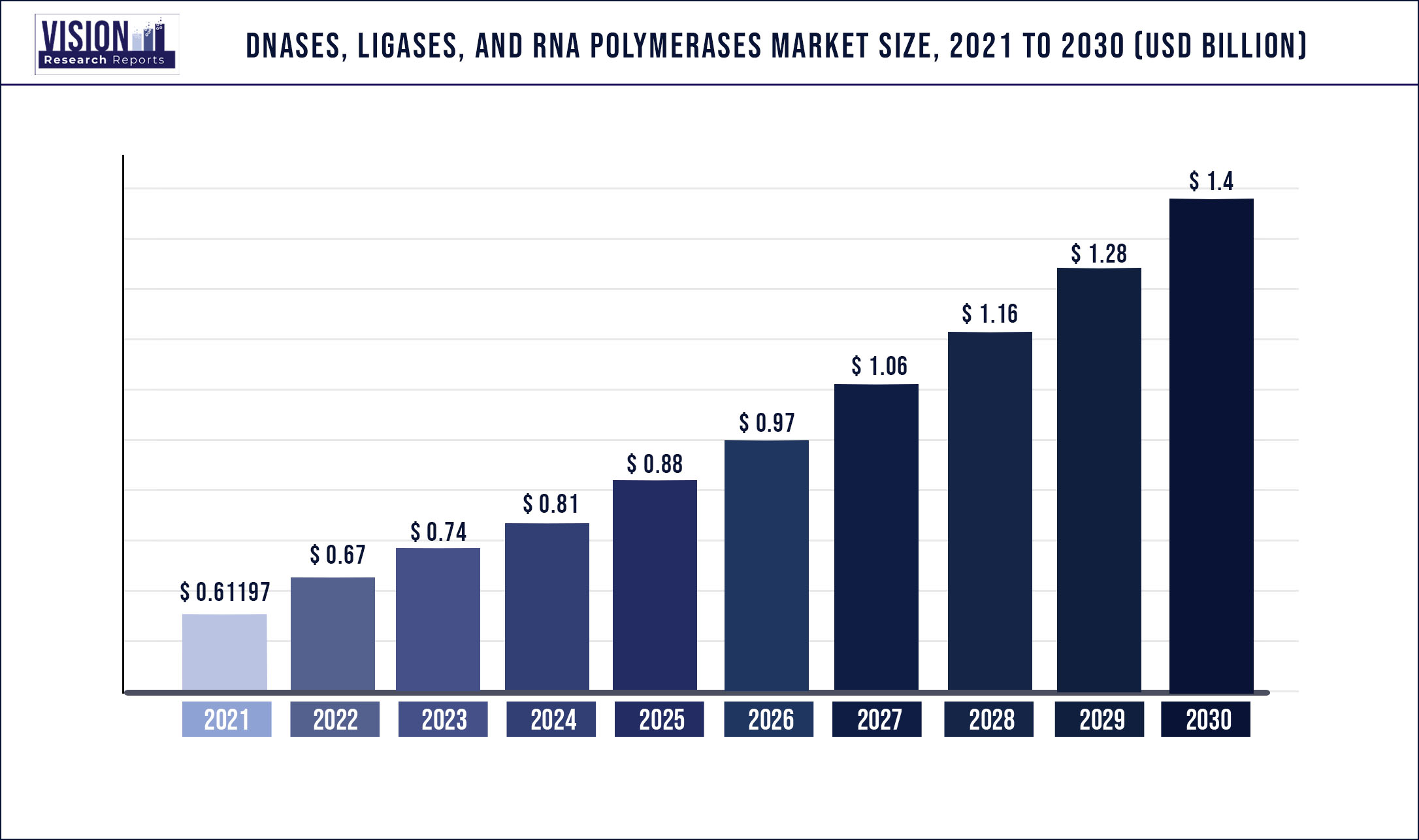

The global DNases, ligases, and RNA polymerases market was estimated at USD 611.97 million in 2021 and it is expected to surpass around USD 1.4 billion by 2030, poised to grow at a CAGR of 9.63% from 2022 to 2030.

Report Highlights

Increasing research and development expenditure is one of the key factors fueling market growth. Furthermore, rising biopharmaceutical production along with a focus on DNA-related innovations is expected to positively impact the global DNases market growth over the forecast period.

For instance, in June 2020, Alphazyme and Codexis entered into a strategic partnership to provide novel enzymes for diagnostics and research. DNases have continued to garner a significant market share in recent years owing to factors such as an increase in the adoption of DNA enzymes related to pharmaceuticals, which are essential for the treatment of various chronic disorders and digestive diseases. In addition, developments in the biotechnology and pharmaceutical fields, such as the introduction of genetic and protein engineering, have helped in expanding applications of enzymes, which is expected to offer lucrative growth opportunities in the forecast period.

An increase in R&D investments to develop ligases as the target for therapeutic applications in cancer is estimated to drive the segment in the forecast period. In addition, strategic activities by major manufacturers will offer lucrative growth opportunities in the projected period. Other factors augmenting segment growth include advancements in healthcare, increasing demand for modernization in the field of medical academics and life sciences, growing investments by governments to develop genomic technologies, and a surge in the demand for oligonucleotide synthesis by private and public research firms.

The COVID-19 pandemic situation has offered lucrative opportunities for RNA polymerase applications. Currently, there are over 150 vaccines and therapeutics that either use mRNA in their production processes or are based on mRNA molecules, which are being assessed for the treatment of a wide range of indications. Many mRNA vaccines are approved for emergency use in many countries across the globe.

For instance, Moderna's mRNA-1273 and BioNTech/ Pfizer BNT-162 vaccines have been approved for use across various regions globally. Moreover, there are instances of huge capital investments for the development of mRNA vaccines. For instance, in June 2021, Sanofi declared an investment of around USD 452.12 annually for its mRNA vaccines development center.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 611.97 million |

| Revenue Forecast by 2030 | USD 1.4 billion |

| Growth rate from 2022 to 2030 | CAGR of 9.63% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Application, region |

| Companies Covered |

Key players in DNases market are Merck KGaA/ Sigma Aldrich; Takara Bio; Calzyme; Thermo Fisher Scientific; Promega Corporation; QIAGEN; Agilent Technologies; RayBiotech; New England Biolabs; and Abnova Corporation. Key players in ligases market are Thermo Fisher Scientific; New England Biolabs; RayBiotech; Agilent Technologies; ABclonal Technology; BioVision; Promega Corporation; MBL International; Blirt; and MyBioSource. Key players in RNA polymerases market are Merck BPS Bioscience, Inc.; Novus Biologicals; Sino Biological, Inc.; MyBioSource; RayBiotech; New England Biolabs; Thermo Fisher Scientific; Biorbyt; Agilent Technologies; and Promega Corporation. |

DNases Application Insights

The other applications segment dominated the market with a revenue share of over 65.04% in 2021. Other applications comprise possible treatment of cystic fibrosis, COPD, and asthma; prediction of common diseases; and forensic applications. Recombinant human DNase1 is a widely used mucolytic agent in individuals with cystic fibrosis. By cleaving DNA, DNase1 reduces the abnormal thickness of cystic fibrosis mucus in vitro and enhances lung function and airway clearance in cystic fibrosis patients. Moreover, enzyme DNases are used in forensic applications, and the most widely utilized is HaeIII for forensic DNA analysis, which cuts DNA at the sequence 5'-GGCC-3'.

The biopharmaceutical processing segment is expected to expand at a CAGR of 8.41% over the forecast period. This is attributed to the factors such as an increase in the adoption of DNA enzymes related to pharmaceuticals, which are essential for the treatment of various chronic diseases and digestive disorders. In addition, developments in the biotechnology and pharmaceutical fields, such as the introduction of genetic and protein engineering, have helped in expanding applications of enzymes, which is expected to offer lucrative growth opportunities in the forecast period.

Ligases Application Insights

The other applications segment held the largest share of over 55.03% in 2021. Other applications include in vitro gene manipulation, analysis of protein-protein interactions and DNA sequencing, and catalyzing the formation of phosphodiester bonds in DNA & RNA molecules. The DNA ligase from T4 bacteriophage is one of the widely used enzymes in molecular biology. DNA ligases are used for various applications in biotechnology and molecular biology. Many times, they have been used in the detection of mutation using ligation chain reaction and construction of recombinant DNA molecules.

The oligonucleotide segment is expected to witness significant growth in the coming years. Oligonucleotide synthesis, the biochemical synthesis of nucleic acids, has emerged as an essential tool in the area of molecular biology. Synthetic oligonucleotides have been used in several applications such as diagnosis of infectious and genetic diseases, disease treatment, and new drug discovery. With 12 oligonucleotide drugs moving to the ligases market in 2021 and more than hundreds in preclinical development and clinical trials, the most recent stage in the development of a product in oligonucleotide manufacturing poses a cost liability to manufacturers.

RNA Polymerase Application Insights

The mRNA production segment dominated the RNA polymerase market with a revenue share of over 75.18% in 2021. The year 2020 was a breakout year for mRNA technology platforms, with the unveiling and extensive usage of mRNA vaccines for coronavirus. The applications of RNA, both in clinical R&D and basic research, have expanded after developments in the field of molecular biology have considerably improved the in vitro reliability of such molecules. At present, there are over 150 vaccines and therapeutics that either use mRNA in their production processes or are based on mRNA molecules, which are being assessed for the treatment of a wide range of indications.

Many mRNA vaccines for COVID-19 are approved for emergency use in many countries across the globe and there are increasing capital investments for the development of mRNA vaccines. For instance, in June 2021, Sanofi declares an investment of around USD 452.12 annually for its mRNA vaccines development center.

The other applications segment is expected to register a CAGR of 8.5% in the forecast period. RNA polymerase plays a key role in transcription, cDNA synthesis, and synthesis of antisense RNA and dsRNA. RNA polymerase is the key transcription enzyme, and transcription begins when RNA polymerase binds to a supporter sequence near the beginning of a gene.

Regional Insights

North America led the market with a share of over 35.16% in 2021 and is anticipated to grow lucratively over the forecast period. The factors such as the increase in the adoption of DNA enzymes that can be used for drug development and are essential for different therapeutic regimes to treat chronic disorders and digestive diseases. Furthermore, RNA polymerases are in high demand after the COVID-19 pandemic in the U.S. due to the demand for mRNA vaccines. RNA polymerases are also regularly used in drug development processes for the treatment of infections caused by tuberculosis and leprosy. Moreover, many novel mRNA-based vaccines are in various stages of development for a wide variety of cancers. Increasing cases of infectious diseases will boost market growth in the forecast period.

Asia Pacific is expected to expand at the fastest CAGR of 9.54% during the forecast period. Significant developments in Japan and China for technological integration and rapid healthcare development, clinical development frameworks, and growing R&D in emerging economies such as Australia and India have created significant opportunities in the Asia Pacific, which is anticipated to boost the market growth in the region during the forecast period.

Key Players

DNases market:

Merck KGaA/ Sigma Aldrich

Takara Bio

Calzyme

Thermo Fisher Scientific

Promega Corporation

QIAGEN

Agilent Technologies

RayBiotech

New England Biolabs

Abnova Corporation

ligases market:

RNA polymerases market:

Market Segmentation

Application Outlook

Regional Outlook

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on DNases, Ligases, And RNA Polymerases Market

5.1. COVID-19 Landscape: DNases, Ligases, And RNA Polymerases Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global DNases, Ligases, And RNA Polymerases Market, By Application

8.1.DNases, Ligases, And RNA Polymerases Market, by Application Type, 2020-2027

8.1.1. DNases Application

8.1.1.1.Market Revenue and Forecast (2016-2027)

8.1.2. Ligases Application

8.1.2.1.Market Revenue and Forecast (2016-2027)

8.1.3. RNA Polymerase Application

8.1.3.1.Market Revenue and Forecast (2016-2027)

Chapter 9. Global DNases, Ligases, And RNA Polymerases Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Product (2017-2030)

9.1.2. Market Revenue and Forecast, by Technique (2017-2030)

9.1.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.1.4. Market Revenue and Forecast, by End-use (2017-2030)

9.1.5. U.S.

9.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

9.1.5.2. Market Revenue and Forecast, by Technique (2017-2030)

9.1.5.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.1.5.4. Market Revenue and Forecast, by End-use (2017-2030)

9.1.6. Rest of North America

9.1.6.1. Market Revenue and Forecast, by Product (2017-2030)

9.1.6.2. Market Revenue and Forecast, by Technique (2017-2030)

9.1.6.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.1.6.4. Market Revenue and Forecast, by End-use (2017-2030)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Product (2017-2030)

9.2.2. Market Revenue and Forecast, by Technique (2017-2030)

9.2.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.2.4. Market Revenue and Forecast, by End-use (2017-2030)

9.2.5. UK

9.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

9.2.5.2. Market Revenue and Forecast, by Technique (2017-2030)

9.2.5.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.2.5.4. Market Revenue and Forecast, by End-use (2017-2030)

9.2.6. Germany

9.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

9.2.6.2. Market Revenue and Forecast, by Technique (2017-2030)

9.2.6.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.2.6.4. Market Revenue and Forecast, by End-use (2017-2030)

9.2.7. France

9.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

9.2.7.2. Market Revenue and Forecast, by Technique (2017-2030)

9.2.7.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.2.7.4. Market Revenue and Forecast, by End-use (2017-2030)

9.2.8. Rest of Europe

9.2.8.1. Market Revenue and Forecast, by Product (2017-2030)

9.2.8.2. Market Revenue and Forecast, by Technique (2017-2030)

9.2.8.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.2.8.4. Market Revenue and Forecast, by End-use (2017-2030)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Product (2017-2030)

9.3.2. Market Revenue and Forecast, by Technique (2017-2030)

9.3.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.3.4. Market Revenue and Forecast, by End-use (2017-2030)

9.3.5. India

9.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

9.3.5.2. Market Revenue and Forecast, by Technique (2017-2030)

9.3.5.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.3.5.4. Market Revenue and Forecast, by End-use (2017-2030)

9.3.6. China

9.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

9.3.6.2. Market Revenue and Forecast, by Technique (2017-2030)

9.3.6.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.3.6.4. Market Revenue and Forecast, by End-use (2017-2030)

9.3.7. Japan

9.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

9.3.7.2. Market Revenue and Forecast, by Technique (2017-2030)

9.3.7.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.3.7.4. Market Revenue and Forecast, by End-use (2017-2030)

9.3.8. Rest of APAC

9.3.8.1. Market Revenue and Forecast, by Product (2017-2030)

9.3.8.2. Market Revenue and Forecast, by Technique (2017-2030)

9.3.8.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.3.8.4. Market Revenue and Forecast, by End-use (2017-2030)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Product (2017-2030)

9.4.2. Market Revenue and Forecast, by Technique (2017-2030)

9.4.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.4.4. Market Revenue and Forecast, by End-use (2017-2030)

9.4.5. GCC

9.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

9.4.5.2. Market Revenue and Forecast, by Technique (2017-2030)

9.4.5.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.4.5.4. Market Revenue and Forecast, by End-use (2017-2030)

9.4.6. North Africa

9.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

9.4.6.2. Market Revenue and Forecast, by Technique (2017-2030)

9.4.6.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.4.6.4. Market Revenue and Forecast, by End-use (2017-2030)

9.4.7. South Africa

9.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

9.4.7.2. Market Revenue and Forecast, by Technique (2017-2030)

9.4.7.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.4.7.4. Market Revenue and Forecast, by End-use (2017-2030)

9.4.8. Rest of MEA

9.4.8.1. Market Revenue and Forecast, by Product (2017-2030)

9.4.8.2. Market Revenue and Forecast, by Technique (2017-2030)

9.4.8.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.4.8.4. Market Revenue and Forecast, by End-use (2017-2030)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Product (2017-2030)

9.5.2. Market Revenue and Forecast, by Technique (2017-2030)

9.5.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.5.4. Market Revenue and Forecast, by End-use (2017-2030)

9.5.5. Brazil

9.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

9.5.5.2. Market Revenue and Forecast, by Technique (2017-2030)

9.5.5.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.5.5.4. Market Revenue and Forecast, by End-use (2017-2030)

9.5.6. Rest of LATAM

9.5.6.1. Market Revenue and Forecast, by Product (2017-2030)

9.5.6.2. Market Revenue and Forecast, by Technique (2017-2030)

9.5.6.3. Market Revenue and Forecast, by Monitoring Method (2017-2030)

9.5.6.4. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 10.Company Profiles

10.1.Merck KGaA/ Sigma Aldrich

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2.Takara Bio

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3.Calzyme

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4.Thermo Fisher Scientific

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5.Promega Corporation

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6.QIAGEN

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7.Agilent Technologies

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8.RayBiotech

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9.New England Biolabs

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10.Abnova Corporation

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1.About Us

12.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others