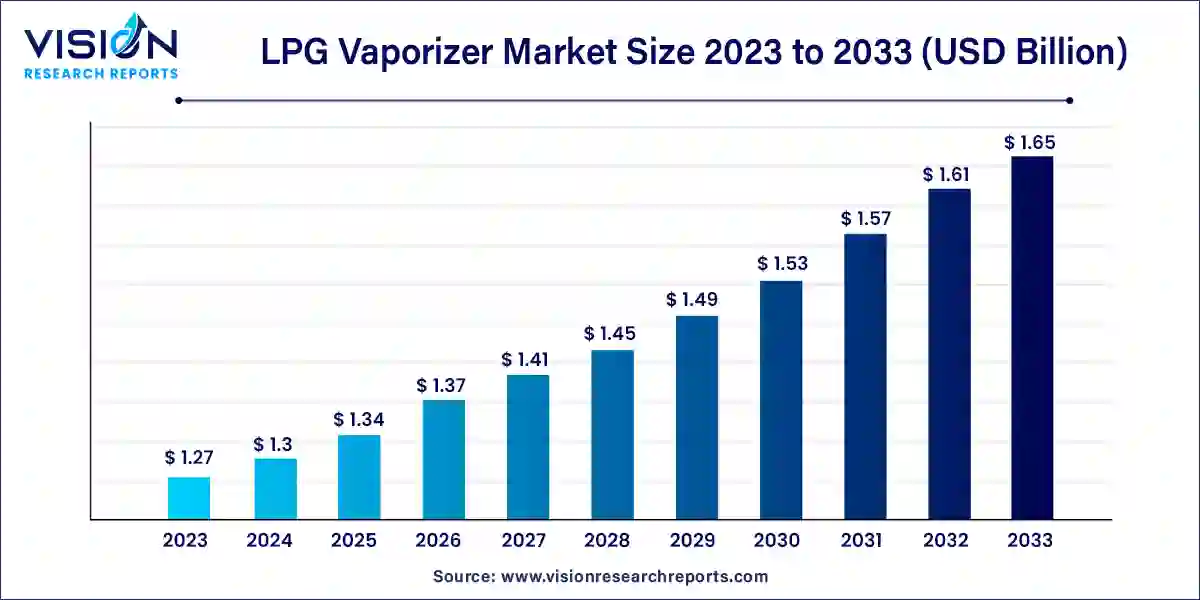

The global LPG vaporizer market size was estimated at around USD 1.27 billion in 2023 and it is projected to hit around USD 1.65 billion by 2033, growing at a CAGR of 2.65% from 2024 to 2033. The LPG vaporizer market is a rapidly evolving sector driven by the increasing demand for liquefied petroleum gas (LPG) across various industries, including industrial, commercial, and residential applications. LPG vaporizers are critical components that convert liquid LPG into its gaseous form, enabling more efficient utilization of the fuel.

The growth of the LPG vaporizer market is primarily driven by an increasing global demand for clean and efficient energy solutions, as LPG is seen as a lower-emission alternative to traditional fossil fuels. Industrial sectors, including manufacturing, chemical processing, and food & beverage, are increasingly adopting LPG due to its cost-effectiveness and environmental benefits. Additionally, advancements in vaporizer technology, such as the development of more energy-efficient and automated systems, are further propelling market expansion. Government regulations promoting the use of cleaner fuels and growing investments in energy infrastructure also contribute significantly to the market's upward trajectory.

The Asia Pacific region held the largest market share, accounting for 44% of global revenue in 2023. Government policies and initiatives, such as India’s Pradhan Mantri Ujjwala Yojana, which aims to provide LPG connections to over 103.5 million households by 2025-26, are driving demand for vaporizers and boosting LPG usage as a clean energy source in the region.

China led the Asia Pacific LPG vaporizer market with a 34.14% share in 2023, largely due to its strong manufacturing capabilities. The country’s industrial infrastructure enables large-scale production of vaporizers at competitive prices, helping manufacturers capitalize on economies of scale while maintaining product quality. This enhances the competitiveness of Chinese manufacturers and supports the market's growth.

North America is expected to have the fastest CAGR of 2.94% during the forecast period, thanks to its well-established LPG infrastructure. Pipelines and storage facilities ensure efficient distribution and a steady supply of LPG to industries and households.

The U.S. held a significant market share in 2023, driven by stringent regulatory standards for safety and environmental protection. Manufacturers in the U.S. are required to comply with these regulations, ensuring high-quality and reliable vaporizer products. The strong demand for LPG vaporizers across residential, commercial, and industrial sectors, particularly for cooking applications, further fuels market growth in the U.S.

Europe captured a notable revenue share in 2023, driven by technological advancements in vaporizer systems. Key European players have heavily invested in R&D to improve the efficiency, safety, and competitiveness of their products. Innovations such as electronic control systems, heat exchange technologies, and enhanced safety features have strengthened the region’s position in both domestic and export markets.

The German market is expected to grow steadily during the forecast period. Known for its excellence in engineering and energy sectors, Germany’s manufacturers produce high-quality, innovative LPG vaporizers. The country’s advanced production facilities, skilled labor force, and emphasis on quality give German companies a competitive edge in the global market.

In 2023, direct-powered LPG vaporizers dominated the market, accounting for a 48% revenue share. These vaporizers outperform their indirect counterparts due to their higher efficiency in converting liquid LPG into gas. Their compact, portable design and ease of installation make them ideal for various applications, including residential, commercial, and industrial use, particularly where immediate gas supply is required.

The water/steam segment is projected to have the fastest compound annual growth rate (CAGR) of 3.04% during the forecast period. These vaporizers use water’s superior heat conductivity to rapidly vaporize LPG, making them suitable for high-demand environments. They operate at lower temperatures and pressures, offering a safer and more controlled operation, which reduces the risks of explosions or hazardous emissions.

The industrial sector led the market with a 44% share in 2023. LPG is widely used in industries like manufacturing, chemicals, and food processing as a primary energy source for heating, drying, and running machinery. Its affordability and availability in many regions make LPG a cost-effective alternative to other energy sources, driving the demand for efficient vaporization systems.

The agricultural sector is expected to grow at the fastest CAGR of 3.24% during the forecast period. LPG’s versatility in heating, irrigation, crop drying, and tractor fuel makes it a favored choice in agriculture. Its cleaner combustion compared to diesel and coal makes LPG an environmentally friendly option. Additionally, government funding initiatives to promote LPG use in agriculture support the demand for LPG vaporizers, contributing to sustainable farming practices.

By Product

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on LPG Vaporizer Market

5.1. COVID-19 Landscape: LPG Vaporizer Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global LPG Vaporizer Market, By Product

8.1. LPG Vaporizer Market, by Product, 2024-2033

8.1.1 Direct-fired

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Electric

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Steam/Water Bath

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global LPG Vaporizer Market, By Capacity

9.1. LPG Vaporizer Market, by Capacity, 2024-2033

9.1.1. 40-160 gal/hr

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. 168-455 gal/hr

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. 555-1005 gal/hr

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. >1000 gal/hr

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global LPG Vaporizer Market, By End-use

10.1. LPG Vaporizer Market, by End-use, 2024-2033

10.1.1. Industrial

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Agriculture

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global LPG Vaporizer Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Capacity (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Algas-SDI

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Standby Systems, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Ransome Gas Industries, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Pegoraro Gas Technologies Srl.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others