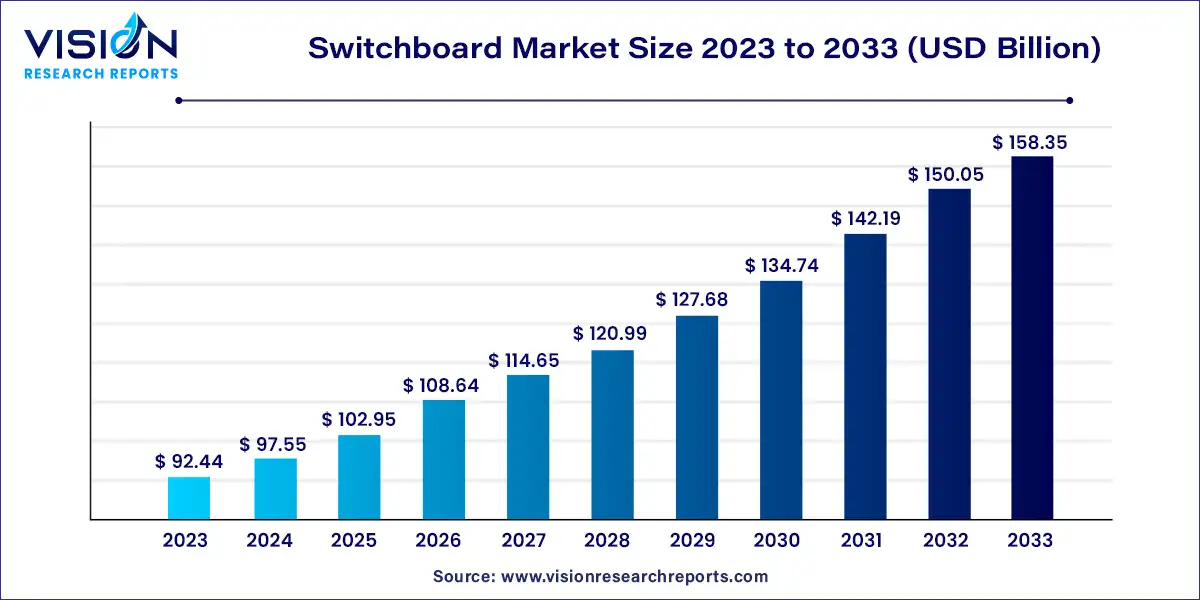

The global switchboard market size was estimated at around USD 92.44 billion in 2023 and it is projected to hit around USD 158.35 billion by 2033, growing at a CAGR of 5.53% from 2024 to 2033.

The global switchboard market is poised for significant growth driven by rising demand for electricity, advancements in infrastructure, and the rapid expansion of industrial sectors. Switchboards, essential components in electrical distribution systems, manage the flow of power within various applications, ensuring safety and efficiency.

The switchboard market is experiencing robust growth due to several key factors. Foremost among these is the increasing global demand for electricity, driven by rapid urbanization and industrialization, particularly in developing regions. Additionally, significant advancements in smart grid technology and automation are enhancing the functionality and efficiency of switchboards, making them indispensable in modern electrical distribution systems. Governments' heavy investment in infrastructure projects further propels market expansion, as new residential, commercial, and industrial constructions require advanced electrical distribution solutions. Together, these factors create a dynamic environment fostering substantial growth in the switchboard market.

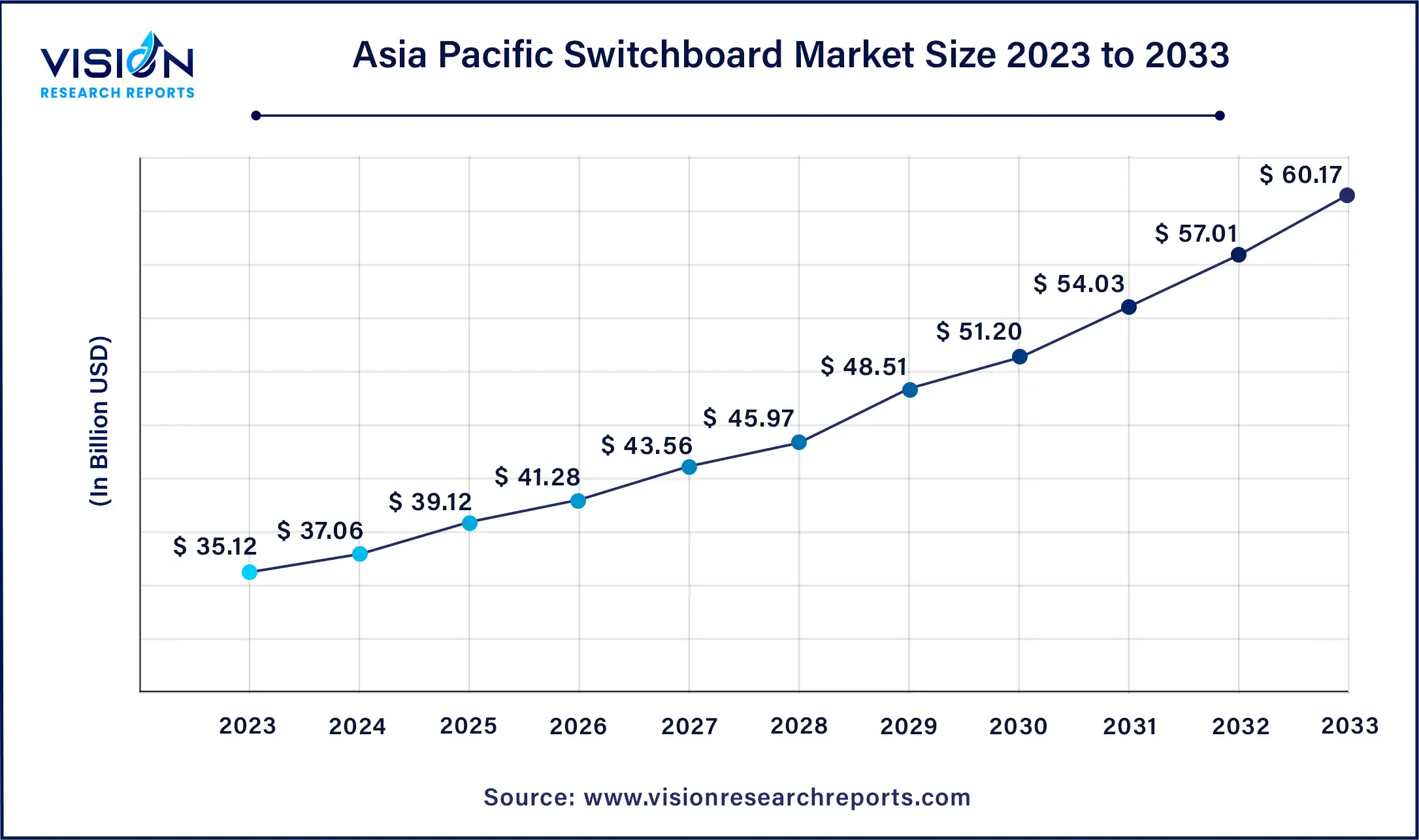

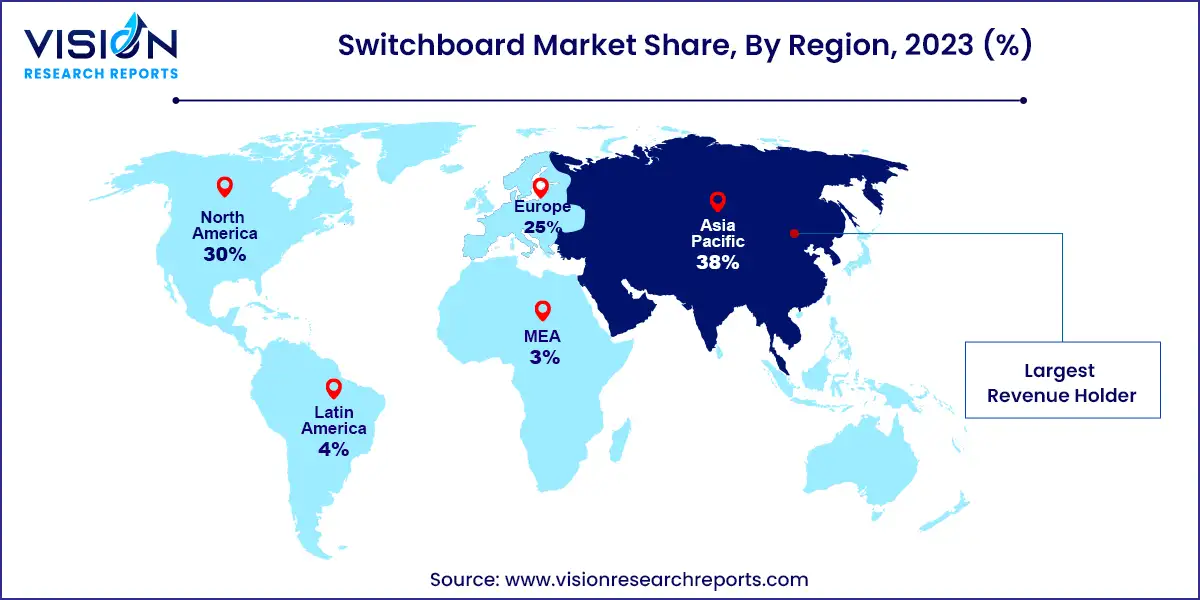

The Asia Pacific switchboard market size was valued at around USD 35.12 billion in 2023 and is projected to hit around USD 60.17 billion by 2033, growing at a CAGR of 5.53% from 2024 to 2033.

The Asia Pacific region holds the dominant share of the global switchboard market, fueled by a combination of factors reshaping industrial, commercial, and residential sectors. Urbanization has surged in Asia Pacific, driving the construction of new buildings, industrial complexes, and infrastructure projects. As a manufacturing and production hub for industries like electronics, automotive, and manufacturing, the region relies heavily on robust electrical systems, thereby amplifying the demand for reliable switchboards to maintain uninterrupted operations.

Meanwhile, the switchboard market in Europe is experiencing rapid expansion, propelled by a convergence of factors reflecting technological advancements and evolving market needs. Europe is undergoing a widespread digital transformation across various industries, prompting increased adoption of smart technologies. Consequently, there is a heightened demand for advanced switchboards equipped with integrated digital capabilities, which serve as the cornerstone of modern control systems, enhancing efficiency and connectivity. Furthermore, Europe has been a frontrunner in the adoption of renewable energy, particularly wind and solar.

In 2023, the high-voltage segment held the largest share of the market, and it is anticipated to continue its dominance throughout the forecast period. High-voltage switchboards are integral to large-scale industrial and utility applications, managing the distribution of electrical power at high voltages, typically above 1,000 volts. These switchboards are essential in environments where significant amounts of power need to be controlled and distributed, such as power plants, transmission and distribution networks, and large industrial facilities. They are designed to handle higher currents and offer robust safety features, ensuring reliable operation under demanding conditions. The increasing investments in renewable energy projects and the modernization of aging electrical infrastructure in many parts of the world are driving the demand for high-voltage switchboards.

In contrast, low-voltage switchboards operate at voltages up to 1,000 volts and are widely used in residential, commercial, and light industrial applications. They are essential for managing electrical distribution within buildings, including homes, offices, and retail spaces, ensuring that electrical power is safely and efficiently distributed to various devices and appliances. The growing urbanization and the expansion of smart building technologies are significantly boosting the demand for low-voltage switchboards. These switchboards often incorporate advanced features such as smart metering, remote monitoring, and energy management systems, which align with the increasing emphasis on energy efficiency and smart grid integration. Furthermore, the ongoing development of infrastructure projects, particularly in emerging economies, is expected to further propel the growth of the low-voltage switchboard segment

In 2023, the IEC segment held the largest share, a trend expected to persist throughout the projection period. The IEC standard, recognized internationally, provides specifications for the design, performance, and testing of switchboard components and systems. It ensures interoperability and compatibility of switchboards across different countries and facilitates global trade by establishing uniform technical requirements. Manufacturers complying with the IEC standard benefit from broader market access and greater acceptance of their products in regions where IEC standards are adopted, including Europe, Asia-Pacific, and many other parts of the world. The IEC standard covers various aspects of switchboard design, including safety, reliability, and environmental considerations, contributing to the overall quality and functionality of switchboard products.

On the other hand, the ANSI standard, predominantly followed in the United States, outlines guidelines and requirements for switchboard design, construction, and performance. ANSI standards are developed collaboratively by industry stakeholders and regulatory bodies to ensure the safety and reliability of electrical equipment, including switchboards, within the U.S. market. Adherence to ANSI standards is essential for manufacturers seeking to market their switchboard products in the United States and ensures compliance with regulatory requirements set forth by agencies such as the Occupational Safety and Health Administration (OSHA) and the National Electrical Code (NEC). Switchboard products meeting ANSI standards undergo rigorous testing and certification processes to demonstrate their conformity to established performance criteria, instilling confidence in end-users regarding their safety and reliability.

The industrial segment held the dominant share in 2023. Industrial end-users encompass a wide range of industries, including manufacturing, energy, oil and gas, mining, and infrastructure development. In industrial settings, switchboards play a critical role in managing the distribution of electrical power within complex and often high-demand environments. These switchboards are designed to withstand harsh operating conditions, such as temperature fluctuations, moisture, and vibration, while ensuring the reliable and efficient delivery of electricity to machinery, equipment, and production processes. Industrial switchboards are typically customized to meet the specific needs and requirements of different industrial applications, offering features such as fault protection, remote monitoring, and scalability to accommodate future expansions or upgrades.

In the commercial sector, switchboards serve buildings and facilities such as offices, retail stores, educational institutions, healthcare facilities, and entertainment venues. Commercial switchboards are designed to support the electrical distribution needs of diverse environments, ranging from small office buildings to large shopping complexes. They ensure the safe and reliable distribution of power to lighting, heating, ventilation, air conditioning (HVAC), communication systems, and other electrical loads essential for commercial operations. Additionally, commercial switchboards often incorporate advanced features such as energy management systems, smart metering, and integration with building automation and control systems (BACS) to optimize energy efficiency, reduce operating costs, and enhance occupant comfort and safety.

By Type

By Product Standard

By End Users

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Switchboard Market

5.1. COVID-19 Landscape: Switchboard Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Switchboard Market, By Type

8.1. Switchboard Market, by Type, 2024-2033

8.1.1 Low-Voltage

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Middle-Voltage

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. High-Voltage

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Switchboard Market, By Product Standard

9.1. Switchboard Market, by Product Standard, 2024-2033

9.1.1. IEC Standard

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. ANSI Standard

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Switchboard Market, By End Users

10.1. Switchboard Market, by End Users, 2024-2033

10.1.1. Industrial

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Residential

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Commercial

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Switchboard Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.1.3. Market Revenue and Forecast, by End Users (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End Users (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End Users (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.2.3. Market Revenue and Forecast, by End Users (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End Users (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End Users (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End Users (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End Users (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.3.3. Market Revenue and Forecast, by End Users (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End Users (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End Users (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End Users (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End Users (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.4.3. Market Revenue and Forecast, by End Users (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End Users (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End Users (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End Users (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End Users (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.5.3. Market Revenue and Forecast, by End Users (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End Users (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Product Standard (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End Users (2021-2033)

Chapter 12. Company Profiles

12.1. ABB Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Mitsubishi Electric.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Schneider Electric.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Emerson Process Management.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Rockwell Automation.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Eaton

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Siemens.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Powerwell

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Kounis.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Gedac Electric

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others