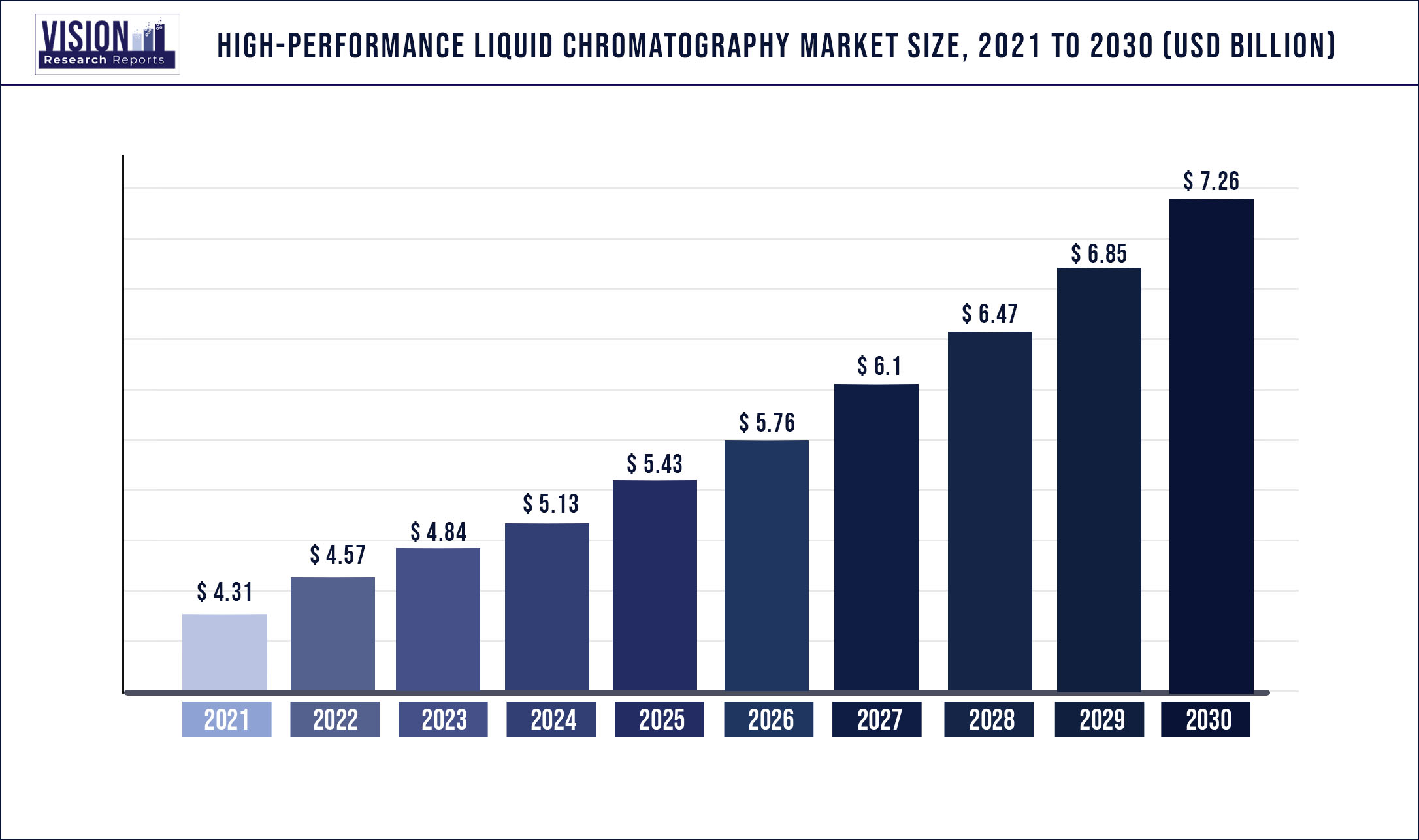

The global high-performance liquid chromatography market was surpassed at USD 4.31 billion in 2021 and is expected to hit around USD 7.26 billion by 2030, growing at a CAGR of 5.96% from 2022 to 2030

Report Highlights

Rapid growth in pharmaceutical production, stringent regulatory norms for drug purity, and increasing adoption of high-performance liquid chromatography (HPLC) techniques for diagnostics and research purposes are driving the market.

HPLC is commonly used for the assessment of drug purity on an industrial scale. It also enables characterization of molecules being explored as potential new drug candidates. Demand for the technique is anticipated to grow due to its increasing applications in ensuring consistency and determination of dosage of active pharmaceutical ingredients. Furthermore, the technique holds significance in quality control testing for assuring the fulfillment of critical quality attributes in the pharmaceutical industry.

The technique is augmenting clinical diagnostic services due to the availability of improved stationary phase alternatives and multiple channel HPLC instruments that can aid in sequential analysis of patient samples. Such attributes are desirable for low- or moderate-throughput laboratories and enable faster turnaround times. Similarly, recent developments in column technologies are increasing the efficiency of HPLC operations and are likely to fuel the market growth. For instance, the advent of>2-µm superficially porous silica particles has led to improved HPLC operations at comparatively lower back-pressure and with the use of shorter columns.

Furthermore, companies involved in the market are launching new HPLC-based analyzers and systems for capitalizing on the expanding scope of applications for the technique. For instance, in June 2021, Trivitron Healthcare launched two new HPLC analyzers, NANO H5 & NANO H110, intended for the detection of HbA1c and Hb variants in less than three minutes.

In addition, the COVID-19 pandemic has accelerated the adoption of HPLC systems for the development of new therapeutics, vaccines, and reliable diagnostic methods for the disease. Furthermore, epidemiological applications of the technique for the characterization of viral proteins are expected to gain traction due to the emerging mutations of the SARS-CoV-2 virus. These factors are anticipated to positively affect the market growth.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 4.31 billion |

| Revenue Forecast by 2030 | USD 7.26 billion |

| Growth rate from 2022 to 2030 | CAGR of 5.96% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, application, end-user, region |

| Companies Covered | Waters Corporation; Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc.; Shimadzu Corporation; Sartorius AG; PerkinElmer, Inc.; Bio-Rad Laboratories, Inc.; Merck KGaA; Tosoh Bioscience GmbH; Gilson, Inc.; Danaher Corporation |

Product Insights

The instruments segment held the largest revenue share of over 45.03% in 2021 due to the increasing dominance of integrated HPLC systems and the availability of advanced detectors. Manufacturers in this domain are focusing on the production of systems that can offer higher productivity and specificity of applications, as evident by the launch of the new i-Series LC-2050/LC-2060 integrated HPLC systems by Shimadzu Corporation in February 2021. These systems offer high-speed sampling capacities, along with a low carryover, for quality control applications. Furthermore, detectors such as Activated Research Company’s Solvere carbon selective detector, which can use both aqueous and organic solvents, are broadening the applicability of HPLC techniques for a variety of sample types.

Consumables and accessories such as columns and filters are expected to gain traction due to improvements in column chemistries and packing materials and increasing significance of filtration techniques for the protection of HPLC columns from any particulate contaminants. Increasing demand for chromatography operations with high sensitivity has led to an emphasis on the reduction of analyte–metal interactions that can interfere with the results. This can be accomplished with the help of advanced metal passivation or the use of PEEK (polyetheretherketone)-lined stainless steel columns. For instance, Agilent Technologies, Inc. provides AdvanceBio SEC PEEK-lined stainless-steel columns. Such columns are expected to witness a high growth potential and are likely to boost the market growth.

Application Insights

Clinical research applications accounted for the largest revenue share of over 35.2% in 2021 and are projected to expand at the fastest rate over the forecast period. This can be attributed to the expanding landscape of clinical trial activities, a surge in biopharmaceutical research and development, and rise in demand for high throughput analytical techniques. Furthermore, advantages offered by the technique for clinical research such as high analytical specificity and short runtimes, capability to run multi- and mega-parametric tests, and applicability to thermolabile, polar, and high molecular weight compounds make it a prominent alternative over other analytical methods. These factors are anticipated to boost the clinical research applications of HPLC.

Diagnostic applications are driven by the use of the technique for identification and quantification of biomarkers essential in the earlier diagnosis of chronic diseases. The technique also aids in increasing the accuracy of diagnosis by distinguishing between similar diseases. In addition, HPLC offers a superior option for analysis of metabolites and is used in the analysis of vitamin D and HbA1c hemoglobin due to its reproducibility and low coefficient of variation. With the rising prevalence of chronic diseases and the increasing need for robust diagnostic techniques, diagnostic applications of HPLC are expected to rapidly expand over the forecast period.

End-user Insights

Pharmaceutical and biotechnology companies dominated the market in 2021 and accounted for over 40.05% share. Applications of HPLC methods in these companies include quality control, determination of drug purity, characterization of drug candidates, evaluation of the stability of active ingredients in pharmaceuticals, and several others. The segment is expected to witness growth due to the compatibility of HPLC with mass spectrometry, which enhances the detection capacities and selectivity of the technique. This increases the growth prospects of the technique for biopharmaceutical applications and is likely to boost the market growth.

Academic and research institutions are expected to grow at the fastest rate of 7.7% over the forecast period due to the rising government funding for academic research, increasing involvement of analytical instrumentation in academic teaching, and a significant role played by academic institutions in research and development activities. For instance, in the U.S., around 50% of all the basic research and about 10% to 15% of overall research and development is conducted at academic institutions. Furthermore, research and development spending by such institutions in the U.S. amounted to over USD 86.4 billion in the financial year 2020. Hence, the segment holds a high potential for the adoption of HPLC infrastructure and is likely to fuel the market growth in the near future.

Regional Insights

North America accounted for the largest share of over 30.04% in 2021. This can be attributed to rapid growth in the pharmaceutical industry, high research and development spending, increasing demand for clinical diagnostic applications, and the presence of key players such as Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc.; and Bio-Rad Laboratories, Inc. in the region. Furthermore, the region is favored by a high extent of scientific awareness and the availability of skilled professionals, which further fuel the growth of HPLC applications.

Asia Pacific is projected to grow at the fastest rate over the forecast period due to a high potential for clinical research in the region because of the availability of a large patient pool. Furthermore, large-scale production of generics and biosimilars in countries such as China and India represents promising growth opportunities for the adoption of the technique for quality control and testing. In addition, research applications of HPLC for the analysis of traditional medication options, such as traditional Chinese medicines, are anticipated to open new growth avenues for the market.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on High-performance Liquid Chromatography Market

5.1. COVID-19 Landscape: High-performance Liquid Chromatography Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global High-performance Liquid Chromatography Market, By Product

8.1. High-performance Liquid Chromatography Market, by Product, 2022-2030

8.1.1 Instruments

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Consumables& Accessories

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Software

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global High-performance Liquid Chromatography Market, By Application

9.1. High-performance Liquid Chromatography Market, by Application, 2022-2030

9.1.1. Clinical Research Applications

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Diagnostic Applications

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Forensic Applications

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Other Applications

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global High-performance Liquid Chromatography Market, By End-user

10.1. High-performance Liquid Chromatography Market, by End-user, 2022-2030

10.1.1. Pharmaceutical & Biotechnology Companies

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Academic & Research Institutions

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global High-performance Liquid Chromatography Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by End-user (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-user (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-user (2017-2030)

Chapter 12. Company Profiles

12.1. Waters Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Thermo Fisher Scientific, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Agilent Technologies, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Shimadzu Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Sartorius AG

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. PerkinElmer, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Bio-Rad Laboratories, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Merck KGaA

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Tosoh Bioscience GmbH

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Gilson, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others