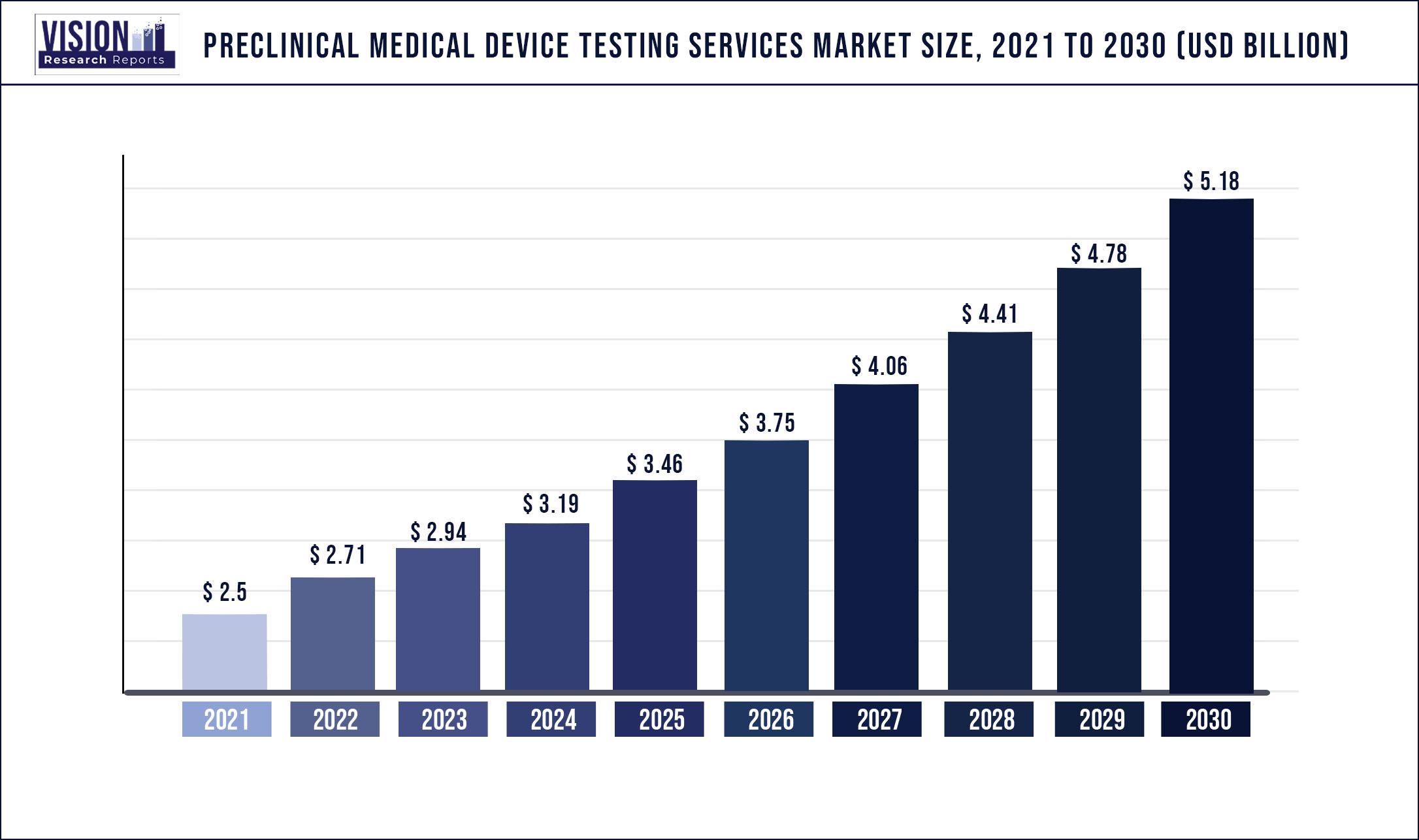

The global preclinical medical device testing services market was valued at USD 2.5 billion in 2021 and it is predicted to surpass around USD 5.18 billion by 2030 with a CAGR of 8.43% from 2022 to 2030

Report Highlights

The rising incidence of diseases has provided manufacturers with different approaches for the formation of medical devices and increasing demand for technologically advanced medical devices are the main factors driving the market growth.

The pace of technological advancement in the healthcare industry has vastly increased in recent years. Medical device technology advancements support simple, painless treatment during disease management. Additionally, advancements in medical device technology help with accurate and quick disease diagnosis results, as well as the affordability of technology-based therapeutic tools for disease treatment. Furthermore, numerous governmental agencies and healthcare institutions support medical research facilities. This funding is primarily intended to promote global health care innovations. The growth of medical device testing in the anticipated period is therefore supported by expanding innovation and technological advancement.

Preclinical testing plays a crucial role in the process of creating new products. Before beginning human testing, most of this testing has been completed and reports should be available. According to ISO-10993, biocompatibility testing results are needed to be included in 510(k) notifications for Class II equipment that has immediate patient contact or contact with the blood supply. This shows that the new device's risks are "substantially equivalent" to the predicate device's risks. In order to show the utility of the new device, validate electrical safety, or examine electromagnetic interference, the testing also involves animal and bench studies.

COVID-19 has created an enormous demand for these services. The growth was not significant during the first half, but it became more significant during the second as the industry adopted the new norms at a faster pace amid the pandemic. Numerous projects that were halted because of COVID have been restarted and PPE kits are witnessing an increase in production and testing. During the pandemic, many medical devices in high demand diverted attention from the equipment needed for surgery. The COVID-19 vaccines, ventilators, and pulse oximeters are the main products that witnessed a spike in demand.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 2.5 billion |

| Revenue Forecast by 2030 | USD 5.18 billion |

| Growth rate from 2022 to 2030 | CAGR of 8.43% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Service, Region |

| Companies Covered | SGS SA, Eurofins Scientific, Pace Analytical Services LLC, Intertek Group Plc, WUXI APPTEC, TÜV SÜD AG, Sterigenics International LLC, Nelson Labs, North American Science Associates, Inc., Charles River Laboratories International Inc. |

Services Insights

The Microbiology & sterility testing segment accounted for the maximum revenue share of 34.41% in 2021. It is one of the major tests included in pre-clinical medical device testing. These examinations aid in identifying any microorganisms that could be present in the apparatus. This test can be used to determine whether bacteria, fungi, or yeasts are present in medical devices in a viable form. For validation purposes, the FDA and other regulatory bodies demand these tests. Also, as a part of routine quality control, these tests are carried out.

Based on the test type of microbiology & sterility testing segment is further classified into bioburden determination, pyrogen & endotoxin testing, sterility test & validation, antimicrobial activity testing, and others. Among them, the sterility test & validation segment is further narrowed down into ethylene oxide (EO) gas sterilization, gamma-irradiation, E-beam sterilization, and X-ray sterilization. The sterilization method must be validated by the manufacturers of sterile devices or of devices that would be cleaned and sterilized in between uses. Steam sterilization is the most frequent method of sterilization followed by hospitals as a standard sterilization procedure and it is not well-liked by companies that produce medical devices. Since almost all materials can be safely sterilized with Ethylene Oxide EO gas, manufacturers frequently use this method. However, the radiation can result in material degradation (cracks) and discoloration. Gamma-irradiation is also frequently used. Other techniques exist, such as E-beam sterilization also play a marginal role.

The chemistry test segment is expected to rise with the fastest CAGR of 9.06% in the forecast period. Chemical testing is done for characterizing, identifying, and comprehending the chemicals used for manufacturing medical devices. Chemical testing complies with the ISO 10993-17 and 10993-18T regulations. According to the biocompatibility standards, it is a requirement for all medical devices to obtain chemical information, which results in chemical characterization for the majority of medical devices. From low-risk items like medical spatulas and disinfectants to high-risk items like implants and cardiac pacemakers, this category includes a wide variety of products. Manufacturers could anticipate potential toxicities and take precautions against them by analyzing the chemicals that commute from the device to the patient. The complexities associated with the designing of medical devices are driving the segment growth.

Regional Insights

North America dominated the market for preclinical medical device testing services with the largest revenue share of 37.43% in 2021. This is primarily caused by the fact that there are many players in this region. It serves as a premier manufacturing hub for sophisticated highly dependable, and expensive medical devices. There is a rapid increase in the manufacturing of medical devices to meet the rising demand for efficient and cost-effective healthcare in this region. Moreover, the rise in demand for cutting-edge medical devices and the availability of sophisticated infrastructure for developing complex, highly dependable, and high-end medical devices. In addition, the FDA policies are promoting the expansion of the market for medical device testing services.

The Asia Pacific is expected to rise with the fastest growth of 9.03% in the forecast period. One of the key factors fueling the regional market is the low cost of outsourcing medical device testing services in the Asia Pacific. The region's rise in disease burden and the growing demand for advanced medical devices are both driving the market expansion. Furthermore, the rising demand for medical devices and favorable policies in India & China is driving the growth. For instance, the Government of India strengthened trade policies in October 2021 that enable Indian medical devices to get international acceptance in the global market. This regulation would drive the demand for testing services in India and the rest of the world.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Preclinical Medical Device Testing Services Market

5.1. COVID-19 Landscape: Preclinical Medical Device Testing Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Preclinical Medical Device Testing Services Market, By Service

8.1.Preclinical Medical Device Testing Services Market, by Service Type, 2020-2027

8.1.1. Biocompatibility Tests

8.1.1.1.Market Revenue and Forecast (2016-2027)

8.1.2. Chemistry Test

8.1.2.1.Market Revenue and Forecast (2016-2027)

8.1.3. Microbiology & Sterility Testing

8.1.3.1.Market Revenue and Forecast (2016-2027)

8.1.4. Package Validation

8.1.4.1.Market Revenue and Forecast (2016-2027)

Chapter 9. Global Preclinical Medical Device Testing Services Market, Regional Estimates and Trend Forecast

9.1.North America

9.1.1. Market Revenue and Forecast, by Service (2016-2027)

9.1.2. U.S.

9.1.3. Rest of North America

9.1.3.1.Market Revenue and Forecast, by Service (2016-2027)

9.2.Europe

9.2.1. Market Revenue and Forecast, by Service (2016-2027)

9.2.2. UK

9.2.2.1.Market Revenue and Forecast, by Service (2016-2027)

9.2.3. France

9.2.3.1.Market Revenue and Forecast, by Service (2016-2027)

9.2.4. Rest of Europe

9.2.4.1.Market Revenue and Forecast, by Service (2016-2027)

Chapter 10.Company Profiles

10.1.SGS SA

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2.Eurofins Scientific

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3.Pace Analytical Services LLC

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4.Intertek Group Plc

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5.WUXI APPTEC

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6.TÜV SÜD AG

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7.Sterigenics International LLC

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8.Nelson Labs

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9.North American Science Associates, Inc.

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10.Charles River Laboratories International, Inc.

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1.About Us

12.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others