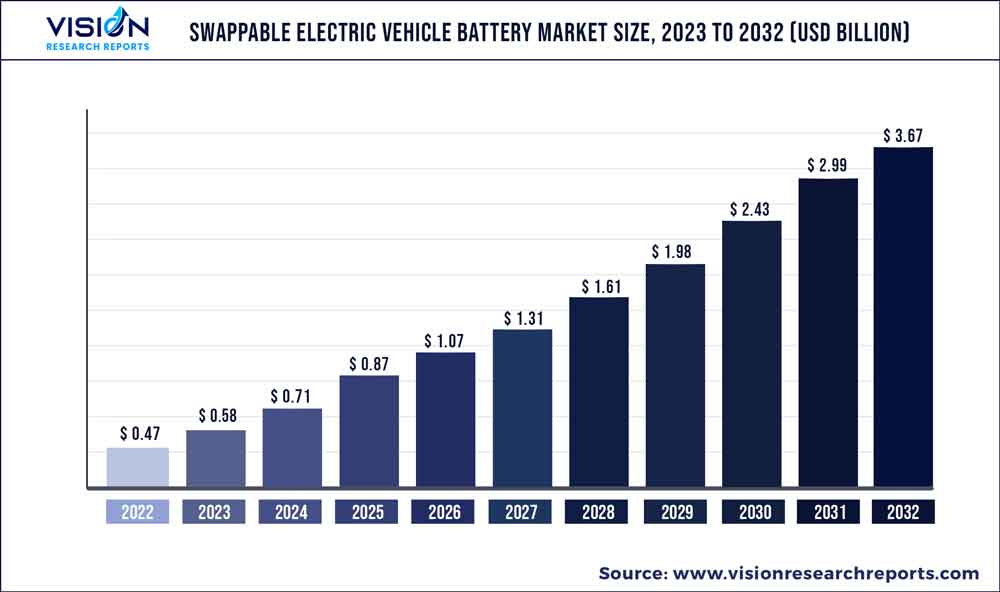

The global swappable electric vehicle battery market surpassed USD 0.47 billion in 2022 and is expected to reach around USD 3.67 billion by 2032, growing at a CAGR of 22.81% from 2023 to 2032. The swappable electric vehicle battery market in the United States was accounted for USD 58.2 million in 2022.

Key Pointers

Report Scope of the Swappable Electric Vehicle Battery Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 47.08% |

| Growth rate from 2023 to 2032 | CAGR of 22.81% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Contemporary Amperex Technology Co.; Limited, NIO Inc.; GOGORO INC.; Silence Urban Ecomobility; Honda Motor Co., Ltd.; SUN Mobility Private Ltd.; ONiON Mobility; Swap Energi Indonesia; Bounce; Okinawa Autotech International Private Limited. |

The rising adoption of electric vehicles with swappable batteries by consumers, as they are not required to pay the high upfront cost of fixed batteries is propelling the market growth. This trend is fueled by various factors, including rising fuel expenses, government incentives, and lower carbon emissions.

To reduce carbon emissions and achieve net-zero targets, governments worldwide are implementing strategic initiatives. Many countries have committed to reaching net-zero emissions by mid-century or even earlier and are participating in international agreements to enhance their efforts. For instance, as per the Mission Zero plan released in 2019, the Netherlands government has set a target for all new buses utilized in public transportation to emit zero harmful exhaust gases by 2025. This implies that the buses must either be battery electric or hydrogen fuel cell electric to comply with the regulation. Hence, ongoing government initiatives to achieve net zero emission goals and the environmental benefits of rechargeable batteries are driving the adoption of swappable electric vehicle batteries, thereby propelling the market's growth.

Furthermore, various companies started producing swappable batteries for two- and three-wheel electric vehicles. For instance, GOGORO INC., a manufacturer of electric scooters, battery-swapping infrastructure, and smart mobility management systems, collaborated with ProLogium Technology, a prominent player in solid-state battery technology, to develop a solid-state lithium ceramic battery for two-wheeler battery swapping. The newly developed solid-state battery technology would be seamlessly integrated with the existing Gogoro swapping network and vehicles.

The declining cost of lithium-ion batteries is expected to drive demand for swappable batteries for electric vehicles. As per a study conducted by the Massachusetts Institute of Technology (MIT) and the Energy and Environmental Science Journal, the reduction in lithium-ion battery prices could result in a significant drop in the prices of swappable batteries, which would make them more economical and increase their demand. The study suggests that more than 50% of this cost reduction is attributed to research and development efforts, including funding from both private and government segments.

The outbreak of the COVID-19 pandemic severely impacted several economies. In addition, increased fuel prices owing to the Russia-Ukraine conflict are expected to prompt consumers to adopt electric vehicles considering the lower lifecycle cost of an electric vehicle as compared to internal combustion engine (ICE) vehicles, which is ultimately creating more demand for swappable electric vehicle batteries. Furthermore, aggressive investments in innovation and subsequent advances in battery technology are expected to create new opportunities for the growth of the swappable electric vehicle battery industry.

Battery Type Insights

The Lithium-ion segment led the market and accounted for more than 94.03% share of the global revenue in 2022. The segment is also anticipated to expand at the highest CAGR during the forecast period. Lithium-ion batteries have become popular in electric vehicles due to their rechargeable feature. Compared to lead-acid batteries, they offer several advantages such as being significantly lighter by 50% to 60% in weight and having a higher energy density, which allows battery manufacturers to reduce the battery pack's overall and size save space. Lithium-ion batteries are preferred by electric vehicle manufacturers as they are efficient and can be fully charged within a short span of one to three hours. With these benefits, the adoption of lithium-ion swappable batteries by electric vehicle manufacturers has been increasing rapidly.

The lead acid segment is expected to register significant growth over the forecast period. Lead acid batteries are a commonly used type of rechargeable battery with a significant capacity. They are known for their reliability and low cost per watt, making them an attractive option for various applications. For instance, in applications where a large capacity is required, there are only a few battery types that offer cost-effectiveness equivalent to that of lead acid batteries. Therefore, lead acid batteries are widely used in electric vehicles and automobiles.

Capacity Insights

The >5 kWh segment dominated the market and accounted for more than 62.04% share of the global revenue in 2022. Swappable batteries with a capacity of >5 kWh provide convenience and flexibility and improve efficiency owing to their higher capacity. In addition, swappable batteries with a capacity of >5 kWh such as 50 kWh offer greater flexibility for electric vehicles as they can be swapped quickly, increasing productivity, and reducing downtime. In addition, the use of large-capacity batteries can also help reduce greenhouse gas emissions, increase energy independence, and improve grid stability.

The <5 kWh segment is expected to grow at the highest CAGR over the forecast period. Rising development of swappable electric vehicle batteries with a capacity of <5-kWh for applications such as electric bikes and scooters is propelling the segment’s growth. For instance, in March 2022, Gogoro Inc. collaborated with ProLogium Technology, a prominent player in solid-state battery technology, to develop a solid-state lithium ceramic battery for two-wheeler battery swapping. The newly developed solid-state battery technology would be seamlessly integrated with the existing Gogoro swapping network and vehicles. The battery has a target capacity of 2 kWh.

Application Insights

The passenger cars segment accounted for over 48.07% share of the market in 2022. The rising sales of electric passenger cars such as SUVs, sedans, hatchbacks, and others (XUV, station wagon, and minivan) are driving the growth of the segment. The key market players are entering into strategic partnerships to offer electric vehicles with swappable batteries. For instance, in January 2022, Geely and Lifan announced a joint venture called Maple to release “Maple 60S”, the first smart battery-swappable electric car. Such launches are creating significant growth opportunities for the market.

The two-wheeler segment is expected to grow at the highest CAGR over the forecast period. According to the "Global EV Outlook 2021" report from the International Energy Agency (IEA), electric two-wheelers make up a significant proportion of the world's electric vehicles, with a current estimated stock of around 290 million, and this number continues to grow. The popularity of two-wheelers among electric vehicles is leading to rising demand for swappable batteries in this segment.Strategic initiatives undertaken by the key market players to launch swappable battery two-wheelers are further fueling the segment’s growth.

Regional Insights

The Asia Pacific segment dominated the market and accounted for more than a 47.08% share of the global revenue in 2022. The vast presence of swappable electric vehicle battery manufacturers such as Gogoro Inc., Nio Inc, Honda Motor Co., Ltd., and SUN Mobility Private Ltd., among others is attributed to the market growth. Countries such as China, Japan, Taiwan, and India are the hub of electric vehicles and are heavily investing in the development of swappable batteries. In January 2022, the Chinese Government announced its plan to invest in the implementation of electric vehicle (EV) infrastructure to meet its goal of supporting 20 million EVs on the road by 2025. Besides, the Indian government has actively been promoting the adoption of EVs as a part of its goal to reduce its dependence on fossil fuels and decrease emissions. At the 26th Conference of the Parties (COP26) held in November 2021, India committed to achieve net zero emissions by 2070.

The demand for swappable electric batteries in Europe is being propelled by several factors, such as increasing concerns regarding climate change, technological advancements, and supportive government measures aimed at promoting sustainability and curbing greenhouse gas emissions. For instance, in October 2022, Next.e.GO Mobile SE, an electric vehicle manufacturer, launched e.Xpress, a new, small commercial last-mile urban delivery EV featuring an exchangeable battery to facilitate zero-emission urban delivery and business fleets.

Swappable Electric Vehicle Battery Market Segmentations:

By Battery Type

By Capacity

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Battery Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Swappable Electric Vehicle Battery Market

5.1. COVID-19 Landscape: Swappable Electric Vehicle Battery Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Swappable Electric Vehicle Battery Market, By Battery Type

8.1. Swappable Electric Vehicle Battery Market, by Battery Type, 2023-2032

8.1.1 Lead Acid

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Lithium-ion

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Others (Nickel-Metal Hydride, Sodium Ion)

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Swappable Electric Vehicle Battery Market, By Capacity

9.1. Swappable Electric Vehicle Battery Market, by Capacity, 2023-2032

9.1.1. < 5 kWh

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. > 5 kWh

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Swappable Electric Vehicle Battery Market, By Application

10.1. Swappable Electric Vehicle Battery Market, by Application, 2023-2032

10.1.1. Two-Wheeler

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Passenger Cars

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Commercial Light Duty Vehicles

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Swappable Electric Vehicle Battery Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.1.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.2.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.3.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Capacity (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. Contemporary Amperex Technology Co., Limited

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. NIO Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. GOGORO INC.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Silence Urban Ecomobility

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Honda Motor Co., Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. SUN Mobility Private Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. ONiON Mobility

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Swap Energi Indonesia

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Bounce

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Okinawa Autotech International Private Limited.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others