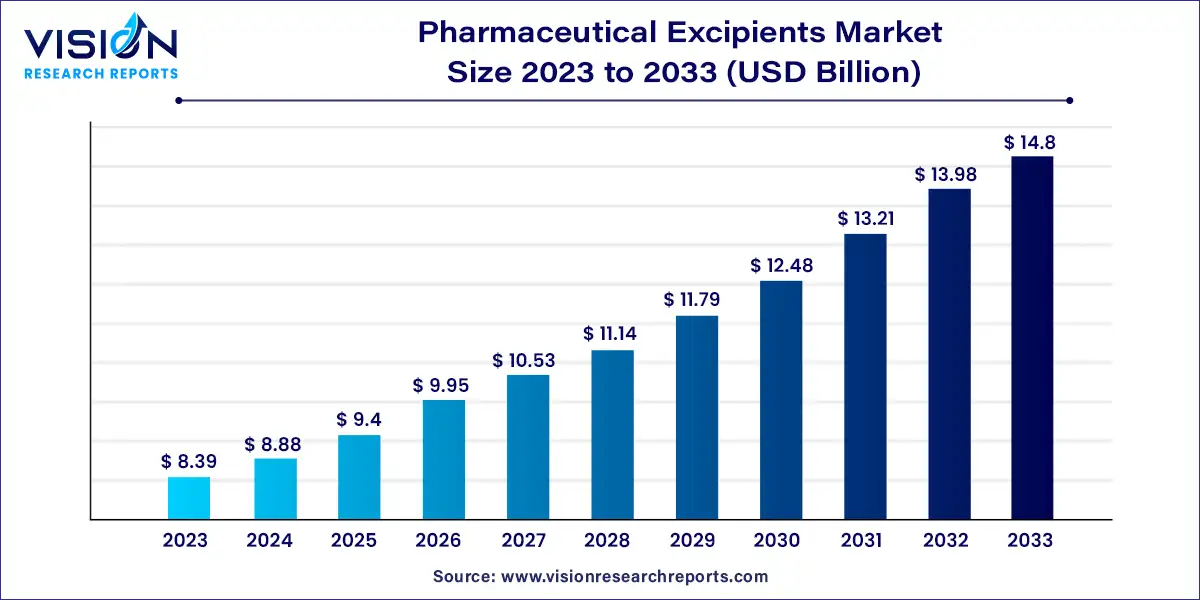

The global pharmaceutical excipients market size was estimated at around USD 8.39 billion in 2023 and it is projected to hit around USD 14.8 billion by 2033, growing at a CAGR of 5.84% from 2024 to 2033.

The pharmaceutical excipients market plays a crucial role in the global pharmaceutical industry, serving as a foundation for the production of effective and stable medications. Excipients are inactive substances used as carriers for the active ingredients of a medication. These materials, which can include fillers, binders, disintegrants, and preservatives, help to ensure that drugs are delivered effectively within the body, enhancing their stability, bioavailability, and patient acceptability.

The growth of the pharmaceutical excipients market is primarily driven by an increasing demand for innovative drug delivery systems, the rising prevalence of chronic diseases, and the expansion of the generic drug industry. As pharmaceutical companies strive to develop more effective and patient-friendly formulations, the need for advanced excipients that enhance drug stability, bioavailability, and delivery is becoming increasingly critical. Additionally, the growing focus on biologics and biosimilars is fueling the demand for specialized excipients that can support the unique requirements of these complex drugs. Furthermore, the rapid expansion of the global pharmaceutical industry, particularly in emerging markets, is providing a significant boost to the excipients market, as manufacturers seek to meet the rising demand for both new and existing medications.

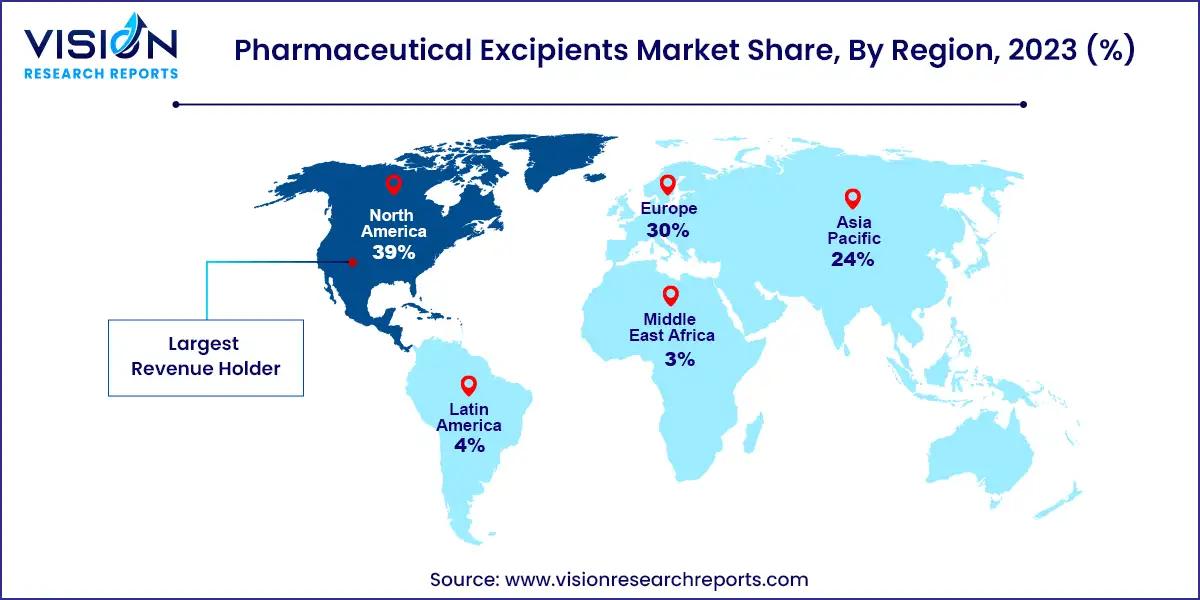

North America has accounted 39% revenue share in 2023. In North America, the market is characterized by advanced pharmaceutical manufacturing capabilities and a high demand for innovative drug delivery systems. The presence of major pharmaceutical companies and robust regulatory frameworks contribute to a strong focus on high-quality excipients that meet stringent standards. The region's emphasis on research and development drives continuous innovation in excipient technologies, supporting the development of sophisticated formulations, including biologics and novel drug delivery systems.

| Attribute | North America |

| Market Value | USD 3.27 Billion |

| Growth Rate | 5.84% CAGR |

| Projected Value | USD 5.77 Billion |

In Europe, the pharmaceutical excipients market benefits from a well-established pharmaceutical industry and a growing focus on regulatory compliance and sustainability. European countries are increasingly adopting green chemistry practices, which are influencing the development of eco-friendly excipients. Additionally, the region's emphasis on personalized medicine and advanced drug delivery systems is fostering demand for specialized excipients that cater to these evolving needs. The market is further supported by collaborations between pharmaceutical companies and excipient manufacturers, aiming to enhance the quality and performance of pharmaceutical products.

The Asia-Pacific region is experiencing rapid growth in the pharmaceutical excipients market, driven by the expanding pharmaceutical industry in countries like China and India. The rise in healthcare spending, increasing prevalence of chronic diseases, and a growing emphasis on generic drug production are key factors fueling this growth. The region's large and diverse population also presents opportunities for the development of excipients that cater to various therapeutic needs. Additionally, the burgeoning pharmaceutical manufacturing sector in Asia-Pacific is attracting investments and partnerships, further boosting the market.

In 2023, fillers & diluents hold the largest market share. In the global pharmaceutical excipients market, fillers and diluents play a crucial role in drug formulation by adding bulk to solid dosage forms, such as tablets and capsules, to achieve the desired size and shape. These excipients are essential for ensuring consistent drug dosing, particularly in cases where the active pharmaceutical ingredient (API) is present in small quantities. Common fillers and diluents include lactose, microcrystalline cellulose, and starch, which not only increase the volume of the dosage form but also contribute to the drug's overall stability and bioavailability. The choice of filler or diluent depends on various factors, including the compatibility with the API, the desired release profile, and the manufacturing process used.

Binders, another vital category of excipients in the pharmaceutical market, are used to hold the ingredients of a tablet together, ensuring that the tablet remains intact during production, packaging, and storage, and disintegrates appropriately upon administration. Binders work by providing mechanical strength to tablets, preventing them from breaking apart prematurely. They can be either natural, such as starch and cellulose derivatives, or synthetic, like polyvinylpyrrolidone (PVP). The selection of an appropriate binder is critical for the production of high-quality tablets that meet the necessary standards for hardness, disintegration, and dissolution. Binders also play a role in enhancing the bioavailability of the drug, ensuring that the active ingredient is released in a controlled manner for optimal therapeutic effect.

The lactose-based excipients segment dominated the market with the largest market share in 2023. In the global pharmaceutical excipients market, lactose-based excipients are among the most commonly used substances due to their versatility and favorable properties. Lactose, a natural sugar derived from milk, serves as an ideal filler and diluent in tablet and capsule formulations. Its high solubility, compressibility, and compatibility with a wide range of active pharmaceutical ingredients (APIs) make it a preferred choice for manufacturers. Lactose-based excipients are particularly valued for their ability to enhance the stability and bioavailability of drugs, ensuring consistent therapeutic effects. Additionally, they are available in various forms, such as anhydrous lactose and spray-dried lactose, allowing for tailored solutions that meet specific formulation requirements. The widespread use of lactose in oral solid dosage forms underscores its importance in the pharmaceutical industry.

Cellulose-based excipients also hold a significant place in the pharmaceutical excipients market, offering unique advantages in drug formulation. Derived from plant sources, cellulose and its derivatives, such as microcrystalline cellulose (MCC) and hydroxypropyl methylcellulose (HPMC), are widely utilized for their excellent binding, disintegrating, and coating properties. These excipients provide structural integrity to tablets, ensuring they maintain their shape during production and handling while disintegrating appropriately in the body to release the active ingredients. Cellulose-based excipients are particularly favored in the production of controlled-release and sustained-release formulations, where they help regulate the release of the drug over time, improving patient compliance and therapeutic outcomes. The biocompatibility, non-toxicity, and renewable nature of cellulose-based excipients further contribute to their popularity, making them indispensable in the development of a wide range of pharmaceutical products.

By Functionality

By Excipient Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pharmaceutical Excipients Market

5.1. COVID-19 Landscape: Pharmaceutical Excipients Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pharmaceutical Excipients Market, By Functionality

8.1. Pharmaceutical Excipients Market, by Functionality, 2024-2033

8.1.1. Fillers and Diluents

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Suspending and Viscosity Agents

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Coating Agents

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Binders

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Disintegrants

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Colorants

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Lubricants and Glidants

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Preservatives

8.1.8.1. Market Revenue and Forecast (2021-2033)

8.1.9. Emulsifying Agents

8.1.9.1. Market Revenue and Forecast (2021-2033)

8.1.10. Flavoring Agents and Sweeteners

8.1.10.1. Market Revenue and Forecast (2021-2033)

8.1.11. Other Functionalities

8.1.11.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Pharmaceutical Excipients Market, By Excipient Type

9.1. Pharmaceutical Excipients Market, by Excipient Type, 2024-2033

9.1.1. Lactose-based Excipients

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cellulose-based

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Starches

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Carboxymethylcellulose Sodium (CCS)

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Sodium Starch Glycolate (SSG)

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Fine Chemicals

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Mannitol

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Biopharma Excipients

9.1.8.1. Market Revenue and Forecast (2021-2033)

9.1.9. Others

9.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Pharmaceutical Excipients Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.1.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.2.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.3.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.4.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.5.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Functionality (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Excipient Type (2021-2033)

Chapter 11. Company Profiles

11.1. Bio-Rad Laboratories Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Abbott Laboratories

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Biosensors International Group Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. DuPont Biosensor Materials

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Pinnacle Technologies Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Johnson & Johnson

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Molecular Devices Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. QTL Biodetection LLC

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. TDK Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Zimmer & Peacock AS

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others