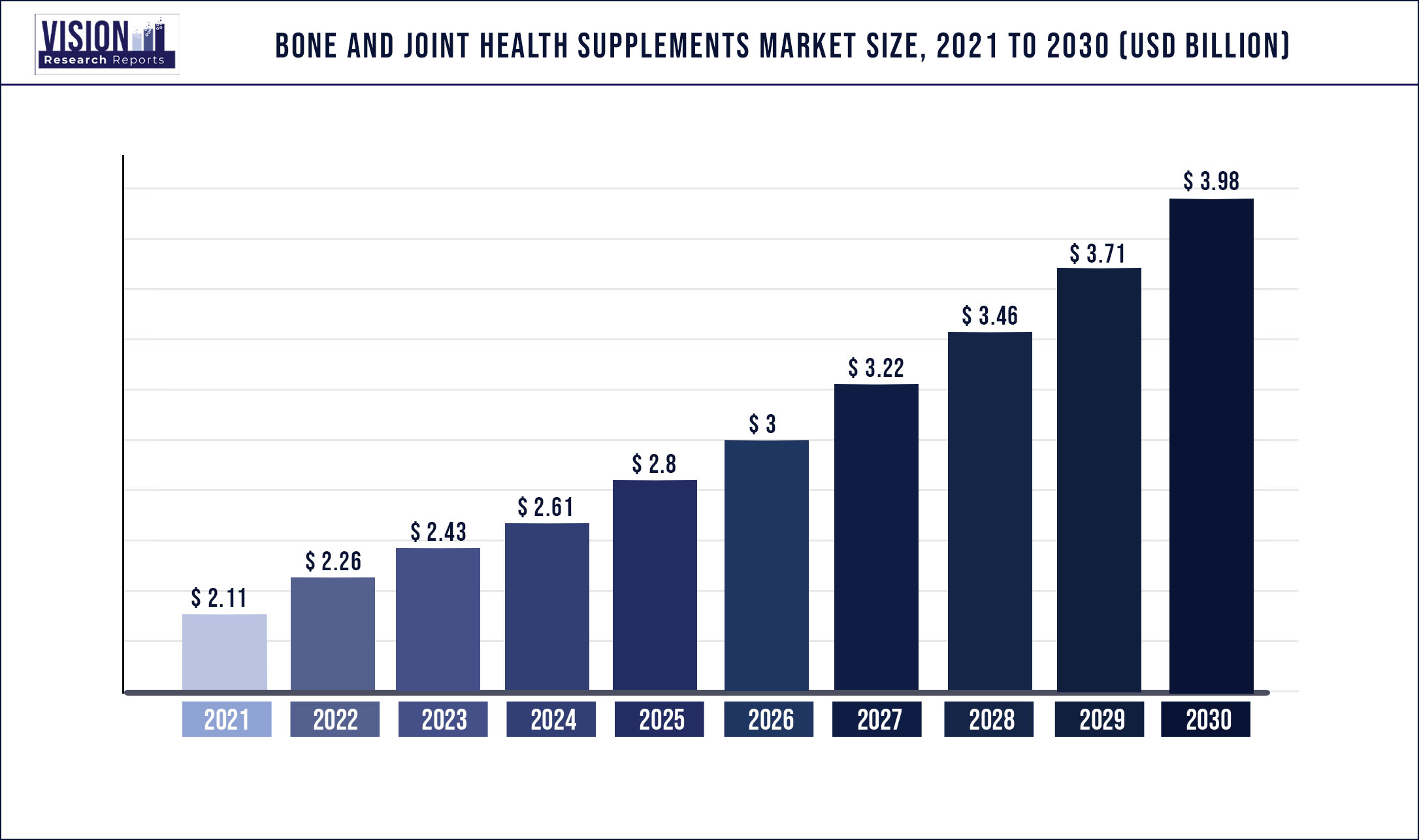

The global bone and joint health supplements market was valued at USD 2.11 billion in 2021 and it is predicted to surpass around USD 3.98 billion by 2030 with a CAGR of 7.31% from 2022 to 2030.

Report Highlights

Increasing prevalence of orthopedic disorders among the geriatric and adult population is one of the major factors driving the market. According to the CDC, around 58.5 million people are diagnosed with arthritis and it is more common in women as compared to men. Also, the increasing burden of arthritis is anticipated to drive the industry during the forecast period. As per the CDC, around 78.4 million adults aged 18 years and above are anticipated to be diagnosed with arthritis. Moreover, the rising geriatric population across the globe is fueling industry growth as the prevalence of orthopedic disorders increases with age. Around 49.6% of people aged above 65 years are diagnosed with arthritis.

Furthermore, the rising health consciousness, increasing consumer interest in active living, and rising disposable income are among the key factors driving the industry. In addition, increasing awareness regarding micronutrient deficiencies, increasing access to supplements, availability of multiple products, and the increasing number of distribution channels are supporting the growth.

Moreover, the increasing focus of key companies on various strategies to meet consumer demand is impelling market growth. For instance, in March 2022, Bioiberica entered into a partnership with ByHealth to develop a product for joint health brand “Highflex” in the China market. Furthermore, the manufacturers are developing new supplements in various formulations to attract the consumer base, thereby positively impacting the industry's growth. For instance, in February 2022, Gadot Biochemical Industries launched ‘Cal2Mag’, a new mineral blend combining calcium and magnesium, to specifically target bone health.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 2.11 billion |

| Revenue Forecast by 2030 | USD 3.98 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.31% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, formulation, consumer group, sales channel, region |

| Companies Covered |

Herbalife International of America, Inc.; GNC Holdings, Inc.; Nature’s Bounty Co.; Bayer AG; BY-HEALTH Co., Ltd.; Amway; Basf SE; Reckitt Benckiser; Vita Life Sciences Ltd.; Glanbia Plc; Now Foods; Pfizer |

Product Insights

The vitamins segment dominated the market in 2021 with a share of over 30.03%. This can be attributed to the growing adoption of healthy lifestyles, increasing life expectancy, and rising focus on active lifestyles. Also, the increasing consumption of vitamin D supplements to reduce the risk of bone fracture is impelling market growth. Also, vitamin K is linked to bone density and subsequently is found to be effective for bone health. It is consumed by people suffering from osteoporosis to reduce the risk of fracture, which is expected to drive the segment over the forecast period.

The minerals segment is expected to grow at a lucrative rate due to the growing adoption of mineral supplements to manage conditions such as osteoporosis and osteoarthritis. The growing rate of osteoporosis among the women and geriatric population has raised the demand for calcium supplements. Furthermore, the increasing focus of the companies on the development of bone & joint health supplements to treat joint health is expected to drive the market over the forecast period. For instance, in May 2022, Vaneeghen introduced FruiteX-B, a mineral complex specifically for joint health, in the European market.

Formulation Insights

The capsules segment held the largest revenue share of over 30.16% in 2021. The availability of product types in various forms of encapsulations is responsible for an increase in the bioavailability of active ingredients. Multilayered or multi-membrane encapsulations, extended-release capsules for vitamins and minerals, and omega-3 fatty acids are some of the products currently available in capsule formulations, which have been responsible for the growth of the industry.

The powder formulations segment is expected to grow at the fastest rate over the forecast period. Powder formulations have captured the market and have been preferentially used in comparison to soft chews and soft gels due to their ease of consumption. Growing demand for powdered vitamin supplements has led to the high growth of this segment.

Consumer Group Insights

The geriatric population segment held the largest revenue share of over 32.4% in 2021. The geriatric population is the major consumer of bone and joint health supplements as the prevalence of bone disorders rise with aging. Osteoporosis is the most common disorder in elders. As per a study, the prevalence of osteoporosis in India was 36.1% among the geriatric population in 2021. Also, about 1.5 million fractures occur due to osteoporosis each year in the U.S. Therefore, increased demand is being witnessed to prevent fractures and maintain bone health.

The adult segment is expected to grow at the fastest rate during the forecast period owing to increasing awareness regarding nutritional supplements. With the shifting trend toward a healthy and active lifestyle, adults are consuming various supplements to maintain their bone health. As per the CRN survey, around 18% of people aged 18 to 34 years and 19% of people aged 35-54 years consume bone health dietary supplements. Furthermore, this number is expected to rise due to the increasing adult population suffering from arthritis. As per the CDC, around 57.3% of the adult population in the U.S. suffer from arthritis.

Sales Channel Insights

The bricks and mortar segment held the largest revenue share of over 65.7% in 2021. The rising number of retail stores selling supplements for bone and joint health with a wide variety of product types of different brands is one of the key factors responsible for the growth of the segment. In, addition, the companies are investing in the opening of stores to reach a larger population base and meet the consumer demand, which is further contributing to the industry growth.

The e-commerce segment is expected to witness the fastest growth during the forecast period. The online sales channel has witnessed substantial growth during COVID-19 and the channel emerged as a strategy to increase geographical reach. The market players are collaborating with e-commerce platforms to make their product types available online, which is positively impacting the growth of the market. Moreover, the shifting consumer preference toward online shopping is expected to drive the market over the forecast period. As per the report by Mintel, 50% of consumers prefer online shopping for mineral and vitamin supplements.

Regional Insights

North America accounted for the largest revenue share of over 35.42% in 2021. The increasing geriatric population and rising number of people suffering from joint pain are some of the factors driving the market in the region. As per the CDC, nearly 14.6 million people are diagnosed with severe joint pain. Moreover, the increasing prevalence of arthritis is fueling the industry's growth. In Canada, approximately 6 million people are diagnosed with arthritis. Furthermore, the increasing awareness regarding overall health among the population is impelling growth. As per the survey conducted by NMI in the U.S., around 37% of supplement consumers are likely to use bone and joint health supplements to support bone health. Also, the high prevalence of micronutrient deficiencies among adults is boosting the demand for bone and joint health supplements in the region.

The Asia Pacific is anticipated to grow at the fastest rate over the forecast period due to growing awareness regarding health and well-being coupled with nutritional deficiencies. The increasing prevalence of vitamin D deficiency and osteoporosis has raised the demand for various supplements supporting bone and joint health. Furthermore, with increasing disposable income, consumers are willing to pay more for supplement product types to maintain health, thereby positively impacting the market growth. In addition, various strategies adopted by companies to strengthen the industry growth in the APAC region are boosting regional growth.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bone And Joint Health Supplements Market

5.1. COVID-19 Landscape: Bone And Joint Health Supplements Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bone And Joint Health Supplements Market, By Product

8.1. Bone And Joint Health Supplements Market, by Product, 2022-2030

8.1.1. Vitamins

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Minerals

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Collagen

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Omega-3

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Glucosamine

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Bone And Joint Health Supplements Market, By Formulation

9.1. Bone And Joint Health Supplements Market, by Formulation, 2022-2030

9.1.1. Capsules

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Tablets

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Powders

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Softgels

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Bone And Joint Health Supplements Market, By Consumer Group

10.1. Bone And Joint Health Supplements Market, by Consumer Group, 2022-2030

10.1.1. Infants

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Children

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Adults

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Pregnant Women

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Geriatric Population

10.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Bone And Joint Health Supplements Market, By Sales Channel

11.1. Bone And Joint Health Supplements Market, by Sales Channel, 2022-2030

11.1.1. Bricks And Mortar

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. E-commerce

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Bone And Joint Health Supplements Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.1.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.1.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.1.5.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.1.6.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.2.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.2.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.2.5.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.2.6.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.2.7.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.2.8.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.3.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.3.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.3.5.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.3.6.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.3.7.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.3.8.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.4.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.4.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.4.5.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.4.6.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.4.7.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.4.8.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.5.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.5.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.5.5.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Formulation (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Consumer Group (2017-2030)

12.5.6.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

Chapter 13. Company Profiles

13.1. Herbalife International of America, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. GNC Holdings, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Nature’s Bounty Co.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Bayer AG

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. BY-HEALTH Co., Ltd.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Amway (US)

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Basf SE

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Reckitt Benckiser (UK)

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Vita Life Sciences Ltd.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Glanbia Plc

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others