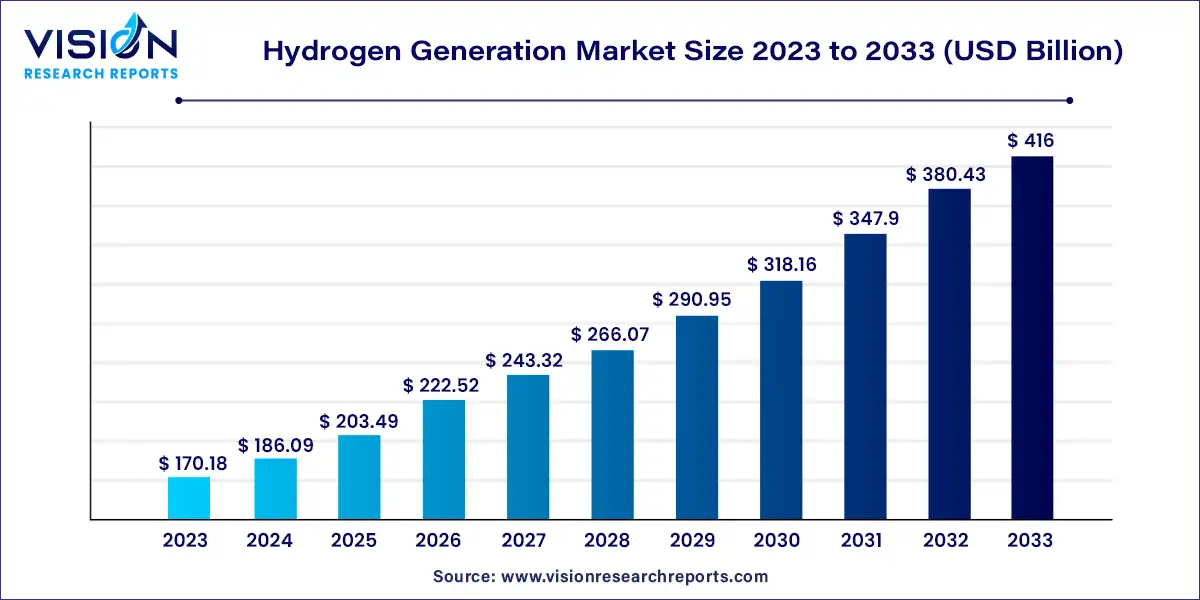

The global hydrogen generation market size was estimated at around USD 170.18 billion in 2023 and it is projected to hit around USD 416 billion by 2033, growing at a CAGR of 9.35% from 2024 to 2033.

The global hydrogen generation market driven by increasing demand for clean energy solutions and the growing emphasis on reducing carbon emissions. As nations strive to transition towards a more sustainable energy landscape, hydrogen emerges as a promising alternative due to its versatility and environmental benefits.

The growth of the hydrogen generation market is propelled by an increasing global initiatives aimed at decarbonization and the transition to renewable energy sources are driving the demand for hydrogen as a clean energy solution. Additionally, technological advancements in hydrogen production methods, such as electrolysis and steam methane reforming, are enhancing efficiency and reducing costs, making hydrogen more competitive with conventional fuels. Moreover, the growing investment in hydrogen infrastructure, including production facilities and refueling stations, is facilitating the expansion of hydrogen-based technologies across various sectors.

Based on technology type, global market is divided into steam methane reforming, coal gasification, and others. Steam methane reforming process is a mature and advanced technology in hydrogen generation. Growing global demand for hydrogen generation is a crucial driving factor for steam methane reformers technology, as this is the most economical hydrogen generation method. Other growth driving factors include operational benefits such as high conversion efficiency associated with steam methane reforming process. Steam methane reforming segment is expected to maintain its lead during the forecast period.

Coal gasification hold a revenue share of more than 35% in 2023. Coal gasification which uses coal as a raw material for producing hydrogen has been in practice for nearly two centuries, moreover, is it also recognized as a mature technology for hydrogen generation. U.S. has a huge domestic resource in coal. Use of coal to generate hydrogen for transportation sector is expected to aid America in reducing its dependency on imported petroleum products.

Technologies in “others” segment include electrolysis and pyrolysis process and electrolyzers. Over the last decade, there has been an increase in new electrolysis installations with an aim to produce hydrogen from water, wherein PEM technology is gaining a significant market share as the process emits only oxygen as a byproduct without carbon emission. Presently most electrolysis projects are in Europe; however, new and upcoming projects have been announced in Australia, China, and America.

Natural gas led hydrogen generation industry with a revenue share of more than 73% in 2023. Hydrogen is produced from natural gas reforming which produces hydrogen, carbon monoxide, and carbon dioxide. Hydrogen production from natural gas is the cheapest method of producing hydrogen. Hydrogen production from natural gas is expected to keep its lead in the forecast period.

Based on system, the merchant generation segment led with a revenue share of about 61% in 2023. Merchant generation of hydrogen means hydrogen is produced at a central production facility and is transported and sold to a consumer by bulk tank, pipeline, or cylinder truck. In many countries such as the U.S., Canada, and Russia there is an extensive existing natural gas pipeline network that could be used to transport and distribute hydrogen. Merchant generation segment is expected to retain its leading position from 2024 to 2033.

Ammonia production accounted for the largest revenue share of above 22% in 2023. It is expected to maintain its lead throughout the forecast period. Ammonia’s potential as a carbon-free fuel, hydrogen carrier, and energy store represents an opportunity for renewable hydrogen technologies to be deployed at an even greater scale. Hydrogen is typically produced on-site at ammonia plants from a fossil fuel feedstock. Natural gas is the most common feedstock, which feeds a steam methane reforming (SMR) unit. Coal can also be used to produce ammonia via a partial oxidation (POX) process.

Turning crude oil into various end-user products such as transport fuels and petrochemical feedstock are some of the major applications of hydrogen. Hydrotreatment and hydrocracking are the main hydrogen-consuming processes in refineries. Hydrotreatment is used to remove impurities, especially Sulphur, and accounts for a large share of refinery hydrogen use globally. Hydrocracking is a process that uses hydrogen to upgrade heavy residual oils into higher-value oil products.

Asia Pacific accounted for the largest revenue share of over 36% in 2023. China led it in 2023, in terms of revenue. Presence of a high number of refineries in major countries such as China and India has resulted in driving the utilization of hydrogen generation. Furthermore, governments in some Asia Pacific countries such as Japan and Australia are evaluating greener and cleaner technologies for hydrogen generation.

Expansion of hydrogen generation industry in North America has been underway for several years. Industry has grown at a brisk pace with contributions from each application and technology. Methanol production and ammonia production are the fastest growing sectors with countries such as the U.S. and Canada witnessing significant growth in the last five years.

Growth in hydrogen generation is expected on account of fuel cell development and deployment in Europe, which is witnessing an increase due to the projects announced by European Commission (EU) through organizations such as Fuel Cells and Hydrogen Joint Undertaking (FCH JU). These projects have been announced with an objective of increasing adoption of fuel cell vehicles in Europe and this will aid in development of supportive hydrogen infrastructure for fuel cell vehicles in major European countries.

By Technology

By Application

By System

By Source

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Hydrogen Generation Market

5.1. COVID-19 Landscape: Hydrogen Generation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Hydrogen Generation Market, By Technology

8.1. Hydrogen Generation Market, by Technology, 2023-2033

8.1.1. Steam Methane Reforming

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Coal Gasification

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Hydrogen Generation Market, By Application

9.1. Hydrogen Generation Market, by Application e, 2023-2033

9.1.1. Methanol Production

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Ammonia Production

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Petroleum Refining

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Transportation

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Power Generation

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Hydrogen Generation Market, By Systems

10.1. Hydrogen Generation Market, by Systems, 2023-2033

10.1.1. Captive

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Merchant

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Hydrogen Generation Market, By Source

11.1. Hydrogen Generation Market, by Source, 2023-2033

11.1.1. Natural Gas

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Coal

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Biomass

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Water

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Hydrogen Generation Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Technology (2021-2033)

12.1.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.3. Market Revenue and Forecast, by Systems (2021-2033)

12.1.4. Market Revenue and Forecast, by Source (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Technology (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Systems (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Source (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Technology (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Systems (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Source (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Technology (2021-2033)

12.2.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.3. Market Revenue and Forecast, by Systems (2021-2033)

12.2.4. Market Revenue and Forecast, by Source (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Technology (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Systems (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Source (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Technology (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Systems (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Source (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Technology (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Systems (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Source (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Technology (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Systems (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Source (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Technology (2021-2033)

12.3.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.3. Market Revenue and Forecast, by Systems (2021-2033)

12.3.4. Market Revenue and Forecast, by Source (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Technology (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Systems (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Source (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Technology (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Systems (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Source (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Technology (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Systems (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Source (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Technology (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Systems (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Source (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Technology (2021-2033)

12.4.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.3. Market Revenue and Forecast, by Systems (2021-2033)

12.4.4. Market Revenue and Forecast, by Source (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Technology (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Systems (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Source (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Technology (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Systems (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Source (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Technology (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Systems (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Source (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Technology (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Systems (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Source (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Technology (2021-2033)

12.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.3. Market Revenue and Forecast, by Systems (2021-2033)

12.5.4. Market Revenue and Forecast, by Source (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Technology (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Systems (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Source (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Technology (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Systems (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Source (2021-2033)

Chapter 13. Company Profiles

13.1. Air Liquide International S.A

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Air Products and Chemicals, Inc

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Hydrogenics Corporation

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. INOX Air Products Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Iwatani Corporation

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Linde Plc

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Matheson Tri-Gas, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Messer

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. SOL Group

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Tokyo Gas Chemicals Co., Ltd.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others