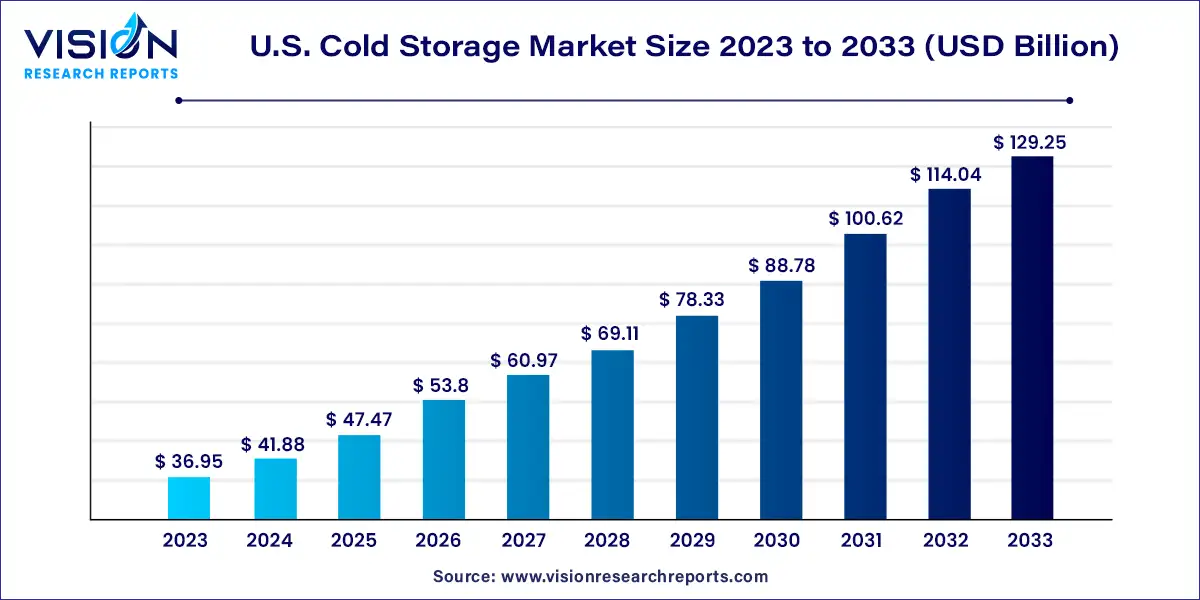

The U.S. cold storage market size was valued at USD 36.95 billion in 2023 and is predicted to hit around USD 129.25 billion by 2033 with a CAGR of 13.34% from 2024 to 2033. The U.S. cold storage market is experiencing significant growth, driven by rising demand for perishable goods, advancements in technology, and the expansion of the e-commerce sector.

The growth of the U.S. cold storage market is driven by the rising demand for perishable goods such as fresh produce, dairy products, and frozen foods necessitates efficient storage solutions to maintain product quality and safety. Secondly, the expansion of the e-commerce sector, particularly online grocery shopping, has significantly increased the need for advanced cold storage facilities to handle the distribution of temperature-sensitive products. Additionally, technological advancements in refrigeration systems and warehouse management are enhancing the efficiency and reliability of cold storage operations.

In 2023, the public warehouse segment dominated the U.S. cold storage market, capturing 78% of the revenue due to its widespread adoption for leased or short-term use at affordable costs. The market is divided into two segments based on warehouse type: private & semi-private, and public. Public warehouses, operated as independent businesses or third-party providers, offer various services such as handling, warehousing, and transportation for a fixed or variable fee. These facilities, also known as duty-paid warehouses, can be owned by individuals or agencies.

While the high costs associated with constructing and maintaining warehouses limit ownership to larger companies, the trend of building private warehouses is on the rise. Private warehouses offer significant benefits, including flexibility, greater control over costs, and the ability to manage facility activities and priorities. Increased international trade and consumer spending have boosted cold storage operating profits over the last five years, and low-interest rates have facilitated financing for new constructions. The private and semi-private segment is projected to grow at a notable CAGR of 11.13% from 2024 to 2033.

The production stores segment held the largest market share in 2023 and is expected to grow at a CAGR exceeding 15.63% from 2024 to 2033. This growth is driven by the need to protect goods, including raw materials and finished food products, throughout the production process. The bulk storage segment is also set to proliferate during the forecast period, as these warehouses are ideal for storing large volumes of fruits, vegetables, and other bulk materials like flour, cooking ingredients, and canned goods, protecting them from spoilage and direct sunlight.

Constructing refrigerated warehouses near ports simplifies customs procedures for temperature-sensitive products. Recent advancements in efficiency and automation have widened the performance gap between older and newer cold storage facilities. Operators are increasingly adopting technologies such as high-speed doors, energy-efficient walls, automated cranes, and cascade refrigeration systems to boost efficiency and reduce costs. For example, automated cranes enable goods to be piled higher, increasing the average building height of new facilities.

In 2023, the frozen segment accounted for over 82% of the market share, driven by growing consumer awareness of convenience foods and a preference for ready-to-cook meals. Frozen foods support microwave cooking and offer easy packaging, contributing to their popularity and the segment's growth. However, the chilled segment is anticipated to experience significant growth over the forecast period.

The market is segmented into chilled and frozen storage based on temperature type. Chilled warehouses maintain temperatures above -5°C and store items like fresh fruits and vegetables, eggs, dry fruits, milk, and dehydrated foods. Frozen warehouses maintain temperatures between -10 to -20°F, storing products such as frozen vegetables, fish, meat, and seafood.

The fish, meat & seafood segment captured the largest market share at 36% in 2023. The market is categorized into fish, meat & seafood; fruits & vegetables; dairy; processed food; and pharmaceuticals. The processed food segment is projected to witness the highest growth, with a CAGR of 16.93% from 2024 to 2033, due to the high demand for processed food products. These products offer advantages such as immediate consumption, easy cooking, and storage, which are driving their adoption. Changing lifestyles, increased safety, and the need for convenience are also major factors contributing to this growth. Excellent marketing and innovative packaging further fuel the market expansion.

The increasing demand for perishable products and the need for fast delivery in the e-commerce food and beverage sector have significantly boosted cold chain operations. The processed food segment is expected to continue growing rapidly due to ongoing improvements in food packaging materials. However, rising incidences of food and pharmaceutical counterfeiting have led to stringent government regulations on production and supply chains. This has prompted industry players to develop rigorous practices and invest in infrastructure improvements to obtain safety certifications.

California held the largest market share by revenue in 2023 and is expected to maintain its dominance through 2033. This significant share is attributed to California's 400 million cubic feet of cold storage space, which serves a large user base. The state boasts the highest number of facilities due to its large population and high demand for cold storage. All facilities are regulated by the California Department of Public Health, Food, and Drug Branch.

Other leading states in the market include Florida, Washington, and Texas, which held significant market shares in 2023. North Carolina and South Carolina are among the fastest-growing markets, with expected CAGR of over 15.2% and 14.7%, respectively, from 2024 to 2033. Cold storage companies are also finding lucrative opportunities in states like North Dakota and Virginia. Advancements in transportation, technology, and the increased adoption of frozen foods are driving demand for refrigeration and storage, contributing to market growth.

By Warehouse Type

By Construction Type

By Temperature Type

By Application

By State

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Cold Storage Market

5.1. COVID-19 Landscape: U.S. Cold Storage Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Cold Storage Market, By Warehouse Type

8.1. U.S. Cold Storage Market, by Warehouse Type, 2023-2033

8.1.1. Private & Semi-private

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Public

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Cold Storage Market, By Construction Type

9.1. U.S. Cold Storage Market, by Construction Type e, 2023-2033

9.1.1. Bulk Storage

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Production Stores

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Ports

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Cold Storage Market, By Temperature Type

10.1. U.S. Cold Storage Market, by Temperature Type, 2023-2033

10.1.1. Chilled

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Frozen

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global U.S. Cold Storage Market, By Application

11.1. U.S. Cold Storage Market, by Application, 2023-2033

11.1.1. Fruits & Vegetables

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Dairy

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Fish, Meat & Seafood

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Processed Food

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Pharmaceuticals

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Cold Storage Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Warehouse Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Construction Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Temperature Type (2021-2033)

12.1.4. Market Revenue and Forecast, by Application (2021-2033)

Chapter 13. Company Profiles

13.1. Americold

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. AGRO Merchants Group North America

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Burris Logistics

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Henningsen Cold Storage Co.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Lineage Logistics Holdings, LLC

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Nordic Logistics

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Preferred Freezer Services

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. VersaCold Logistics Services

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. United States Cold Storage

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Wabash National Corporation

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others