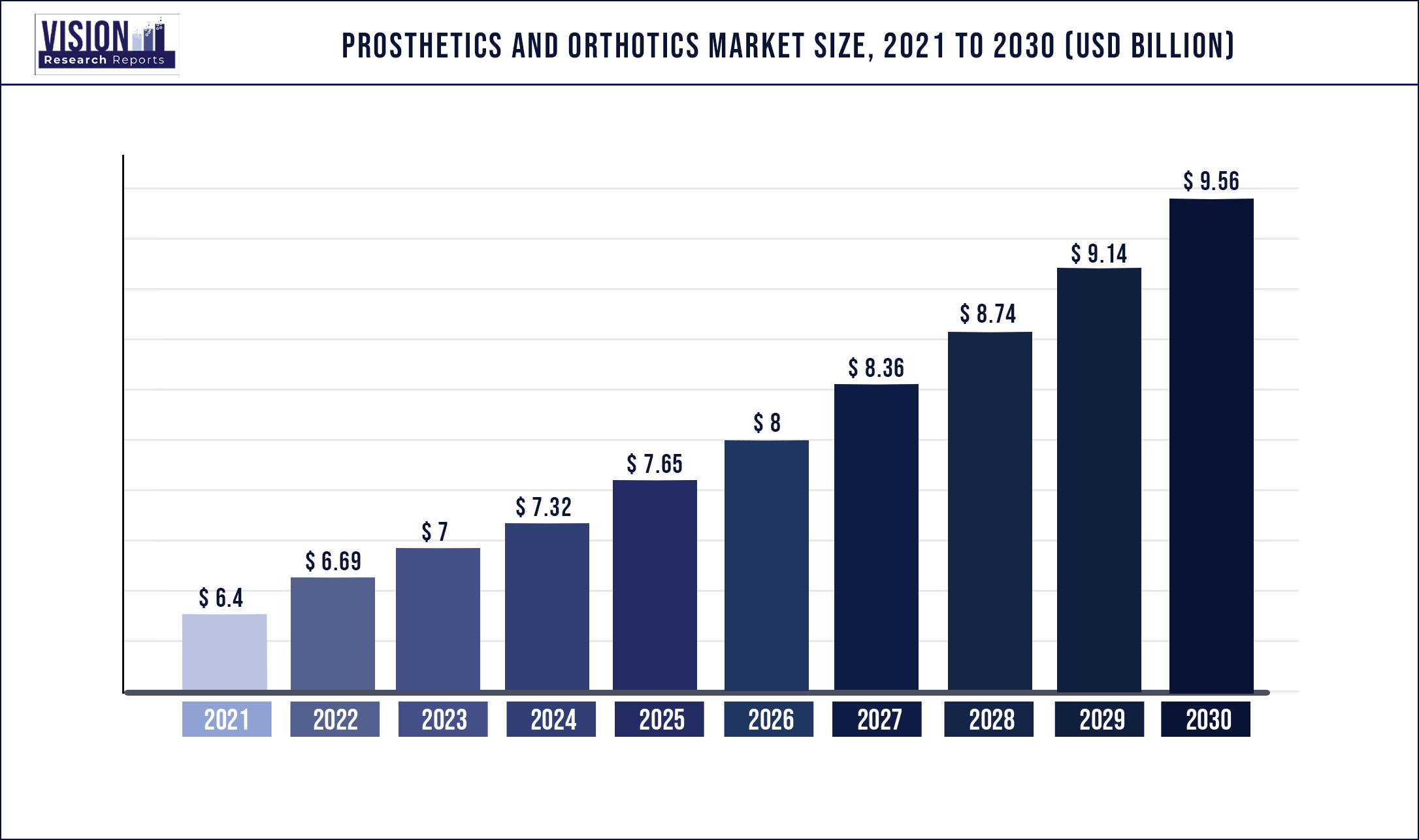

The global prosthetics and orthotics market was valued at USD 6.4 billion in 2021 and it is predicted to surpass around USD 9.56 billion by 2030 with a CAGR of 4.56% from 2022 to 2030.

Report Highlights

Increasing incidences of sports injuries, rising occurrence of osteosarcoma, and growing geriatric population base are the key factors driving the market growth.

As per the American Orthotic & Prosthetic Association, at least 11 states in the U.S. (as of March 23, 2020) and multiple local municipalities had issued orders restricting operations of “non-essential” businesses until further notice during the COVID-19. However, healthcare facilities were considered as “essential” services and exempted from the regulations.

The rising geriatric population across the globe has become one of the key factors driving demand for prosthetics & orthotics. For instance, per the United Nations, the number of people aged 60 years or above globally is expected to be more than double by 2050, increasing from 962 million in 2017 to 2.1 billion in 2050. Geriatrics are more susceptible to the conditions such as osteoporosis and osteopenia, making them common users of various orthopedic solutions.

The increasing incidence of osteosarcoma in young adults and children also drives the market to a great extent. Patients recovering from this surgery generally need orthopedic devices and prosthetics as a part of post-surgery treatment, which is slated to drive the market in the upcoming years. Around 800 to 900 new cases of osteosarcoma are reported in the U.S. each year as of 2018.

Ossur, Otto bock, and Blatchford Inc. are a few of the prominent players in the market. These companies are involved in various strategic initiatives, such as collaborations, acquisitions, and product launches, to gain a competitive edge in the market. For instance, in October 2021, Otto bock established its new production plant in Blagoevgrad, Bulgaria. The new facility will work as a production site for the finished products as well as components. Similarly, in July 2020, Fillauer LLC collaborated with FabCo, a Nashville-based prosthetic design company, for forming a new fabrication company. Through this, Fillauer moved its lower and upper prosthetic central fabrication to the Nashville facility.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 6.4 billion |

| Revenue Forecast by 2030 | USD 9.56 billion |

| Growth rate from 2022 to 2030 | CAGR of 8.2% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, region |

| Companies Covered |

Ossur; Blatchford Inc.; Fillauer LLC; Otto bock Healthcare GmbH; The Ohio Willow Wood Company; and Ultra flex Systems Inc. |

Type Insights

Based on type, the market is segmented into orthotics and prosthetics. Orthotics held the dominant share of more than 70.24% in the prosthetics & orthotics market in terms of revenue in 2021. This may be attributed to the increasing prevalence of osteoarthritis, rising incidences of sports injuries, and growing penetration of orthopedic technology. Upper limb orthotics accounted for the largest share owing to various benefits offered, such as reduced pain and rapid recovery in terms of movement.

Spinal orthotics is expected to exhibit the fastest growth rate owing to the factors such as the increasing number of spinal injuries, rising target population, and unhealthy lifestyle of youths. Orthotics are further segmented into lower limbs, upper limbs, and spinal orthotics. Prosthetics, on the other hand, comprise upper-extremity and lower-extremity prosthetics, liners, sockets, and modular components.

The prosthetics segment is expected to show significant growth during the forecast period. Major companies manufacturing this product are Ossur and Blatchford Inc. An increase in the disability rate across the globe is expected to drive the market in the coming years. For instance, as per the report published by Rehabilitation Research and Training Center on Disability Statistics and Demographics, in 2018, percentage of the people with disabilities, in the U.S., increased from around 11.9% in 2010 to 12.9% in 2017, thereby leading to rising demand for the prosthetics.

Regional Insights

In terms of the region, North America was the leading market in 2021, with a market share of more than 37.05%, and is anticipated to witness the same trend in the near future. This growth can be attributed to well-established healthcare infrastructure, increasing R&D investments by companies, and favorable reimbursement policies.

Moreover, the rising prevalence of osteosarcoma and increasing incidences of sports injuries are expected to drive market growth. Moreover, the focus of the U.S. healthcare system on the quality of care and value-based services has led to a favorable market environment for prosthetics & orthotics.

The Asia Pacific market is expected to show lucrative growth of 5.31% during the forecast period. The region is driven by an increasing number of diabetes-related amputations, a rise in the number of road accidents, and supportive government initiatives. For instance, Asian Prosthetic & Orthotics Meeting took place in November 2018 in Thailand to foster cooperation between Asian countries and discuss the ongoing and emerging issues related to prosthetics & orthotics.

As per the report by Asian Diabetes Prevention Initiative, 60.0% of the diabetic population lives in Asia, currently, and by 2030 it is estimated that both India and China will have around half a million people with diabetes. The aforementioned factors are expected to propel the market during the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Prosthetics And Orthotics Market

5.1. COVID-19 Landscape: Prosthetics And Orthotics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Prosthetics And Orthotics Market, By Type

8.1.Prosthetics And Orthotics Market, by Type, 2021-2030

8.1.1. Orthotics

8.1.1.1.Market Revenue and Forecast (2021-2030)

8.1.2. Prosthetics

8.1.2.1.Market Revenue and Forecast (2021-2030)

Chapter 9. Global Prosthetics And Orthotics Market, Regional Estimates and Trend Forecast

9.1.North America

9.1.1. Market Revenue and Forecast, by Type (2021-2030)

9.1.2. U.S.

9.1.3. Rest of North America

9.1.3.1.Market Revenue and Forecast, by Type (2021-2030)

9.2.Europe

9.2.1. Market Revenue and Forecast, by Type (2021-2030)

9.2.2. UK

9.2.2.1.Market Revenue and Forecast, by Type (2021-2030)

9.2.3. France

9.2.3.1.Market Revenue and Forecast, by Type (2021-2030)

9.2.4. Rest of Europe

9.2.4.1.Market Revenue and Forecast, by Type (2021-2030)

Chapter 10.Company Profiles

10.1.Ossur

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2.Blatchford, Inc.

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3.Fillauer LLC

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4.Otto bock Healthcare GmbH

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5.The Ohio Willow Wood Company

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6.Ultra flex Systems

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7.Steeper Group

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1.About Us

12.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others