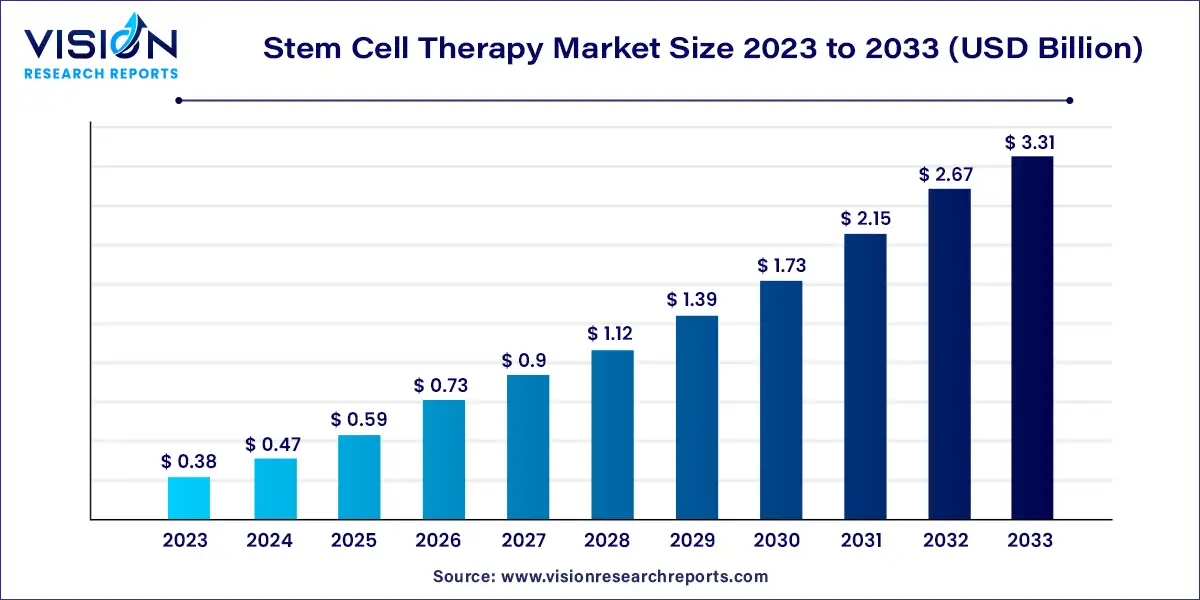

The global stem cell therapy market size was valued at USD 0.38 billion in 2023 and it is predicted to surpass around USD 3.31 billion by 2033 with a CAGR of 24.18% from 2024 to 2033.

The stem cell therapy market is witnessing significant growth and evolution, driven by advancements in regenerative medicine and increasing demand for innovative treatment options. Stem cell therapy, harnessing the remarkable potential of stem cells to regenerate and repair damaged tissues and organs, has emerged as a promising approach in medical research and clinical practice.

The growth of the stem cell therapy market is propelled by an increasing prevalence of chronic diseases and degenerative disorders worldwide drives the demand for innovative treatment options. Stem cell therapy offers promising solutions for conditions such as cardiovascular diseases, neurodegenerative disorders, orthopedic injuries, and autoimmune conditions, as it harnesses the regenerative potential of stem cells to repair damaged tissues and organs. Secondly, ongoing advancements in research and technology expand the scope of stem cell therapy applications, including tissue engineering, organ transplantation, and cell-based therapies for cancer and genetic disorders.

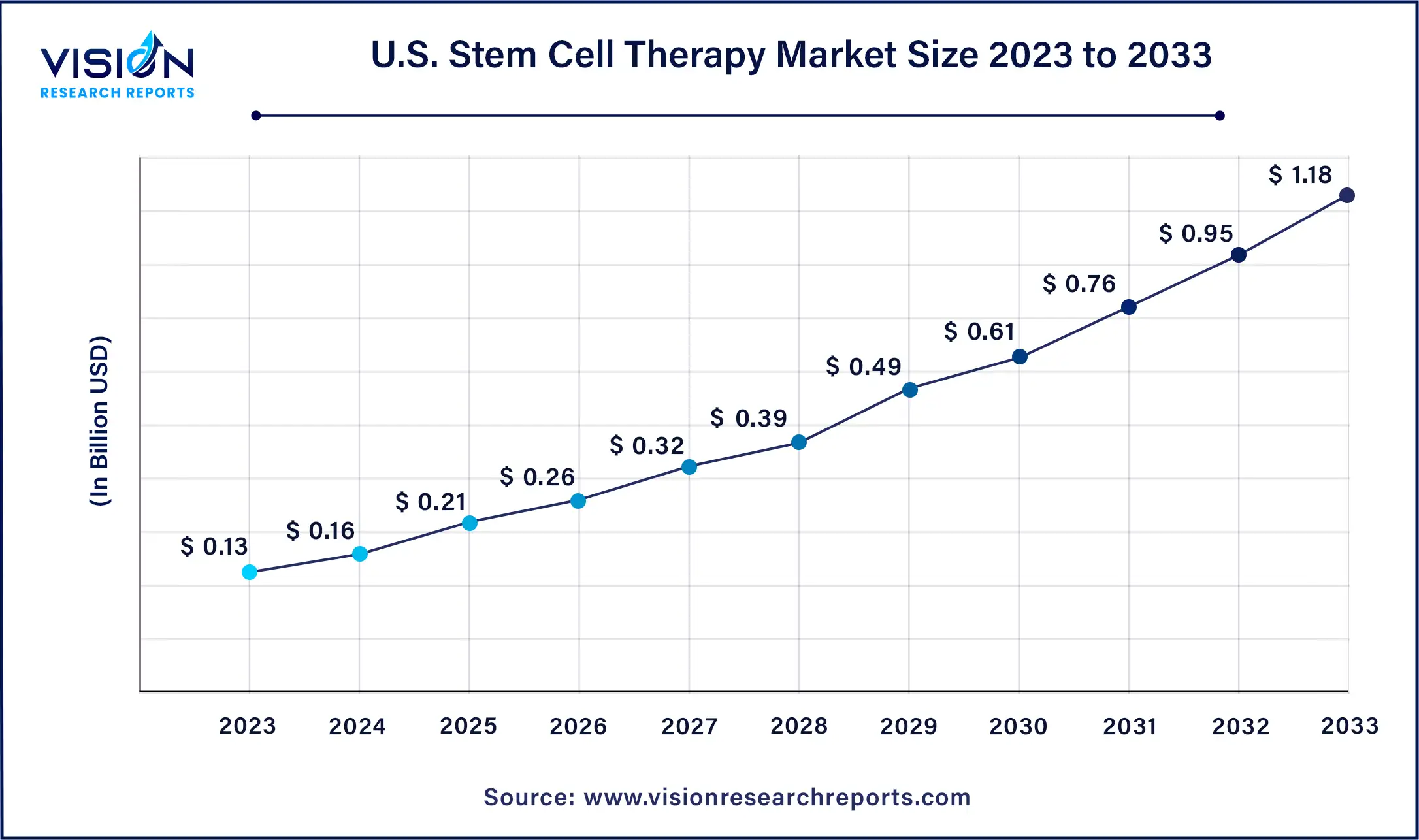

The U.S. stem cell therapy market size was estimated at around USD 0.13 billion in 2023 and is projected to hit around USD 1.18 billion by 2033, growing at a CAGR of 24.18% from 2024 to 2033.

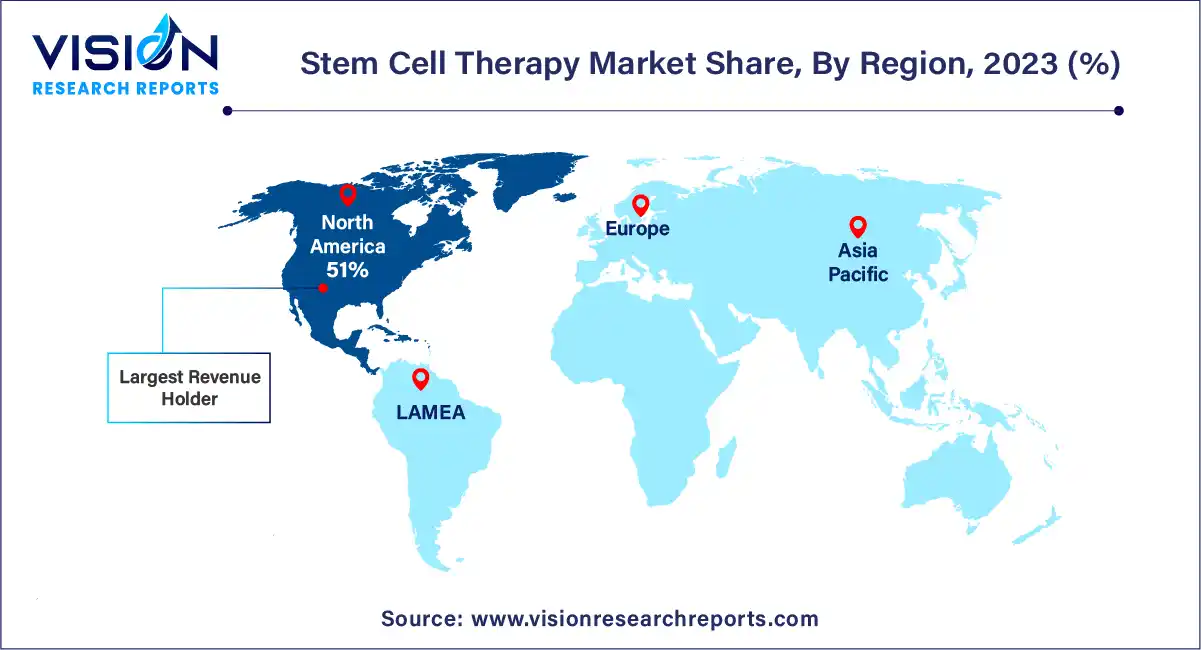

In 2023, North America dominated the stem cell therapy market, capturing a revenue share of 51%, and is poised to experience the fastest compound annual growth rate (CAGR) during the forecast period. This growth is facilitated by several factors, including favorable regulatory frameworks, increasing rates of chronic diseases, and advancements in technology. Moreover, robust research and development activities are fueled by substantial funding from institutions and private organizations, driving innovation in stem cell therapy. For example, the California Institute for Regenerative Medicine (CIRM) authorized funding totaling approximately USD 89 million for initiatives related to its Clinical and Translation programs in April 2023. Additionally, expanding investments in healthcare infrastructure and the growing demand for regenerative medicine solutions contribute to market expansion, positioning North America at the forefront of the global market with promising growth prospects.

Meanwhile, Europe's stem cell therapy market is experiencing robust growth driven by escalating research activities and rising demand for regenerative medicine. Major players such as Novartis, Mesoblast, and TiGenix are making significant investments in technology and infrastructure to capitalize on this growth trajectory. For instance, in January 2024, CellVoyant secured USD 8.11 million in seed funding aimed at accelerating the development of innovative stem cell therapies. Market expansion is further propelled by supportive government initiatives and collaborations between academic institutions and industry players. With an estimated market value reaching billions, Europe's stem cell therapy sector continues to attract substantial investments and foster innovation.

Segmented by therapy type, the market comprises allogeneic stem cell therapy and autologous stem cell therapy. Allogeneic stem cell therapies dominated the market in 2023, holding a substantial revenue share of 69%. This leadership position stems from various factors driving its expansion. Primarily, the burgeoning landscape of research and clinical trials in this realm propels growth. As scientific knowledge deepens and technology progresses, there is a noticeable uptick in investigations into allogeneic stem cell therapies. This heightened emphasis on research and development yields novel treatments and therapies, fostering market expansion.

Furthermore, increased collaboration among academic institutions, biotech firms, and pharmaceutical companies fosters innovation. A case in point is the acquisition of Appia Bio Inc., a biotech company, by Gilead Sciences subsidiary Kite in August 2021. The partnership aims to jointly explore and develop new hematopoietic stem cell (HSC)-derived therapies targeting hematopoietic cancers. This collaboration leverages the expertise of both entities to enhance cell delivery, thereby improving cancer treatment outcomes.

The market is witnessing notable expansion driven by significant strides in clinical trials and research. As scientists delve into the potential of autologous stem cells across various medical conditions, anticipation fuels innovation. For example, in August 2022, a medical team at the National Institutes of Health achieved a milestone by successfully implanting a tissue patch derived from a patient's cells, a step toward treating advanced dry age-related macular degeneration (AMD). This pioneering therapy, derived from induced Pluripotent Stem (iPS) cells, resulted from collaboration between the Ocular and Stem Cell Translational Research Section. The growing number of clinical trials centered on harnessing a patient's stem cells for regenerative purposes underscores the mounting interest and investment in this medical domain. With each advancement and successful trial, the potential of autologous stem cell treatments expands, offering patients worldwide newfound hope and life-altering opportunities.

Segmented by therapeutic application, the market encompasses oncology, cardiovascular disease (CVD), musculoskeletal disorders, and others. The "others" segment took the lead in 2023, commanding a substantial revenue share of 73%, driven by ongoing research and clinical advancements. Stem cell therapy holds promise for addressing blood disorders like ß-thalassemia and sickle cell disease by tackling underlying genetic defects and replenishing healthy blood cells. A recent study spanning 2000 to 2021 revealed a notable 13.7% global increase in births of infants affected by sickle cell disease, underlining the urgent need for effective treatments. Hematopoietic stem cell transplantation techniques offer potential for improved outcomes and enhanced quality of life for patients.

Likewise, in neurological disorders such as Cerebral adrenoleukodystrophy, Parkinson's disease, Alzheimer's disease, and spinal cord injuries, stem cell therapy presents regenerative medicine opportunities. A study published in The Lancet Neurology projects a significant rise in Parkinson's disease cases by 2040, emphasizing the urgency for effective treatments. Stem cells can replace damaged neurons, promote tissue repair, and modulate inflammatory responses, offering hope for disease modification and functional recovery. As research progresses and clinical trials yield promising results, the market for stem cell therapies in these segments is poised for continued growth, potentially transforming treatment paradigms worldwide.

The musculoskeletal disorders segment is projected to register a significant compound annual growth rate (CAGR) of 19.72% during the forecast period. Driven by the rising prevalence of conditions like osteoarthritis, rheumatoid arthritis, and spinal disorders, this market segment experiences heightened interest in stem cell therapy. According to a report by the World Health Organization (WHO), 1.71 billion people globally suffer from musculoskeletal conditions, making it a leading cause of disability worldwide. Stem cell-based therapies offer a promising alternative to traditional treatments, providing potential for long-term relief and enhanced quality of life for patients grappling with these debilitating conditions. Consequently, patients and healthcare providers are increasingly optimistic about the transformative impact of stem cell therapies on managing and treating musculoskeletal disorders.

By Therapy Type

By Therapeutic Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others