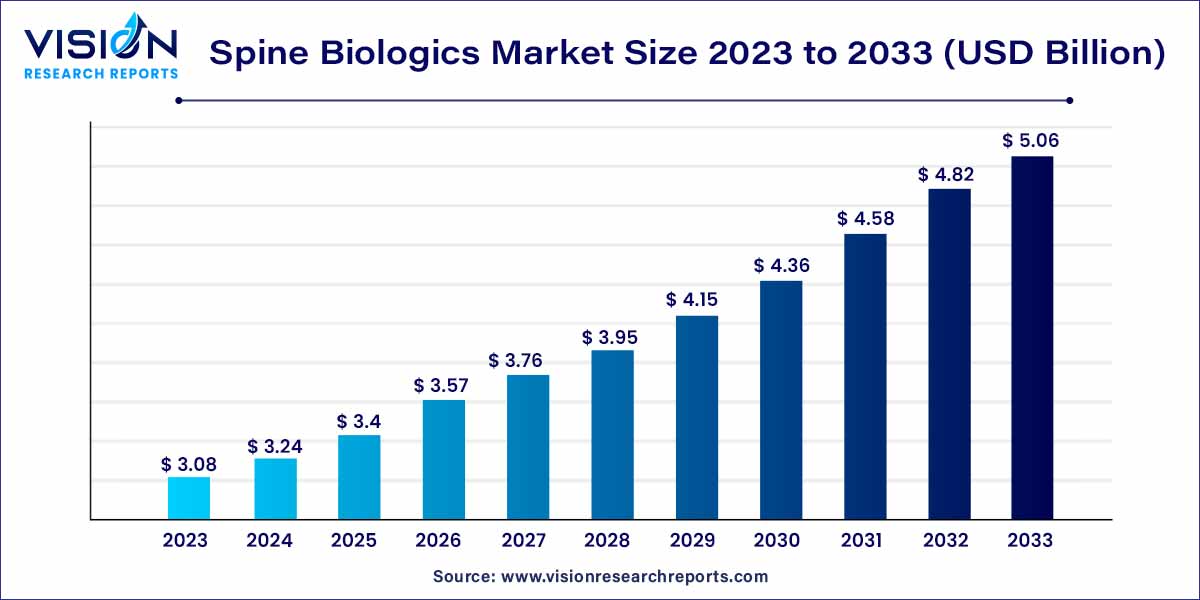

The global spine biologics market size was estimated at around USD 3.08 billion in 2023 and it is projected to hit around USD 5.06 billion by 2033, growing at a CAGR of 5.09% from 2024 to 2033. The market is expected to rise as a result of several factors, including rising treatment rates for degenerative spine conditions, improvements in bone grafting techniques, and a growing demand for minimally invasive operations.

The Spine Biologics market stands at the forefront of innovation, playing a pivotal role in the ever-evolving field of spinal care. As advancements in biotechnology continue to reshape the healthcare landscape, the demand for innovative solutions to address spinal disorders has led to the emergence of a dynamic and rapidly expanding Spine Biologics market.

The growth of the Spine Biologics market is propelled by several key factors. Firstly, the increasing prevalence of spinal disorders, coupled with a rising aging population, has significantly augmented the demand for innovative solutions in spinal care. Additionally, the growing trend towards minimally invasive procedures has fueled the adoption of Spine Biologics, as these interventions offer enhanced healing potential and reduced recovery times. The continuous efforts of key industry players in research and development, striving to introduce novel and effective biologic solutions, further contribute to the market's expansion. As patient and healthcare professional preferences shift towards biologically-driven interventions, the Spine Biologics market is poised for sustained growth, supported by a diverse product portfolio catering to specific spinal conditions such as degenerative disc disease, spinal fusions, and fractures.

The spinal allografts segment was the dominant force in the market, contributing to 59% of the global revenue in 2023. This prominence can be attributed to the myriad benefits associated with allograft usage. The increasing adoption of allografts over autografts is rapid, driven by their properties such as osteoconductivity and immediate structural support. Additionally, the utilization of allografts eliminates the need for a secondary surgery to harvest bone, resulting in reduced surgery time and improved wound healing. The spinal allografts segment is further divided into two types: machined bones allograft and demineralized bone matrix.

Conversely, the cell-based matrix segment is poised to experience the most rapid growth during the forecast period. The anticipated support for this growth comes from the availability of cell-based matrices from various companies, including DePuySynthes, NuVasive, and Stryker. Commercially available cell-based matrices include ViviGen, Osteocel Pro, Bio4, among others.

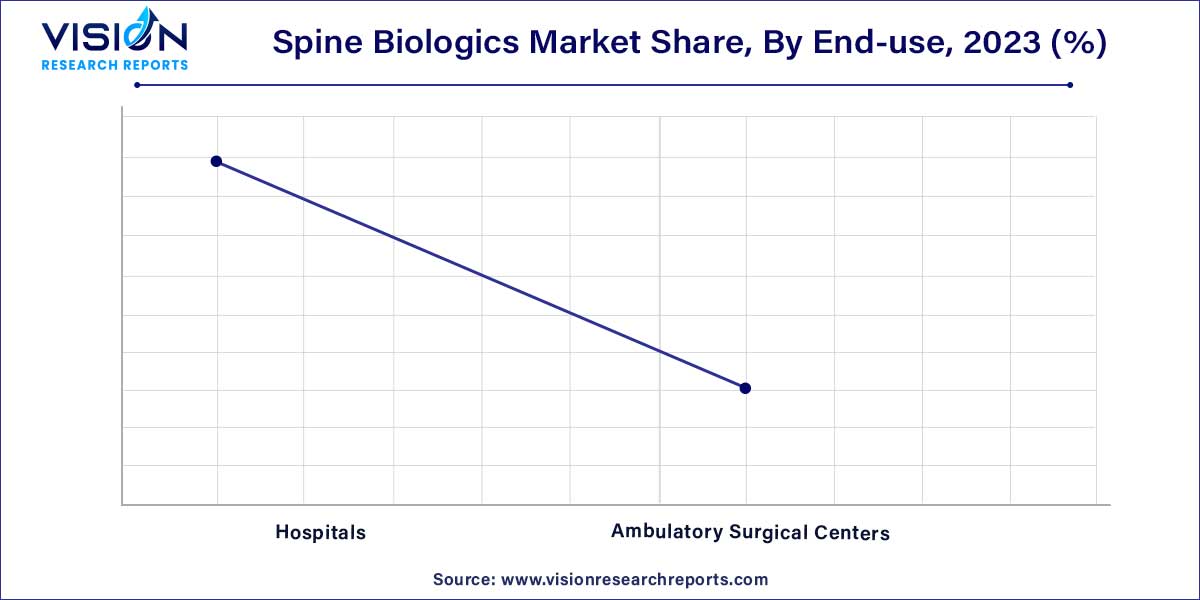

The hospital segment emerged as the market leader in 2023, primarily driven by the increased prevalence of spine fusion surgeries conducted within these facilities. The presence of renowned hospitals such as George Washington University Hospital and Massachusetts General Hospital, offering specialized services for spinal surgeries, is anticipated to further propel the growth of this segment throughout the forecast period.

Meanwhile, the outpatient facilities segment is poised for significant growth in the coming years. These facilities encompass ambulatory surgery centers (ASC) or outpatient surgery centers (OSC). The surge in demand for minimally invasive surgeries, continuous technological advancements in surgical devices and equipment, and the autonomy granted to surgeons in selecting such equipment are key factors expected to drive the growth of this segment. Notably, there is a considerable number of outpatient facilities providing spine surgeries, with Cardinal Health reporting over 160 outpatient spine surgery facilities in the U.S. in 2021. Moreover, as indicated by the University Pain Centers in September 2023, there are over 5,000 Medicare-certified ambulatory surgery centers across the U.S., covering major surgical specialties, including orthopedic and spine surgeries. Consequently, the substantial presence of outpatient facilities offering spine surgeries is anticipated to foster robust growth in this segment.

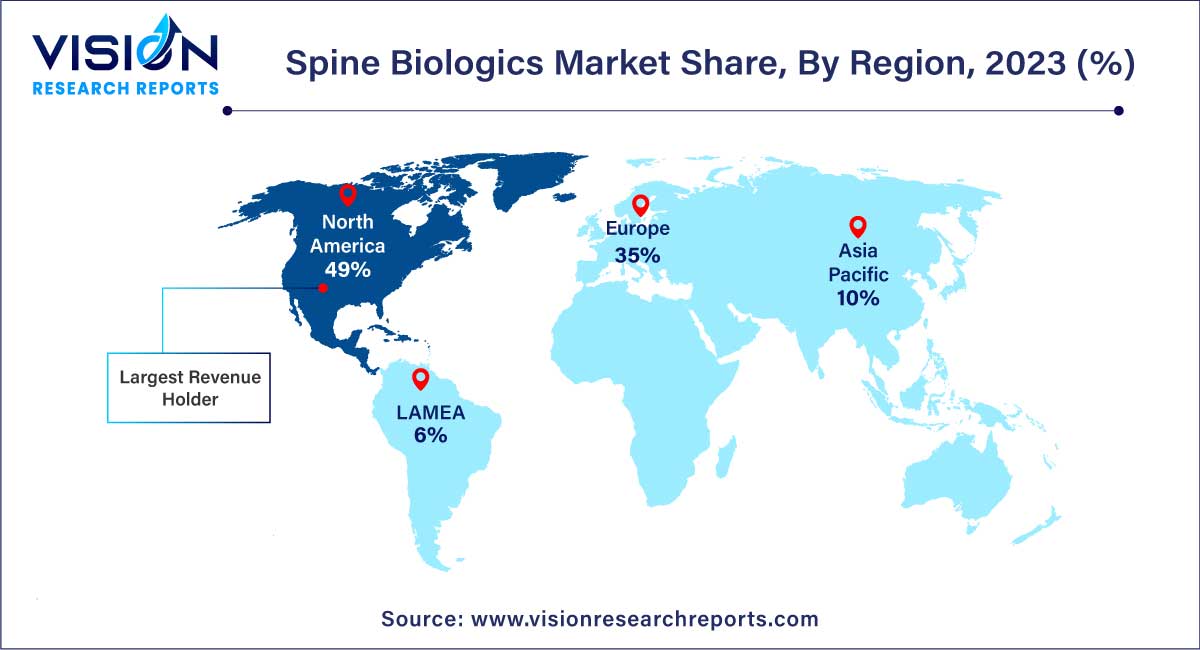

In 2023, North America asserted its dominance in the market, holding a substantial 49% share. The region's market growth is credited to a stable economic environment, an uptick in the adoption of minimally invasive surgeries, and a rising incidence of spine disorders such as disc-related issues, spinal stenosis, and spondylolisthesis. Notably, an article from the American Medical Association in May 2022 highlighted the commonality of lumbar spinal stenosis, affecting around 11% of older adults in the U.S. The presence of key industry players like Orthofix Holdings, Inc., Stryker, and NuVasive, Inc. in the U.S. further augments North America's strong position, supporting regional expansion.

On the other hand, Asia Pacific is poised for the fastest growth in the market. This projection is underpinned by factors such as a sizable patient pool, increasing awareness among patients and surgeons regarding the benefits of biologics, advancements in healthcare infrastructure, growing healthcare expenditure, and a surge in the prevalence of spine injuries, particularly due to road accidents. The region's rising incidence of obesity, attributed to sedentary lifestyles and changing patterns, is also expected to contribute to the industry's growth in the coming years.

By Product

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others