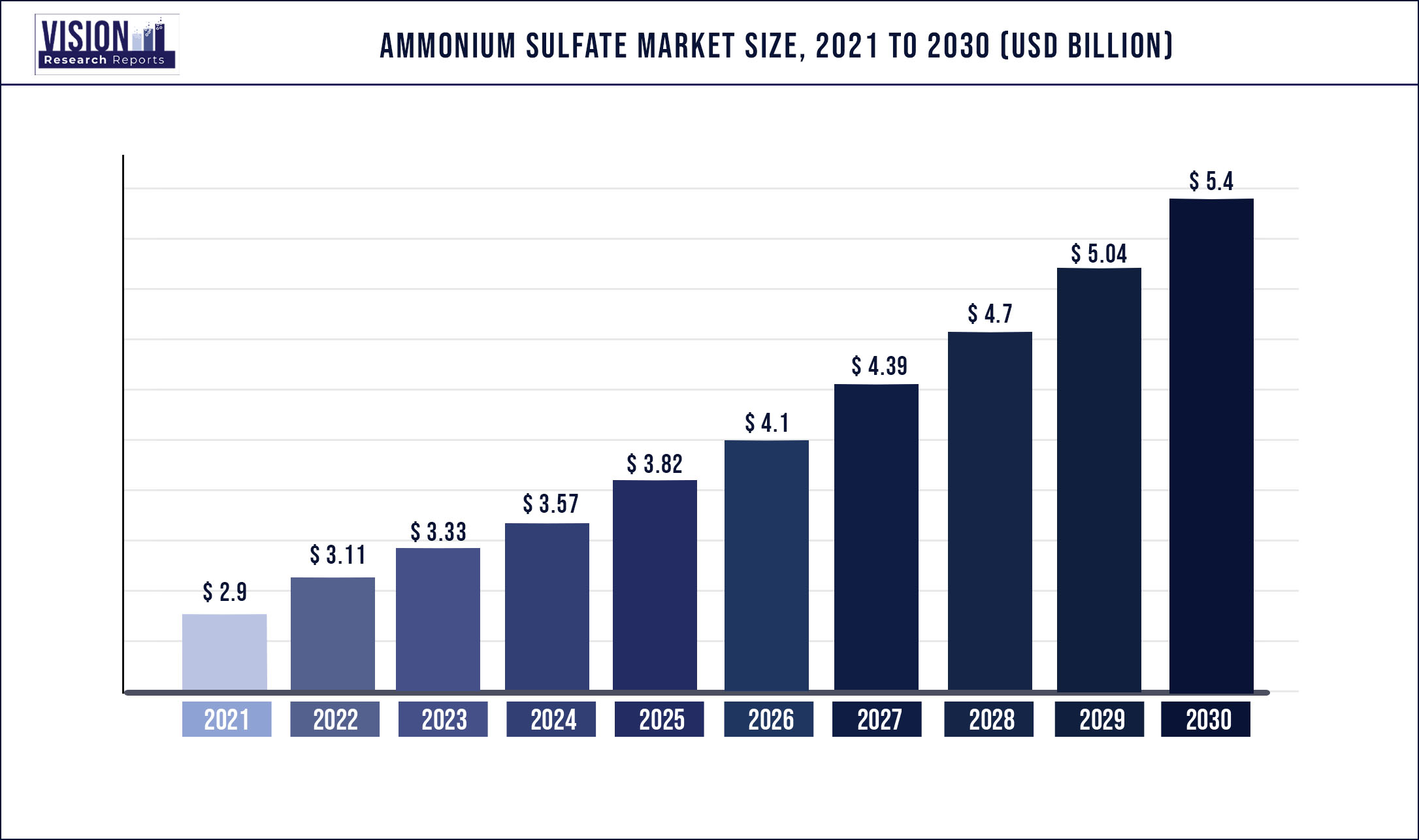

The global ammonium sulfate market was valued at USD 2.9 billion in 2021 and it is predicted to surpass around USD 5.4 billion by 2030 with a CAGR of 7.15% from 2022 to 2030.

Report Highlights

The advancement in agriculture technology would drive the demand for fertilizers, which would indirectly result in the growing demand for ammonium sulfate.

Ammonium sulfate is an inorganic water salt comprising sulfur and nitrogen. The composition is used in the agricultural sector as fertilizer. It has the ability to provide stability and functionality to the fertilizer. Benefits associated with these fertilizers include water-solubility, easy blending abilities with nitrogenous fertilizers, and elevation of soil. These benefits ensure high plant growth, thereby leading to the high demand from farming communities.

Rice is a staple food crop in most Asian countries and is grown by almost two billion people according to the Food and Agriculture Organization (FAO). North America accounted for the third-largest market share after Asia Pacific and Europe in 2021. The Ministry of Health, Labor, and Welfare declared the product as safe for health with no health problems associated, therefore it is accepted and utilized across the globe.

The global market is very competitive; thus several manufacturers are investing in the development of technologies for the production method of the product. Manufacturers are focusing on mergers and acquisitions to increase their global presence and broaden their product portfolio. For instance, in 2019, Sumitomo Chemical announced the merger of Sumitomo Chemical India Limited and Excel Crop Care Limited to expand the business in India.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 2.9 billion |

| Revenue Forecast by 2030 | USD 5.4 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.15% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, application, region |

| Companies Covered |

BASF SE; Evonik Industries; Lanxess Corporation; Novux International; Sumitomo Chemical; Honeywell International |

Product Insights

The solid segment dominated the market with a revenue share of over 90.03% in 2021. This is attributed to an increase in demand for the solid segment. Ammonium sulfate is commonly identified as an organic sulfate salt, which is a white odorless solid. It easily dissolves in water but is observed to be non-dissolving in acetone or alcohol. Solid ammonium sulfate crystals are broadly used in alkaline soils as fertilizers globally owing to their ability to improvise the soil nutrient content and sulfur deficiency. The solid or crystalline grade is higher in purity and is hence anticipated to gain preference in the pharmaceutical industry.

The liquid form of the product is commercially available as a pale yellowish solution and is recognized to be a non-toxic, stable, and non-hazardous substance. Liquid ammonium sulfate solution is extensively used in water treatment applications. The market for liquid ammonium sulfate (LAS) is projected to witness significant growth as alternatives of LAS, such as aqueous or anhydrous ammonia, are identified to be hazardous and their transport and handling require adherence to an extensive set of protocols. This type of sulfate is widely accepted and used as an effective and stable source of ammonia for chloramination.

Application Insights

The fertilizers segment accounted for the largest revenue share of over 70.23% in 2021. The demand is attributed to the use of ammonium sulfate as a fertilizer for alkaline soils as it contains both nitrogen and sulfur. Growing fertilizer consumption across agriculture-based economies is expected to drive the demand for the product over the forecast period. In soil, the product breaks into ammonia, sulfur dioxide, nitrogen, and water. Nitrogen and ammonia are used by plants to make amino acids, while sulfur is required for metabolism.

Major applications of ammonium sulfate include fertilizers, food and feed additives, pharmaceuticals, and water treatment. The market is mainly driven by fertilizers as ammonium sulfate is widely used as a substance in fertilizer production and is essentially used by all major nitrogenous fertilizer producers worldwide. Increasing demand for food products has pushed the agricultural industry to use ammonium sulfate products in fertilizer formulations globally. The pharmaceuticals segment is anticipated to register a lucrative CAGR over the forecast period. Ammonium sulfate is a key component in the pharmaceutical industry, wherein it is widely used as an intermediate to fractionate and precipitate protein.

Regional Insights

Asia Pacific held the largest volume share of over 45.6% in 2021. The growth is attributed to the increase in demand for fertilizers used in the agriculture sector in the region, which in turn, will boost the demand for ammonium sulfate. Agriculture is a primary sector in many of the economies in this region such as India, Bangladesh, and Sri Lanka. Although the growth of the agriculture sector is comparatively slow, constant innovations in the field are projected to create substantial growth opportunities for various fertilizers to be used in agriculture.

Europe accounted for the second-largest share in terms of volume in 2021. The growth is credited to the increase in demand for fertilizers used in multiple crop production. Multiple agencies are establishing regulations regarding the utilization of synthetic fertilizers in the region. Central and South America are anticipated to register a revenue-based CAGR of 6.95% over the forecast period due to an increase in the demand for high-quality ammonium sulfate-based fertilizers used in the healthy growth of the major crops, which include grapes, soybeans, sunflower seeds, and wheat. The agriculture sector accounts for half of the share of the country’s GDP in Central and South America, including Argentina, Bolivia, Dominica, Paraguay, and Belize.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Ammonium Sulfate Market

5.1. COVID-19 Landscape: Ammonium Sulfate Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Ammonium Sulfate Market, By Product

8.1. Ammonium Sulfate Market, by Product, 2022-2030

8.1.1. Solid

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Liquid

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Ammonium Sulfate Market, By Application

9.1. Ammonium Sulfate Market, by Application, 2022-2030

9.1.1. Fertilizers

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Pharmaceuticals

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Food & Feed Additives

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Water Treatment

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Ammonium Sulfate Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. BASF SE

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Evonik Industries

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Lanxess Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Novus International

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Sumitomo Chemical

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Honeywell International

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Royal DSM

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others