen to have a brighter future due to their market recognition and brand value. The loyalty with which the branded generics have provided service to the people has helped it to earn its current position. It helps the patients to opt for a better alternative as compared to the branded medicines. The cost of the branded generics is slightly higher as compared to its competitors. As a result of the rapid urbanization the demand and supply of branded generics has mainly experienced a boost in the urban regions.

Route of Administration Insights

On the basis of route of administration, the largest share in the market has been acquired by oral formulations. This route of administration has proved itself as the most commonly used route by almost all the patients globally. Starting from human beings to animals, the oral route of administration has been considered as the safest and most convenient. Maximum sales and demand has been experienced by the pharmaceutical sector for this route of administration of medicines. The market has also experienced a huge demand for topical applications which is foreseen to show a tremendous boost during the forecast period.

The increasing number of cases suffering with skin disorders has boosted the demand for topical applications. It is considered to be the next most convenient route of administration after the oral formulations. This route of administration is commonly considered for the treatment of skin disorders and small children. The segment of injection has also contributed to a great extent to the growth of the market as it is considered to be a common route of administration in the hospital sector. This segment is experiencing an increase in demand due to its fast action on the system of the body.

Therapeutic Application Insights

On the basis of therapeutic application, the segment of oncology has acquired the largest share in the market due to the huge number of patients that are available all over the world. Major lifestyle disorders lead to the development of cancer among the youngsters and middle-aged people. The expensive treatment options which are available in the market imposes an additional pressure on the disposable income of the people. The presence of generic drugs in the market for the treatment of cancer has helped the society to a great extent.

The next segment that has made a considerable contribution to the growth of the market is of the cardiovascular diseases. The disorders related to the cardiovascular system are forcing to increase rapidly during the forecast period. The tremendous pressure and stress which is experienced by the younger generations due to the workload has boosted the number of patients suffering with cardiovascular disorders.

The medicines which are prescribe in order to treat the cardiovascular diseases are very costly and hence the generic drugs experience a high demand from the current market. The number of cases suffering with respiratory diseases has also increased due to the rapidly increasing pollution all over the world. The occurrence of the pandemic made a significant impact on the health of the people by affecting and weakening the respiratory system. Faulty lifestyle practices have also increased the number of cases belonging to respiratory disorders.

Geography Insights

On the basis of geography, the region of North America is considered as the largest sector which consumes generic drugs. A huge number of people residing in this region suffer with a number of chronic diseases. As the people belonging to this region are aware regarding the health care facilities which are supplied by the government and the private organizations, the sales and demand for generic drugs has experienced a fast growth in this region. The huge number of people belonging to the geriatric population has boosted the consumption of geriatric medicines. The prevalence of respiratory and cardiovascular diseases among the people has boosted the market of generic drugs. The high cost of the branded medicines has also boosted the demand for generic drugs.

The region of Asia Pacific has emerged as the next largest market for generic drugs. A shortage of disposable income with the people belonging to this region has imposed an additional pressure on the people which has boosted the demand for generic drugs to a great extent. The region of Europe and Latin America has shown significant contribution to the growth of the market due to the huge demand of generic drugs experienced.

Key Market Players

Recent Development

Segments covered in this report

By Brand

By Route of Administration

By Therapeutic Application

By Distribution Channel

On the basis of geography

North America

Europe

Asia Pacific

Rest of the World

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Specialty Generic Drugs Market

5.1. COVID-19 Landscape: Specialty Generic Drugs Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Specialty Generic Drugs Market, By Brand

8.1. Specialty Generic Drugs Market, by Brand, 2023-2032

8.1.1. Branded Generic Drugs

8.1.1.1. Market Revenue and Forecast (2022-2030)

8.1.2. Pure Generic Drugs

8.1.2.1. Market Revenue and Forecast (2022-2030)

Chapter 9. Global Specialty Generic Drugs Market, By Route of Administration

9.1. Specialty Generic Drugs Market, by Route of Administration, 2023-2032

9.1.1. Topical

9.1.1.1. Market Revenue and Forecast (2022-2030)

9.1.2. Oral

9.1.2.1. Market Revenue and Forecast (2022-2030)

9.1.3. Parental

9.1.3.1. Market Revenue and Forecast (2022-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2022-2030)

Chapter 10. Global Specialty Generic Drugs Market, By Therapeutic Application

10.1. Specialty Generic Drugs Market, by Therapeutic Application, 2023-2032

10.1.1. Cardiovascular system

10.1.1.1. Market Revenue and Forecast (2022-2030)

10.1.2. Oncology

10.1.2.1. Market Revenue and Forecast (2022-2030)

10.1.3. Dermatology

10.1.3.1. Market Revenue and Forecast (2022-2030)

10.1.4. Respiratory system

10.1.4.1. Market Revenue and Forecast (2022-2030)

10.1.5. Central nervous system

10.1.5.1. Market Revenue and Forecast (2022-2030)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2022-2030)

Chapter 11. Global Specialty Generic Drugs Market, By Distribution Channel

11.1. Specialty Generic Drugs Market, by Distribution Channel, 2023-2032

11.1.1. Retail pharmacies

11.1.1.1. Market Revenue and Forecast (2022-2030)

11.1.2. Hospital pharmacies

11.1.2.1. Market Revenue and Forecast (2022-2030)

11.1.3. Others

11.1.3.1. Market Revenue and Forecast (2022-2030)

Chapter 12. Global Specialty Generic Drugs Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Brand (2022-2030)

12.1.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.1.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Brand (2022-2030)

12.1.5.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.1.5.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.1.5.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Brand (2022-2030)

12.1.6.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.1.6.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.1.6.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Brand (2022-2030)

12.2.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.2.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.2.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Brand (2022-2030)

12.2.5.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.2.5.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.2.5.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Brand (2022-2030)

12.2.6.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.2.6.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.2.6.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Brand (2022-2030)

12.2.7.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.2.7.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.2.7.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Brand (2022-2030)

12.2.8.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.2.8.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.2.8.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Brand (2022-2030)

12.3.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.3.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.3.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Brand (2022-2030)

12.3.5.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.3.5.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.3.5.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Brand (2022-2030)

12.3.6.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.3.6.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.3.6.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Brand (2022-2030)

12.3.7.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.3.7.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.3.7.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Brand (2022-2030)

12.3.8.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.3.8.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.3.8.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Brand (2022-2030)

12.4.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.4.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.4.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Brand (2022-2030)

12.4.5.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.4.5.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.4.5.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Brand (2022-2030)

12.4.6.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.4.6.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.4.6.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Brand (2022-2030)

12.4.7.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.4.7.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.4.7.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Brand (2022-2030)

12.4.8.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.4.8.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.4.8.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Brand (2022-2030)

12.5.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.5.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.5.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Brand (2022-2030)

12.5.5.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.5.5.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.5.5.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Brand (2022-2030)

12.5.6.2. Market Revenue and Forecast, by Route of Administration (2022-2030)

12.5.6.3. Market Revenue and Forecast, by Therapeutic Application (2022-2030)

12.5.6.4. Market Revenue and Forecast, by Distribution Channel (2022-2030)

Chapter 13. Company Profiles

13.1. Alkem Laboratories Limited

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Teva Pharmaceutical Industries Limited

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Cipla Ltd.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Dr. Reddy’s Laboratories Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Mylan N.V.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Lupin Limited

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. STADA Arzneimittel AG

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Hikma Pharmaceuticals plc

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Torrent Pharmaceuticals Ltd.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Endo International plc

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others